Case Law Details

In re Nutricia International Private Limited (CAAR Mumbai)

In the case concerning the classification of the 5-HMO Mix, an imported product used in manufacturing infant formula, Nutricia International Private Limited sought an advance ruling on whether the product is classifiable under various tariff headings. The product, a blend of five human milk oligosaccharides (HMOs), was examined to determine whether it should fall under Tariff Item 2940, 1702, or 2106 of the Indian Customs Tariff. The ruling found that the 5-HMO mix, which is composed mainly of 2′-Fucosyllactose, 3′-Fucosyllactose, Lacto-N-Tetraose, 3′-Sialyllactose, and 6′-Sialyllactose, qualifies as a “chemically pure” sugar under Tariff Item 2940, as the individual oligosaccharides meet the criteria for chemical purity despite trace impurities. The ruling also emphasized that, according to Indian Customs law, specific tariff headings take precedence over more general ones, confirming the classification of the mix under CTH 2940. The application of this classification ensures the product is recognized as an intermediary ingredient for further manufacturing rather than a final food product, thereby excluding it from headings related to food preparations (CTH 2106 and 1901). This ruling clarifies the classification of the 5-HMO mix in line with established customs regulations and judicial precedents.

RELEVANT TEXT OF THE ORDER OF CUSTOMS AUTHORITY OF ADVANCE RULING, MUMBAI

Ruling

1. Nutricia International Private Limited (IEC No. 051109638 I) (hereinafter referred as “The Applicant”) filed an application for advance ruling in the Office of Secretary, Customs Authority for Advance Ruling, Mumbai. The said application was received in the secretariat of the CAAR, Mumbai on 04.09.2024, along with its enclosures in terms of Section 281-1 (1) of the Customs Act, 1962 (hereinafter referred to as the ‘Act’). The applicant is seeking advance ruling regarding classification of 5-11M0 Mix being imported by them for manufacturing infant formula manufactured by them.

2. Submission by the Applicant:

2.1 Nutricia International Private Limited (“the Applicant”), is a Private Limited company year 2011 under the Companies Act, 1956. The Applicant is part of the Danowned Danone group. The Applicant is engaged in the import, marketing of numerous products which serve the following markets:

i. Infant Nutrition

ii. Adult Nutrition

iii. Health an Wellness

2.2 The Applicant is now proposing to import the product `5-HMO mix’. Post import, the same will be used by the Applicant for manufacturing infant formula manufactured by them.

2.3 About 5- MO Mix: 5-HMO Mix (hereinafter referred to as the ‘product’) is a mixture of 5 different type’ s of human milk oligosaccharides (`HMOs’). Below is the composition of the product:

| SI. No. | Ingredient | % of Total weight | Nature of the ingredient |

| 1. | 2′-Fucosy lactose | 52 %DW (+/- 5 DW) | HMO |

| 2. | 3-Fucosy lactose | 13 %DW (+/- 3 DW) | HMO |

| 3. | Lacto-N- etraose | 26 %DW (+/- 3 DW) | HMO |

| 4. | 3 ‘ -Sialyllactosetose | 4 %DW (+/- 1 DW) | HMO |

| 5. | 6′-Sialyllactose | 5 %DW (+/- 1 DW) | HMO |

| 6. | other carbohydrates | < 10 %Area | Leftover unconverted starting material |

| 7. | Lactose | < 3 % DW | Leftover unconverted starting material |

2.4. The HMC in the 5 HMO Mix are individually synthesized from a carbon source (e.g. Socrose, glucose = glycerol) and lactose as precursor by production strains and secreted into medium. The fermentation medium is isolated from the microbial biomass e HMOs are further purified from the resulting solution using ion exchange al purification steps. The final HMO solution is then spray dried to produce a solid white powered. The resulting individual HMO powders are used in a wet-blending process to generate the 5-HMO Mix which is subsequently spray dried to obtain the final product.

2.5 The HMO content constitutes more than 90% of the product, with majority of it being 2’Fucosyllactose The Lactose and Carbohydrates are leftover unconverted starting material in the product. The Applicant also submitted the technical specifications sheet of the product.

2.6 About monosaccharides, oligosaccharides and Human milk oligosaccharides:

Monosaccharides are known as simple sugars and are the most basic units of carbohydrates. Oligosaccharides are a type of chain made up of 3 to 10 monosaccharides. Human milk oligosaccharide (`HMOs’) are multifunctional glycans, naturally present in human milk, and are a structurally hand biologically diverse group of complex indigestible sugars. All HMOs are based on a lactose (Gal), N-ethylglilucosamine occurring HMOs synthetically pro molecule and made of five basic monosaccharides: glucose (Glc), galactose casamino (G1cNAc), fucose (Fuc) and sialic acid (SA.). These naturally can also be synthesized. The 5-HMO Mix is a product that utilizes 5 different used HMOs.

