In Goods and Service Tax there are Two methods to Collect Taxes that is Forward Charge Mechanisms and Reverse Charge Mechanisms.

In Every Law passed by the Government to collects taxes, it has to introduce two type of Power to Collect Tax that is

- Levy of Tax (which is Section 9 of CGST Act, 2017 and Section 5 of IGST Act, 2017)

- Taxable Transaction rather called as Supplies in GST (Which is Section 7 of CGST Act, 2017)

Reverse Charge is Defined Under Section 2(98) of CGST Act, 2017 as under: –

“reverse charge” means the liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such goods or services or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or subsection (4) of section 5 of the Integrated Goods and Services Tax Act

In Every Transaction there are two Parties Involves, One is Supplier and Second Is Recipient. Supplier is Defined Under Section 2(105) of CGST Act, 2017 which states in general that “the Person Supplying the Goods and Services including the Agent on behalf of that Person”. Recipient is Defined under Section 2(93) of CGST Act,2017 which describes Recipient under three situations which are explained as below: –

| Where Consideration is Involved | The Person who is Liable to Pay that Consideration |

| Where No Consideration is Involved in case of GOODS | The Person to Whom the Goods are Delivered |

| Where No Consideration is Involved in case of SERVICES | The Person to whom the Service is Rendered. |

From above Provisions of Law and Definitions provided we can Summarise that Goods and Service Tax Liability onus in case of Reverse charge is on the Recipient of Goods or Service or Both in cases when it is covered under Section 9(3)/(4) of CGST Act, 2017 or Section 5(3)/(4) of IGST Act, 2017.

So if the Goods or Services are not Covered strictly under Section 9(3)/(4) of CGST Act, 2017 or Section 5(3)/(4) of IGST Act, 2017 then the Liability to pay Tax will be on Supplier of Goods or Services. Here we must also observe that Section 9(3)/(4) of CGST Act, 2017 deals with Taxable Transaction covered under Intra State Supplies and Section 5(3)/(4) of IGST Act, 2017 are covered under Inter State Supplies.

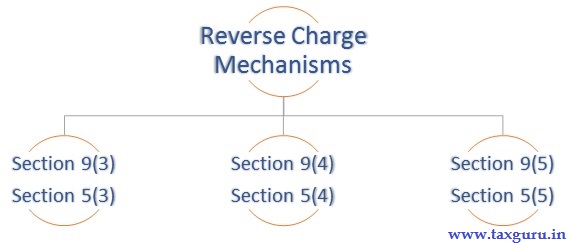

To explain the further Relevant Provision and their Integration with each other I have divided the Provision of Reverse Charge under three Parts are as below-

SECTION 9(3) OF CGST ACT,2017 READ WITH SECTION 5(3) OF IGST ACT,2017

Section 9(3) of CGST Act,2017 read as

“The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.”

Section 5(3) of IGST Act,2017 read as

“The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both”

As per above statement of Law it is clearly stated that Government shall time to Time Specify Categories of Goods or Services or both which shall be covered under Reverse Charge Mechanisms.

The Notification which specifies Goods and Services are Stated by Government which are specified below

| CATEGORIES | NOTIFICATION NO. |

| Goods* | – Notification No. 4/2017-Central Tax (Rate) the 28th June 2017 |

| Services* | – Notification No. 13/2017-C.T. (Rate), dated 28-6-2017 read With Notification No.22/2019-C.T (Rate) dated 30.09.2019 read with Notification No. 29/2018-C.T. (Rate) dated 31-12-2018. w.e.f. 1-1-2019) read with Notification No.29/2019-Central Tax (Rate), dated 31.12.2019. read with Notification No.22/2019-C.T (Rate) dated 30.09.2019 with effect from 1’st October, 2019 – CGST ACT,2017

– Notification No.10/2017-Integrated Tax (Rate) ,dt. 28-06-2017 -IGST ACT,2017 |

*Charts of Specified Categories of Goods are Specified in Detail below of this article in annexure.

SECTION 9(4) OF CGST ACT,2017 READ WITH SECTION 5(4) OF IGST ACT,2017

Section 9(4) of CGST Act,2017/Section 5(4) of IGST Act, 2017 read as

“The Government may, on the recommendations of the Council, by notification, specify a class of registered persons who shall, in respect of supply of specified categories of goods or services or both received from an unregistered supplier, pay the tax on reverse charge basis as the recipient of such supply of goods or services or both, and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to such supply of goods or services or both.” w.e.f 1st February 2019

In Similar to view of Section 9(3)/5(3) of the Act’s, Government has Specified Categories of Goods or Services or Both received from Unregistered Supplier shall be cover under this Section.

