The Ministry of Corporate Affairs in its drive to enhance transparency, investor protection and corporate governance, has notified Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2018 on 10 September 2018 effective from 02nd October, 2018.:-

In accordance with the said rules, unlisted public companies need to dematerialize its existing securities and ensure that further issue of securities and transfers are only in dematerialized form.

A. Dematerialization:

Dematerialization is the process of converting Physical Securities into electronic format. It should be related to Listing of securities. A Shareholder intending to dematerialize its securities needs to open a Demat account with Depository Participant. Investor Deface and surrenders his Physical Securities and in turn gets Electronic Shares in his Demat Account:

B. Benefit of Dematerialization:

- Elimination of risk of duplication, theft, fraud and loss with respect to physical share certificates.

- Exemption from payment of stamp duty on transfer.

- Ease in transfer and pledge of securities.

C. Applicability:

Every unlisted public company with effect from 02 October 2018 shall-

- Issue its securities only in dematerialized form; and

- Ensure dematerialization of all its existing securities

D. Major Impact on Company:

i. After 02.10.2018, Unlisted Company has to ensure that entire holding of securities of its Promoters, Directors, Key Managerial personnel is in dematerialized Form, otherwise company shall not be able to do followings:

-

- Issue of securities;

- Buy-back of securities;

- Issue of bonus shares; and

- Rights issue

ii. After 02.10.2018, all new issue of securities or transfer of securities shall be only in Dematerialize form.

iii. Impact on Security Holders (Transfer / subscription of Securities):

Rule 3 of the amendment specifies that every holder of Securities who intends to transfer securities or who intends to subscribe to any securities of an unlisted public company has to make sure that all their existing Securities are held in dematerialised form before such transfer or subscription to the Securities;

E. Impact:

The shareholders who continue to hold shares and other types of securities of listed companies in physical form even after 05.12.2018, will not be able to lodge the shares with company / its RTA for further transfer.

Note: Only the requests for transmission and transposition of securities in physical form, will be accepted by the listed companies / their RTAs.

F. What will happen if I don’t demat my physical shares?:

In this case, Shareholder will not be able to sell or transfer your shares after December 5, 2018. You will have to wait for demat of shares before being able to sell/transfer them.

G. In case of demise of shareholder holding physical securities, what could be the procedure to transfer those physical securities (nominee registered / nominee not registered)?:

Transmission and transposition of shares held in paper form will continue to be allowed. Transmission happens upon death of any or all shareholders. Transposition means change in ownership pattern; eg. From combination A & B (in this order) to B & A or from A & B & C to B & A & C. Though these will still be possible in paper form even after Dec. 4, 2018, conversion to demat is still suggested for many other benefits it offers.Issue its securities only in dematerialized form; and

A. Whether it is mandatory for Public Limited Companies to Convert Physical shares into Demat?

B. What are the consequences if Public Company fails to apply ISIN No. or don’t convert shares in Demat?

C. Whether there was / is any due date for conversion of shares into DEMAT? ETC.

D. Whether it is mandatory for public Limited Companies to file Reconciliation Share Capital Audit Report?

FIRST STEP:

As per Rule 9A (3) every holder of security of PUC can transfer its shares on or after 02nd October, 2018 only in Demat Form. For conversion of shares into Demat shareholders required ISIN No. of Company.

As per Companies Act, 2013 Rule 9A it is responsibility of company to give opportunity to its shareholders to convert their shares into Demat. Therefore, all the PUC required applying for ISIN on or before 2nd October, 2018.

Even as per Rule 9A (4) Every unlisted public company shall facilitate dematerialization of all its existing securities by making necessary application to a depository as defined in clause (e) of sub-section (1) of section 2 of the Depositories Act, 1996 and shall secure International security Identification Number (ISIN) for each type of security and shall in-form all its existing security holders about such facility.

One can opine that:

It is mandatory for all PUC to apply for ISIN no. to comply with provisions of Rule 9A. Irrespective of the fact whether shareholders want to transfer its shares or not. It is responsibility of Company to facilitate dematerialization to share holders.

Consequences:

As there is no penalty/ fine prescribed under rule 9A therefore, as per section 450 of Companies Act, if no penalty/ fine prescribed in any Rule or Section then penalty / fine shall be as per Section 450 i.e.