2.7 Benefits f 5 HMO mix: The HMOs in the 5 HMO mix are reported to reduce growth of several common harmful bacteria in infants. HMOs support a natural gut microbiome by nourishing beneficial gut bacteria such as bifidobacterial, lactobacilli and Bacteroides. It also helps build and balance immunity in infants and has a positive impact on brain development in infants by affecting cognition and regulation of neurons.

3. Applicants Interpretation of Law/Facts:

3.1 The applicant states that the Tariff is aligned, up to the 6-digit level, with the Harmonized System of Nomenclature (`HSN’) issued by the World Customs Organization (`WC0′). It has been held by the Hon’ble Supreme Court in the case of Collector of Customs, Bombay Vs. Business Forms — 2002 (142) ELT 18 that the HSN Explanatory Notes aid in the interpretation of the Headings of the Tariff and may be used as a safe guide for the same.

3.2 The classification of the goods imported into India is to be determined based on the General Rules of Interpretation (hereinafter referred to as the “GRI”) set out in the Tariff. As per Rule 1 of the GRI, classification of the imported products shall be determined according to the terms of the headings and any relative Section or Chapter Notes and, provided such headings or Notes do not otherwise require, according to the remaining Rules of the GRI.

3.3 The product in question i.e., 5-HMO Mix is a mixture of 5 different human milk oligosaccharides which are obtained from lactose. Oligosaccharides are specifically, covered under Heading 2940. Thus, at the outset classification under Pleading 2940 be examined.

3.4 THE PRODUCT CLASSIFICATION UNDER HEADING 2940: Relevant extracts of FISN Explanatory Notes to Heading 2940 are set out below:

29.40 – Sugars, chemically pure, other than sucrose, lactose, maltose, glucose and fructose; sugar ethers, sugar acetals and sugar esters, and their salts, other than products of heading 29.37, 29.38 or 29.39.

(A) SUGARS, CHEMICALLY PURE

This heading covers only chemically pure sugars. The term “sugars” covers monosaccharides, disaccharides and oligosaccharides. Each saccharide unit must consist of at least four, but not more than eight, carbon atoms and, as a minimum, must contain a potential reducing carbonyl group (aldehydic or ketonic) and at least one asymmetric carbon atom bearing a hydroxyl group and a hydrogen atom. The heading excludes :

a) Sucrose, this, even when chemically pure, falls in heading 01.

b) Glucose and lactose; these, even when chemically pure, fall in heading 17.02.

c) Maltose which, even when chemically pure, hills in heading 17.02. Isomeric with sucrose. Crystalline mass. Used in medicine.

d) Fructose (laevulose) which, even when chemically pure, falls in heading 17.02. Isomeric with glucose. Yellowish crystals in the pure state. Used in medicine (for diabetic diets).

e) Aldol (heading 29.12) and acetoin (3-hydroxy-2-butanone) .(heading 29.14), which, though they meet the criteria for being saccharide units, are not sugars.

The following are included among the chemically pure sugars falling under this heading :

(1) Galactose*. Isomeric with glucose. Obtained by hydrolyzing lactose. Found in pectin substances and mucilage’s. Crystalline when pure.

(2) Sorbose (sorbenose). Isomeric with glucose. White crystalline powder, very soluble in water. Used in the synthesis of ascorbic acid (vitamin C), and in the preparation of culture media

(3) Xylose (wood sugar) (C5+11005). White crysials. Used in pharmacy.

(4) Trehalose, isomeric with sucrose. Ribose and arabinose, isomeric with xylose. Raffinose (C181–132016)..Fucose, rhamnose (C61-1120s), digitoxoside (C61–11204) and other deoxy sugars. These sugars are all essentially laboratory products. .

The sugars of this heading. may, be in the ‘form of aqueous solutions.

3.5 As per the above extract, oligosaccharides are clearly covered uncle; Heading 2940. HMOs arc nothing but oligosaccharides derived from human milk (natural or chemically synthesized).. Thus, HMOs too are nothing but oligosaccharides and are covered under Heading 2940.

3.6 Lactose and carbohydrate present in the imported product are unconverted raw materials / by-products. Thus, they are permissible impurities allowed to be present in the imported product. Relevant extracts from the Chapter Notes to Chapter 29 are as follows:

The separate chemically defined compounds of this Chapter may contain impurities (Note 1 (a)). An exception to this rule is created by the wording of heading 29.40 which, with regard to sugars, restricts the scope of the heading to chemically pure sugars.

