What is an Accounting standard?

Accounting standards are established guidelines that outline the standardized treatment of specific or generalized transactions. They enable stakeholders to compare financial data consistently within the same company over time or among different entities. Accounting standards ensure the presentation of a true and fair view of an entity’s financial statements.

Global history:

At Earliest stage, US GAAP, originally designed by the US, was among the most accepted set of standards globally. But with change in time and advancements in world economies, Changes became the necessity of the hour & major countries came together and formed a committee, known as International Accounting Standards Committee (IASC) in 1973 and issued International Accounting Standards (IAS).

Further in 2001, IASC was modified and converted into IASB (International Accounting Standards Board) which notified and issued IFRS (International Financial Reporting Standards) and replaced the existing IAS.

Indian history:

India used to apply modified GAAP, which was called ‘IGAAP’ (Indian GAAP) before the existence of Accounting Standards. But with introduction of IFRS, the IASC provided the member countries with two options:

- To adopt the IFRS in its entirety and apply as whole, without any changes, or

- To adopt the Converged IFRS, with required changes in IFRS.

India used option 2, and hence adopted the IFRS after making the necessary changes in them, so that the converged IFRS could suit best to the economic, taxation, accounting and business culture of India. These converged IFRS were named as Ind AS.

Applicability of Ind AS in India:

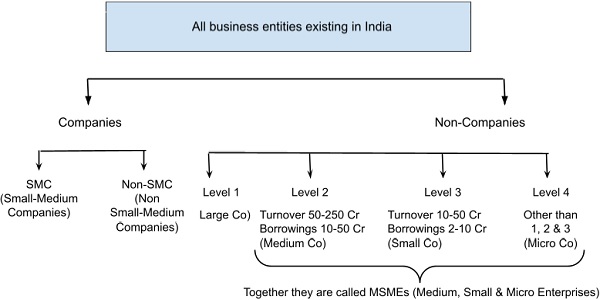

Ind AS is applicable to almost majority business entities existing in India. The criteria for applicability can be understood with the help of this flowchart:

- SMC – Companies fulfilling these condition:

- Not Listed or not in process of being listed,

- Non – Banks, NBFCs, Insurance Co,

- Turnover does not exceed 250 Cr,

- Borrowings does not exceed 50 Cr,

- Non-Smc – Companies which are not SMCs

- Level 1 – Entities fulfilling these conditions:

- Listed or in process of being listed,

- Banking, NBFCs or Insurance Co,

- Turnover exceed 250 Cr,

- Borrowings exceed 50 Cr

Apart from these conditions for any category, if the subsidiary or holding of any entity fulfills these conditions, then such entities will also be considered in the same category as of its subsidiary or holding entity.

Conclusion: Accounting standards play a vital role in ensuring consistency and comparability in financial reporting. The global history of accounting standards showcases the transition from IAS to IFRS, while India adopted Ind AS by making necessary modifications. The applicability of Ind AS in India varies based on the size, listing status, and type of business entities. Adhering to accounting standards facilitates transparency, enhances investor confidence, and enables meaningful analysis and decision-making based on accurate and reliable financial information.