The Central Board of Direct Taxes vide Notification No. 07/2019-Central Tax (Rate) ,dt. 29-03-2019 w.e.f 01-04-2019 has specified such Supply Covered under Section 9(4) Section 9(4) of CGST Act,2017/Section 5(4) of IGST Act, 2017.

SECTION 9(5) OF CGST ACT,2017 READ WITH SECTION 5(5) OF IGST ACT,2017

Section 9(5) of CGST Act,2017

“ The Government may, on the recommendations of the Council, by notification, specify categories of services the tax on intra-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services:

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax.

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also he does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.”

Section 5(5) of IGST Act,2017

“The Government may, on the recommendations of the Council, by notification ,specify categories of services, the tax on inter-State supplies of which shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the supplier liable for paying the tax in relation to the supply of such services

Provided that where an electronic commerce operator does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax.

Provided further that where an electronic commerce operator does not have a physical presence in the taxable territory and also does not have a representative in the said territory, such electronic commerce operator shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax.”

In respect of specified services stated in the provisions above, tax shall be paid by the ECO on behalf of the service suppliers if such services are supplied through it and all the provisions of the Act shall apply to such ECO as if he is the supplier liable to pay tax in relation to the supply of such services. The Government has notified following categories of services, the tax on intra-State/ inter-state supplies shall be paid by the ECO –

| S. NO. | DESCRIPTION OF SUPPLY OF SERVICE | SUPPLIER OF SERVICE | PERSON LIABLE TO PAY GST | NOTIFICATION NO. |

| 1 | Transportation of passengers by a radio-taxi, motorcab, maxicab and motor cycle | Any person | E-commerce operator | Notification No. 17/2017-Central Tax (Rate) dt 28th June, 2017 Corresponding IGST Notification No. 14/2017-Integrated Tax (Rate) dt 28th June, 2017 |

| 2 | Providing accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes | Any person except who is liable for registration under sub- section (1) of section 22 of the said CGST Act | E-commerce operator | —— do——– |

| 3 | Services by way of house- keeping, such as plumbing, carpentering etc | Any person except who is liable for registration under sub- section (1) of section 22 of the said CGST Act | E-commerce operator | Inserted vide Notification No. 23/2017-Central Tax(Rate) dated 22nd Aug, 2017

Corresponding Notification No. 23/2017-Integrated Tax (Rate) dated 22nd Aug, 2017 |

Furthermore, above mentioned suppliers of services covered u/s 9(5) are exempted from compulsory registration and can take benefit of threshold limit.

TIME OF SUPPLY UNDER RCM

TIME OF SUPPLY IN CASE OF GOODS

Section 12 Sub Section 3 as per CGST Act,2017 states that

“In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely: —

(a) the date of the receipt of goods; or

(b) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(c) the date immediately following thirty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier:

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b) or clause (c), the time of supply shall be the date of entry in the books of account of the recipient of supply.”

From the above Provision we can observe that Tax Liability in case of Recipient of Goods must discharge even if the payment for Supply is not made to Supplier of Goods nor if the same is not entered in books of accounts. The Recipient will have to discharge Liability maximum by 30 days from the date of issue of Invoice or any other Document.

TIME OF SUPPLY IN CASE OF SERVICES

Section 13 Sub Section 3 as per CGST Act,2017 states that

“In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earlier of the following dates, namely:––

(a) the date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

(b) the date immediately following sixty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier:

Provided that where it is not possible to determine the time of supply under clause (a) or clause (b), the time of supply shall be the date of entry in the books of account of the recipient of supply:

Provided further that in case of supply by associated enterprises, where the supplier of service is located outside India, the time of supply shall be the date of entry in the books of account of the recipient of supply or the date of payment, whichever is earlier.”

In case of Services it will be complex to determine when the service will be delivered to the recipient hence in such case Tax Liability has to be discharge by recipient from date of payment or date immediately following 60 days from the issue of invoice.

INPUT TAX CREDIT UNDER RCM

When we discussed on Input Tax Credit on Forward charge mechanism same is taken on accrual basis by the Recipient even if the amount of tax is not paid to the Supplier of Services except under situation referred under 2nd Proviso to Sub Section 2 of Section 16 of CGST Act,2017.

Whereas in Reverse Charge Mechanism the scenario to claim tax is different, the Input Tax Credit can only be claimed if tax is paid by recipient.