The term “impurities” applies exclusively to substances whose presence in the single chemical compound results solely and directly from the manufacturing process (including purification). These. substances may result from any of the factors involved in the process and are principally the following :

(a) Unconverted starting materials.

(b) Impurities present in the starting materials.

(c) Reagents used in the manufacturing process (including purification):

(d) By-products.

It should be noted; however, that such substances are not in all cases regarded as “impurities” permitted under Note 1 (a). When such substances are deliberately left in the product with a view to rendering .it particularly suitable for specific use rather than for general use, they are not regarded as permissible impurities. For example, a product consisting of methyl acetate with methanol deliberately left in with a view to improving its suitability as a solvent is excluded (heading 38.14 For certain compounds (e.g., ethane, benzene, phenol, pyridine), there are specific purity criteria, indicated in _Explanatory Notes to heading 29.01, 79.02, 29.07 and 29.33.

3.7 Thus, 5 HVIO mix is rightly classifiable under Heading 2940.

3.8 Classification of the product under Heading 2940 as per BTI Rulings: Reliance is also placed on the below BTI Rulings in support of the classification of HMOs under Heading 2940:

| SI. No. | BTI Ruling No. | Product Details | Classification |

| 1. | DEBTI49449/21-dated: 04.02.2022 | Salt of a sugar ether; 6′-Sialyllactose Sodium Salt According to the documents submitted, the product is the chemically uniform compound 6′-sialyllactose-sodium salt without any further additives. 6′-Sialyllactose Sodium Salt exists as a white solid and is used as a human milk oligosaccharide (HMO) as an ingredient in baby food. The product is to be classified under heading No 2940 of the Combined Nomenclature as the salt of a sugar ether. | Heading 2940 |

| 2. | DEBTI49449/21-dates: 10.02.2022 | Chemically pure sugar; 2′-Fucosyllactose Heading 2940 dated According to the documents submitted, the product is the chemically uniform compound 2′- fucosyllactose without further additives. The. CAS No. is 41263-94-9. 2′-fueosyllactose is a white solid and is used as a human milk oligosaccharide (HMO) as an ingredient in baby food. The product is to be classified as chemically pure sugar under heading No 2940 of the Combined Nomenclature. | Heading 2940 |

| 3. | DEBTI49446/21-I dated: 01.02.2022 | I dated: 01.02.2022 salt of a sugar ether; 3′- sialyllactose Sodium Salt According to the documents submitted, the product is the chemically uniform compound 3′- sialyllactose sodium salt without any further additives. The CAS No. is 128596-80-5. 3′- sialyllactose sodium salt is a white solid and is used as a human milk oligosaccharide (HMO) as an ingredient in baby food. The product is to be classified under heading No 2940 of the Combined Nomenclature as the salt of a sugar ether. | Heading 2940 |

3.9 Thus, as per international customs practice as well the product is classifiable under Heading 2940.

3.10 THE PRODUCT CLASSIFICATION UNDER HEADING 1702: Sugars obtained from lactose (known as milk sugars) are covered under Heading 1702. Thus, alternatively, the product may be classifiable under Heading 1702. Chapter 17 covers Sugar and Sugar Confectionery. Relevant portion of Chapter Notes to Chapter 17 are extracted below:

“1. This Chapter does not cover:

(a) Sugar confectionery containing cocoa (heading 1806);

(b) Chemically pure sugars (other than sucrose, lactose, maltose, glucose and fructose) or other products of heading 2940; or

(c) Medicaments or other products of Chapter 30.”

3.11 Thus, from a perusal of the above it is .understood that if the product is not classifiable under Heading 2940, the same can be classified here. If, arguendo, only chemically pure oligosaccharides• are covered under Heading 2940 and the presence of lactose and carbohydrates renders the product to fall outside the ambit of Heading 2940, then the product would be classifiable’ under Chapter 17 as it covers other sugars, regardless of whether the presence / absence of impurities. The relevant portion of l-ISN Explanatory Notes to Heading 1702 is extracted below:

17.02 – Other sugars, including chemically pure lactose, maltose, glucose and fructose, in solid form; sugar syrups not containing added flavouring or colouring matter; artificial honey, whether or not mixed with natural honey; caramel.

3.12 From a perusal of the above, it is clear that all sugars, other than those which are chemically pure, are classifiable under Heading 1702. It is undoubted that the imported product is a sugar. Thus, if the imported product is not classifiable under Heading 2940, the same will be classifiable under Heading 1702.

3.13 The Sugar in Heading 1702 are capable of use in various industries for various manufacturing of baby food or low-calorie food, as flavouring or colouring in the pharmaceutical industry, etc. The product is manufactured by treating er ingredients are added to the product. The product contains HMOs, and arting material of lactose and carbohydrates. As demonstrated above, HMO gar. Each of the 5 HMO present are oligosaccharides, which are sugars. The remaining unconverted lactose too is a sugar.

