Circular No. 1061/10/2017-CX

F.No: 116/15/2017-CX-3

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise & Customs

New Delhi, dated 30th November, 2017

To

The Principal Chief Commissioner/ Chief Commissioner of GST & Central Excise (Chandigarh, Meerut, Kolkata and Shillong zone)

DG, GSTI, New Delhi

Pr. CCA, CBEC

DG, DG Audit, New Delhi

Subject: Procedure for manual disbursal of budgetary support under Goods and Service Tax Regime to the units located in States of Jammu & Kashmir, Uttarakhand, Himachal Pradesh and North East including Sikkim. —reg.

Madam/Sir,

Attention is invited to the Circular No. 1060/9/2017-CX dated 27.11.2017 issued by the Board on the above subject. In terms of para 10 of the aforesaid circular a separate circular on the manner of allocation of the budget by DIPP and direct transfer of the sanctioned amount into bank accounts of the beneficiaries through PFMS was also required to be issued by the Board. The issue was consulted with the Principal C.C.A., CBEC. Accordingly, it has been decided to substitute sub-para (vi) of para 8 of the circular dated 27.11.2017 as under:-

“(vi) After registration of the eligible unit, based on the details mentioned by the applicant on the Registration Form, the bank account of the applicant shall be validated by the Asstt./Dy. Commissioner (in the capacity of Program Division of CBEC) and a Unique Vendor Id will be created. This exercise should be completed within 3 days of registration of the eligible unit and the unique vendor Id shall be on endorsed on all the copies of the application. The second copy of the application shall be kept in record by the DDO.”

2. The manner of transfer of the budget by DIPP to DDOs and manner of sanction and payment shall be as per paras 3 & 4 below:-

3. Transfer of budget by DIPP to DDOs

(i) The Assistant/Deputy Commissioner of CGST Division after receipt of the application for budgetary support shall determine the tentative amount of budget allocation required for disposal of all the pending applications. The budget requirement shall be forwarded by the CGST Commissionerates in respect of all the Divisions in their jurisdiction to ADG, DG Audit, New Delhi who has been nominated as the nodal officer for the scheme by the Board. The DDO Code and PAO Code of the concerned Division & Commissionerate and amount required by each of the Division shall also be indicated in the requirement. The ADG, DG Audit would compile the requirement and forward it to the concerned Scheme Division of the DIPP with a copy endorsed to the Pr. CCA, CBEC.

(ii) Scheme Division of the DIPP on the basis of requirement received from ADG, DG Audit would issue a Letter of Budget Authorization through the Accounts Office, DIPP in favour of the Pr. Accounts Office, CBEC on PFMS portal allocating/authorizing the budget in favour of each of the DDO duly mapped to a specific PAO, CBEC. The Pr. Accounts Office, CBEC shall forward the authorized budget to the respective PAOs and the budget shall get reflected against the concerned DDO on PFMS.

(iii) Once the budget so authorized is exhausted after disbursement, further assessment of the budget requirement shall be made and a communication for further requisition of budget authorization shall be sent by the Commissionerate to the ADG, DG (Audit). The Scheme Division of the DIPP shall get the fresh Letter of Authorization issued through Pr. Accounts Office, DIPP in favour of Pr. Accounts Office, CBEC per para 3(i1) above.

(iv) DDO of each of the Division of CGST Commissionerates must ensure availability of sufficient budget so authorized by DIPP before sending the bill to the concerned PAO. The PAO shall pass the bill on First-In-First-Out basis subject to availability of budget and return the bill if sufficient budget is not available against the respective DDO.

(v) The entire process of Budget authorization and the payments against such authorization will be dealt by the provision of IGAA Module of PFMS. For further details with regard to the authorization of budget through PFMS, the User Manual as available at http://cga.nic.infiwritereaddata/tilejFinalMODIHEDLOAUSERMANUAL2509 2017.pdf may be referred.

4. Sanction and payment of budgetary support:

(i) After the sanction of the budgetary support, a sanction order addressed to concerned Pay and Accounts Officer shall be issued by the jurisdictional Assistant/Deputy Commissioner of CGST Division in duplicate, a copy of which shall be endorsed to DDO for preparation of the bill. The sanction order should, inter alia contain the detailed Account Head and the beneficiary details along with the amount to be paid.

(ii) The Assistant/Deputy Commissioner shall also act as Programme Division (PD) on PFMS portal and prepare the sanction on PFMS and forward it online to concerned DDO. It should be ensured by the Programme Division that the sufficient budget is available.

(iii) DDO on the basis of physical copy of the sanction order received from Programme Division (PD) shall prepare the bill and forward the same to the mapped Pay and Account Office. Bank account details of the beneficiaries duly certified by DDO shall be attached with the bill along with the ink signed Sanction Order.

(iv) The standard operating procedure as applicable for payment through PFMS shall be applicable and funds shall be transferred into the account of beneficiaries by the PAO.

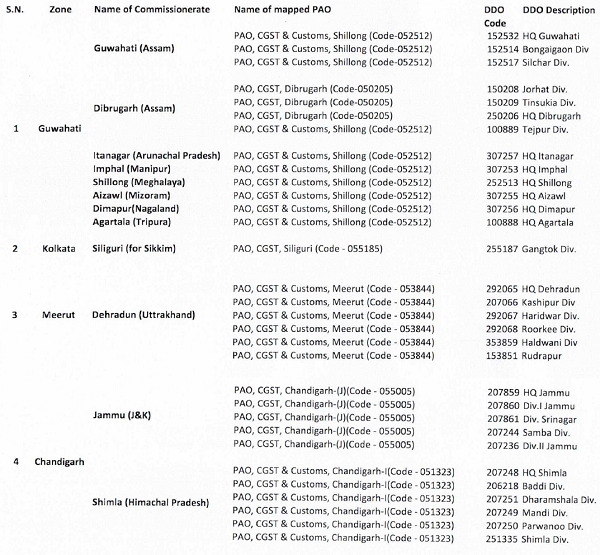

5. Zone-wise list of Commissionerates containing details of the mapped PAOs and DDOs along with the Codes is enclosed for reference.

6. Difficulty faced, if any, in the implementation of the Circular should be brought to the notice of the Board. Hindi version will follow.

Encl.: As above

Yours Faithfully,

(Rohan)

Under Secretary

CX3