Ind AS 21: The effect of changes in foreign exchange rates

Applicability:

1. Accounting of transaction and balances in foreign currency

2. Translating results and financial position of foreign operations

3. Translating entity’s results and financial position into PRESENTATION CURRENCY

Not Applicable to:

1. Foreign currency derivatives which are covered by Ind AS 109.

2. Hedge accounting for foreign currency items (including hedge of net investment in foreign operation). Ind AS 109 applies to hedge accounting.

3. Presentation in “Statement of cash flows”:

- of cash flows arising from transactions in foreign currency

- to translation of cash flows of foreign operations

(This presentation is covered under Ind AS 7: Statement of Cash flows)

4. Long term foreign currency monetary items for which entity opted exemption given in Ind AS 101 (Para D13AA).

Let’s understand some terms to understand the accounting treatment under Ind AS 21:

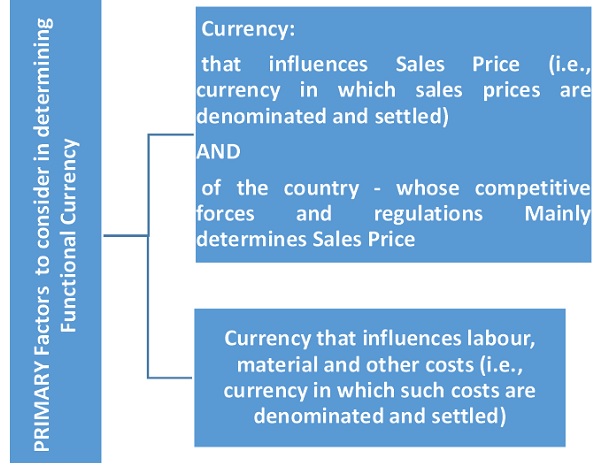

Functional Currency – currency of primary economic environment in which entity operates i.e., the one in which it generally expends cash.

SECONDARY Factors which can be considered:

- Currency in which funds from financing activities are generated

- Currency in which receipts from operating activities are usually retained

ADDITIONAL factors to be considered in determining functional currency of foreign operation and whether the functional currency is same as of reporting entity (Reporting entity being the entity that has the foreign operation as its subsidiary, branch, associate or JV, the activities of which are conducted in currency other than those of reporting entity):

- Activities of foreign operation are carried out as an extension of reporting entity;

- Transactions with reporting entity are high proportion of foreign operation activities;

- Foreign operation’s cash flows directly affects reporting entity’s cash flows and readily available for remittance to reporting entity;

- Foreign operation’s cash flows are not sufficient to service expected debt obligations without funds being made available by reporting entity.

Example: Foreign operation only sells goods imported from reporting entity and remits the proceeds to it. In this case, foreign operation is an extension of reporting entity.

When above indicators are mixed, management uses its judgement to determine functional currency. As part of this approach, priority to be given to Primary indicators before considering secondary and additional indicators. Hence, when functional currency is clear from the Primary indicators, no need to go to Secondary and additional indicators.

Functional currency cannot be changed unless there is a change in those underlying transactions, events and conditions. When there is a change in functional currency, entity should apply the translation procedures prospectively from the date of the change.

Translation of Foreign currency transactions in Functional currency:

Foreign currency is the currency other than functional currency of the entity.

Foreign currency transactions including:

- Purchase or sale price denominated in foreign currency

- Amount payable or receivable (including loans) denominated in foreign currency

- Acquisition/disposal of assets or settlement of liabilities denominated in foreign currency

Translation procedures (same as AS-17):

Initial recognition:

Apply spot exchange rate (between functional currency and foreign currency) at the date of the transaction to the foreign currency amount.

At end of each reporting period:

- Foreign currency monetary items => translate using closing rate;

- Foreign currency non-monetary items that are measured in terms of historical cost => translate using the rate at the date of the transaction;

- Foreign currency non-monetary items that are measured at Fair Value => translate using the rate when the fair value was measured;

Exchange difference on monetary items shall be recognised in profit or loss in the period in which they arise.