How to Reflect these items in Return of Income?

| GSTR-1 | SUPPLIER: – | If Registered will book the invoice by ticking Supply under RCM in Return of Income and if Unregistered no requirement |

| RECIPIENT: – | Recipient is not required to fill any details in GSTR-1 since GSTR-1 is filed for Outward Supply of Goods | |

| GSTR-2/2A | SUPPLIER: – | Supplier is not required to fill any details in GSTR-2 since GSTR-2 is filed for Inward Supply of Goods |

| RECIPIENT: – | In GSTR-2A the Invoices pertaining to Registered Dealer for supply covered under RCM will be reflecting and invoices for unregistered Dealer i.e Self Invoice raised by Recipient will have to be Filed in GSTR-2 (However in current Scenario Filing of GST R 2 is not Permitted). | |

| GSTR-3B | SUPPLIER: – | Supplier will Reflect GST in exempted Supplies Table 3.1 point c since he is not Required to pay tax Liability |

| RECIPIENT: – | Recipient will Reflect taxable value and GST amount in row name Inward Supplies liable to Reverse Charge Table 3.1 Point d exempted Supplies since he is not Required to pay tax Liability |

Based on Which Document we can Claim Input Tax Credit under RCM Mechanisms?

To understand the Documents or evidence for Claiming Input Tax Credit we should refer Section 31 of CGST Act,2017 read with Rule 36 of CGST Rules,2017.

Section 31 Subsection (3) Clause (f) read as follows

“a registered person who is liable to pay tax under sub-section (3) or sub-section (4) of section 9 shall issue an invoice in respect of goods or services or both received by him from the supplier who is not registered on the date of receipt of goods or services or both;”

Rule 36 sub-rule 1(b) of CGST Rules 2016 read as follows

(1) The input tax credit shall be availed by a registered person, including the Input Service Distributor, on the basis of any of the following documents, namely

(b) an invoice issued in accordance with the provisions of clause (f) of sub-section (3) of section 31, subject to the payment of tax

Interpretation of Section 31(3)(f)

A Registered Person who is liable to pay Tax Shall issue an invoice in respect of goods and – Recipient

Services received from supplier – Self Invoice

Who is Unregistered on date of Receipt of goods and Services or both -Unregistered Supplier

We can say from above in case of Unregistered Supplier the Recipient can take Input Tax Credit on Self Invoice Generated by him as per Rule 36(1)(b) for such supply.

Now the second Question arises about Registered Supplier.

In case of Registered Supplier, the Invoice raised by him under Section 31 reflected in GSTR-1 correspondingly Reflecting in GSTR-2A of Recipient is sufficient Evidence to claim Input Tax Credit

ANNEXURES

Notification No. 4/2017-C.T. (Rate), dated 28-6-2017 – NOTIFIED GOODS UNDER RCM

Table-1

| S. No. | Tariff Item, Sub-heading, or Chapter | Description of Supply of Goods | Supplier of Goods | Recipient of Supply |

| (1) | (2) | (3) | (4) | (5) |

| 1. | 0801 | Cashew nuts, not shelled or peeled | Agriculturist | Any registered person |

| 2. | 1404 90 10 | Bidi wrapper leaves(tendu) | Agriculturist | Any registered person |

| 3. | 2401 | Tobacco leaves | Agriculturist | Any registered person |

| 4. | 5004 to 5006 | Silk yarn | Any person who manufactures silk yarn from raw silk or silk worm cocoons for supply of silk yarn | Any registered person |

| 4A | 5201

(Effective from 15-11-2017) |

Raw cotton | Agriculturist | Any registered person |

| 5. | – | Supply of lottery | State Government, Union Territory or any local authority | Lottery distributor or selling agent.

Explanation. – For the purposes of this entry, lottery distributor or selling agent has the same meaning as assigned to it in clause (c) of Rule 2 of the Lotteries (Regulation) Rules, 2010, made under the 2 provisions of sub-section (1) of Section 11 of the Lotteries (Regulations) Act, 1998. |

| 6. | Any Chapter

(Effective from 13-10-2017) |

Used vehicles seized and confiscated goods, old and used goods, waste and scrap | Central Government, State Government, Union territory or a Local authority. | Any registered person |

| 7. | Any Chapter

(Effective from 28-5-2018) |

Priority Sector Lending Certificate | Any registered person | Any registered person |

Notification No. 13/2017-C.T. (Rate), dated 28-6-2017 read With Notification No.22/2019-C.T (Rate) dated 30.09.2019 read with Notification No. 29/2018-C.T. (Rate) dated 31-12-2018. w.e.f. 1-1-2019) read with Notification No.29/2019-Central Tax (Rate), dated 31.12.2019. read with Notification No.22/2019-C.T (Rate) dated 30.09.2019 with effect from 1’st October, 2019 – CGST ACT,2017 – NOTIFIED SERVICES UNDER RCM

