Many of us are confused with New GST Returns forms, but it’s not so confusing if we differentiate Old Returns with New GST Returns, let’s look after one by one for easy learning without any delay.

A) What we have in Old Return?

B) What we have in New Return?

C) What is the most Complex situation in New Returns as compare to Old Return?

D) Date of Implementation?

Old is always Gold, but Government thinks something Different. Many of us was habitual in filing above Old Returns but unfortunately New Returns have been replaced with Old Returns in the name of easing Compliance, let’s look how much it will ease.

NEW RETURNS

Under New GST Returns one of most Important return is Form GST RET-1 it will contains:-

- Outward Supply Details

- Inward Supply Details (ITC Availed)

- Payment of Tax

- Interest Liability (If Any)

Most of details will be Auto Fill from its Two Anmol Ratna:-

♦ Form GST Annexure -1 (Outward Supply Details, just like GSTR 1 of Old Return with some Changes)

♦ Form GST Annexure -2 (Inward Supply Details, one of the most Important Ratna of Form GST RET-01)

Now, we see that How Anx-1 Sheet is Different from GSTR-1 offline Excel Sheet:-

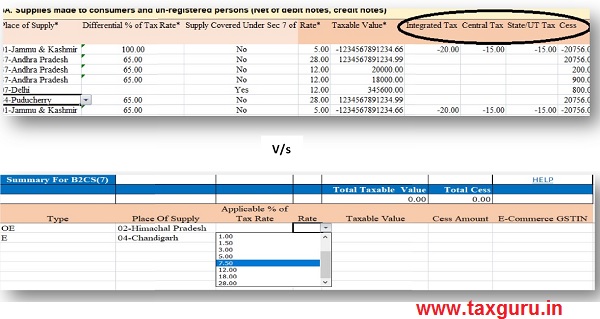

No……1 (B2C)

No…….2 (B2B)

Now, we have to put Debit Note/Credit in B2B Section along with HSN Code and also with proper Tax bifurcation between IGST, CGST & SGST.

V/s

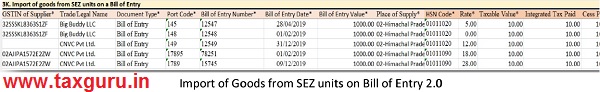

For “Invoice Type” as per Old Sheet, in New Return Sheet we will have different Sheet for SEZ(With or Without Payment) and also different for Deemed Export and For Supplies Covered under Sec 7 of IGST Act have given different column in every sheet wherever required.

No……3 (SEZ under New Return)

As per Annx-1 in New Return, now we will get Separate Sheet for SEZ in that we will have option to select “GST Payment Type” as WPAY or WOPAY and one also new option with “Would You Claim Refund” we have option Yes or No for the Same followed by HSN Code wise entry.

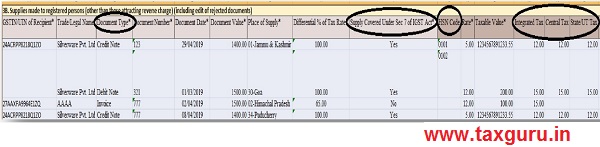

No…..4 (Most Awaited – RCM)

One of the most awaited Sheet, is now will be live on New GST Return Forms i.e. “Inward Supplies attracting Reverse Charge (to be reported by recipient, GSTIN wise, net of Debit/Credit notes and Advance Paid, if any)”

No……5 (Other Misc)

No……6 (Danger Zone)

One of the most important and somewhat complex sheet is “Missing Documents on which credit has been claimed in (T-2)/T-1 tax period and supplies has not reported the same till filing of return for the Current period”.

What is T-2 & T-1?

T-2 – Two month after the Tax Period (Monthly Return Filers)

T-1 – One Quarter after the Tax Period (Quarterly Return Filers)

This sheet has three way relations i.e. with GST Form RET-1, GST Annx-2 & Lastly with GST Annx-1.

Let’s take small Example for better understanding (OFU)

One is Miss Chota Don & another is Miss Maska they both are Business friends, Miss Chota Don is monthly return filer i.e. GST RET-1. She is habitual in reconciling her Annx-2, one good day when she was filing return for the month January’2020, what she finds that 2-3 invoices of Miss. Maska were not reflecting in Annx-2 for which goods supplied by her. Due to invoice missing in her Annx-2, she claim ITC on provisional basis for the month January’2020. After that Miss. Chota Don always remind Miss Maska for uploading Invoice Details, but Miss Maska fails to do that and Miss. Chota Don missed his two month deadline period i.e. March’2020.

Now what, Miss Chota Don has to reverse his ITC claimed on provisional basis i.e. claimed in January’20 GST Form RET-1. Now Miss Chota Don will upload missing invoice in Above Sheet in the month March’2020 in Annx-1.

Last but not the least; in New Returns Form GST Annx-1 we also have one template for Amendment of B2B Invoices, Debit/Credit Notes and also including amendment of any Rejected Documents.

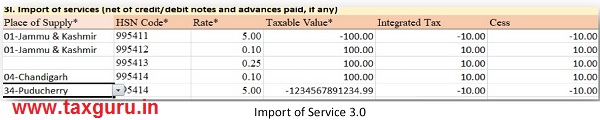

Now, let’s see what we have in Annx-2

When Newly GST Law was implemented i.e 1st July’2017 that time we have GSTR 2 with Accept, Reject & Pending Option, now same have been come up with some modified sheet to ease compliance. In offline Tool of Beta Version, we will find that it provide us reconciliation tool with our Purchase Register with output of Partial Match, Exact Match & Partial Match with approximation.

This is Form GST PMT-08, a new Version of GSTR 3B. In this form every taxpayer have to put basic details on Self-Assessment basis and according Tax will be calculated by the System and after that Tax payment is to be done.

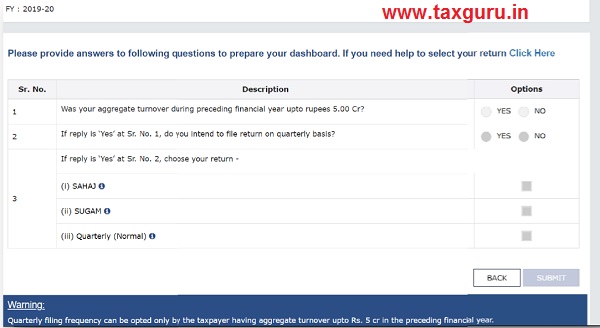

What are other types of Forms available for Small Turnover Taxpayers in New Returns?

A) SAHAJ

B) SUGAM

What is the Turnover Limit to switch to SAHAJ or SUGAM from NORMAL Return?

In New GST Returns, Turnover Limit has been Enhance for Small Taxpayers from Rs.1.5 Cr to Rs.5 Cr.

**As per the Latest Updates as on 14th March’2020 followed by CBEC Notification, New Returns will be come in force from October’2020 onwards, till time Old return will be followed.

Note:- Many more thing are there in New GST Returns Forms Viz New Areas of Complexity in RET-1, SAHAJ, SUGAM details format etc will be covered in Part II post.

VERY INFORMETIVE ARTICLE

Impressive article very Helpful Thank you for sharing