‘Import Substitution’ (IS) generally refers to a Trade & Economic Policy that that advocates Replacing or Eliminating or Minimizing the Importation of the commodity and Encourage for the Production in the Domestic Market. It is based on the Premise that a Country should attempt to Reduce its Foreign Dependency through the Local Production of Industrial Products.

Import substitution is the idea that Blocks Imports of manufactured goods to help an economy by increasing the demand for domestically produced goods. The logic is simple: Why import foreign-made cars or clothing or chemicals when one could produce those goods at home and employ workers in doing so?

In the 1940s and 1960s a new paradigm of industrialization and development had taken developing countries by storm – Import Substituting Industrialization (ISI) in Latin America—particularly in Brazil, Argentina, and Mexico—and in some parts of Asia and Africa. But that was soon overtaken in the 1970s and beyond by the open trade export-led growth strategy that led to the tremendous economic success of East Asian economies, followed by that of China.

Import substitution is popular in economies with a Large Domestic Market like India. For large economies, promoting local industries provided several advantages: Economic Growth, Improved GDP, Employment Generation & Elevate Poverty, Develop Robust Domestic Manufacturing Base & Industrialization, Import Reduction & Improve the Trade Balance, and Saving in Foreign Currency that Reduced the Pressure on Foreign Reserves; becoming more Self-sufficient and Less Vulnerable to Adverse Terms of Trade and Decrease Dependency on other Nations.

Through this policy, the government is trying to Protect the Domestic Industries from Foreign Competition through Two Forms:

Tariffs: Tax on imported goods to discourage their Importation.

Non-Tariff Barriers: Specify the quantity of goods to be imported.

The dis-advantages of Import Substitution are too much Protection to Domestic Industry Limits Growth, Create Inefficiency, Low Levels of Innovation, Low Quality, Inferior to International Standards, Obsolete Products, Doesn’t have the Sufficient Technology, Not Exposed to International Competition, Competitive Disadvantage. The Consumers have Less Choice and to pay more Cost.

Import Substitution A Balancing Act

While adopting Import Substitution, we should take into consideration some of the factors like Capabilities of Domestic Manufacturing Industry, Economic Compulsions & Constraints (like Forex Reserves), WTO Regulations, FTAs & Other International Norms and also End Consumers Right to Choose. Following re some of the guiding principles:

> Should not Restrict or Exercise Blanket Control on All Imports

> Should not Open Up Domestic Market Irrationally to the Foreign Suppliers

> Reasonable Protection Should be Provided to Domestic Industry as they Can’t be Equated with Global Giants.

> Rational Controls over Non-Essential Imports

> Competition must be Among Equals

> Focus on Value Addition

> Collaboration – Mutual Beneficial Arrangements

Let’s now Discuss need for Import Substitution from

♦ Domestic Consumption & Domestic Production

♦ Non-Essential Imports

♦ Nationalism & Self Sufficiency / Reliance

Domestic Consumption & Domestic Production

India is the world’s second most populous country with a population of 1.3 billion. With an annual population growth rate 1.1 per cent, India is estimated to become the most populous country by 2024.

With its size and growing middle class, India provides an enormous business potential. According to a recent report published by World Economic Forum, India is poised to become the third largest consumer market next to US and China by 2030. The report also states that the consumer spending in India is expected to grow to USD 6 trillion by 2030.

Consumption has always been the driving force and pillar of India’s growth story. For instance, presently, consumption has a share of 57 per cent in the total gross domestic product. It shows that consumption demand has a greater impact on the overall growth of the country. India has Large Growing Middle Income Population – Inceasing Share of Young Working Population.

India has become one of the most attractive destinations for investment in the manufacturing sector. Manufacturing has emerged as one of the high growth sectors in India. The Government of India has taken several initiatives to promote a healthy environment for the growth of manufacturing sector in the country. India is an attractive hub for foreign investments in the manufacturing sector. Several mobile phone, luxury and automobile brands, among others, have set up or are looking to establish their manufacturing bases in the country.

India can Achieve I’s full Manufacturing Potential as it looks to Benefit from Demographic Dividend and Large Working Force over the Next Two to Three Decades. The manufacturing sector of India has the potential to reach US$ 1 trillion by 2025.

