Sponsored

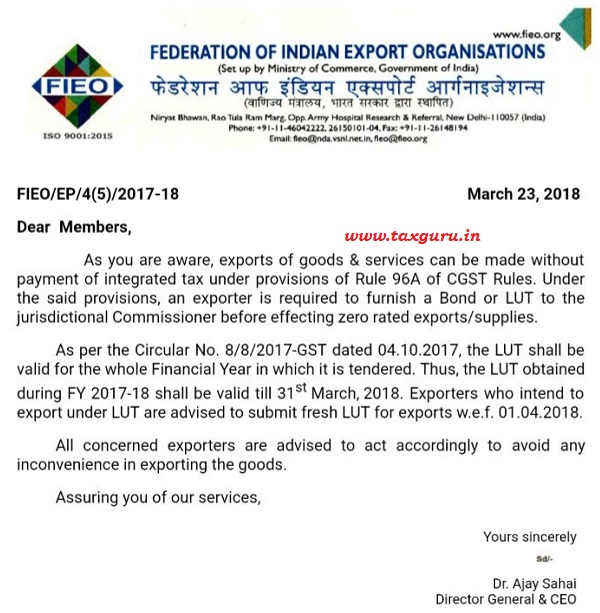

As you are aware, exports of goods & services can be made without payment of integrated tax under provisions of Rule 96A of CGST Rules. Under the said provisions, an exporter is required to furnish a Bond or LUT to the jurisdictional Commissioner before effecting zero rated exports/supplies.

As per the Circular No. 8/8/2017-GST dated 04.10.2017, the LUT shall be valid for the whole Financial Year in which it is tendered. Thus, the LUT obtained during FY 2017-18 shall be valid till 31st March, 2018. Exporters who intend to export under LUT are advised to submit fresh LUT for exports w.e.f. 01.04.2018.

All concerned exporters are advised to act accordingly to avoid any inconvenience in exporting the goods.

Source- FIEO Letter to Its Members

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

I have export done in month of July 17 to Oct 17 without payment to Igst but said period we have not apply for lut , so any provision in Gst regin ,those are not apply Lut in early period or any relaxation given.

If I never obtained LUT before and i want to opt for the same now, what are the requirements that i need to submit ?

It is advisable to submit LUT application manually together with the documents required to be attached.However, an online application may also be submitted in the portal and an acknowledgement from the portal should be printed and attached with the manual application.It is understood that there are technical glitches in the GST portal, on which the authorities are believed to be working.

We have submitted application for LUT for the year 2018-19 on 31,03.2018. As per ARN acknowledgement the Jurisdiction is showing State GST DC. On 2nd Aprll,18 we approached to DC SGST he says that he is not aware about LUT. And on his system is not showing ant LUT for approval. Can we send the consignment for export stating only ARN no. .

Please read the circular.

As per the Circular No. 8/8/2017-GST dated 04.10.2017, the LUT shall be valid for the whole Financial Year in which it is tendered. Thus, the LUT obtained during FY 2017-18 shall be valid till 31st March, 2018. Exporters who intend to export under LUT are advised to submit fresh LUT for exports w.e.f. 01.04.2018.

All concerned exporters are advised to act accordingly to avoid any inconvenience in exporting the goods.

Is there any provision to use LUT for movement of goods purchased under advance license without payment of GST in domestic market.

The LUT issued to us states that it is valid till 31.08.18. Even then should we have to apply for new LUT now?

Dear Sir

!00% EOU Unit has applied LUT July-2017 concern A.C of Central Tax acceptance letter issued valid date June-2018. so we can apply to Fresh LUT or not?

Please clarify in this regard

As per CBEC circular Exporter has to obtain fresh LUT w.e.f. 01.04.2018 from the Jurisdiction of Excise Department for exporters who were registered in Central Excise and Sales Tax Department for exporters who were registered in State Sales Department. It can be checked GSTIN No wise in the List of Registered Exporters published by CBEC

We have submitted online application and rcvd acknowledge copy also but not approve online.

Pls confirm shall have to manually submit documents to Dept. or not. Pls explain

Will have to apply online or to be manually submit documents. Pls explain and send to link

When can we finally expect to have the IGST (paid to manufactures) refunded. The goods have been exported long time back under Bond without payment of IGST (while Export).

There has been no information on this concern since frist day

sir please sent one topic of contractor

No it seems wrong, because LUT mentions validity date & its 1 year from date of issuance. Its not issued on financial year basis

The circular uses this caveat “This notification has been issued in supersession of Notification No. 16/2017 – Central Tax dated 7th July, 2017 except as respects things done or omitted to be done before such supersession. “. It means LUT issued against 16/2017 prior this circular is valid till the date of validity mentioned therein.

Hope I am correct.