Biggest tax reform since independence

Pre- GST Indirect tax regime

VAT (VALUE ADDED TAX)

- Implemented in April 2005

- It is replacement to complex Sales Tax

- It overcomes the Cascading Effect of Tax

- It is applied on “Value Added Portion” in sales price

Problems with VAT

- It is not uniform in nature

- VAT Act is charged by different states, hence credit chain is broken in this respect.

- Burden of “tax on tax” in earlier system.

TAXONOMY OF INDIAN TAXATION

| Vat / sales tax | On Sale of goods, other than newspapers |

| Stamp duty | On Other than 10 specified instruments |

| Tax | On Agricultural income |

| Toll tax | On Utilities |

| Other taxes | On Land and buildings, Entry of goods in local area (entry tax), Consumption or sale of electricity, Vehicles, Luxuries including taxes on entertainment, Betting and gambling, Alcoholic liquor, Narcotic drugs and Opium |

WHAT IS GST

- GST is a comprehensive value added tax on goods and services

- It is collected on value added at each stage of supply.

- No differentiation between goods and services as GST is levied at each stage in the supply chain

- Seamless input tax credit throughout the supply chain

- Taxes are passed through all stages of production & distribution and tax is borne by the final consumer

- All sectors are taxed with very few exceptions / exemptions.

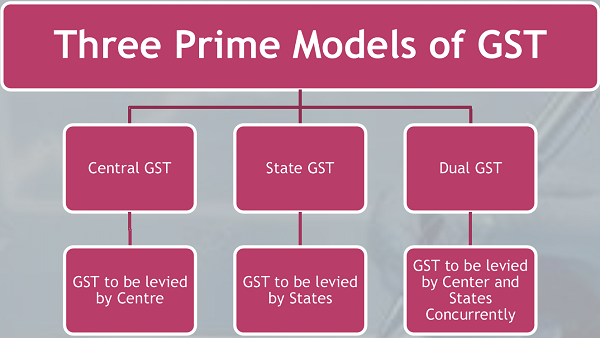

The Dual GST Model:

- GST at Central level (Union) Government level only

- GST at State level Government level only

- GST at both, Union and State Government levels

INDIAN GST REGIME

| Dual GST | Minimum Exemptions | Inter State Import of Goods & Services | Excluded Products |

| Center & State to Levy GST on common Base | Potentially aligned to current VAT Exemptions | Integrated- GST (IGST) on interstate supplies/ import of goods and services | Crude, MS, HSD, ATF and Natural gas to be included at a future date

Stamp duty Alcohol for human consumption Real estate and power |

COMPARATIVE ILLUSTRATION

| Product A | VAT System | GST System |

| Basic Price | 100 | 100 |

| + 12% Excise Duty | 12 | NA |

| + 12.5% VAT | 14 | NA |

| State GST | NA | 12 |

| Centre GST | NA | 12 |

| Total Tax Burden | 26 | 24 |

| Value of Product to consumer | 126 | 124 |

GST GLOBAL SCENARIO

- More than 160 countries have already introduced GST/ National VAT.

- France was the first country to introduce GST system in 1954.

- Typically it is a single rate system but two/ three rate systems are also prevalent.

- Canada and Brazil have a dual VAT.

- Standard GST rate in most countries ranges between 15-20%.

- Goods and services tax in Brazil

- Brazil was the first country to adopt Dual GST system.

- Brazil has adopted a dual GST where the tax is levied by both the central and the provincial governments.

- GST rate is 20 %.

- It has been a part of the tax landscape in Europe for the past 50 years.

- It is fast becoming the preferred form of indirect tax in the Asia pacific region.

- While countries such as Singapore and New Zealand tax virtually everything at a single rate, Indonesia has five positive rates, a zero rate and over 30 categories of exemptions.

- In China, GST applies only to goods and the provision of repairs, replacement and processing services.

- It is only recoverable on goods used in the production process, and gst on fixed assets is not recoverable.

- There is a separate business tax in the form of vat.

RATES OF TAX AROUND THE GLOBE

Standard Indirect Tax Rate

GST: SUMMARY OF BUSINESS IMPACT

| Sr. No. | Business Area | Impact |

| 1 | Procurement |

|

| 2 | Manufacturing |

|

| 3 | Output Service / Distribution of Goods |

|

| 4 | Information Technology |

|

SHORT TERM IMPACTS OF GST IN INDIA

- The GST will fuel inflation for the short term.

- Important note: Tax payers with an aggregate turnover in a financial year upto Rs. 20 (or 10) Lakhs would be exempt from tax.

- A major problem with GST is that the GST doesn’t include liquor and petroleum, and

economic experts and pundits feel that’s it’s a major revenue source for the government and it will be a big place for the capitalist to slash their black money.

SIGNIFICANT FEATURES OF GST

- Levied on all goods and services except alcoholic liquor for human consumption

- Petroleum and petroleum products would be subject to GST (except five products)

- In the case of tobacco and tobacco products, the center alone would have power to levy excise duty in addition to the GST

- Taxes on entertainment and amusement to the extent levied and collected by a Panchayat or a Municipality or a Regional council or a District council are not be subsumed under GST.

- Inter State GST levied and collected by the GOI and should be apportioned between the union and the states in the manner as may be provided by parliament by law on the recommendations of GST Council

INPUT TAX CREDIT MECHANISM

INVOICING REQUIREMENT IN GST

- Ensure that the following details are duly mentioned in the tax invoice

> Name, address and GSTIN of the supplier

> Serial number containing only alphabets and / or numbers unique for a Financial year (This is to be furnished in FORM GSTR-1)

> Date of Invoice

> Name, address and GSTIN of recipient, if registered

> Name, address of recipient and address of delivery along with the state, in case the recipient is unregistered and taxable supply is of Rs. 50,000/- or more

> HSN of goods or accounting code of services

> Description of Goods or services

> Quantity of goods

> Total value of goods or services

> Rate & amount of tax (CGST, SGST or IGST)

> Place of supply along with name of state, in case the supply is in the course of inter state trade

> To be mentioned whether tax is payable under reverse charge

> Signature or digital signature of authorized representative