Non-Essential Import

India imports around 11,500 types of goods every year with commodities like Crude Oil, Gold, Electronic Goods, Fertilizers, Capital Goods, Machine Tools, Edible Oil, Plastic Goods, Metal, Toys and Pharmaceutical Products etc.

Non–essentials are things that are not absolutely necessary. In a recession, consumers could be expected to cut down on non–essentials like Toys, Plastic Goods, Sports Items, Furniture, Gold, Household Steel Items, Electronic Goods, Electrical Items, Wrist Watches, Wall Clocks, Ampoules, Glass Rods and Tubes, Hair Cream, Hair Shampoos, Face Powder, Eye and Lip Make up Preparations, Printing Ink, Paints and Varnishes, some Tobacco Items and Food Items, such as Fruits and Almonds, among others.

Import from China

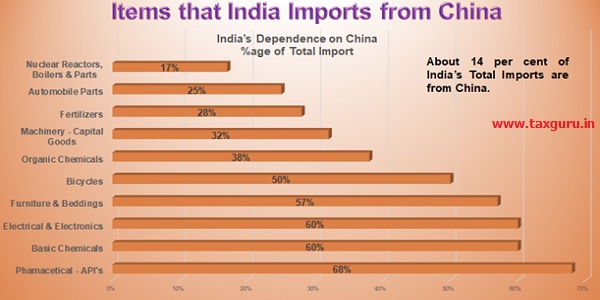

China accounts for about 14 per cent of India’s Total Imports (20 per cent of India’s total non-oil, non-gold imports).

The major commodities currently imported from China are: Electronic Equipment; Mobile Handsets, Smartphones; Telecom & Power Equipment’s, Capital Machines, Engines and Pumps; Organic Chemicals; Fertilizers; Iron and Steel; Plastics; Metal Products; Gems and Precious Metals; Ships and Boats; and Medical and Technical Equipments; Batteries, Leather Products, toys, Chemicals and Critical Pharma Ingredients and Automobile Parts etc.

Non-essential Imports from China amount to ₹4 Trillion a year, according to a commerce ministry estimate.

India’s trade deficit with China fell to USD 48.66 billion in 2019-20 on account of decline in imports from the neighboring country, according to government data.

Exports to China in the last financial year stood at USD 16.6 billion, while imports aggregated at USD 65.26 billion, the data showed the trade deficit between the countries was at USD 53.56 billion in 2018-19 and USD 63 billion in 2017-18.

Import Substitution through Various Tariff & Non-Tariff Measures

The government is looking to introduce an import substitution policy to ‘Replace Foreign Imports’ and boost domestic manufacturing in the wake of the current economic scenario due to Covid-19.

WTO Compatible Trading Barriers

Tariff Barriers

Tariff is a Tax Levied on Goods Traded Internationally, that is on Imports. As a result, the Price Level of Imported Products Rises and the Demand for them decrease, thus imports are Controlled.

Non-Tariff Barriers

Non-Tariff Barriers (NTBs) include all the Rules, Regulations and Bureaucratic Delays that help in keeping Foreign Goods out of the Domestic Markets or Discourage.

Following are some of Tariff & Non-Tariff Barriers

Import Restrictions – Tariff Barriers

India has increased duties on more than 3,600 tariff lines covering products from sectors such as textiles and electronics since 2014.

India already raised taxes on imports of goods such as electronic items, toys and furniture in February, 2020.

Products from around 20 sectors that have a manufacturing advantage and can attract investments are being considered for import restrictions.

These include furniture, leather, footwear, agro-chemicals, air-conditioners, CCTVs, sports goods, toys, ready-to-eat food, steel, aluminium, electric vehicles, auto components, TV set-top boxes, ethanol, copper, textiles and bio fuels.

The government is also planning to impose a 20-25% import duty on active pharma ingredients (API) that can be produced locally to cut reliance on China.

Government Looking at Non-tariff Barriers to Curb Chinese Imports

Strategy of Increasing Customs Duty to Restrict Imports Not Proved Effective. Non-Tariff Measures Need to be Implemented.

