What is Sovereign Gold Bond Scheme and Why Sovereign Gold Bonds should be preferred over Physical Gold and Gold ETFs?

Gold has marched ahead of all other assets over the past 1/3/5-year timeframe in terms of investment returns. The Gold ETFs has given 47.79% in last one year as on 05th May’2020. Financial Planners advise 0-10% of the portfolio to be invested in gold depending upon the risk profile, goals and capital market expectations.

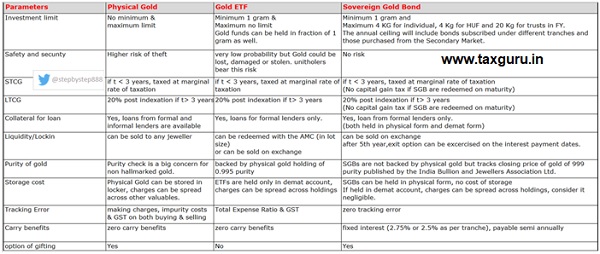

Allocation to gold can be taken by way of Sovereign Gold Bonds, Physical Gold and Gold ETFs (or Gold funds).

as on 05th May’2020 valueresearchonline.com

Sovereign Gold Bonds Scheme

SGBs are issued by the Reserve Bank of India on behalf of the Government of India and the borrowing through issuance of the Bonds form part of market borrowing programme of Government of India (SGBs are not backed by physical gold).

SGBs are tradable government securities denominated in grams of gold with prices linked to the value of the underlying asset — that is gold of 999 purity.

Maturity of Sovereign Gold Bond & Exit option available before maturity:

The tenor of SGB is for a period of eight years with premature optional exit window after 5th year which can only be exercised on the interest payment dates.

Sovereign Gold Bond Price

The bond issue is priced at the simple average of closing price of gold of 999 purity— published by the India Bullion and Jewellers Association—in the last three* working days of the week preceding the subscription. The same methodology is followed for calculation of redemption price.

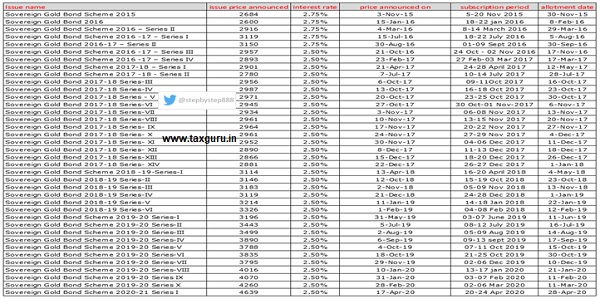

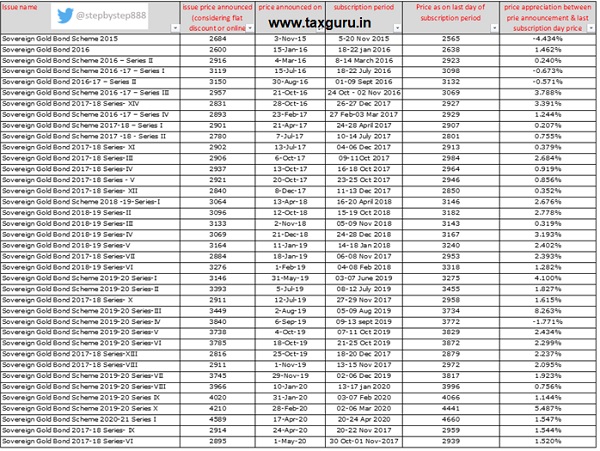

However, in some of the earlier tranches ₹ 50 per gram flat discount has been given and for more recent tranches, issued price has been reduced by ₹ 50 per gram than the nominal value to those investors applying online and the payment against the application is made through digital mode. Payment can also be made through cash (up to ₹ 20000) or cheques or demand draft but ₹ 50 per gram online discount will not be applicable. Here are the details of all the tranches.

*in initial nine tranches, instead of last three, previous week’s (Monday–Friday) simple average of closing price was considered.

Eligibility

Any resident individual including HUFs, trusts, universities and charitable trusts can buy sovereign gold bonds. An investor can have only one unique investor ID & the same is used for all the subsequent investments in the scheme. Non-Resident Indians cannot buy Sovereign Gold Bonds. However, individual investors with subsequent change in residential status from resident to non-resident may continue to hold SGB till early redemption or maturity. SGBs can also be purchased by a guardian or on behalf of a minor.