3.14 Further, from a perusal of the other sugars mentioned in the HSN Explanatory Notes to Heading 2940 and the functions / uses of these sugars, it is clear that the 5-HMO mix is similar to the other sugars which are covered under Heading 1702, such as those used in baby food products. Therefore, for the reasons enumerated above, the product is alternatively classifiable under Heading 1702. .

3.15 THE PRODUCT NOT CLASSIFIABLE UNDER HEADING 2106: Heading 2106 covers food preparations not elsewhere specified or included. The relevant portion of FISN Explanatory Notes to Heading 2106 is extracted below:

21.06 – Food preparations not elsewhere specified or included.

2106.10 – Protein concentrates and textured protein substances

2106.90 – Other

Provided that they are not covered by any other heading of the Nomenclature, this heading covers :

(A) Preparations for use, either directly or afier processing (such as cooking, dissolving or boiling in water, milk, etc.), for human consumption.

(B) Preparations consisting wholly or partly of foodstuffs, used in the making of beverages or food preparation for human consumption. The heading includes preparations consisting of mixtures of chemicals (organic acids, calcium salts, etc.) with foodstuffs (flour, sugar, milk powder, etc.), for incorporation in food preparations either as ingredients or to improve some of their characteristics (appearance, keeping qualities, etc.) (see the General Explanatory Note to Chapter 38).

However, the heading does not cover enzymatic preparations containing foodstuffs (e.g., meat tenderizers consisting of a proteolytic enzyme with added dextrose or other foodstuffs). Such preparations fall in heading 35.07 provided that they arc not covered by a more specific heading in the Nomenclature.

3.16 Therefore, it appears that for products to fall under Heading 2106, such products must be —

a. Food preparation

b. Such food preparations should not be specified or included elsewhere. In other words, it is a residuary heading and if products are covered or included elsewhere they will not fall under Chapter Heading 2106.

3.17 The product is not a food preparation as contemplated under Heading 2106: From a perusal of the above extract of HSN Explanatory Notes to Heading 2106, it is clear that only two categories of product are covered under Heading 2106. (A) Preparations which are for direct human consumption or consumption after processing; and (B) Preparations which are mixed with foodstuffs and further used for the manufacture of food preparations.

3.17.1 The product is not fit for direct human consumption as the product: It is submitted that the product in as imported condition cannot be directly used for human consumption. The product is a concentrated formulation which is further used by the Applicant as one of the ingredients in the mass production of the baby formula manufactured and sold by it. Therefore, it is clear that the imported products cannot be used for direct human consumption.

3.17.2 The product is not fit for human consumption after processing as the nature of processing envisioned under Heading 2106 is simple processing that can be undertaken at home: With respect to whether the product is for use for human consumption after processing, it is submitted that the product is not in the nature of products that can be consumed by humans after simple processing. The type of processing that is envisioned under the ambit of Heading 2106 is “cooking, dissolving or boiling in water, milk, etc”. These processes illustrate that the processes covered under Heading 2106 are simple processes which can be undertaken at hot by a consumer to consume the preparations. The imported products being a concentrated H 0 mix which is intended for use in further manufacturing, cannot be consumed after si pie processing and is not fit for direct human consumption.

3.18 The product is not in the nature of preparations consisting wholly or partly of foodstuffs: Food uffs here refers to products ready for consumption. The imported product is just chemical in it ported form. Thus, it is not classifiable under this Heading.

3.19 Heading 106 is a residuary heading. As the imported products are aptly covered under Heading 2 40 and Heading 1702; the same is automatically excluded from Heading 2106: From a pe usal of Heading 2106, it IS evident that the same is a residual entry; which would only include products which cannot be covered under any other Entry in the schedule. Whereas, the pro uct in the present case squarely falls under Heading 2940, and if not that then under Heading 1 02. Thus, it is submitted that resort to residuary Heading of 2106 can be Made only when the product does not fall under Heading 2940 or even Heading 1702 even by liberal interpretation of t. Thus, the product is not classifiable under Heading 2106.

3.20 EVEN t N APPLYING GRI, THE PRODUCT IN QUESTION IS CLASSIFIAK HEADING 2940 OR 1702, AND NOT UNDER 2106: The product in present case is a fixture of 5 HMOs. The composition is set out in facts. It is relevant here to refer to Rule 2(b of the GRI, read with Rule 3:

“Rule 2 ): Any reference in ‘a heading to a material or substance shall be taken to include reference to mixtures or combinations of that material or substance with other material or substances. Any reference to goods of a given material or substance shall be taken o include a reference to goods consisting wholly or partly of such material or substances . The classification of goods consisting of more than one material or substances shall be according to the principles of Rule 3.