Table-2

| Sr. No. | Category of Supply of Services | Supplier of Service | Recipient of service |

| (1) | (2) | (3) | (4) |

| 1. | GTA Services:

Supply of Services by a Goods Transport Agency (GTA) who has not paid central tax @ 6% in respect of transportation of goods by road to – (a) any factory registered under or governed by the Factories Act, 1948; or (b) any society registered under the Societies Registration Act, 1860 or under any other law for the time being in force in any part of India; or (c) any cooperative society established by or under any law; or (d) any person registered under CGST/ (e) anybody corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person; located in the taxable territory. “Provided that nothing contained in this entry shall apply to services provided by a goods transport agency, by way of transport of goods in a goods carriage by road, to, – (a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Governmental agencies, which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under Section 51 and not for making a taxable supply of goods or services.” |

Goods Transport Agency (GTA) | (a) any factory registered under or governed by the Factories Act, 1948; or

(b) any society registered under the Societies Registration Act, 1860 or under any other law for the time being in force in any part of India; or (c) any cooperative society established by or under any law; (d) any person registered under CGST/IGST/ (e) anybody corporate established, by or under any law; or (f) any partnership firm whether registered or not under any law including association of persons; or (g) any casual taxable person located in the taxable territory. |

| 2. | Legal Services

Services provide by an individual advocate including a senior advocate or firm of advocates by way of legal services, directly or indirectly. Explanation. – ‘Legal service’ means any service provided in relation to advice, consultancy or assistance in any manner and includes representational services before any Court, Tribunal or Authority. |

An individual advocate including a senior advocate or firm of advocates. | Any business entity located in the taxable territory. |

| 3 | Arbitral Services

Services supplied by an arbitral Tribunal to a business entity. |

An arbitral Tribunal | Any business entity located in the taxable territory. |

| 4 | Sponsorship Services

Service provided by way of Sponsorship Service to anybody corporate or partnership firm. |

Any person | Anybody corporate or partnership firm located in the taxable territory. |

| 5 | Government Services :

Services supplied by the Central Government, State Government, Union territory or local (A) renting of immovable property service, and (B) services specified below :- (i) services by the Department of posts by way of speed post, life insurance, express parcel post and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. |

Central Government, State Government, Union territory or Local Authority | Any Business Entity located in the taxable territory. |

| 5A | Services by the Government: Services supplied by the Central Government, State Government, Union territory or local authority by way of renting of immovable property to a person registered under the Central Goods and Services Tax Act, 2017 (with effect from 25-1-2018. | Central Government, State Government, Union territory or Local Authority. | Any person registered under the Central Goods and Services Tax Act, 2017 |

| 5B | Services supplied by any person by way of transfer of development rights or Floor Space Index (FSI) (including additional FSI) for construction of a project by a promoter. | Any Person | Promoter |

| 5C | Long term lease of land (30 years or more) by any person against consideration in the form of upfront amount (called as premium, salami, cost, price, development charges or by any other name) and/or periodic rent for construction of a project by a promoter. | Any person | Promoter |

| 6 | Services by the Director: Services supplied by a director of a company or a body corporate to the said company or the body corporate. | A director of a company or a body corporate | A company or a body corporate located in the taxable territory |

| 7 | Insurance Agent Service: Services provided by an insurance agent to person carrying on insurance business. | An Insurance Agent | Any person carrying on insurance business, located in the taxable territory. |

| 8 | Recovery Agent Service: Services provided by a recovery agent to a banking company or a financial institution or a non-banking financial company. | A Recovery Agent | Banking company or financial institution or a non-banking financial company, located in the taxable territory. |

| 9 | Copyright Service

Supply of Services by a music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of Section 13 of the Copyright Act, 1957 relating to original dramatic, musical or artistic works to a music company, producer or the like. |

Music composer, photographer, artist, or the like. | The Music company, producer or the like, located in the taxable territory. |

| 9A | Supply of services by an author by way of transfer or permitting the use or enjoyment of a copyright covered under clause (a) of subsection (1) of section 13 of the Copyright Act, 1957 relating to original literary works to a publisher.

