Sponsored

Page Contents

Gems & Jewelry Industry in India

- The gems and jewellery market in India is home to more than 300,000 players, with the majority being small players.

- Its market size is about US$ 75 billion as of 2017 and is expected to reach US$ 100 billion by 2025.

- India is one of the largest exporters of gems and jewellery and the industry is considered to play a vital role in the Indian economy as it contributes a major chunk to the total foreign reserves of the country.

- The Gems and Jewellery sector, contributing around 7 per cent of the country’s GDP and 15 per cent to India’s total merchandise exports.

- Its contribution to foreign exchange earning stood at UDS 38.59 billion in 2016.

- It also employs over 4.64 million workers and is expected to employ 8.23 million by 2022. One of the fastest growing sectors, it is extremely export oriented and labour intensive.

- It contributes 29 per cent to the global jewellery consumption.

- India exports 75 per cent of the world’s polished diamonds.

- Gold demand in India rose to 338.70 tonnes between January to June 2018.

- India’s gems and jewellery exports stood at US$ 13.18 billion between April – August 2018*. During the same period, exports of cut and polished diamonds stood at US$ 10.31 billion, thereby contributing about 78.22 per cent of the total gems and jewellery exports in value terms. Exports of gold coins and medallions stood at US$ 201.75 million and silver jewellery export stood at US$ 239.04 million between April – August 2018.

GST Taxation on Gems & Jewelry

| Pre GST |

| Excise duty @ 1% |

| State VAT in range of 1% – 1.2% highest being 5% in the state of Kerala. |

| Import Customs Duty of 10%. |

| Import – Ed. Cess + SHEd Cess – 3% |

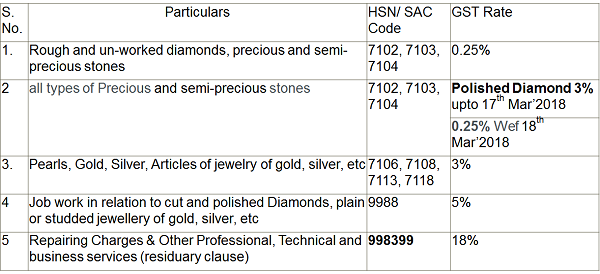

GST Rates on Gems & Jewelry

Transactions under GST

Gem & Jewelry Sector has a very Complex and varied transactions like the below cases which are discussed in the PPT in detail how GST applicable in such cases at the below link.

- Case -1 : Sales Transaction : Single Price inclusive of Making Charges

- Case – 2 : Sales Transaction : Making Charges Shown Separately

- Case – 3 : Sales Transaction : Diamond Studded Jewelry

- Case – 4 : Promotional Schemes

- Case – 5 : Promotional Schemes : After Sale Gifts through Lottery

- Case – 6 : Sending for Job Work to Karigars

- Case – 7 : Repairing of the Old and Worn out Jewellery

- Case – 8 : Making Charges & Job Work

- Case – 9 : Exchange a Coin / Bullion into Ornaments

- Case – 10 : Buying & Selling of Old Ornaments

- Case – 11 : Old Jewelry is Completely Remade after Melting And Sold

- Case – 12 : Sending on Approval Basis

- Case – 13 : Transferred for Exhibition to a Different State – Casual Registration

- Case – 14 : e Way Bill : Exemption

- Case – 15 : Input Tax Credit & Credit Refund

- Case – 16 : Imitation Jewelry – Inverted Tax Structure

- Case – 17 : Supply From Un-registered (Business) : Liability to Pay GST on RCM

- Case – 18 : Supply From Un-registered Individual

- Case – 19 : Exchange offer : Valuation

- Case – 20 : Supply by SEZ Units

- Case – 21 : Stock Transfer of Goods Between Braches:

- Case – 22 : Place of Supply Provisions

- Case – 23 : Time of Supply

- Case – 24 : GST on Advance Payment

- Case – 25 : Hallmarking Charges

- Case – 26 : Goods Sent For Exhibition

- Case – 27 : Goods Physically Carried by Representative

- Case – 28 : Packing Costs and Freight Charges

- Case – 29 : Processing Loss

- Case – 30 : GST rate for intermediaries/ aggregators

Details of GST Applicability are discussed for all the above cases in PPT link @ below

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

I don’t see any link for the PPT please provide the same.