1. Introduction of GIFT and its concept

The High-Powered Expert Committee submitted a report on ‘Making Mumbai an International Financial Services Centre’ to the Ministry of Finance in 2007, however, the initiative was abandoned due to the global financial crisis in 2008. The Hon’ble Finance Minister Mr. Arun Jaitley while presenting the Union Budget for the year 2015-16, recognizing that India produces some of the finest financial minds, announced the establishment of Gujarat International Financial Tec-City (“GIFT City”), in Gujarat as India’s first International Financial Service Center (“IFSC”).

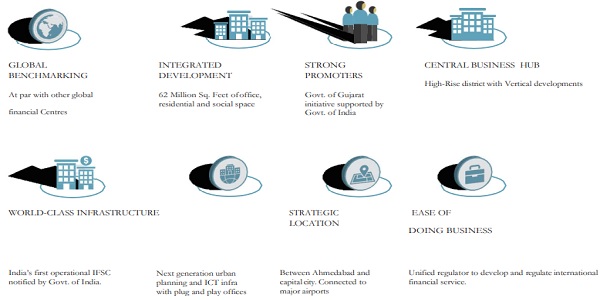

The purpose of setting up the GIFT City is to develop a world class smart city that becomes a global financial hub with the development of an IFSC. GIFT City is central business hub with state-of-the-art infrastructure and a first of its kind development in India. The IFSC in GIFT City seeks to bring to the Indian shores, those financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches /subsidiaries of Indian financial institutions. Establishment of IFSC in India is expected to increase employment opportunities, capture an estimated INR 1,334 crore per day worth trading in rupee derivative, thereby, enhancing economic activity and revenue generation.

This paper summarizes the present regulatory regime for GIFT City along with some structures that may be explored in GIFT City, the direct and indirect tax benefits extended to units established in IFSC to promote their growth.

To develop and implement GIFT City, the Government of Gujarat through its undertaking Gujarat Urban Development Company Limited (“GUDCL”) has established “Gujarat International Finance Tec-City Company Limited” (“GIFTCL”). GUDCL facilitates urban development by assisting state government in formulation of policy, institutional capacity building, project implementation, and in raising funds from multilateral agencies for urban projects in order to achieve high living standards and growth of economic activities.

The GIFT Master Plan facilitates Multi Services Special Economic Zone (“SEZ”) with IFSC status, Domestic Finance Center and associated social infrastructure. GIFT SEZ Limited (“GIFT SEZ”) has been formed by the GIFTCL for development of Multi Services SEZ at Gandhinagar with a prime focus on development of IFSC and allied activities in SEZ. The GIFT SEZ has been set up in accordance with the Special Economic Zones Act, 2005 (“SEZ Act”), Special Economic Zone Rules, 2006 (“SEZ Rules”) and the regulations made thereunder. The core objectives of developing IFSC in GIFT Multi Services SEZ are as under:

- To realize the vision of the Government of India (“GoI”) to emerge as a major economic power by facilitating development of strong base of IFSC in the country.

- Facilitate the implementation of the Government’s strategy for the development of a financial hub in the South Asian sub-continent.

- Position the IFSC as a world-class zone for the long-term provision of office / service accommodation and high technological, economic and commercial infrastructure.

GIFT SEZ is divided into well-defined Processing & Non-Processing areas with emphasis on integrated development such as limited residential & recreational facilities to make the area lively 24 x 7. The GIFT City consists of a Multi- Service SEZ SEZ) and an exclusive Domestic Tariff Area (“DTA”). The total area of 261 acres has been demarcated as SEZ and additional 625 acres has been marked as DTA. It is a Vertical City which will optimize land area consumption for development. It is located on the banks of River Sabarmati connecting the Business capital (Ahmedabad) and Political capital (Gandhinagar) of Gujarat State. The GIFT City has seamless transport connectivity internally and connected to different parts of the world through Ahmedabad International Airport situated just 20 Kms away.

GIFT City caters to India’s large financial services potential by offering global firms, world-class infrastructure and facilities. It aims to attract the top talent in the country by providing the finest quality of life.

The salient features of the GIFT City have been provided below:

2. Benefits/Incentives

For GIFT City to achieve the intended success, the GoI has provided several tax incentives for IFSCs. Brief summary of the tax incentives has been provided under:

I. Direct Tax incentives

i. Tax holiday for units in IFSC: Section 80LA of the Income Tax Act, 1961 (“ITA”) provides that units of an IFSC can avail 100% deduction from its gross total income arising from business for which such unit has been established for any 10 consecutive years out of a period of 15 years, beginning with the year in which the requisite permission for the operation of the IFSC unit was obtained (“Tax Holiday”);

ii. Computation of income: While computing income of non-resident, section 115A(4) of the ITA prohibits deduction under chapter VI-A (which includes the provision for Tax Holiday) of the ITA in certain cases. However, an exception has been provided such that the conditions contained in section 115A(4) are not applicable to units located in IFSC. Accordingly, the units located in IFSC should be able to take full benefit of Tax Holiday under section 80LA of the ITA.