When gain/loss on non-monetary item recognised in OCI, exchange component shall also be recognised in OCI (example – Ind AS 16 requires revaluation gain/loss on PPE to be recognised in OCI and this standard requires revalued amount (i.e., on Fair value of PPE) to be translated at the date when such value is determined, resulting in exchange difference that has to be recognised in OCI.

Let’s consider these two cases:

1. Carrying amount of inventories is lower of cost or net realisable value (Ind AS 2: Inventories)

2. Carrying amount of assets for which there is an indication of impairment : lower of carrying amount before considering impairment losses and its recoverable amount (Ind AS 36: Impairment of assets)

When such amount is non-monetary foreign currency item, carrying amount is determined by comparing:

- Cost or carrying amount translated at the rate at the date when that amount was determined (i.e., rate at the date of transaction for item measured in historical cost); or

- NRV or recoverable amount translated at the rate at the date when that value was determined (e.g., closing rate at the end of the reporting period)

Impact of this comparison: Impairment loss is recognised in functional currency but would not be recognised in the foreign currency, or vice-versa.

Net investment in foreign operation is the amount of the reporting entity’s interest in the net assets of that operation.

An item for which settlement is neither planned nor likely to occur in the foreseeable future is a part of entity’s net investment in foreign operation.

Example: An entity has two subsidiaries A and B. Subsy B is a foreign operation. Subsy A grants loan to Subsy B. On maturity, Subsy B will issue equity shares for the same. In this case, Subsy A’s loan receivable would be Entity’s net investment in Subsy B.

When a monetary item forms part of reporting entity’s net investment in foreign operation and that monetary item is denominated in foreign currency, exchange difference shall be recognised in Profit / Loss in the following cases:

- When foreign currency is same as of functional currency of either reporting entity or of foreign operation

- In the standalone financial statements of the reporting entity even if foreign currency is other than the functional currency of reporting entity or foreign operation.

Monetary item forms part of reporting entity’s net investment in foreign operation

⇓

That monetary item is denominated in foreign currency (other than functional currency of reporting entity and foreign operation)

⇓

Such exchange difference shall be recognised in OCI in consolidated financial statements of reporting entity.

⇓

And shall be reclassified from Equity to Profit / Loss on disposal of net investment

Example: Intragroup monetary items shall be eliminated and the resulting exchange difference shall be booked in Profit/Loss.

When entity keeps its books of accounts in currency other than its functional currency, entity shall translate all amounts into functional currency at the time preparing financial statements.

This standard permits presentation currency of entity to be any currency. Presentation currency is the currency in which the financial statements are presented.

Translation procedures from functional currency to presentation currency (when presentation currency is different from the functional currency):

| When functional currency is not currency of hyper inflationary economy | When functional currency is the currency of hyper inflationary economy |

| Assets and Liabilities – at closing rate at the date of balance sheet

Income and expenses – at exchange rates at the date of the transaction (average rate) Exchange difference shall be recognised in OCI, such differences to be transferred to Profit/Loss on disposal. |

All amount assets, liabilities, equity items, income & expenses (including comparatives) shall be translated at Closing rate at the date of most recent statement of financial position.

If amounts are translated into currency of non-hyper inflationary economy, comparative amounts shall not be adjusted for subsequent changes in exchange rates. |

Hyper inflationary economy as per Ind AS 29:

- Monetary amounts are quoted in relatively stable foreign currency rather than in local currency;

- Cumulative inflation rate over three years is approaching, or exceeds, 100%;

- Prefers to keep its wealth in

- non-monetary assets, or

- relatively stable foreign currency

- Sales/purchases on credit takes place at prices that compensate for the expected loss of purchasing power during the credit period, even if the period is short;

- Interest rates, wages and prices are linked to a price index.