Non-tariff Barriers : Framing Technical Regulations and Quality Norms

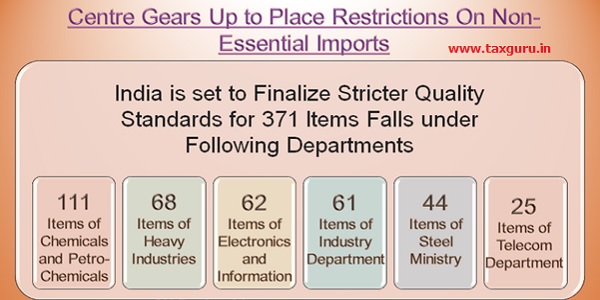

The government is taking steps such as Framing Technical Regulations and Quality Norms for several products to cut dependence on China for imports with the aim of deterring non-essential lower quality imports which render Indian products uncompetitive.

As many as 371 products have been identified for technical regulations. Out of these, technical regulations have been formulated for 150 products worth about USD 47 billion of imports.

Over 50 quality control orders (QCOs) and other technical regulations have been notified in the past one year including on electronic goods, toys, air conditioners, bicycle parts, chemicals, safety glass, pressure cooker, items of steel, electrical items such as cables.

Over 50 quality control orders (QCOs) and other technical regulations have been notified in the past one year including on electronic goods, toys, air conditioners, bicycle parts, chemicals, safety glass, pressure cooker, items of steel, electrical items such as cables.

Compulsory Registration Scheme (CRS)

Ministry of Electronics & Information Technology (MeitY) has notified “Electronics and Information Technology Goods (Requirement for Compulsory Registration) Order, 2012” on 3 Oct 2012.

As per the Order, no person shall manufacture or store for sale, import, sell or distribute goods which do not conform to the Indian standard specified in the order. Manufacturers of these products are required to apply for registration from Bureau of Indian Standards (BIS) after getting their product tested from BIS recognized labs.

Bureau of Indian Standards then registers the manufacturers under its registration scheme who are permitted to declare that their articles conform to the Indian Standard (s). The registered manufacturers are then allowed to put the Standard Mark notified by the Bureau.

The Scheme is modified from Time to Time to include more & more Items.

India Announces Import Curbs On 101 Defense Items in Aug’2020

In a push to promote the domestic defense industry, Defense Minister Rajnath Singh on Aug’2020 announced restrictions on import of 101 weapons and military platforms including light combat helicopters, transport aircraft, conventional submarines and cruise missiles by 2024.

Making the announcement on Twitter, the defence minister estimated that the domestic defense industry would receive contracts worth almost Rs 4 lakh crore within the next five to seven years as a result of the decision to prune the import list. Singh said the defence ministry is now ready for a “big push” to boost indigenous defense manufacturing in tune with Prime Minister Narendra Modi’s call for ‘Atmanirbhar Bharat’.

The list incorporates major armaments such as artillery guns, assault rifles, corvettes, sonar systems, transport aircraft, ammunition, radars, conventional diesel-electric submarines, communication satellites and shipborne cruise missiles.

The items on the list, worth a total of $53.4 billion, are to be manufactured in India, with local companies as prime contractors. Of these, about $17.3 billion will be either Army or Air Force programs, and defense contracts worth $18.6 billion will be meant for naval programs. The MoD said these orders will be placed with domestic companies within the next five to seven years.

The domestic industry will now stand a better chance to compete among itself and cater to local demand. Singh’s announcement came a week after a draft defense procurement policy of the defense ministry projected a turnover of Rs 1.75 lakh crore in defense manufacturing by 2025.

MoD signs Rs 2,580 cr deal for Pinaka Rocket Launchers

In a big boost to the ‘Make in India’ initiative, the defence ministry has signed contracts worth Rs 2,580 crores with Indian companies to supply six army regiments with Pinaka missiles.

The acquisition wing of the ministry of defence signed contracts with Bharat Earth Movers Ltd, Tata Power Company Ltd, and Larsen & Toubro on August 31, a statement from the ministry said.

The six Pinaka Regiments comprise of 114 Launchers with automated gun aiming and positioning system and 45 command posts to be procured from M/s TPCL and M/s L&T, and 330 vehicles to be procured from M/s BEML.

