Relevant Date: 26th June 2020

Introduced by: Ministry of MSME dated 26th June 2020

Effective date: 1st July 2020

What is new?

1. Classification of enterprises:

An enterprise shall be classified as a micro, small or medium enterprise on the basis of the following criteria, namely:-

| Type of Enterprises | Investment in P&M | Turnover |

| Micro Enterprises | Not exceeding 1 Cr. | Not exceeding 5 Cr. |

| Small Enterprises | Not exceeding 10 Cr. | Not exceeding 50 Cr. |

| Medium Enterprises | Not exceeding 50 Cr. | Not exceeding 250 Cr. |

2. How to become a MSME

1. Any person who intends to establish a MSME may file Udyam Registration online in the Udyam portal, based on self declaration.

2. There is no requirement to upload documents, Papers, Certificates etc.

3. On successful registration, an enterprise will be assigned a URN i.e Udyam Registration No.

4. An URC i.e Udyam Registration Certificate shall be issued on completion of registration process.

3. Composite Criteria of investment and turnover

a. This Criteria are used for the classification of an enterprise as MSME.

b. If an enterprise cross the maximum limit specified for its present category in either of two criteria of investment or turnover, it will cease to exist in that below the maximum limit specified for its present category in both the criteria of investment as well as turnover.

c. All units with GSTIN listed against same PAN shall be collectively treated as one enterprise, and

d. Turnover and Investment figure for all of such entities shall be seen together and only the aggregating values will be considered for deciding the category as MSME.

4. How to calculate investment in P&M or Equipment.

a. Calculation of investment in plant & Machinery or equipment will be linked to the ITR of the previous years filed under Income Tax Act, 1961.

b. In case of new enterprise where prior ITR not filed, the investment shall be based on self-declaration of the promoter of the enterprise and such relaxation shall be end after the March 31st of the financial year in which its file its first ITR.

c. The term plant and machinery have the same meaning as in Income tax Rules, 1962.

d. The Purchase value of the Plant & Machinery either machinery purchased first hand or second hand shall be taken into account excluding the GST on self declaration basis, if the enterprise is new and have not filed any ITR.

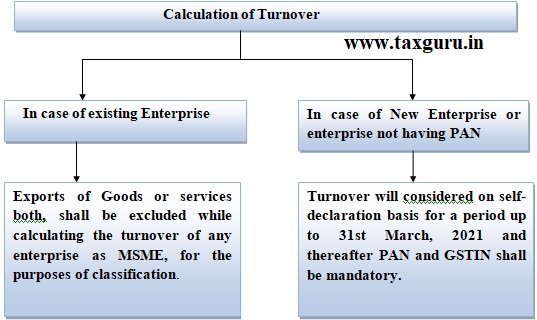

5. How Calculate Turnover?

a. Exports of Goods or services both, shall be excluded while calculating the turnover of any enterprise as MSME, for the purposes of classification .

b. Information as regards turnover and export turnover for an enterprise shall be linked to the income tax Act, CGST Act, and GSTIN.

c. In case of enterprise which do not have PAN will considered on self-declaration basis for a period up to 31st March, 2021 and thereafter PAN and GSTIN shall be mandatory.

6. How to Register an MSME?

a. Form for the registration shall be as provided in Udyam registration portal.

b. No fees for registration.

c. Adhaar is mandatory.

d. The Adhaar shal be of-

i. Proprietor in case of proprietorship firm,

ii. Managing Partner in case of partnership firm,

iii. Karta in case of HUF.

e. In case of Company, LLP, Trust, Corporative Society, the organization or its authorized signatory shall provided GSTIN and PAN along with its Adhaar.

f. In case of enterprise is duly registered as an Udyam with PAN, any deficiency of information for previous years when it did not have PAN shall be filed upon self declaration basis.

g. More than one Udyam Registration in case of one enterprise except any number of activities including manufacturing or service or both may be specified or added in one Udyam Registartion

h. any misrepresentation and suppression of facts shall be liable to such penalty as specified under section 27 of the Act.

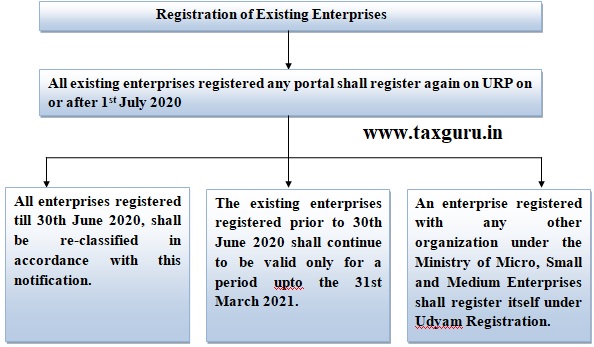

7. Registration of existing enterprises

1. All existing registered under EM-Part-II or UAM shall register again on the Udyam Registration portal on or after 1st July, 2020.

2. All enterprises registered till 30th June 2020, shall be re-classified in accordance with this notification.

3. The existing enterprises registered prior to 30th June 2020 shall continue to be valid only for a period upto the 31st March 2021.

4. An enterprise registered with any other organization under the Ministry of Micro, Small and Medium Enterprises shall register itself under Udyam Registration.

Information in the blog was so useful and valuable for any person having interest to update the knowledge on MSME

Calculation of Investment in plant & machinery is done as per latest ITR as per income tax act, 1961.

So do we have to consider written down value of P&M? . As we Submit wdv value of fixed assets as per income tax act

Please reply