iii. Reduced minimum alternate tax: Section 115JB provides that in case of a unit located in an IFSC which derives income solely in convertible foreign exchange, minimum alternate tax (“MAT”) shall be applicable at rate of 9%. Pertinent to note that the MAT rate for companies has been reduced from 18.5% to 15% under the ITA. Considering this, the Government may consider a further reduction of the MAT rate applicable to a unit located in an IFSC.

iv. Reduced corporate tax rate: As per section 115BAA of the ITA, domestic companies may opt for concessional corporate tax rate of 25.17% (inclusive of surcharge and cess) provided certain specified deductions / benefits are not taken, for example, additional depreciation, deduction under section 10AA etc. However, a specific exemption has been provided that units in IFSC opting for lower tax rate would be eligible to claim deduction under Section 80LA of the ITA. Pertinent to note that the taxpayer has to specifically opt for this regime before filing the income-tax return and the option cannot be subsequently withdrawn once opted. Also, MAT does not apply to companies which opt for this concessional regime. Accordingly, units in an IFSC can opt for concessional tax rate and also take deduction under section 80LA of the ITA.

v. Tax on distributed income: Section 115R provides that no additional income-tax is chargeable in respect of any amount of income distributed on or after the September 1, 2019 by a specified Mutual Fund, out of its income derived from transactions made on a RSE located in any IFSC and where the consideration for such transaction is paid or payable in convertible foreign exchange;

vi. Concessional withholding tax on interest income: Section 194LC provides a concessional rate of withholding tax for certain interest income earned by non-resident, not being a company or a foreign company. Section 194LC provides that the Indian company or business trust responsible for paying interest to non-resident, not being a company or to a foreign company, shall withhold tax at rate of 4% on such interest income in respect of monies borrowed by it from a source outside India by way of issue of any long-term bond or rupee denominated bond on or after the April 1, 2020 but before the July 1, 2023, which is listed only on a RSE located in any IFSC;

vii. Concessional rate of tax on capital gains: Section 112A and 111A of the ITA provides that longterm capital gains or short-term capital gains arising on sale of equity share or units of equity-oriented funds or units of a business trust on a RSE established in IFSC where consideration for such sale is received in foreign exchange, shall be taxable at the concessional rate of rate of 10% and 15%, respectively, irrespective of payment of securities transaction tax;

viii. Exemption from capital gains tax from transfer of specified securities: Section 47(viiab) of the ITA exempts any transfer of global depository receipts, rupee denominated bonds of an Indian company, derivatives or other specified securities as may be notified by the Central Government made by nonresidents on RSE in IFSC and where the consideration for such transaction is paid or payable in foreign currency, from capital gains tax. The Central Board of Direct Taxes (“CBDT”) has recently notified the following securities listed on a RSE located in an IFSC would also be eligible for the exemption from capital gains tax under section 47(viiab):

a. foreign currency denominated bond;

b. unit of a Mutual Fund;

c. unit of a business trust;

d. foreign currency denominated equity share of a company;

e. unit of AIF.

these securities along with global depository receipts, rupee denominated bonds of an Indian company, derivatives are hereinafter collectively referred to as “Specified Securities”.

ix. Exemption of certain income of Category-III AIF in IFSC: Section 10(4D) of the ITA exempts the income accrued or arisen to or received by a Category-III AIF in IFSC as a result of transfer of the Specified Securities, on RSE located in IFSC where consideration for such transfer is paid in convertible foreign exchange, to the extent such income accrued or arisen to, or is received in respect of units held by a non-resident. This exemption is available only to Category-III AIF located in IFSC of which all units are held by non-residents other than units held by sponsor or manager.

x. Exemption from filing income-tax return: The CBDT has exempted i) a non-resident, not being a company, or ii) a foreign company having income chargeable under the ITA from any investment in an investment fund (i.e. Category-I / Category -II AIF) set up in an IFSC located in India, from filing of income-tax return in India. However, such exemption is available only if tax has been appropriately deducted and deposited to the government by the IFSC AIF as per provisions of the ITA.

xi. Exemption from obtaining permanent account number: The CBDT has recently granted exemption to a non-resident, not being a company or a foreign company, investing in Category-I / Category-II IFSC AIF from obtaining a permanent account number (“PAN”), provided the conditions below as satisfied:

-

- The non-resident investor does not earn any income in India, other than the income from investment in IFSC AIF;

- The IFSC AIF withholds tax under section 194LBB of the ITA and duly remits such tax withheld to the Central Government;

- The non-resident furnishes the specified details (like name, email ID, contact number, address in resident country etc.) to the IFSC AIF;

Further, the CBDT has provided that IFSC AIF shall electronically furnish a quarterly statement within 15 days from the end of the quarter of the financial year in Form No. 49BA to the tax authorities. Additionally, the CBDT has also clarified that the provisions of section 206AA of the ITA shall not apply in respect of payments made to a person being a non-resident, not being a company, or a foreign company if the provisions of section 139A do not apply to such person on account of the above exemption.

