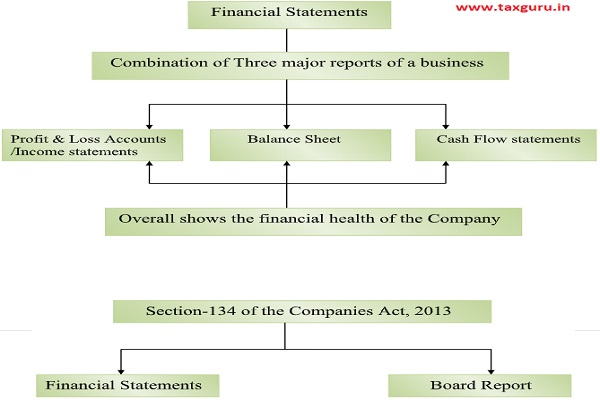

Article discuses Provision of Section 134 of the companies Act, 2013 related to Financial Statements & Boards Report and Rule 8 of the Companies (Accounts) Rules, 2014 which deals Important matters to be stated in the Board Report.

|

Section -134 of the companies Act, 2013 (Financial Statements & Boards Report) |

||

| Sub-Section | Heading | Provisions |

| 1 | Approval of Financial Statements | Approved by the Board of Directors before the signing |

| Signed by whom | a. Chairperson of the company authorized by the Board, or

b. by 2 Directors out of 1 which one shall be managing director, if any, c. and CEO, CFO and CS of the Company, In case OPC only by One director |

|

| 2 | Auditor Report | AR shall attach to financial statements of the Company. |

| 3 | Board Report | A Board report shall also attached with Financial Statements.

Board report includes the followings- I. website of the Company, if any ii. Director responsibility statements iii. details of fraud reported us 143 iv. declaration given by Independent director, v. Statement on company’s policy on us 178 on appointment and remuneration of director etc vi. Explanations or comments by board on every Qualification, adverse remark, reservation, made by- 1. Auditor in his report and 2. PCS in his secretarial Audit Report vii. Details of Loans, Guarantee, Security provided us 186 viii. Particulars of related parties transaction us 188 ix. the state of affairs of company x. Amount, if any proposed to be recommended as Dividend xi. The conservation of energy, technology absorption, Foreign exchange earning and outgo xii. Risk management policy. x. CSR xii. Such other matters as may be prescri௭ |

| 4 | Board Report as an annexure to financial statements | Under this section the board report shall be attached to the financial statements |

| 5 | Director responsibility statement | The director responsibility statements forms a part of board report which states the followings-

i. the annual accounts has been prepared in accordance with the applicable accounting standards. ii. directors has selected such accounting policies and made judgments, and estimates that are reasonable and prudent so as to give a true and view of state of affairs of the company at end of the financial year and to the P&L of the company for that period. iii. Directors had taken proper and sufficient care for the maintenance of adequate accounting records in accordance with the provisions of the act for safeguarding the assets of the Company and for preventing and detecting of fraud. iv. annual accounts has prepared on a going concern basis, or v. statements on internal finance control |

| 6 | Signing of Board Report | The Board report shall be signed by its-

i. Chairperson ii. if chairperson not authorized by atleast by 2 directors, one of whom shall be MD, 3. By directors where there is one director. |

| 7 | Other attachments to financial statements including CFS | a. any notes annexed to or forming part of such financial statement;

b. The auditor’s report c. The Board’s report |

| 8 | Fine in case of contravention | Not less than Rs. 50,000 which may extend to 25,00,000

In case of officer Not less than 50,000 which may extend to 5,00,000 or with both. |

| Imprisonment | Every officer in default shall be punishable with imprisonment for a term not less than 3 years. | |

–

|

Rule 8 of the Companies (Accounts) Rules, 2014 |

||

| Some Important matters to be stated in the Board Report | ||

| 1 | Preparation of the Board Report | Based upon the Standalone financial Statements and also report on the highlights of performance of the Subsidiaries, Associates and JV Companies. |

| 2 | Related party transactions | Board Report shall includes the particulars of contracts, Arrangements with related party and it shall be in Form AOC-2 |

| 3 | Conservation of Energy | It includes-

i. steps taken on conservation of energy ii. steps taken by the company for utilizing the alternative sources of energy; iii. Capital Investment on energy conservation equipments. |

| 4 | Technology absorption | It includes-

i. Efforts made towards technology absorbtion ii. what kind of benefits arrived from it iii. Details of Imported technology- a. what technology imported. b. year of import, c. whether the technology has been fully absorbed d. if not fully absorbed area e. Expenditure incurred on R&DX |

| 5 | Foreign exchange earning & Outgo | Proper details of such. |

| 6. | Statement on formal annual evaluation | Every listed company, or

Every Public company- Having paid up share capital of 25 crore or more, shall include, in the board report a statement indicating the manner in which formal annual evaluation has been made by its board of its own performance |

| 7 | Miscellaneous matters | 1. Financial Summary & Highlights

2. Change in the nature of business 3. Details of Directors KMPs who appointed and resigned during the year 4. Independent director appointed during the year. 5. Name of subsidiaries, Associates, & Joint Venture Companies 6. Details relating to deposits 7. any default in repayment of deposit during the year 8. Details of any proceedings against the Company 9. Details of internal financial control. 10. Disclosure regarding maintenance of cost records, |

Read. Thanks.