INSOLVENCY PROFESSIONAL: A KEY TO RESOLUTION

INFORMATION BROCHURE

“Have a fierce resolve in everything you do.

Demonstrate determination, resiliency, and tenacity.

Do not let temporary setbacks become permanent excuses.

Use mistakes and problems as opportunities to get better, not reasons to quit.”

Insolvency and Bankruptcy Board of India

Insolvency Professional Division

7th Floor, Mayur Bhawan, New Delhi – 110001

www.ibbi.gov.in

Disclaimer: This brochure is designed for the sole purpose of creating awareness on the subject and must not be used as a guide for taking or recommending any action or decision, commercial or otherwise. A reader must do his own research and / or seek professional advice if he intends to take any action or decision in the matters covered in this brochure. The content of this brochure is updated on March 31, 2021. The Code, Rules, and Regulations relevant to the matter are available at www.ibbi.gov.in.

Background

Prior to the enactment of the Insolvency and Bankruptcy Code, 2016 (IBC/Code), the legal and institutional machinery for dealing with financial stress and default had not kept pace with changes in the Indian economy. The recovery action by creditors, either through the Indian Contract Act, 1872 or through special laws such as the Recovery of Debts and Bankruptcy Act, 1993 and the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 did not yield desired outcomes. Similarly, action through the Sick Industrial Companies (Special Provisions) Act, 1985 and the winding-up provisions under the Companies Act, 1956 were not proving to be very helpful for either recovery by lenders or restructuring of firms. Further, the laws dealing with individual insolvency, namely, the Presidency Towns Insolvency Act, 1909 and the Provincial Insolvency Act, 1920, were not suitable to the changing needs of the time. This hampered confidence of entrepreneurs and lenders and consequently availability of credit in the market.

About the Code

The Code provides a time-bound, market mechanism for reorganisation and insolvency resolution of persons (companies, limited liability partnerships, partnership and proprietorship firms and individuals) in distress. The objective of such reorganisation and resolution is maximisation of value of assets of the persons to promote entrepreneurship, enhance availability of credit, and balance of the interests of all stakeholders.

The resolution process begins with admission of an application filed by an entitled stakeholder in the event of a threshold amount of default. The Code envisages a calm period when the stakeholders endeavour to resolve the distress without fear of recovery or enforcement actions. In case of corporate insolvency, the creditors assess the viability of the corporate debtor (CD) and endeavour to rescue it through a resolution plan. Corporate insolvency resolution process (CIRP) ends up either with an approval of a resolution plan rehabilitating the CD or an order for commencement of its liquidation.

In case of individual insolvency, the debtors and creditors negotiate a repayment plan, which is implemented under the supervision of a resolution professional. A bankruptcy process, entailing sale of the assets of the debtor, arise on failure of either the insolvency resolution process or implementation of repayment plan. The Code envisages a Fresh Start Process to discharge individuals with extremely limited means of their debt, where the chances of recovery is very less compared to the efforts involved.

In sync with its objectives, the Code provides for clawing back the value lost in avoidance transactions. In liquidation waterfall, Government stands at the bottom of the list, only above the equity. In case of bankruptcy, the Government stands at the bottom of the list, above unsecured creditors. The Code has overriding effect over other laws in case of any conflict or inconsistencies.

The Code provides an ecosystem comprising of four pillars to help the stakeholders to resolve their stress. First of these is a class of regulated persons, insolvency professionals (IPs). They play a key role in the efficient working of the insolvency, liquidation, and bankruptcy processes. The second pillar is a new industry of the Information Utilities (IUs). They store financial information about debtors in electronic database and eliminate delays and disputes during resolution process. The third is the Adjudicating Authority (AA), namely, the National Company Law Tribunal (NCLT) in case of corporate insolvency and the Debt Recovery Tribunal (DRT) in case of individual insolvency.

The fourth pillar is the regulator, namely, the Insolvency and Bankruptcy Board of India (IBBI). Set up as a unique regulator, it regulates a profession as well as processes. It has regulatory oversight over IPs, Insolvency Professional Agencies (IPAs), Insolvency Professional Entities (IPEs) and IUs. It writes and enforces rules for processes, namely, CIRP, corporate liquidation, fresh start, individual insolvency resolution and individual bankruptcy under the Code. It is also the ‘Authority’ under the Valuers Rules for regulation and development of the valuation profession.