Disposal of foreign operation – following partial disposal shall be accounted for as disposal:

- Loss of control of a subsidiary that includes a foreign operation (cumulative amount of exchange difference attributable to Minority Interest shall be reclassified to Profit/Loss)

- Loss on significant influence of an associate that includes a foreign operation

- Loss of joint control over jointly control entity that includes a foreign operation

Any other disposal shall be accounted for as Partial disposal.

On partial disposal of subsidiary that includes foreign operation, proportionate share in cumulative exchange difference in OCI shall be re-attribute to Minority Interest

Notes:

- In consolidated financial statements, exchange difference related to Minority Interest shall be recognised as part of Minority Interest.

- When financial statements are as of date different from reporting entity, different upto 3 months is allowed provided effects of significant transactions/events are made.

- For practical reasons, exchange rate that approximates the actual rate (for e.g. average rate for a week/month might be used). However, if exchange rate fluctuates insignificantly, use of average rate is not appropriate.

Take a situation now:

The entity received/paid advance consideration in a foreign currency for the goods/service to be transferred/purchased or to purchase/sale any asset. So the issue is – how to determine the date of transaction for the purpose of determining exchange rate to use on initial recognition of income/expense, asset.

This issue was resolved under Appendix B. The date for determining exchange rate shall be the date on which an entity has initially recognised the advance consideration.

Disclosures:

i) Exchange difference recognised in: Profit or Loss (except for financial instruments measured at FVTPL), Equity and reconciliation of such exchange difference at beginning and end of the period;

ii) Fact that presentation currency is different from functional currency, if it is different, and the functional currency of the entity and reason thereof

Further, it shall describe the financial statements as complying with Ind ASs only if translation procedures are completely complied with otherwise three additional disclosures are also required.

iii) Fact that functional currency, either of reporting entity or of significant foreign operation, has changed during the period and the date of change in functional currency and reason thereof;

Key differences between Ind AS 21 and AS 11

| S. No. | Ind AS 21 | AS 11 |

| 1 | Based on concept of functional currency. | Reporting currency is used as the measurement currency. |

| 2 |

Ind AS 21 requires exchange differences arising on translation/settlement of all foreign currency monetary items (including long term foreign currency monetary item) are recognised in profit or loss in the period in which they arise. Ind AS 21 contains applicability exclusion for an entity which has applied second alternative to defer/capitalise exchange differences. This exclusion is based on voluntary exemption given in Ind AS 101. Entities can continue using their IGAAP policy for deferral of exchange differences on long term foreign currency monetary items. Note: this is an option. Company can use Ind AS 21 accounting for exchange differences on these items. However, this option is not allowed for new long term foreign currency monetary items recognised after Ind AS implementation. |

AS 11 gives two options for accounting of exchange difference: a) Recognise exchange difference in profit of loss in the period in which they arise. b) Long term foreign currency monetary item: this option once selected is irrevocable. If it relates to acquisition of depreciable capital asset, exchange difference added to / deducted from cost of the asset and depreciated over the remaining useful life of the asset. However, if it relates to other than depreciable capital asset, exchange difference accumulated in “Foreign currency monetary item translation difference account” and amortised over the life of such long term asset or liability. |

| 3 | Presentation currency of entity can be any currency (i.e., currency in which financial statements presented are presented can be different from functional currency). | Does not deal with this concept. These terms are used in AS 11: Reporting currency and Foreign currency. |

| 4 | Ind AS 21 is based on functional currency approach for foreign operation. However, factors to be considered in determining an entity’s functional currency are similar to indicators to determine integral foreign operation under AS 11.

Further, functional currency of integral foreign operation will always be same as of reporting entity and therefore, despite the different terminology used, no substantive differences in respect of foreign operation accounting. |

There is no concept of functional currency. Further, AS 11 prescribed separate accounting for integral foreign operation and non-integral foreign operation.

|

| 5 | Not applicable to derivative accounting and hedge accounting of foreign currency items. | AS 11 deals with accounting for forward exchange contracts (except hedging risk of firm commitments).

|

Soon, Practical examples will be shared.

For practical examples, read here:

https://taxguru.in/chartered-accountant/practical-situations-ind-21-itfg.html