#AD

Today CA’s, CPA’s, Accountants are more and more often going for digitalization to revolutionize accounting and taxation practices. By integrating technologies such as Artificial Intelligence (AI), Machine Learning (ML) and other innovative solutions in their practice, CAs can boost personal efficiency, increase data accuracy, reduce time-consuming routine, and even elevate client satisfaction.

Let’s explore how digitalization is reshaping the way CAs work, on the example of data entry automation.

Why Manual Data Entry Isn’t the Best Option Anymore

How much time do you spend manually typing each entry and detail from the document into accounting software?

Imagine all the things you could do if you didn’t have to spend hours typing in data.

You could focus on growing your business, coming up with new ideas, or simply spending more time with family. Instead, you find yourself stuck in the office late at night, entering data over and over again. It’s a time-consuming job that leaves little time for anything else.

Even a tiny error can lead to significant problems, like costly penalties. Plus, after a long day, tired eyes can easily make mistakes. Caught up in data entry, businesses often miss deadlines for filing reports. This not only risks fines but also delays important insights needed for quick decision-making.

How Data Entry Automation Сhanges the Game

Data entry automation makes it easier and much faster to handle paperwork like the entry of invoices and bank statements. It uses AI, OCR, and ML technologies to recognize the data with high precision. This data is then transferred into popular accounting software such as Tally and Zoho Books. Automation software does more than just collect data; they automatically match supplier, customer, item names, transaction types, and suggest ledgers.

It is important to note that data entry automation serves not as a replacement for accountants but as a loyal assistant, freeing up additional time for critical tasks without compromising accuracy.

Let’s see how you can upload 100 documents into Tally at once using one of the top automation solutions in the industry — Entera.

How to Upload 100 Invoices to Tally Using Entera?

Entera is accounting software that makes data entry ten times faster and more accurate. It automates the entire data entry process, from collecting documents to publishing them into Tally, Zoho Books, QuickBooks, and saves in digital storage.

Step 1: Collecting Documents

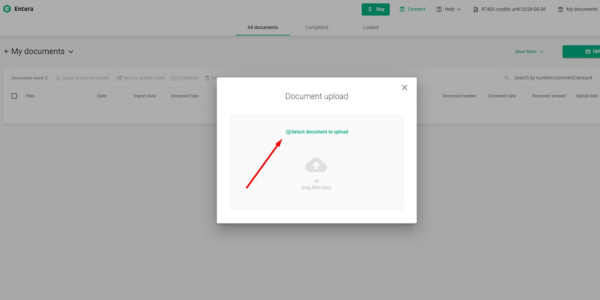

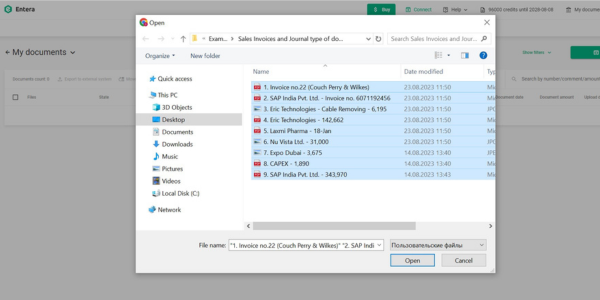

Entera collects documents from various sources and even directly from your clients. With the bulk import feature you can upload and process hundreds of invoices and bank entries at once. This speeds up the data entry process up to 10 times compared to manual data entry.

Entera accepts invoices in various formats, such as XLS, JPG, PDF, and images, directly from your computer, smartphone, or even by forwarding an email with attached documents.

–

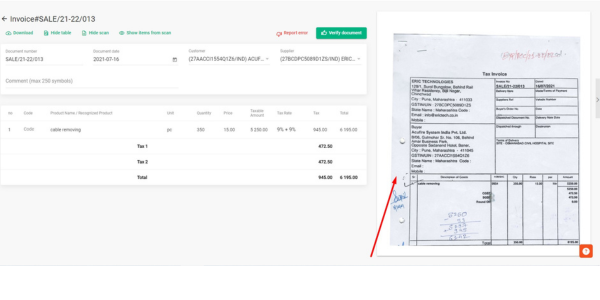

Step 2: Recognizing Documents

Once your documents are uploaded, Entera automatically recognizes them. You can continue with other tasks or even turn off your computer as Entera works autonomously. After recognition is completed, you’ll receive an email notification.

Also, Entera keeps a copy of the original paper document with the digital one, so it’s easy for you to find it later.