xii. Other exemption:

a. Commodities transaction tax not leviable on units in an IFSC;

b. Stamp duty not chargeable in respect of the instruments of transaction in RSE and depositories established in IFSC.

c. Aircraft leasing and financing: The Government of Gujarat in exercise of the powers conferred by clause 9 of the Gujarat Stamp Act, 1958 issued notification dated August 4, 2020, for exemption of stamp duty chargeable under the Gujarat Stamp Act in connection with establishment / incorporation / setting up or carrying out or availing, providing any services or acquisition of moveable or immoveable property for the purpose of and in relation to aircraft / aircraft engine / helicopter leasing, and or aircraft / aircraft engine helicopter financing or refinancing or insurance, reinsurance business in or from SEZ Including IFSC at GIFT City, Gandhinagar for the period of 10 years.

II. Indirect Tax incentives

i. Customs Duty: Exemption from customs duty for all goods imported in the SEZ used for authorized operations. However, any removal of goods from SEZ into Domestic Tariff Area (“DTA”) would attract customs duty;

ii. Central Excise Duty: Exemption from duty of excise on domestic procurement to carry out authorized operations. However, the removal of goods into DTA shall be liable to customs duty;

iii. Drawback: Drawback and such other benefits on goods brought into the SEZ. Goods supplied to SEZ regarded as export for customs purpose;

iv. Deemed Export: Supply of goods or services by an Export Oriented Unit (“EOU”) or Software Technology Parks of India (“STPI”) unit regarded as export. Foreign Trade Policy (“FTP”) regards supplies to SEZ as export of goods or services;

v. Goods and Service Tax (“GST”): Supply of goods or services from DTA to a unit located in SEZ Unit is regarded as a zero rated supply (irrespective of the currency in which payment is being made). Further, import of services into FTWZ/ SEZ is not liable to GST;

vi. Central Sales Tax (“CST”): Exemption from CST on inter-state procurement of goods used for authorized operations. (Entails compliance of issuing ‘Form I’ by the SEZ unit to the supplier of goods);

vii. Electricity Duty / Stamp Duty / Registration Fees: Exemptions / reimbursements under the Gujarat State Industrial and IT Policy. New IT policy introduced in February 2016 for five years (2016- 2021); and

viii. The Government of Gujarat has also exempted stamp duty for entities having registered office in GIFT for capital market activities. The Government of Gujarat has also issued a notification dated April 11, 2020 to refund the Stamp Duty to Stockbrokers having registered office in GIFT City.

3. Ancillary services at IFSC

A framework for enabling Ancillary services has been provided considering the importance of professional and other service providers for the development of financial products, financial services and financials institutions in the IFSC. This framework shall be applicable to all ancillary service providers (hereinafter referred to as “service provider(s)”) engaged in one or more permissible ancillary services within the IFSC.

Ancillary services shall mean those services which directly or indirectly aid, help, assist or strengthen or are attendant upon or connected with the services, as detailed under sub- clauses (i) to (xi) of clause (e) of subsection (1) of section 3 of the IFSCA Act, 2019.

Permissible ancillary services:

The service providers may engage in any one or more of the following activities:

i. Auditing, Accounting, Bookkeeping and Taxation Services;

ii. Professional Legal, Compliance and Secretarial;

iii. Management Consulting Services;

iv. Administration, Assets Management Support Services and Trusteeship Services;

v. Any other services as approved by IFSCA from time to time

## Detailed circular on framework of ancillary services issued on 10th Feb,2021 and clarification of circular issued on 10th June,2021 can be read at www.ifsca.gov.in

4. Conclusion

The Indian government and all the regulatory agencies have been working in unison to enable GIFT City for offering business and regulatory environment that is comparable to other leading IFCs. While the world has witnessed the growth of international financial hubs such as London, New York, Hong Kong, Singapore and Dubai, the time is now ripe to enhance capital flows through the GIFT City in India. India’s attractiveness has also been enhanced by the Government’s move to create an environment in which there is ease of doing business. Further, given the global political unrest, it may be a good time for investors to explore IFSC in India.

Having said the above, notably, the IFSC in GIFT City provides numerous benefits to the entities setting up operations there, some of the benefits include: a state-of-the-art infrastructure at par with other leading global financial centres, a liberal tax regime and a strong regulatory and legal environment. However, the recent tax and regulatory clarifications / relaxations should provide a stimulus for further development of IFSCs in India and enable bringing back of financial services and transactions that are currently carried out in OFCs to India.

This should also generate significant direct and indirect employment in the financial sector in India. Further, appropriate utilization and allocation of land in GIFT City should also provide immediate boost for business activities in GIFT City. The establishment of IFSC Authority to act as a single window for regulating activities in an IFSC should help build investor confidence through consistency, transparency and clarity in policy measures.

Hi, Brilliant write up. I had a query

If a new Company is set up in IFSC as ancillary service provider opting for New tax regime @25.17%, would that mean it is not required to pay neither 9% MAT nor CT @ 25.17% for 10 consecutive years out of 15 years?