Insolvency Professional

Unlike the erstwhile regime, the Code makes provision for professional services for various processes. While elucidating the role of an IP, the Bankruptcy Law Reforms Committee (BLRC), which conceptualised the Code, observed: “This entire insolvency and bankruptcy process is managed by a regulated and licensed professional namely the Insolvency Professional or an IP, appointed by the adjudicator. In an insolvency and bankruptcy resolution process driven by the law there are judicial decisions being taken by the adjudicator. But there are also checks and accounting as well as conduct of due process that are carried out by the IPs. Insolvency professionals form a crucial pillar upon which rests the effective, timely functioning as well as credibility of the entire edifice of the insolvency and bankruptcy resolution process.”

Regulatory Framework

The Code prohibits any person from rendering his services as IP without being enrolled as a member of an IPA and registered with the IBBI. Thus, the IBBI acts the principal regulator of the insolvency profession, while the IPAs are frontline regulators. The provisions of the Code read with those in the Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016 [IP Regulations] and the Insolvency and Bankruptcy Board of India (Model Bye-laws and Governing Board of Insolvency Professional Agencies), Regulations, 2016 [Model Bye-Laws Regulations] govern the insolvency profession.

Becoming an IP

Mandatory Examination/Proficiency Courses

♦ Limited Insolvency Examination (LIE): This is an online (computer-based and in a proctored environment) examination (duration 2 hours) with objective multiple-choice questions conducted by IBBI across India. For further details, please visit https://www.ibbi.gov.in/examination/limited-insolvency-examination

♦ Pre-Registration Educational Course (PREC): This is a 50-hour course conducted by IPAs to groom professional members for the role of IP.

♦ Graduate Insolvency Programme (GIP): This is two-year full-time programme conducted by the Indian institute of Corporate Affairs. A student who completes the GIP is eligible for registration as an insolvency professional.

Qualification and Experience

An individual is eligible for registration as an IP if he has (a) ten years of post-membership experience as a Chartered Accountant, Company Secretary, Cost Accountant, or Advocate, or has 15 years of experience in management after a bachelor’s degree, or successfully completed Graduate Insolvency Programme, (b) passed the Limited Insolvency Examination, and (c) undergone pre-registration training.

Fit and Proper Person

A distinct requirement of the profession, as compared to most other professions in the country, is that an IP, at all times, must be a fit and proper person so that the stakeholders have confidence in the insolvency regime and its practitioners. For determining whether a person is fit and proper or not, IBBI considers various aspects, including but not limited to (i) integrity, reputation and character, (ii) absence of convictions and restraint orders, and (iii) competence and financial solvency.

Application Process

An individual seeking registration as an IP, must be enrolled as ‘professional member’ of an IPA. He must

approach any of following three IPAs for enrolment:

- Indian Institute of Insolvency Professionals of ICAI [IIIP ICAI]: For more information, please visit: iiipicai.in

- ICSI Institute of Insolvency Professionals [ICSI-IIP]: For more information, please visit:icsiipa.com

- Insolvency Professional Agency of Institute of Cost Accountants of India [IPA ICAI]: For more information, please visitipaicmai.in

Post enrolment with an IPA, an application for registration must be made in Form A of the Second Schedule to the IP Regulations. The application is submitted online through the link provided on IBBI website. While filling-up the e-form for seeking registration as an IP, a one-time, non-refundable fee of Rs.10,000 plus applicable taxes are to be paid online.

Certificate of Registration

Subject to fulfilment of eligibility norms, the IBBI may grant registration to the applicant as an IP. Upon registration, he is assigned a unique registration number and issued a certificate of registration authorising him to render services as an IP. Any refusal to grant certificate of registration is only by way of a reasoned order. IBBI does not issue any membership card / identity card to IPs.

Continuing as an IP

The registration granted to an IP is subject to the conditions that the IP:

(a) at all times abides by the Code, rules, regulations, and guidelines thereunder and the bye-laws of the IPA with which he is enrolled;

(b) at all times continues to satisfy the eligibility requirements for registration as an IP;

(c) undergoes continuing professional education;

(d) does not outsource any of his duties and responsibilities under the Code;

(e) pays to the IBBI, a fee of ten thousand rupees, every five years

(f) pay to the IBBI, a fee calculated at the rate of 0.25 percent of the professional fee earned for the services rendered by him as an IP in the preceding financial year;

(g) take adequate steps for redressal of grievances;

(h) maintains records of all assignments undertaken by him under the Code for at least three years from the completion of such assignment;

()abide by the Code of Conduct specified in the First Schedule to the IP Regulations; and

(a) abides by such other conditions as may be imposed by the IBBI.