Defense Canteens to Ban Import of Finished Goods

In a major decision in Oct’2020, Government banned all ‘Direct Imported’ items being sold at the government-controlled Canteen Stores Department (CSD), which operates canteens for Defense Forces.

India’s defense canteens sell liquor, electronics and other goods at discounted prices to soldiers, ex-servicemen and their families. With annual sales of over $2 billion across 4,000 military shops, they make up one of the largest retail chains in India.

Out of the 5,500 items sold by the CSD, around 420 are imported according to the Manohar Parrikar Institute for Defense Studies and Analyses (IDSA). Imports make up around 6-7% of total sales value in the defense shops.

Among all the countries, China accounts for a bulk of the imported items such as Toilet Brushes, Diapers, Vacuum Cleaners, Electric Kettles, Sandwich Toasters, Laptops and Ladies’ Handbags, Consumer Durables, Smart Phones, Footwear & Foreign Liquor.

India has in recent months taken steps to curb Chinese businesses and investments following a border clash in June that killed 20 Indian soldiers.

Government steps up efforts to cut Solar Panel Imports from China, proposes 20-25% customs duty

The levying of the duty is aimed at reducing imports from China, which continues to be the largest supplier of solar equipment to India even after imposition of the safeguard duty in July 2018.

The government in July 2018 had imposed a 25% Safeguard Duty on import of solar cells from China, Malaysia and developed countries.

To curb imports of solar panels, the Ministry of New and Renewable Energy (MNRE) has proposed to levy 20-25% basic customs duty, Union power minister RK Singh said. For solar cells, the domestic manufacturing capacity of which is lower, the duty will be 15%, he added. The duty on panels will progressively be increased to 40%.

The duties are levied right after the safeguard duty regime on these products ended on July 31.

Government Directed Telecom Firms like BSNL, MTNL to Avoid Using Chinese Equipment

The government directed telecom firms like BSNL, MTNL, and their subsidiaries to avoid using Chinese equipment as border tension between the two countries escalates. The Telecom Ministry has now ordered BSNL, MTNL, and other private companies to ban all Chinese deals and equipment.

Ban on power equipment imports from China, Pak

India will not allow import of power equipment from China and Pakistan, power minister R K Singh announced, citing recent transgression in border areas and cyber security threats. Imports from other nations will need permissions.

“Today we manufacture everything that is required for power generation, transmission and distribution. In 2018-19, we imported Rs 71,000 crore power equipment of which Rs 21,000 crore are Chinese. We cannot tolerate this, that you have a country which transgresses into our country and yet we create jobs in that country, when we have the ability to manufacture it (equipment) ourselves. We have decided not to buy from prior-reference countries. Any equipment imported will need permission. And we will not give permissions for equipment from China and Pakistan.

New ‘Rules of Origin’ to Check Misuse of FTA Provisions

Notification No. 81/2020-Customs (N.T.) dated 21st August, 2020.

Circular No. 38/2020-Customs; Dated 21st August, 2020

The government has come out with norms for the enforcement of ‘Rules of Origin‘ provisions for allowing Preferential Rate of Customs Duties on Products Imported under Free Trade Agreements aiming at striking a delicate balance in its efforts to check misuse of FTAs by unscrupulous importers and ensuring that their use by legitimate businesses is not discouraged.

The Department of Revenue has notified the ‘Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020’ which “come into force on September 21, 2020“.

Measures by DGFT to Shift Import of Items Allowed Freely to Restricted / Prohibited : Examples

ACs with Refrigerants :

On 15th Oct’2020, Director-General of Foreign Trade (DGFT), moved Split System and Others ACs with refrigerants have been from “Free” to “Prohibited” category. The domestic market of air conditioners is believed to be around $5-6 billion.

Colour Television

On July 31, 2020, “Import policy of colour television…..is amended from free to restricted,”

Imports of TV stood at about $1 billion during 2018-19. China ($535 million in 2018-19) is the largest exporter of TV sets in India. It was followed by countries like Vietnam ($327 million), Malaysia ($109 million), Hong Kong ($10.52 million, Korea, Indonesia, Thailand, and Germany.

