1. Introduction

GST (Goods and Services Tax) is a single indirect tax system in India that applies to every product and service. Several updates have been made to the GST slabs in 2025, especially for food products.

Food items are used daily in every household, so 0%, 5%, 12%, or 18% GST rates directly affect consumers.

In this article, you will find:

GST list of essential food items

Pre-packaged and branded food items at GST

GST of restaurant and processed foods

Latest updates and table format in easy reference

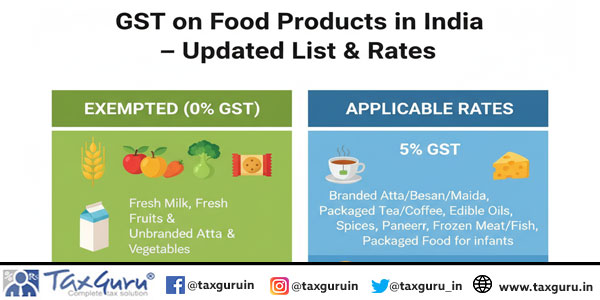

2. 0% GST – Exempted Essential Food Items

These items are completely GST free, meaning no tax is levied on them:

Fresh milk, curd, lassi, paneer (unbranded) Unbranded wheat, rice, pulses, vegetables, fruits Fresh fish, meat, eggs Unbranded honey, coconut, coconut water Unbranded dry fruits and edible oils Simple understanding: This is a basic food of daily use, hence the government has not imposed GST on it.

3. 5% GST – Pre-packaged & Labeled Food Items

These items are lightly processed or packaged:

Pre-packaged paneer, khakra, roti, pizza bread Packaged dairy products – butter, ghee, cheese Condensed milk, malt, starches Processed foods – pasta, noodles, cakes, pastries Packaged namkeens, sauces, dried fruits, nuts Simple idea: If food is pre-packed or branded, a little GST will be charged (5%), so that there is government revenue and common items remain affordable.

4. 12% – 18% GST – Branded / Luxury / Restaurant Foods

These items usually fall into the processed or luxury category:

Branded flour, rice, cereals Packaged snacks, chocolates, frozen pizza Restaurant food – AC, dine-in, takeaway Luxury food items Simple understanding: High-end, branded, or restaurant food attracts a higher GST because it is not a basic necessity, and the government also needs revenue.

5. Important Updates – September 22, 2025

The government set the GST rate on essential food items at 0% or 5%, which reduced prices.

Dairy products like ghee, butter, and paneer are subject to a 5% GST.

Companies like Amul and KMF also reduced prices on their products.

Simple solution: The aim of the government is to ensure that essential food remains affordable and the GST system is simplified.

6. Quick Reference Table – GST on Food (2025)

| GST Rate | Applicable Items |

| 0% | Fresh milk, curd, vegetables, fruits, grains, eggs, unbranded dry fruits, edible oils |

| 5% | Pre-packaged paneer, butter, ghee, cheese, processed snacks, dried fruits |

| 12–18% | Branded flour, rice, cereals, chocolates, frozen pizza, restaurant food |

| 40% | Tobacco, alcohol (sin goods) |

GST on Food Items – FAQs (2025)

1. What is the GST rate for food items?

Food items are subject to 0%, 5%, 12%, 18% GST slabs, depending on whether the item is fresh/unbranded, packaged, processed, or luxury.

2. What are the 12% GST items?

Branded flour, packaged cereals, processed snacks, some bakery items, and pre-packaged foods.

3. Which food item has 18% GST?

Luxury or high-end items: chocolates, frozen pizza, sauces, branded bakery products, restaurant food (dine-in/AC).

4. Which items will have 40% GST?

40% GST is mostly applicable on sin goods, like tobacco, pan masala, alcohol.

5. Which item has 28% GST?

28% slab mainly luxury goods and some non-essential items, like soft drinks (aerated), ice cream brands, sweetened beverages.

6. Is 12% GST slab removed?

Nahi, 12% GST slab is still applicable for branded and processed foods.

7. Is GST on restaurants 5 or 18?

Restaurants GST slab:

5% = Non-AC restaurants, takeaway (no input credit)

18% = AC restaurants, hotels above certain tariff, or dine-in with input credit

8. How much GST on vegetables?

Fresh/unbranded vegetables = 0% GST

Processed or packaged vegetable items = 5% GST

9. What is GST on rice?

Unbranded rice = 0% GST

Branded/packaged rice = 5% GST

10. Do cakes have 18% GST?

Depend:

Branded/processed cakes = 12–18% GST

Homemade/unbranded cakes (local bakery) = 5% GST

11. Is ice cream GST 5 or 18?

Packaged branded ice cream = 18% GST

Small/unbranded local ice cream = 5% GST

12. What is the GST rate on milk?

Fresh/unbranded milk = 0% GST

Packaged/processed milk (tetra pack, flavoured) = 5% GST

7. Conclusion

The classification of food items in the GST system in 2025 is consumer-friendly and revenue balanced.

Daily essential food = 0% GST → affordable

Packaged / processed foods = 5% GST → reasonable tax

Branded / luxury / restaurant foods = 12–18% GST → tax on high-end products

*****

This knowledge is useful for common consumers, small business owners and CA aspirants.