Applicability

Presently, it is mandated for registered persons whose aggregate turnover (based on PAN) in the preceding financial year is more than Rs. 500 Crores w.e.f 1st October 2020 (Notification No. 13/2020 – Central Tax dated 21st March 2020 and Notification No. 61/2020 – Central Tax dated 30th July 2020).

Entities/ persons specifically exempted

- Special Economic Zone Units

- Insurer or a banking company or a financial institution, including a non-banking financial company

- Goods transport agency supplying services in relation to transportation of goods by road in a goods carriage

- Suppliers of passenger transportation service

- Suppliers of services by way of admission to exhibition of cinematograph films in multiplex screens

E-invoicing

E-invoicing facilitates exchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format.

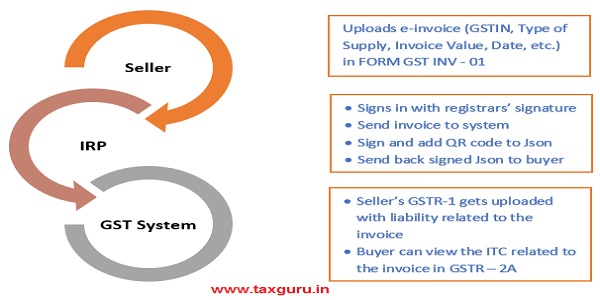

Registered persons will continue to create their GST invoices on their own ERP Systems and then these invoices will be reported to ‘Invoice Registration Portal (IRP) by uploading specified particulars (in FORM GST INV-01: Refer Notification No. 60/2020 – Central Tax dated 30th July 2020).

On reporting, IRP returns the e-invoice with a unique ‘Invoice Reference Number (IRN)’ after digitally signing the e-invoice and adding a QR Code. Then, the invoice can be issued to the receiver (along with QR Code). A GST invoice will be valid only with a valid IRN (Notification No. 68/2019 – Central Tax dated 13th December 2019).

Supplies covered

B2B GST Supplies and Export Invoices, Credit and Debit Notes issued by notified class of taxpayers are currently covered under e-invoice. E-invoicing is not mandatory to B2C invoices (although dynamic QR Code will have to be generated).

Getting e-invoice ready

Understanding e-invoice

As notified on 30th July 2020, GST INV-01 consists of 12 Sections (Mandatory + Optional) and 6 annexures consisting of total 138 fields. Out of these 12 Sections, 5 are Mandatory and 7 are Optional. Two annexures are mandatory. The 5 Mandatory sections are Basic Details, Supplier Information, Recipient Information, Invoice Item Details, Document Total. The two mandatory annexures are details of the items and document total.

Software developers

Businesses will continue to issue invoices as they are doing now. Necessary changes on account of e-invoicing requirement (i.e. to enable reporting of invoices to IRP and obtain IRN), will be made by ERP providers in their respective software. They need to get the updated version having this facility.

QR Code

The QR code will be part of signed JSON, returned by the IRP. It will be a string (not image), which the ERP/accounting/billing software shall read and convert into QR Code image for placing on the invoice.

Bulk uploading of invoices to IRP

Bulk upload will be generally required by large taxpayers. Their ERP will be designed in such a way that user can report invoices in bulk. However, reporting to IRP by the tool and generation of IRN will be one after another, which will not be seen by the user. For the user it will appear bulk upload and bulk receipt.

Logo on e-invoice

E-invoice schema is a single standard applicable to all businesses in the country. Elements of invoice which are internal to business, such as company logo etc. are not part of e-invoice schema. After reporting invoice details to IRP and receipt of IRN, at the time of issuing invoice to receiver (e.g. generating as PDF), any further customisation, i.e. insertion of company logo, additional text etc., can be made by respective ERP providers.

Business

What needs to be printed

E-invoice: Optional, once the IRP returns the signed JSON, it can be converted into PDF and printed.

IRN: Optional, IRN is anyway embedded in the QR Code to be printed on invoice.

QR Code: Mandatory, The QR code which comes as part of signed JSON from IRP, shall be extracted and placed on the invoice before generation of PDF/print.

Generation of dynamic QR Code in case of B2C transaction

To encourage digital payment, Notification No. 14/2020-Central Tax dated 21st March 2020 mandates entities with aggregate turnover greater than Rs. 500 crores in preceding financial year to include QR code on their B2C invoices.

QR code can be made available either on the Point of Sale (PoS) machine of the seller or the Invoice issued by the seller.

Practical FAQs

Is Invoice number same as Invoice Reference Number (IRN)?

No. Invoice no. (e.g. ABC/1/2019-20) is assigned by supplier and is internal to business. Its format can differ from business to business and also governed by relevant GST rules. IRN, on other hand, is a unique reference number (64 character hash) generated and returned by IRP, on successful registration of e-invoice.

On generation of IRN, will the IRP send or e-mail the e-invoice to the receiver?

No. IRP will not do this. Upon receiving signed JSON from the IRP, it is for the supplier to send the e-invoice (along with QR Code etc.) to the receiver.

Can an IRN/invoice reported to IRP be cancelled?

Yes. This request can be triggered through ‘Cancel API’ within the prescribed period. It shall be vital here to note that once an IRN/invoice is cancelled, the same invoice number cannot be used again to generate another invoice. In case it is used again then the same will be rejected when it is uploaded on IRP.

Can an IRN/invoice be cancelled partially?

No. It has to be cancelled in toto. No partial cancellation of reported e-invoice allowed.

Can details of a reported invoice be amended?

Yes. They can be amended. Details of e-invoices successfully registered on IRP will be pushed to the GST System. So, any amendments to the e-invoice have to be carried out on GST portal and not on IRP. Further, the amendments are governed by relevant provisions of GST Law and Rules.

With the introduction of e -invoicing, is e-way bill still compulsory?

Yes. While transporting goods, wherever the e-way bill is needed, the requirement continues to be mandatory.

How to verify an invoice is duly reported to IRP?

A dedicated mobile app to scan and verify validity of e-invoice QR Code will be provided. Further, a “Search IRN” facility will also be provided on GST Portal.