Pneumatic Tyres

On 12 June’2020, India put import of new pneumatic tyres under restricted list, to limit their imports especially from China. In FY20, India imported new pneumatic tyres worth $370 mn with China ($93 mn) and Thailand ($95 mn) contributing the larger chunk of it.

Refined Palm Oils

The government on 8th Jan’2020 put restrictions on import of refined palm oils. The country imports around 15 million tonnes of edible oil a year, forking out Rs 70,000 crore. “Out of this, around 20% is refined oils and the rest is crude. Now more crude oil will be imported,”

According to the Solvent Extractors’ Association (SEA), a trade body, the existing refining capacity in the country is around 30 million tonnes, but only 45% this is being utilized.

Agarbatti

Import policy of Agarbatti and other Odoriferous preparations which operate by burning …is revised from Free to Restricted. Now importers of these goods require licence from the government for import purpose. Its imports increased to USD 12.35 million in 2018-19 from USD 7.51 million in 2017-18.

Imported Toys

India imported toys worth nearly Rs 4,000 crore in 2019-20 , almost 85% Imported from China. The commerce ministry had in February issued the quality control order (QCO) mandating that no toy, including those manufactured in India, would be sold without having BIS certification from September. Till now there are no licence-holders for manufacturing toys.

Silk Imports

Rs 800 crore silk imports from China can be stopped if local production ramped up.

In order to protect domestic sericulture farmers and silk reelers, anti-dumping duty of $1.85 per kg has been imposed on Mulberry raw silk of 3A Grade and below, originating in or exported from China to restrict in order to promote local production and create more jobs.

Viscose Staple Fibre (VSF)

Anti-dumping duty Imposed on viscose staple fibre (VSF) — a key raw material used in apparels, home textiles, dress materials, knitwears and non-woven applications – Anti-dumping duty $0.103 to $0.512 per kg on imports from Indonesia, China and Thailand.

India Lists 38 Drug Raw Materials for which it wants to End Dependence on China

“The government’s apex body, the Central Drug Standards Control Organisation (CDSCO) has prepared a list of 38 essential APIs where India needs to be self-dependent.

‘The government wants these API’s be produced locally in a bid to end the country’s dependence on Chinese imports.

Indian drugmakers import around 70 per cent of their total bulk drugs from China. In 2018-19 fiscal, the government had informed the Lok Sabha that the country’s firms imported bulk drugs and intermediates worth $2.4 billion from China.

India is moving towards reducing dependency on the import of Active Pharmaceutical Ingredients (APIs) and drug intermediates from China. “There has been a 4 per cent reduction in import of APIs and other raw materials from China in the last one year,” R Uday Bhaskar, Director-General, Pharmaceutical Export Promotion Council (Pharmaexcil)

The government is also planning to impose a 20-25% import duty on active pharma ingredients (API) that can be produced locally to cut reliance on China.

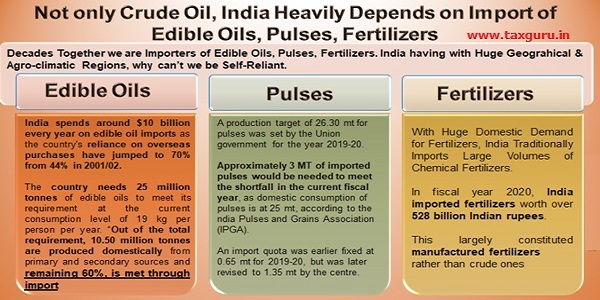

India Should Become Self-Reliant on Edible Oils, Pulses & Fertilizers

Not only Crude Oil, India Heavily Depends on Import of Edible Oils, Pulses, Fertilizers.

Decades Together we are Importers of Edible Oils, Pulses, Fertilizers. India having with Huge Geograhical & Agro-climatic Regions, why can’t we be Self-Reliant.

Decades Together we are Importers of Edible Oils, Fertilizers

India having with Huge Geograhical & Agro-climatic Region, why can’t be Self-Reliant in Edible Oils (India spends around $10 billion every year on edible oil imports as the country’s reliance on overseas purchases have jumped to 70% from 44% in 2001/02).

