√ Section 22(1) of the CGST Act, provides for registration to supplier of services or goods & services having aggregate turnover exceeding Rs. 20 lacs. Hence every supplier having turnover more than Rs. 20 lacs is required to register.

√ Section 24 (Compulsory registration) of CGST Act,2017 requires as Flows –

(iv) person who are required to pay tax under sub-section (5) of section 9;

(ix) persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52.

(x) every electronic commerce operator who is required to collect tax at source under section 52.

(xi) every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person.

√ Thus, E-Commerce operators are required to register under GST irrespective their turnover limit.

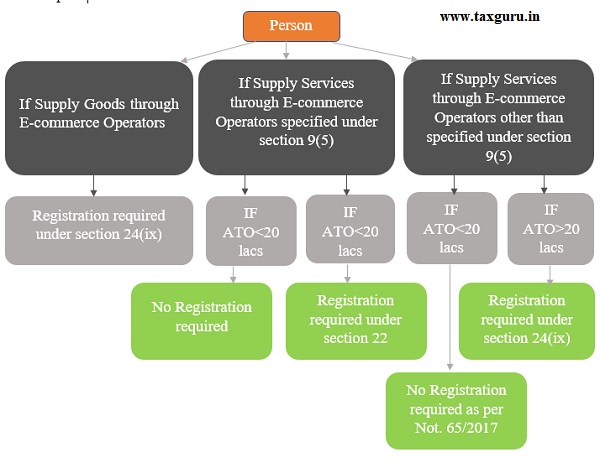

√ Notification 65/2017- Central Tax dt. 15/11/2017 provides that a person supplying services, other than supplier of services under section 9(5) of the CGST Act, 2017, through an e-commerce portal are exempted from obtaining compulsory registration provided their aggregate turnover does not exceed INR 20 lacs.

√ TCS Registration has to be obtained in every state where the supplier is situated however, ECO does not require a place of business or establishment in every state where the supplier is situated. The e-commerce operator may declare the Head office at its place of business for obtaining registration in that State/UT where it does not have physical presence.

√ Registration requirement in case of person supplied through e-commerce operator: –

√ Registration requirement in case of e-commerce operator: –

√ Scenarios for registration for a supplier who supply through E- Commerce Operator:

| Supply | Turnover | GST paid by | Registration required |

| 1. Supply of Goods | 10 lakhs | Supplier | Yes |

| 2. Supply of Goods & Service | 10 lakhs | Supplier | Yes |

| 3. Supply of service of transportation of passengers by radio taxi, motor cab (specified under section 9(5)) | 10 lakhs | ECO | No |

| 4. Supply of service of transportation of passengers by radio taxi, motor cab (specified under section 9(5)) | 25 lakhs | ECO | No |

| 5. Supply of service specified under section 9(5) except transportation of passengers by radio taxi, motor cab | 10 lakhs | ECO | No |

| 6. Supply of service specified under section 9(5) except transportation of passengers by radio taxi, motor cab | 25 lakhs | Supplier | Yes |

| 7. Supply of service except service specified under section 9(5) | 10 lakhs | NA | No |

| 8. Supply of service except service specified under section 9(5) | 25 lakhs | Supplier | Yes |

Supply Turnover GST paid by Registration required

| Supply | Turnover of ECO | Registration required for ECO |

| 1. Unregistered Supplier provides service specified under section 9(5) through ECO. | 10 lakhs | Yes |

| 2. Unregistered Supplier provides service specified under section 9(5) through ECO.

– Registered Supplier provides service specified under section 9(5) through ECO. |

10 lakhs

8 lakhs |

Yes |

| 3. Unregistered Supplier provides service except specified under section 9(5) through ECO. | 10 lakhs | No

|

| 4. Unregistered Supplier provides service except specified under section 9(5) through ECO. | 25 lakhs | Yes |

| 5. Registered Supplier provides service except specified under section 9(5) through ECO. | 10 lakhs | Yes |

| 6. Unregistered Supplier provides service except specified under section 9(5) through ECO.

– Registered Supplier provides service specified under section 9(5) through ECO. |

10 lakhs

8 lakhs |

Yes |

| 7. Registered Supplier provides goods through ECO. | 10 lakhs | Yes |

How register for GST ? charges for it ?

And

How file GST returns ? Have any monthly or yearly charges ?

Please share details.