Continuing Professional Education

An IP needs to continuously upgrade himself through Continuing Professional Education (CPE) to remain relevant and provide value added services. The IBBI (Continuing Professional Education for Insolvency Professionals) Guidelines, 2019 provide that an IP shall undertake a minimum of 10 credit hours of CPE each calendar year and a minimum of 60 credit hours of CPE in each rolling block of three calendar years. These, however, do not apply to IPs who have completed the age of 65 years.

Code of Conduct

An IP is required to abide by the Code of Conduct stipulated under the First Schedule to the IP Regulations. The Code of Conduct stipulates conduct of an IP in respect of:

♦ Integrity and Objectivity

♦ Independence and Impartiality

♦ Professional Competence

♦ Representation of Correct Facts and Correcting Misapprehensions

♦ Information Management

♦ Confidentiality

♦ Occupation, Employability and Restrictions

♦ Remuneration and Costs

♦ Gifts and Hospitality

Authorisation for Assignment

The IP Regulations prohibit an IP from accepting or undertaking any assignment as Interim Resolution Professional (IRP), Resolution Professional (RP), Liquidator, Bankruptcy Trustee (BT), Authorised Representative (AR) or in any other role under the Code unless he holds an Authorisation for Assignment (AFA) issued to him/her by his/her IPA. An IPA issues or renews an AFA if the IP meets the specified requirements, such as, has paid fees due to the IPA and the IBBI, is not in employment, has filed all required returns and made all required disclosures, remains a fit and proper person, has undertaken CPE, has no disciplinary proceeding pending against him, has not attained the age of 70 years, etc. An AFA has a validity of one year and required to be renewed if an IP wishes to undertake any assignment. He may seek renewal of the AFA before the date of its expiry, but not earlier than 45 days before the date of expiry of AFA. This facility enables a person in employment to be registered as an IP; he has to quit employment when he wishes to have an AFA.

Insolvency Professional Entity

An IP is required to perform a variety of tasks, which may be beyond the capability of an individual. He may not have the required skills sets. In such cases, the Code enables him to engage professionals to support him. Further, an IP may not be able to handle the quantity of work in a process. In such cases, the IP Regulations enable him to hire support services from IPEs. The IBBI recognises IPEs. A company, a limited liability partnership or a partnership firm having minimum net worth of ₹1 crore is eligible for recognition as an IPE. IPEs provide support services to IPs.

Fee for Services

The fees charged by IPs is market driven and the same is not regulated by IBBI. However, the law provides that IP must provide services for remuneration, which is charged in a transparent manner, is a reasonable reflection of the work necessarily and properly undertaken and is not inconsistent with the applicable regulations.

Registered IPs and IPs holding AFAs

The following table presents the details of IPs registered across the country as on 31st March 2021:

| City / Region

|

Registered IPs | IPs having AFA | ||||||

| IIIP of ICAI |

ICSI IIP

|

IPA of ICMAI

|

Total | IIIP of ICAI

|

ICSI IIP

|

IPA of ICMAI

|

Total

|

|

| New Delhi | 405 | 254 | 75 | 734 | 307 | 194 | 59 | 560 |

| Rest of Northern Region | 396 | 187 | 59 | 642 | 291 | 148 | 38 | 477 |

| Mumbai | 375 | 138 | 34 | 547 | 264 | 99 | 26 | 389 |

| Rest of Western Region | 266 | 105 | 38 | 409 | 193 | 78 | 26 | 297 |

| Chennai | 128 | 84 | 12 | 224 | 79 | 62 | 7 | 148 |

| Rest of Southern Region | 348 | 194 | 61 | 603 | 235 | 132 | 50 | 417 |

| Kolkata | 199 | 35 | 21 | 255 | 145 | 25 | 17 | 187 |

| Rest of Eastern Region | 60 | 23 | 7 | 90 | 36 | 18 | 6 | 60 |

| Total Registered | 2177 | 1020 | 307 | 3504 | 1550 | 756 | 229 | 2535 |

(*Excluding 6 cases where registration has been cancelled and 10 cases where individual has deceased)

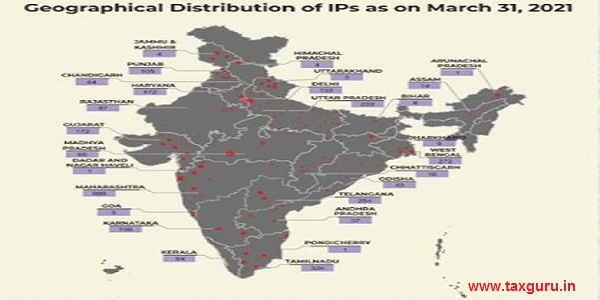

The following picture presents geographical distribution of IPs in the country

Role of an IP

An IP plays a key role in resolution, liquidation and bankruptcy processes as may be applicable to companies, limited liability partnerships (LLPs), partnership firms, proprietorship firms and individuals.

