General Understanding of Exports is that Goods and Services that are Produced in one country and sold to buyers in another.

However, with Exploration of Trade Different Types of Transactions are also become Possible. One such International Transaction is “Third Country Exports”

“Third–Country Exports” means exports made by an Exporter in one Country & Arranging Supply from a Third Country to the Importer (Buyer) in Some other Country.

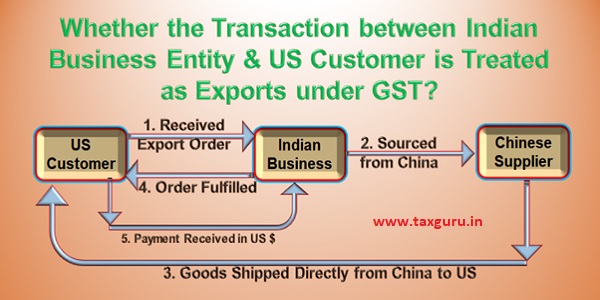

For example, Indian Business Entity, after getting Export Order from USA, Sources the Goods from say China and asks Chinese Supplier to make Shipment Directly to USA. In this case the Goods are not Entering into India, but Directly Transported to USA.

Now let’s discuss Whether GST is Applicable on the sale of goods to the company in USA, where goods sold are shipped directly from China to USA without entering India.

To move forward, we shall try to answer following:

1. Whether the Transaction between Indian Business Entity & US Customer is Treated as Exports under GST?

2. Whether the Transaction is Treated as Supply & GST Applicable on Third Country Exports?

3. How Invoice will be Raised for the Transaction?

Whether the Transaction is Treated as Exports under GST?

Export of Goods : As per Section 2 (5) of IGST Act, 2017 : Export of Goods is Defined as

“Taking Goods out of India to a place outside India”

Since in the above Third Country Exports, Goods are not Physically moved from India, therefore is not Considered as Exports.

Whether the Transaction is Treated as Supply & GST Applicable on Third Country Exports?

Entry No. 07 : CGST (Amendment) Act 2018 :

Schedule III lists out certain transactions which are treated neither as ‘supply of goods’ nor ‘supply of services’.

Vide CGST (Amendment) Act 2018, Entry No. 07 has been inserted to give effect to the following.

Entry No. 07: Earlier there was no provision to deal with a situation of supply of goods from a place in non-taxable territory to another place in non-taxable territory without such goods entering into India.

Now with the insertion of Entry No. 7, it has now become clear that such supply shall not be a ‘Supply within the meaning of section 7(2)(a)’.

Supply of Goods from Non-taxable territory to another place in Non-taxable territory without entering into India are treated neither as ‘supply of goods’ nor ‘supply of services’.

In this Case Transaction between Indian Entity & US Customer is not Treated as Supply & therefore GST is Not Applicable.

How Invoice will be Raised for the Transaction?

As discussed above, since the Transaction is Not Treated as Exports and also Not Treated as Supply under GST and therefore No GST is applicable. Tax Invoice under Sec 31 of CGST Act is not Required to Raise – Commercial Invoice can be Raise for the Transaction.

Two Different Opinions :

Different Advance Ruling are Pronounced on the matter as Follows :

1. In Re Synthite Industries Ltd (AAR Kerala); Order No. CT/2275/18-C3; 26/03/2018

Advance Ruling: Not Liable to GST on the sale of goods procured from China and directly supplied to USA without entering into India.

2. In re Sterlite Technologies Ltd (GST AAR Gujarat); Advance Ruling No. GUJ/GAAR/R/04/2020; 17/03/2020

Advance Ruling: GST Liable on Goods Purchased & Sold Outside India.

Opinion of the Author:

As per paragraph 7 to the Schedule-III to the CGST Act 2017 (as amended by CGST (Amendment) Act 2018 which enlists the transactions which shall not be regarded as supply.

Paragraph 7 to the Schedule-III to the CGST Act 2017 is reproduced here – “Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India”.

Therefore, it should not be treated as supply under the provisions of the GST law and therefore No GST is Applicable.

*****

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST & Foreign Trade Consultant, Practitioner, International Corporate Trainer & Author. Author is Available for Corporate Trainings & Consultancy and Can be reached @ snpanigrahi1963@gmail.com

In the case of third-country export, what documents have to submitted with the bank againstremittance? Also for example in the above given example:- if I receive money from a buyer in Usain us dollars, can I make the payment to China in Yuan?

What is the procedure/provision if a exporter is from India and the goods is manufactured in UK and wanted to move the goods to New Zealand but the proceeds of exports will be paid by Newzealand customer to India. Also the cost of moving the goods from UK to Newzealand will have to paid from India.

In the case of third-country export, what documents have to submitted with the bank against remittance? Also for example in the above given example:- if I receive money from a buyer in Usa in us dollars, can I make the payment to China in Yuan?

In the case of third-country export, what documents have to submitted with the bank against remittance as BE is not available?

Is Import services used for outside India is coming under GST?

Dear sir,

Since 3rd country export is neither supply of goods and nor supply of service. Can u please guide how to report 3rd country export in GSTR1 AND 3B.

Thanks

Since both purchase and sale is outside the purview of GST, there will not be a requirement to disclose this transaction in GSTR 1 OR GSTR 3B. In GSTR 9 AND 9C, this will be shown as reco items.

As the exporter in India is just managing or acting like facilitator of the goods exchange, can this be treated as rendering Service?

Not MERCHANT EXPORT, Such transactions are known as third country export because goods are procured from a foreign country & exported directly to foreign country without goods physically entering india customs..

Dear Sir,

We want to know.. procedure and require documents for Merchanting Trade,,,,

Dear Sir, Thanks for your valued guidance, I want to know how shall we justify the payment received from Customer based in US to whom we directly supplied from China, but we received the payment from US Customer in Indian Current Bank Account. How should that be treated? As I perceive multiple entries through such dealings might be questionable by Tax authorities.

Dear Sir,

Following is a quote by my friend….

“I have a big order for export of Pigeon Peas Pulses. As you all know that export of pulses from india is banned. I have few contacts that i will get the pulses from other countries. Now my question is that shall i export it from foriegn source country to foriegn destination country and take payment in India?

Sir.

The title of the article confusing.

Better you should have put it ‘MERCHANTING TRADE’ as such transactions under FEMA are termed as Merchanting Trade.