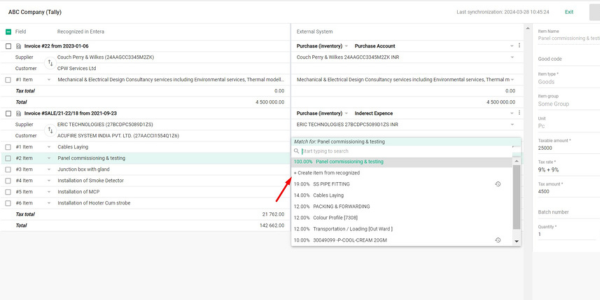

Step 3: Matching Items

The main goal of automation is to accurately input data from documents directly into your accounting software following your accounting process.

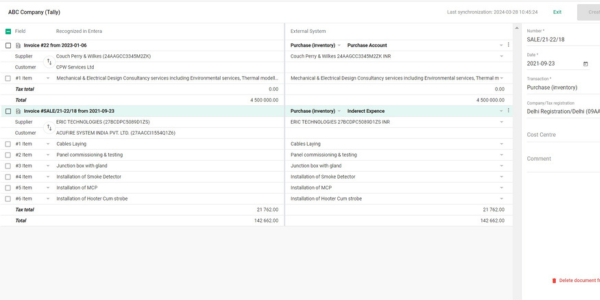

Entera uses AI and RPA technologies to seamlessly sync categories, suggest ledgers, match item names, from your documents with the corresponding entries in your Tally.

Using the mass actions feature, you can add numerous new items and adjust various fields as needed. Entera memorizes your choice of supplier, customer, item name, transaction types, ensuring that the next time you upload documents, the appropriate values are automatically filled in.

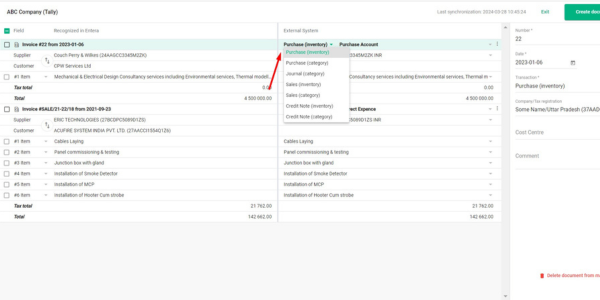

Furthermore, you can effortlessly change the voucher type for all identified documents before transferring them to your accounting system.

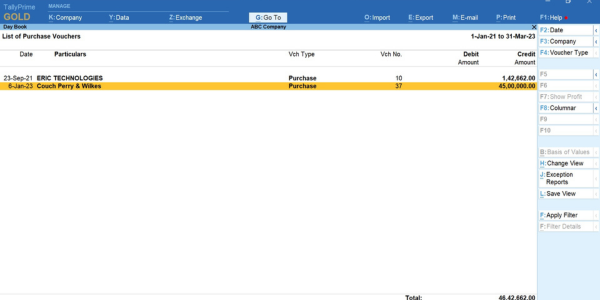

Step 4: Transferring to Tally

At this final step, simply choose all the documents Entera has recognized and click the “Create Documents” button. Through its seamless integration, Entera will directly move these documents into your Tally Day Book.

Entera safely keeps your recognized documents in a digital archive. It allows you to easily find and download any document, keeping your files organized and helping during audits.

We’ve just explored the basic aspects of automating data entry, but what additional benefits does the automation offer to accountants?

Import of Bank Statements from PDF to Tally in 3 minutes

Entera imports hundreds of bank statement entries into Tally just in minutes, matching transactions and creating ledgers without needing special skills or templates. Simply upload your bank statement, select transaction types and Tally ledgers, and let the software handle the rest.

Automated Import from Excel to Tally

With AI-based software there’s no need for templates or special programming skills. Simply upload xls files as they are. Entera uses AI and OCR technologies to extract data with 100% accuracy. The system checks data, matches items, HSN Codes, and maps sales, invoices, and GST. It remembers your choices for future use.

By Implementing Automation in Your Data Entry Process You Gain:

Increased Efficiency: Bulk import, Mass Actions, Auto-Ledger – features that save up to 30% of the time spent on routine tasks, freeing accountants to focus on more critical tasks or personal development.

Reduced Errors: OCR and AI tecnologies extract data with 99% accuracy, reducing the risk of errors, fines or personal penalties.

Competitive Advantage: Automation helps accountants work on 10 times more documents without losing quality and allows them to take on new clients.

Audit Readiness: Automated data entry ensures documents are organized and easily accessible, keeping the business always prepared for audits.

Financial Benefits: Quicker data entry allows businesses to take on more clients and boost revenue. Additionally, the lower risk of fines for late reports contributes to better financial health.