Rule 3: hen by application of Rule 2 (b) or for any other reason, goods are prima facie, classifiable under two or more headings, classification shall he effected as follows:

(a) The heading which provides the most spec* description shall be preferred to heading providing a more general description. However, when two or more headings each re ‘r to part only of the materials or substances contained in mixed or composite goods o to part only of the items in a set put up for retail sale, those headings are to be regraded as equally specific in relation to those goods, even if one of them gives a more complete or precise description of the goods.

(b) Mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by referent e to 3 (a), shall be classified as if they consisted of the material or component which ryes them their essential character, insofar as this criterion is applicable

(c) When goods cannot be classified by reference to 3 (a) or 3 (b), they shall be classify • d under the heading which occurs last in numerical order among those which equally merit consideration”

3.21 Thus, as per the above extracts, reference to Sugars (HMO) in Heading 2940 and Heading 1702 shall include reference to mixtures of HMOs.

3.22 Food ,reparations and similar mixtures are also covered under Heading 2106. If mixtures and combinations of materials or substances consisting of more than one material or substance, are prima facie classifiable under two or more headings, they ought to be classified according to the principles of Rule 3.

3.23 The product is classifiable under Heading 2940 or alternatively, under Heading 1702 by virtue of Rule 3(a) of GRI as it is the more specific heading: As per Rule 3(a), the most specific description is to be selected. Heading 2940 covers “Sugars, chemically pure, other than sucrose, lactose, maltose, glucose and fructose; sugar ethers, sugar acetals and sugar esters, and their salts, other than products of heading 29.37, 29.38 or 29.39”. Heading 1702 covers “Other sugars, including chemically pure lactose, maltose, glucose and fructose, in solid form; sugar syrups not containing added flavouring or colouring matter; artificial honey, whether or not mixed with natural honey; caramel”. Whereas, Heading 2106 covers food preparations not elsewhere specified or included”.

3.24 Heading 2940 clearly covers Sugars such as HMOS i.e. oligosaccharides, and Heading 1702 covers other sugars which do not fall under Heading 2940. The lactose and carbohydrates in the product are leftover impurities / unconverted starting material only. Therefore, for the product containing 90% 1-11VIOS, i.e. sugar, Heading 2940 or alternatively Heading 1702, are the more specific headings. As submitted in the foregoing paragraphs, Heading 2106 is a residuary entry which covers food preparations only if not specified elsewhere. Thus, it is clear that Heading 2940 or Heading 1702 are the more specific headings.

3.25 lf, arguendo, the classification is not possible even by virtue of Rule 3(a), then reference shall be made to Rule 3(b).

3.26 The product is classifiable under Heading 2940 or alternatively, under Heading 1702 by virtue Of Rule 3(b) of GRI as the essential character of the product is imparted by the HMO: In accordance with Rule 3(b) of GRI, the mixtures, composite goods consisting of different materials if cannot be classified by reference to Rule 3(a), then they shall be classified as if they consisted of the material or component which gives them their. essential character.

3.27 The HMO content in the product accounts for 90% of the total composition of the product. Out of the same, more than 50% of comprises of 2′-Fucosyllactose 1-IMO. Further, as stated above, carbohydrates and lactose are merely leftover unconverted starting material. HMOs help in building immunity and balancing gut health in infants which is the intended use of the product. And the product is used for manufacturing “Aptamer Gold Stage 1 Infant Formula with Prebiotic” which is a baby formula for such integral function performed by the HMOs in it. Thus, it is evident that the essential character in the 5 I-IMO Mix is imparted by the HMOs only, and accordingly, the product i.e. a mixture of 5 HMOs is to be classified as per the correct classification for the HMO.

3.28 As demonstrated above by placing reliance on HSN Explanatory Notes to Heading 2940 and BTI Rulings, it is clear that an HMO being an oligosaccharide is classifiable under Heading 2940. Accordingly, a mixture of 5 HMOS, wherein the essential character is imparted by the HMO, shall be classifiable under Heading 2940 only. If not under Heading 2940, then alternatively, the product is classifiable under Heading 1702.

3.29 Thus, for the reasons enumerated .above, the product is correctly classifiable under Heading 2940. In support of the same, the Supplier is also classifying the 5 HMO mix under Heading 2940. And alternatively, the product is classifiable under Heading 1702.

