GST Input Tax Credit Explained

GST is a dual concept system. On every transaction (within a state), there will be component of Central GST (CGST) and State GST (SGST). Integrated GST (IGST) is for interstate transactions. Therefore, it is important for businesses to know how to set off the input credit against each of these components in the order as prescribed by the Law.

The order in which credit needs to be set off is explained in the table below:

| Input Tax Credit | Set off against liability |

| CGST (Central GST) | CGST and IGST (in that order) |

| SGST (State GST) | SGST and IGST (in that order) |

| IGST (integrated GST) | IGST, CGST, SGST (in that order) |

Discuss with an example.

Example 1 – How can CGST and SGST ITC be used?

Xyz Ltd. is a bike manufacturer located in Rajasthan. The details of transactions effected by Xyz Ltd. are furnished below along with the tax component:

| Party Name | Destination State | Transaction Type | Product | Input Credit | Tax Liability | ||

| CGST | SGST | CGST | SGST | ||||

| Ratan Steel | Rajasthan | Purchase (Inward Supply) | Steel | 1,20,000 | 1,20,000 | – | –

|

| Paras Automobiles | Rajasthan | Sales (Outward Supply) | Bike | – | – | 36,000 | 36,000 |

| Paras Automobiles | Rajasthan | Sales (Outward Supply) | Spare parts | – | – | 90,000 | 90,000 |

At the end of the month, Xyz Ltd. adjusts available input credit against their tax liability

In the example, Xyz Ltd. has a tax liability of 1,26,000. Here is how it happens:

1. XYZ Ltd. have Input tax credit of 1,20,000 each against CGST and SGST.

2. As prescribed by Law, XYZ Ltd. first utilized ITC of CGST 1,20,000 to set off CGST liability of 1,26,000 (36,000+90,000). After this adjustment, CGST liability is 6,000 (1,26,000 – 1,20,000).

3. Later, SGST input credit of 1,20,000 is set off against SGST liability of 1,26,000 (36,000+90,000). After setting off SGST input credit, 6,000 (1,26,000 – 1,20,000) is the SGST liability.

4. After utilizing the available input credit of both CGST and SGST,the tax liability of XYZ Ltd. is 12,000 (CGST liability 6,000 + SGST liability 6,000).

5. Any input credit balance of CGST, after setting off tax liability towards CGST, cannot be used to set off against SGST. The balance of ITC under CGST (post set off of CGST liability) will be carried over to the next period.

6. Similarly, the SGST balance after set off of SGST liability will be carried over to the next period.

Example 2 – How can IGST ITC be utilized?

Consider another set of transactions for XYZ Ltd.

Party Name |

Destination State |

Transaction Type |

Product |

Input Credit |

Tax Liability |

||||

CGST |

SGST |

IGST |

CGST |

SGST |

IGST |

||||

ABC Aluminium Industries Ltd. |

Maharashtra |

Purchase (Inward Supply) |

Aluminium Bars |

– |

– |

30,000 |

– |

– |

– |

JK Rubber Industries Ltd. |

Maharashtra |

Purchase (Inward Supply) |

Tyres |

– |

– |

10,000 |

– |

– |

– |

Krishna Spares |

Gujrat |

Sale (Outward Supply) |

Spare Parts |

– |

– |

– |

– |

– |

12,000 |

A-one Auto Parts |

Rajasthan |

Sale (Outward Supply) |

Spare Parts |

– |

– |

– |

24,000 |

24,000 |

– |

At the end of the month, XYZ Ltd. utilized IGST Input tax credit to set off their tax liability.

As illustrated above,

1. XYZ Ltd. haveIGST Input tax credit of 40,000 and tax liabilities of IGST 12,000, CGST 24,000 and SGST 24,000.

2. As prescribed by Law, IGST Input credit needs to be utilized first to set off IGST tax liability. The remaining ITC can be used to set off CGST and then against the SGST liability, in that order.