With Huge Domestic Demand for Fertilizers, India Still Imports Large Volumes of Chemical Fertilizers (In fiscal year 2020, India imported fertilizers worth over 528 billion Indian rupees. This largely constituted manufactured fertilizers rather than crude ones).

India needs 25 million tonnes of edible oils to meet its requirement at the current consumption level of 19 kg per person per year. “Out of the total requirement, 10.50 million tonnes are produced domestically from primary and secondary sources and remaining 60%, is met through import.

India needs 25 million tonnes of edible oils to meet its requirement at the current consumption level of 19 kg per person per year. “Out of the total requirement, 10.50 million tonnes are produced domestically from primary and secondary sources and remaining 60%, is met through import.

The oilseed production of the country has been growing impressively. Despite this, there exists a gap between the demand and supply of oilseeds, which has necessitated sizable quantities of imports, the minister added.

Soybean, rapeseed & mustard, groundnut, sunflower, safflower & niger are the primary sources while oil palm, coconut, rice bran, cotton seeds & tree-borne oilseeds are the secondary sources of production of edible oil in India.

Import Substitution – Opportunity to Become Self-Reliant on Many Manufacturing Products

Listed Down below some of the Items which can be Manufactured in India

> Mobile Phones and Telecom Equipment to Cameras, solar panels, air-conditioners and penicillin — accounted for nearly three-fourths of the imports from China

> Value Added Footwear

> Medical Consumables Like Surgery Gloves, Masks, Shoes, Body Cover etc.

> Medical Diagnostic Equipment’s & their Consumables

> Electronic Goods like Mobiles, Color TVs, Cameras etc

> Toys, Furnitures, Sugar Mill Machinery, Light Engineering Goods like Bicycles, Sewing Machines, Electronic Goods for Audio-Visual Aids, Chemicals Like Soda Ash, Caustic Soda, Bleaching Powder etc

> Increase in the domestic productions of Fertilizers, Iron and Steel, Railway Wagons, Diesel Engines, Newsprint, Paper and Paper Board and Crude Mineral Oil have lessen the Pressures on our Import Bill Considerably.

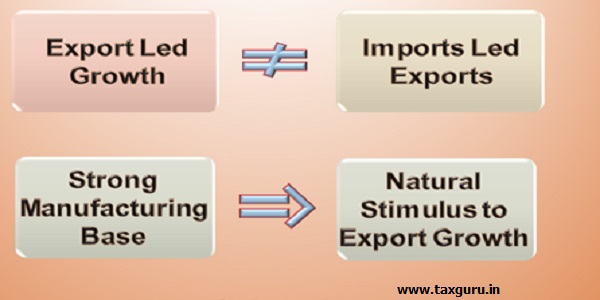

Export-Led Growth

Export led growth is where a significant part of the expansion of real GDP, jobs and per capita incomes flows from the successful exporting of goods and services from one country to another.

In recent years a number of countries have experienced rapid growth across a number of export industries which has helped to fuel their long-run expansion. These nations include China, Ireland, South Korea, Singapore, Hong Kong, Vietnam, Ethiopia and other emerging countries.

Import Substitution Measures Instil Strong Growth of Domestic Manufacturing.

Strong Manufacturing Base Naturally Boost Export Growth Because of Expansion of Scale & Scope

Step-Motherly Treatment to Deemed Exports – Deprived off Stand at par with Export Promotion Imports

“Deemed Exports” refers to those transactions in which the goods supplied do not leave the country and the payment for such supplies is received either in Indian rupees or in free foreign exchange. Deemed Exports not only Saves Scarce Forex Outflow, but Largely Promote Grow of Domestic Industry.

Deemed exports are those supplies of goods that are notified as ‘deemed exports’ where:

(a) The goods supplied do not leave India;

(b) Payment for such supplies is received in Indian Rupees/ Convertible Foreign Exchange;

and

(c) Such goods are manufactured in India.

Undoubtedly, treating Deemed Exports at par with physical exports and extending all the benefits of the latter to them is too big a step to take right away.

However, Deemed Exports are not being Incentivised by giving the full benefits of exports in terms of Rebate or Refunds and also suffers from too many complications and tedious paperwork.