4. Port of Import and reply from Jurisdictional Commissionerate

4.1 The. applicant in their CAAR-.1 indicated that they intend to import the subject goods i.e. 5-HMO Mix at the jurisdiction of office of Commissioner of Customs (Imports), Air Cargo Complex, Sahar, Mumbai = 400099 and office of Commissioner of Customs, NS-III, JNCH,

Tal-Uran, Dist: Raigad, Nhava Sheva, Maharashtra — 400 707. In terms of Provisions of the the Customs Act, 1962 read with the Sub-regulation No. (7) of the of the Customs Authority for Advance Rulings Regulations, 2021, the rewarded to the office of Commissioner of Customs (Imports), Air Cargo umbai Complex, Nhava Sheva, Maharashtra — 400 707 on 12.09.2024 as– indicated by No. 13 of their CAAR-1 Forms calling upon them to furnish the relevant ents, if any, in respect of the said application.

Office of commissioner of Customs, NS-III, JNCH, Tal-Uran, Dist: Raigad, Nhava a — 400 707 vide its email dated 24.10.2024 informed that it does not pertain Id be forwarded to NS-I Commissionerate. Therefore, the application was ffice of Commissioner of Customs, NS-I, JNCH, Tal-Uran, Dist: Raigacl, arashtra — 400 707 on 28.10.2024 calling upon them to furnish the relevant ents, if any, in respect of the said application. Further reminders were also 24 and 24.12.2024, however, no reply, till date, has been received in this Office.

The office f Commissioner of Customs (Imports), Air Cargo Complex, Sahar, Mumbai — 400099 vide its letter dated 31.12.2024 replied that Human Milk Oligosaccharides merits classification und or heading 2940 in terms of GRI Rule 3(a) as it provides more specific description of H1 0 Mix than any other heading.

5. Records o Personal Hearing

5.1 A persona hearing was held on 13.11.2024 at 3:00 PM in the office of the CAAR, is wanathan, Shri Srinidhi Ganeshan and Ms. Anaya Bhide all Advocates aring on behalf of the applicant (Human Milk. 01 classification und form remain und submitted a coin (Page — 30) case Alternatively, the under CTH 2940, submission and reiterated the contention of the applicant location. They contended that the subject import goods i.e. 5-HMO Mix gosaccharides) to be used in preparation of ‘Infant Milk Formula’ merit CTI 29400000. They submitted that each component ingredient in pure r the same CTH when mixed / processed together in form of HMO. They elation index in support of their claim relying upon HSN explanatory notes laws in three BTI rulings dated 07.02.2022, 10.02.2022 and 04.02.2022. also submitted that if the subject import goods do not merit consideration hey may fall under CTH 1702. They also requested to provide an additional ing the composition of the formula / source in a week time which was permitted.

Nobody a appeared from the department for the PH.

6. Additional Submissions by the Applicant

6.1 The applicant vide its email dated 13.11.2024 further submitted a synopsis capturing in ns made during the hearing on 13.11.2024. The submission also answers the following queries posed during the hearing:

a. whether HMOs can be obtained from a process other than biosynthesis, and whether en if they are chemically synthesized, the terminology for HMOs is still “human ilk oligosaccharides”.

b. Whether HMOs are commonly used in infant formulas

6.2 The applicant further submitted that the 5-HMO Mix (hereinafter referred to as the `product’) is a mixture of 5 different types of human milk oligosaccharides (‘HMOs’). The HMOs used in th product have been chemically synthesised.

6.3 About HMOs & the product in question: Human milk oligosaccharides are a structurally and biologically diverse group of complex indigestible sugars, naturally present in human milk. `Oligosaccharides’ are a type of chain made up of 3 to 10 monosaccharides, which are simple sugars and are the most basic units of carbohydrates. All IIMOs are based on a lactose molecule and made of five basic monosaccharides: glucose (Glc), galactose (Gal), N-ethyl glucosamine (GIcNAc), fucose (Ric) and sialic acid (SA.). The product in question is made up of 5 chemically synthesized HMOs. Below is the composition of the product:

| SI. No. | Ingredient | % of Total weight | Nature of the ingredient |

| 1. | 2′-Fucosyllactose | 52 %DW (+7- 5 %DW) | HMO |

| 2. | 3-Fucosyl lactose | 13 %DW (+7- 3 %DW) | HMO |

| 3. | Lacto-N-Tetraose | 26 %DW (-1-1- 3 %DW) | HMO |

| 4. | 3 ‘-Sialyllactose | 4 %DW (+1- 1 %DW) | HMO |

| 5. | 6′-Sialyllactose | 5 `)/%DW (-11- 1 %DW) | HMO |

| 6. | other carbohydrates | < 10 %Area | Leftover unconverted starting material |