Role of an IP in CIRP

In conducting CIRP of a CD, an IP may act as an IRP or RP. As IRP / RP, a whole array of statutory and legal duties / powers is vested with him. He manages the affairs of CD, exercises the powers of its Board of Directors and complies with applicable laws on behalf of CD. He is entrusted to protect and preserve the value of assets of CD, manage its operations as a going concern and facilitate the committee of creditors (CoC) in taking prudent decisions for resolution of insolvency. For efficient conduct of the process, IP is entrusted to perform other key activities including making public announcement, verification of claims, preparation of information memorandum, raising interim finance, appointment of valuers, inviting prospective resolution applicants to put forth their resolution plan, etc.

The Code empowers him to appoint professionals, seek cooperation from personnel of CD and seek orders from the AA in case of any preferential, undervalued, extortionate, or fraudulent transaction. He acts as a link between the AA and CoC as also other stakeholders. Thus, as IRP / RP, he is tasked with conducting and facilitating the CIRP while attempting to address and balance the interests of all stakeholders. During a CIRP, an IP may also be appointed as authorised representative (AR) for any class of creditors.

Role of an IP in Liquidation Process

During a liquidation process, an IP acts as a liquidator and has three broad responsibilities of claim adjudication, sale of business / assets and distribution of liquidation proceeds. For performing these functions, a liquidator is entrusted to make public announcement inviting claims, verify claims, take into his custody or control the assets of CD, form a liquidation estate and endeavour to sell the assets of liquidation estate through public auction, in consultation with the stakeholders’ consultation committee. For efficient reporting, a liquidator is required to maintain registers and books of account of CD, prepare reports and submit before AA. The Code empowers him to appoint professionals, seek direction to secure cooperation from personnel, auditor, promoter, partner, IRP, RP of CD. He may also seek orders from the AA in case of any preferential, undervalued, extortionate, or fraudulent transaction.

Upon realisation of liquidation estate, he distributes the sale proceeds among the stakeholders as per the waterfall. On completion of liquidation process, he submits an application with the final report to AA for closure of the liquidation process and dissolution of the CD.

Role of an IP in Fresh Start and Individual Insolvency Resolution

During an insolvency resolution process, an IP in capacity of RP files an application before the AA on behalf of debtor or the creditor. He examines the application and submits a report recommending acceptance or rejection of application. In case of a fresh start process, he examines objections of creditors, finalises list of qualifying debts and may seek directions from AA on non-compliances by debtor and submit application for revocation of order admitting or rejecting application. In case of insolvency resolution process, he prepares a list of creditors, offers consultation to debtor in preparation of repayment plan and submits repayment plan to AA along with his report on such plan. He convenes meeting of creditors, prepares a report of meeting of creditors and provides thereof to debtor, creditors, and the AA. On approval of repayment plan by AA, he supervises its implementation and upon completion informs AA and persons bound by it. On the basis of repayment plan, he applies to AA for passing a discharge order.

Role of an IP in Bankruptcy Process

On passing of bankruptcy order, the estate of debtor vests in the IP acting as BT. In case order is passed on an application by creditor, BT may require information related to statement of financial position. BT prepares a list of creditors of the bankrupt and convenes meeting of creditors. He is responsible for conducting the administration and distribution of the estate of bankrupt by investigating his affairs, realizing, and distributing the estate. He holds property of every description, makes contracts, sues and may be sued, enters into engagements in respect of the estate of the bankrupt, employs persons to assist him, executes any power of attorney, deed or other instrument and does any other act which is necessary or expedient for the purposes of or in connection with the exercise of his rights. On completion of administration and distribution of estate, he convenes a meeting of committee of creditors and submits a report for approval. He applies to AA for discharge of bankrupt and is released of his duties with effect from the date on which committee of creditors approves his report.

“You have to perform at a consistently higher level than others. That’s the mark of a true professional. Professionalism has nothing to do with getting paid for your services.”

Joe Paterno

***