(Sl.9 & 9A changes carried vide Notification No.22/2019-C.T (Rate) dated 30.09.2019 with effect from 1’st October,2019) |

Author | Publisher located in the taxable territory:-

Provided that nothing contained in this entry shall apply where:- (i) the author has taken registration under the Central Goods and Services Tax Act,2017 (12 of 2017), and filed a declaration , in form at annexure I, within the time limit prescribed therein, with the jurisdictional CGST or SGST commissioner, as the case may be, that he exercises the option to pay central tax on the service specified in column (2), under forward charge in accordance with Section 9 (1) of the Central Goods and Service Tax Act, 2017 under forward charge, and to comply with all the provisions of Central Goods and Service Tax Act, 2017 (12 of 2017) as they apply to a person liable for paying the tax in relation to the supply of any goods or services or both and that he shall not withdraw the said option within a period of 1 year from the date of exercising such option; (ii) the author makes a declaration, as prescribed in Annexure II on the invoice issued by him in Form GST Inv-I to the publisher. ”; |

| 10 | Reserve Bank Services :

Supply of services by the members of Overseeing Committee to (Reserve Bank of India Effective from 13-10-2017) |

Members of Overseeing Committee constituted by the Reserve Bank of India. | Reserve Bank of India |

| 11 | Services by DSAs:

Services supplied by individual Direct Selling Agents (DSAs) other than a body corporate partnership or limited liability partnership firm to bank or non-banking financial company (NBFCs) Effective from 27-7-2018). |

Individual Direct Selling Agents (DSAs) other than a body corporate, partnership or limited liability partnership firm. | A banking company or a non-banking financial company, located in the taxable territory. |

| 12 | Services provided by Business Facilitator (BF) to a banking company. | Business facilitator (BF) | A banking company, located in the taxable territory. |

| 13 | Services provided by an agent of Business Correspondent (BC) to Business Correspondent (BC). | An agent of Business Correspondent (BC). | A business correspondent, located in the taxable territory. |

| 14 | Security Services (services provided by way of supply of security personnel) provided to a registered person :

Provided that nothing contained in the entry shall apply to,- (i)(a) a Department or Establishment of the Central Government or State Government or Union territory; or (b) local authority; or (c) Government agencies; which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under Section 51 of the said Act and not for making a taxable supply of goods or services; or (ii) a registered person paying tax under Section 10 of the said Act. Sl. No. 12 to 14 vide Notification No. 29/2018-C.T. (Rate) dated 31-12-2018. w.e.f. 1-1-2019) |

Any person other than a body corporate. | A registered person, located in the “taxable territory.” |

| 15 | Services provided by way of renting of any motor vehicle designed to carry passengers where the cost of fuel is included in the consideration charged from the service recipient, provided to a body corporate.

Notification No.29/2019-Central Tax (Rate), dated 31.12.2019. |

Any person, other than a body corporate who supplies the service to a body corporate and does not issue an invoice charging central tax at the rate of 6% to the service recipient. | Any body corporate located in the taxable territory”. |

| 16 | Services of lending securities of Securities under Lending scheme, 1997 (Scheme). Securities and Exchange Board of India (SEBI), as amended.

Sl.16 changes have carried vide Notification No.22/2019-C.T (Rate) dated 30.09.2019 with effect from 1’st October, 2019. |

Lender i.e. a person who deposits the securities registered in his name or in the name of any other person duly authorised on his behalf with an approved intermediary for the purpose of lending under the scheme of SEBI. | Borrower i.e. a person who borrows the securities under the Scheme through an approved intermediary of SEBI). |

In addition to cited (Table -2) services, the following two additional services has been notified by the Central Government vide Notification No. 10/2017-Integrated Tax(Rate) Dated 28-06-2017 wherein whole of the tax shall be payable by the recipient on services under Section 5(3) of IGST Act,2017 on RCM method.

Table-3

| Si. No. | Category of Supply of Services | Supplier of Service | Recipient of service |

| (1) | (2) | (3) | (4) |

| 1 | Any service supplied by any person who is located in a non-taxable territory to any person other than non-taxable online recipient. | Any person located in a non-taxable territory. | Any person located in the taxable territory other than non-taxable online recipient. |

| 10 | Services supplied by a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the Customs Station of clearance in India. | A person located in a non-taxable territory. | Importer, as defined in Sec 2(26) of the Customs Act,1962, located in the taxable territory |

The above analysis of provision is strictly on the basis pf personal opinion of the author and changes or modification required shall be highly accepted.

The Author is a Practicing Chartered Accountant in Nagpur and can be reach at consultant.karan19@gmail.com.

if a registered person received a bill of transporter of let say 10,000. In such case RCM is applicable, is it required to be shown in GSTR-1 as RCM and self-invoicing showing gstin of supplier and recipient as same?