| 7. | Lactose | < 3 % DW | Leftover unconverted startinnr, material |

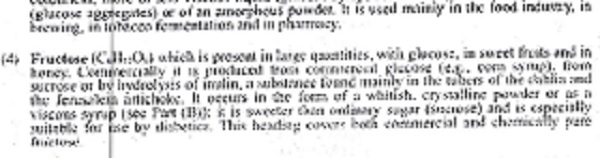

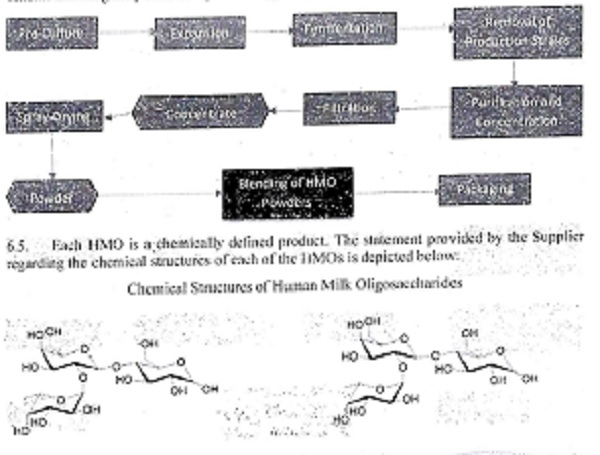

6.4. The HMOs in the 5 HMO Mix (2′-Fucosyllactose, 3-Fucosyllactose; 3′-Sialyllactose, 6′-Sialyllactose. and Lacto-N-tetraose) are individually synthesized from a carbon source (e.g. sucrose, glucose or glycerol) and lactose as precursor using individual production strains and are secreted into the fermentation medium. The fermentation medium is separated from the microbial biomass using filtration. The HMOs are further purified from the resulting solution using ion exchange resins and additional purification steps. The final HMO concentrates are eventually spray-dried and blended to produce a solid white 5 HMO Mix powder. A flow scheme showing the production process is given below:

6.6. The Total HMO content constitutes more than 90% of the product, with majority of it being 2’Fucosyll ctOse. The Lactose and Carbohydrates are leftover Unconverted starting material in the pr. duct. The technical specifications sheet of the product is enclosed with the Application.

6.7 Chemically synthesized HMOs too are referred to as “Human Milk Oligosaccharide “. These are permitted for use in infant nutrition products: While HMOs are naturally bios, synthesized by humans via breast milk, the large-scale use of it in research or in infant formula became difficult due to limited access to human donor milk. Thus, development of ew synthetic methods began to emerge to solve this scale issue. Thus, artificial Synthes s methods such as chemoenzymatic techniques and microbial metabolic engineering processes were developed, resulting in ability to produce certain HMO structures at a large scale.

The 5 HMO mix is artificially synthesized using the Microbial Fermentation Process. This process 1. . Microbial metabolic engineering, as well other processes such as chemoenzymatic synthesis, etc. and their prevalent use for commercially producing HMOs is elaborated upon in the publication titled ‘From lab bench to formulated ingredient: Characterization production, and commercialization of human milk oligosaccharides’ by Clodagh Walsh. The publication elaborates on artificial synthesis of HMOs for use as a formulated ingredient in various industries, and from the perusal of publication, it is clear that even chemically synthesized HMOs are still referred to as ‘human milk oligosaccharides’.

HMOs at beneficial for protection against pathogenic bacteria or viruses, prevention against bowel in ambition, and improve the immune system respos,sAiluingt1Te#cvekqpinent of infants. And it is due to such benefits that HMOs are used in the manufacturing of infant formula. Synthetically produced 2′-Fucosyllactose (2’FL) and Lacto-N-neotetraose (LNnT) are the common HMOs that have been added to infant formula. The use of these HMOs in infant formula is approved by the European Union and the United States.

Even in the product concerned, the individual HMO are listed as novel foods and are approved under the European Union’s Commission Implementing Regulation (EU) 2017/2470 tar use in infant food. Further, its use in infant food is also concluded as ‘Generally Recognized as Safe (GRAS) in the U.S.

From the above it is evident that HMOs can be chemically synthesized and its use in infant nutrition products is permitted.

6.8 The product is classifiable under Heading 2940: It is submitted that the product in question is a mixture of 5 different HMOs. Each human milk oligosaccharide is a type of oligosaccharide. Oligosaccharides are “a type of carbohydrate chain made up of three to 10 simple sugars, which are also known as monosaccharides”. Each Oligosaccharide present in the 5 HMO mix is in turn made of 5 monosaccharides [glucose (Ole), galactose (Gal), N-ethyl glucosamine (G1cNAc), fucose (Fuc) and sialic acid (SA.)] . Thus, each HMO is clearly an oligosaccharide and thus is specifically covered under Heading 2940 as visible from the INN Explanatory Notes. to Heading 2940. Thus, it is submitted that a mixture of 5 oligosaccharides should also be covered under Heading 2940.