Category wise minimum and maximum limit for investment:

The Bonds are issued in denominations of one gram of gold and in multiples thereof. Following table clarifies minimum and maximum investment per Financial Year:

| Category | Minimum | Maximum |

| Individual | 1 gram* | 4 KG# |

| Hindu Undivided Family | 1 gram* | 4 KG# |

| Trusts, Universities & Charitable Institutions | 1 gram* | 20 KG# |

*in earlier tranches it was 2 grams

#the annual ceiling per financial year is for units procured through bonds subscribed under different tranches during initial issuance and bought from exchange in a Financial Year. An investor can utilise the ceiling on fiscal year basis. in earlier tranches this limit was different.

Interest on Sovereign Gold Bond (carry benefits)

SGB pays fixed interest at the rate of 2.50% per annum on the amount of initial investment. Interest gets credited semi-annually and the last interest will be payable on maturity along with the principal. Interest on the SGB is taxed as per the provisions of the Income-Tax Act, 1961 (43 of 1961). Tax is not deducted at source and it is the responsibility of bondholder to comply.

Capital Gains on Sovereign Gold Bond

Individual investors holding Sovereign Gold Bonds is exempted for capital gains tax (long term as well as short term) arising on redemption of SGB on maturity. In case the SGBs are sold/transferred/premature exited this benefit will not be available and tax treatment will be same as that of a debt mutual fund.

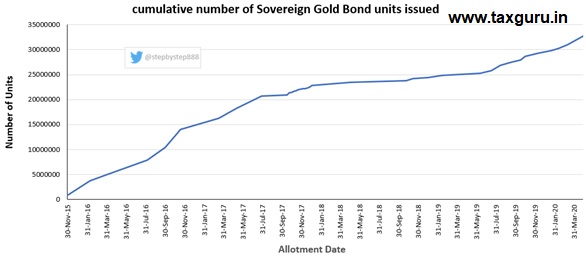

Till now, Government has issued SGB worth 32750 KG of Gold.

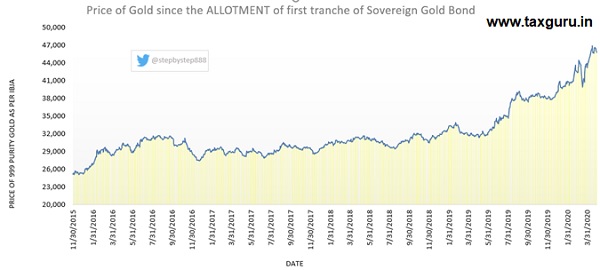

Performance of Gold since the allotment of first tranche of Sovereign Gold Bond:

Comparison of all the three options for taking exposure to gold:

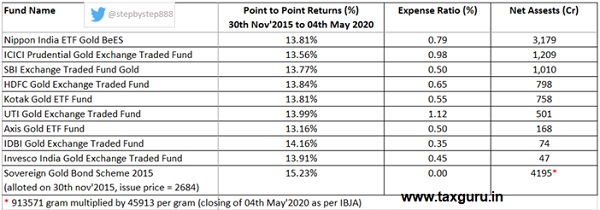

Return Comparison between first tranche of Sovereign Gold Bonds and ETFs:

Sovereign Gold Bond has beaten all the gold ETFs. Bigger difference is, SGB pre-tax and post-tax return will be same on maturity on the other hand minimum taxation slab on Gold ETFs is 20% post adjusting the Cost of Inflation Index.

SGB would have beaten ETFs by a wider margin had the interest pay-out been invested back in SGB (here the writer has calculated based on interest pay out and not interest reinvestment).

Sovereign Gold Bond Scheme 2020-21

Below are the details of upcoming tranches:

Observation of the writer

When the price of a fluctuating asset is fixed and subscription is open for few days, there is always scope for taking advantage of fluctuating prices. In the table below, there were opportunities when Gold was available up to 8.26% cheaper than the market. As a keen observer of anything and everything related to personal finance, just wanted to highlight this anomaly.

What are you waiting for talk to your financial adviser and consider Sovereign Gold Bonds as an investment avenue!

This article has been written by an aspiring fee only financial planner who intends to start affordable fee only advisory after getting the licence from SEBI. Writer can be reached on twitter @stepbystep888 (Nishant Batra)