Misconceptions VS Reality

Facts about 1% payment of tax liability in cash in GST under Rule 86B

Misconception 01: Large number of taxpayers would be affected by the rule.

Reality:

The rule provides for various exemptions like exporters, suppliers of goods of inverted duty structure, taxpayers having a footprint in the Income Tax data base etc. It is expected that this rule would be applicable to less than 0.5% of total taxpayer base of 1.2 crore. The rule clearly identifies where the risk to revenue is high and imposes deterrence to the fraudsters in a multi-layered fraud of passing fake ITC. This rule would help to control such fraudsters, who issue fake invoices and show high turnovers, but have no financial credibility and flee after misusing ITC without payment of any tax liability in cash.

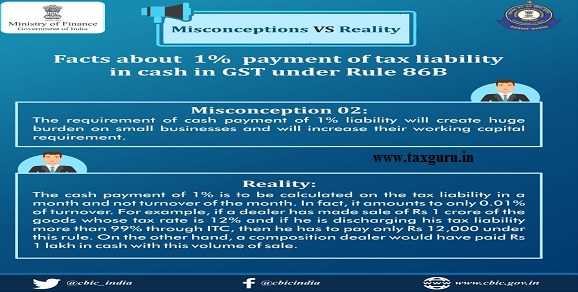

Misconception 02:

The requirement of cash payment of 1% liability will create huge burden on small businesses and will increase their working capital requirement.

Reality:

The cash payment of 1% is to be calculated on the tax liability in a month and not turnover of the month. In fact, it amounts to only 0.01% of turnover. For example, if a dealer has made sale of Rs 1 crore of the goods whose tax rate is 12% and if he is discharging his tax liability more than 99% through ITC, then he has to pay only Rs 12,000 under this rule. On the other hand, a composition dealer would have paid Rs 1 lakh in cash with this volume of sale.

Misconception 03:

Misconception 03:

This rule adversely affects small and medium enterprises.

Reality:

The new provision which restricts the use of ITC for discharging output liability is applicable to the registered person whose value of taxable supply other than exempt supply and export, in a month exceeds Rs 50 lakh — that means those whose annual turnover is more than Rs 6 crore. Therefore, the rule does not apply to micro and small businesses, and Composition dealers.

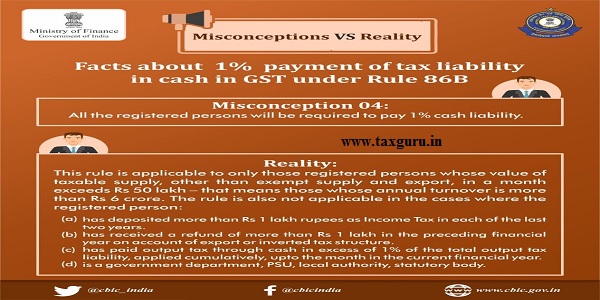

Misconception 04:

All the registered persons will be required to pay 1% cash liability.

Reality:

This rule is applicable to only those registered persons whose value of taxable supply, other than exempt supply and export, in a month exceeds Rs 50 lakh – that means those whose annual turnover is more than Rs 6 crore. The rule is also not applicable in the cases where the registered person:

(a) has deposited more than Rs 1 lakh rupees as Income Tax in each of the last two years.

(b) has received a refund of more than Rs 1 lakh in the preceding financial year on account of export or inverted tax structure.

(c) has paid output tax through cash in excess of 1% of the total output tax liability, applied cumulatively, upto the month in the current financial year.

(d) is a government department, PSU, local authority, statutory body.

I need to understand whether 1% tax liability on outward taxable supply of more than 50 lakh is applicable in monthly basis or on turnover basis on full FY. Suppose August my supply was 52 lakh and I have paid 1% tax in cash and then on December again my taxable supply was 52 lakh then do I need to pay 1% tax via cash. Please revert