Many Intellectual Economist Critics with their Western Mindset & Sold out Brains, still Advocate Irrational Import Led Growth. As a Result of which India with Lopsided Export Promotion Schemes Encourage & Promote Imports. Therefore, Foreign Trade Policy Needs a Fresh Outlook & Approach to Encourage Domestic Content.

In the Name of Import Led Export Promotion, we have Greatly Ignored Domestic Industry and made to Collapse. Instead of the Huge Amounts of Money Spent on the So-Called Export (Import) Promotion Schemes, if it is Spent on Focused Development of Indigenous Industry, then it could have Proven to Expand Many Folds GDP & Employment Generation – Become Competitive, self-Reliant and as a Result of which could have Provided Strong Manufacturing Base for Exports.

Nationalism Vs Protectionism

Nationalism is not boycott Imports from any Particular Country. It is a Call for Self-Reliance. It is not Protectionism. It is to Strengthen Domestic Capability in Self Defiance to Foreign Adversities. Self-Sufficiency is Right of Every Nation. Governments Intervene in the Economy to Elevate the Nation from the hardships of Free Market Economy. Govt. Initiatives for Economic Revival – Atmanirbhar Bharat Abhiyaan – A Call to the Nation for Self-reliance, called by Hon’ble Prime Minister, Shree Narendra Modi is in the Interests of the Nation.

It is also Responsibility of Every Citizen of India to Stop / Avoid / Minimize Use of Non-Essential Imported Goods to Make Indian Economy Strong & Create Jobs.

Why Import from China

Visit any Market Place in India or go to any Shopping Mall or visit any online retail site, you will find attractive and cheap Chinese products everywhere whether it’s electronic gadgets, crackers, decoration items, electrical goods, kitchen items or other daily consumables, you will find a cheaper Chinese version for almost everything.

Due to cheap prices, wide availability and attractive outer look and huge profit dissemination to the dealers, Chinese Products becoming best choice for business as well as for Indian consumers.

Trick of Trade of China is Innovation – Understanding Customer Need & Requirements & Delivering them @ Cheaper Prices.

In Tough Times We Need to Take Tough Decisions. Thinking Differently & Innovating. Doing Different Things will be the Norm in New Normal, Crisis Forces us to Re-Examine & Innovate. Convert the Crisis to Opportunity. Only through Innovation we can re-gain lost Domestic Market to Overseas Suppliers.

Since India has Huge Market Demand, we shouldn’t Surrender to Outsiders and Depend on Foreign Supplies for even Small Domestic Needs.

As our Prime Shree Narendra Modi said “Local to Global is key to make self-reliant India. Global brands were sometimes also very Local. But when people started using them, started promoting them, they became Global from Local. Therefore, from today every Indian has to become vocal for their local”

Think it Over

♦ Why Dragon Kites in the Indian Skies – Can’t we Manufacture

♦ Why Indian Diwali Celebrations – Needs Chinese Crackers & Lightings

♦ Why we Pray Chinese Made Indian Gods / Goddesses

♦ Why Imported from China Diyas (deepam, pramida – an oil lamp usually made from clay, with a cotton wick dipped in ghee or vegetable oils), Candles and Agarbattis (Incense sticks) Lit to Pray before Gods / Goddesses

♦ Why there is Entry of Chinese Rakhi in the Relation between Indian Brothers & Sisters

♦ Why Chinese Toys for Indian Kids

♦ Why Made in China Tricolor – Flying in India as National Flag ‘Tiranga’ – it’s Shameful.

♦ Now we reached a stage where without Chinese Import Support Indian Pharma Industry can’t survive – Is it we Wanted?

♦ Anything that’s Foreign is Crazy to Indians – It’s Chinese Mania – Can’t we Survive without Chinese Products?

Whatever possible, if Every one of Us, Support then Only as a Nation we shall Survive with Pride & Self-Reliance.

This Diwali take this Pledge to Buy only Indian Products to Contribute Your Part as a True National for Reviving the Ailing Indian Industry.

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST & Foreign Trade Consultant, Practitioner, International Corporate Trainer & Author.

Available for Corporate Trainings & Consultancy

Can be reached @ snpanigrahi1963@gmail.com

Sir it is a exhaustive article ,thanks for sharing