3. Xyz Ltd. first utilized IGST ITC to set off IGST liability of 12,000.

4. Remaining IGST ITC credit 28,000 (40,000 – 12,000) is used to set off CGST liability of 24,000.

5. Post this adjustment, the remaining IGST ITC of 4,000 is used to set off SGST liability to the extent of 4,000.

6. Now, after utilization of Input credit available, the SGST liability of Xyz Ltd. is 20,000.

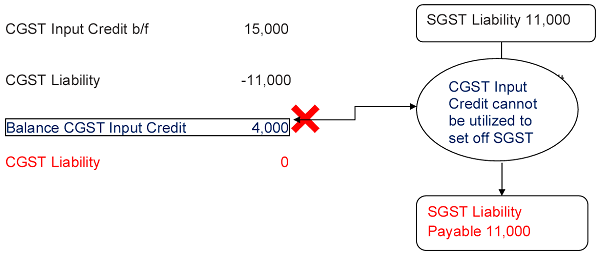

Example 3 – CGST ITC cannot be used for SGST liability

Let us consider another scenario of XYZ Ltd. to illustrate non-utilization of CGST ITC against SGST liability.

XYZ Ltd. had a carry forward balance of CGST Input credit 15,000.

| Input Credit balance | Amount |

| CGST Input Credit | 15,000 |

During the month, outward supply details of Xyz Ltd. are furnished below:

| Party Name | Destination State | Transaction Type | Product | Input Credit | Tax Liability | ||

| CGST | SGST | CGST | SGST | ||||

| A-one Auto Parts | Rajasthan | Sale (Outward Supply) | Spare Parts | – | – | 11,000 | 11,000

|

As illustrated,

As illustrated,

1. XYZ Ltd. utilized CGST Input Credit of previous period 15,000 to set off CGST liability of current period 11,000.

After this set off, XYZ Ltd. has a balance CGST input credit of 4,000.

As prescribed by the Law, excess CGST Input Credit for the period cannot be set off against SGST liability of current period. Similarly, SGST Input Credit cannot set off against CGST liability.

Thus, the balance CGST credit was not utilized, and the SGST liability for Xyz Ltd. for the months is 11,000.

The Set-off mechanism for UTGST is similar to SGST.

About the Author:

Author is practicing chartered accountant in Sirohi (Rajasthan). He can be reached at camukeshkumar16@gmail.com

SIR, WE HAVE FILING THE PREVIOUS RETURN FOR THE F/Y 2017-18 BUT ITS SHOWS LATE FEE IS IN NEGATIVE CGST IS -1200 AND SGST IS -1200 AND THE LIABILITY IS NOT SET OFF NOR FILING RETURN PLZ HELP ME SIR,,, WE HAVE CLEAR ALL RETURNS FROM 2017-18 TO TILL DATE.

SIR, WE HAVE OUTPUT CGST RS.50000 AND SGST RS.50000 AND INPUT CGST RS.47000 AND SGST RS.47000. AFTER CLICK ON SAVE AND SUBMIT BOTTON AND THEN GO TO PAYMENT AND PAID RS.6000 ( CGST RS.3000 & SGST RS.3000). THEN GO TO PAYMENT OF TAX TILES AND FILL UP INPUT CGST RS.47000 AND SGST RS.47000 AND IN CASH PAID OPTION FILL UP SGST RS.3000 AND CGST RS.3000. THEN CLICK ON OFFSET LIABILITY. BUT THE ABOVE DATA NOT TAKEN IN PAYMENT OF TAX BOX. HOW CAN I ADJUST AND GSTR-3B FILL WITH DSC OR EVC? PLEASE GUIDE ME WITH MOVIE AND EXAMPLE. RAJU

Excellent

m…

SUPER…..FULLY SERVES THE PURPOSE..

TNX….

Please give one more example to tell the ITC Mechanism in which credit of CGST & SGST is adjusted against IGST liability.