The COMPANY and EVERY OFFICER of the company who is in default or such other person shall be punishable with fine which may extend to ten thousand rupees, and where the contravention is continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which the contravention continues.

SECOND STEP:

As per first step it is concluded that it is mandatory for Public Limited Companies to apply for ISIN. In second step what are the compliances on Public Limited Company after allocation of ISIN:

As per Rule 9A(8) The audit report provided under regulation 55A of the securities and Exchange Board of India (Depositories and participants) Regulations, 1996 shall be submitted by the unlisted public company on a half-yearly basis to the Registrar under whose jurisdiction the registered office of the company is situated.

H. Legislative Requirement (Regulation 55A):

Under provision of Regulation 55A of the SEBI (Depositories and Participants) Regulations, 1996, listed companies are required to submit

- Reconciliation of Share Capital Audit Report on a Half Yearly basis to the stock exchanges audited by a qualified chartered accountant or a practicing company secretary, for the purpose of reconciliation of share capital held in depositories and in physical form with the issued / listed capital.

- The Reconciliation of Share Capital Audit Report is required to be submitted to the Registrar of Companies within 30 days from the end of the Half Year.”

One can opine that:

First half year for PUC shall be closed on 31st March, 2019, therefore every PUC mandatorily required to file Reconciliation of Share Capital Audit Report with Roc on or before 30th April, 2019. (Irrespective of fact shareholders converted shares in Demat or Not)

However, in Reconciliation of Share Capital Audit Report Company have to give details of Shares in Physical as well as shares in Demat. Therefore if shareholders have not converted their shares into Demat then report will required to mention details of shares in physical

Consequences:

As there is no penalty/ fine prescribed under rule 9A therefore, as per section 450 of Companies Act, if no penalty/ fine prescribed in any Rule or Section then penalty / fine shall be as per Section 450 i.e.

The COMPANY and EVERY OFFICER of the company who is in default or such other person shall be punishable with fine which may extend to ten thousand rupees, and where the contravention is continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which the contravention continues.

THIRD STEP:

In third step further compliances on Public Limited Company after allocation of ISIN:

A. Make timely payment of Fees (admission as well as annual).

B. Maintenance of Security deposit of 2 years’ Fees, as per agreement executed with the followings:

-

- Depository;

- Registrar to an issue;

- Share Transfer Agent

C. Comply with the regulations, guidelines or circulars, if any issued by the Securities and Exchange Board or Depositoryfrom time to time.

MOST IMPORTANT QUESTION – IMPACTS

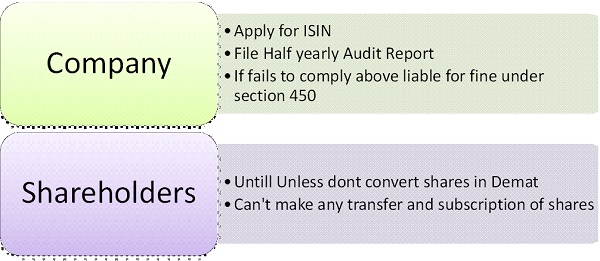

Therefore, one can opine that

- In case Company fails to apply for ISIN or fails to file half yearly audit company is liable for consequences under Section 450.

- If shareholders fails to convert shares in Demat they are liable for consequences i.e. not able to transfer of shares not able to subscribe shares.

QUICK BITES

A. Whether Company required applying separate ISIN for each type of Security?

Yes, PUC required applying for separate ISIN for each type of Security.

B. Share holders don’t intent to transfer shares Or Company doesn’t intent to issue new Securities, still it’s required to apply ISIN and has to file?

Irrespective of fact whether shareholder intent to convert or not, it is responsibility of Company to apply for ISIN and have to file half year audit Return.

C. What is due date of submission of half yearly Audit Report with ROC?

Due date of submission of Reconciliation of Share Capital Audit Report is within 30 days of closure of Half Year i.e. 30th April, 2019 for the half year ended 31.03.2019.

D. What is due date of submission of half yearly Audit Report with ROC?

Due date of submission of Reconciliation of Share Capital Audit Report is within 30 days of closure of Half Year i.e. 30th April, 2019 for the half year ended 31.03.2019.

E. Whether return in 55A needs to file even company has not applied for ISIN or demat it shares?

It doesn’t concern whether company applied for ISIN or not, but company need to file this form with ROC. Otherwise it will be non compliance on part of Company.