Further, there are various. BTI Rulings in support of the classification of HMO under Heading 2940. Further, the HMOs are chemically synthesized will not affect their classification, as the classification under Heading 2940 is determined based on the chemical formulas of the product concerned and not based on its source. Within Heading 2940 itself numerous products mentioned in HSN ‘Explanatory -Notes are chemically synthesised’ (e.g. galactose – obtained by hydrolyzing lactose). Accordingly, the product is classifiable under Heading 2940 only.

6.9 Alternatively, the product is classifiable under Heading 1702: It is submitted that if the product is not classifiable under Heading 2940, then it is classified under Heading 1702, as .the heading covers sugars other than those of Heading 1701 and Heading 2940. Further, the Heading covers. both commercially produced sugar as well as chemically pure sugars (e.g. commercial lactose and chemically pure lactose, commercial glucose and chemically pure glucose, commercial maltose and chemically pure maltose, etc.)

6.10 In any case, the product is not classifiable under Heading 2106: ;t is submitted that the product is not classifiable under Heading 2106 as it is not in the nature of a food preparation. Food preparation as per the HSN Explanatory Notes is chemical added with any foodstuff like flour, milk etc. The product in question is purely chemical and is not mixed with any foodstuff in the nature of flour, Milk etc.

Further, the product is a raw material for manufacturing infant formula and cannot be consumed directly. ,The product cannot be consumed even after processing it using simple processes such as cooking, -dissolving etc. as envisaged in the HSN Explanatory Notes to Heading 2106.

Further the product is not in the nature of food supplements covered under Heading 2106, as the products covered therein are products made using various vegetable/fruit extracts and marketed in retail with the declaration that the same maintain the general well-being of the consumer. The product in question is not in the nature of such a preparation. It is a raw material used in industry to make infant products. Thus, it is not in nature of”food supplements” covered under Heading 2106. Accordingly, the product cannot be classifiable under Heading 2106.

6.11 In light of above submissions made, it is submitted that that the product is correctly leading 2940, or alternatively under classifiable Heading 1702.

7. Discussions and Findings

7.1 I have considered all the materials placed before me in respect of the classification of subject goods. I have gone through the submissions made by the applicant during the personal hearing as well a. the response received from the Jurisdictional Customs Commissionerate. Therefore, I proc ed to pronounce a ruling on the basis of information available on record as well as existing le al framework.

7.2 The applicant has sought advance ruling in respect of the following questions:

a) Question: Whether the product in question in the present application is classifiable under Tariff Item 2940 0000?

b) Question: If the answer to the above question is in the negative, then whether the product in question in the present application is classifiable under Tariff Item 1.702 9090?

c) Question: If the answer to the above questions is in the negative, what would be the correct classification of the products mentioned above under the Customs Tariff of India?

7.3 At the outset, I find that the issue raised at the Sr. No. 08 in the CAAR-1 form is squarely covered under Section 28H(2) of the Customs Act, 1962 being a matter related to the classification of nods.

7.4 The applicant submitted that the subject goods i.e. `5-HMO Mix’ is a mixture of 5 different types o human milk oligosaccharides (`IIMOs’) which would be used. by the applicant for ma factoring “Aptamer Gold Stage I infant Formula with Prebiotic” which is a baby formula. Th product is a mixture of various HMOs and consists of 2′ Fucosyllactose (2′ FL), 3′ Fucosyllactose (3′ FL), Lacto-N-Tetraose (LNT), 3′ Sialyllactose (3′ SL), Sialyllactose (6′ L) and leftover unconverted starting materials.

7.5 Before deciding on the issue, let me deliberate on the legal framework prescribed in Customs Tariff Act, 1975, Chapter/Section notes along with I-ISN explanatory notes. Classification of goods in the Harmonized System of Nomenclature (HSN) is governed by the General Rules fot the interpretations. Rule 1 of the General Rules for the Interpretation of the Import Tarifftotle Customs Tariff Act, 1975 stipulate that for legal purposes, the classification of the import item shall be determined according to the terms of the, headings and any relative Section or Chapter Notes.

7.6 In this case, there are 3 competing headings i.e. CTH 2940, CTI-I 1702 and CTH 2106 where this product i.e. `5-1-1M0 Mix’ can be classified. Further, there are two more heading i.e. CTII 3824 a d CTH 1901, which are also required to be examined to arrive at the correct classification oft e subject goods i.e. `5-HMO Mix’. Let me discuss each and every competing heading:

7.7 Relevant portion of CTH 2940 is reproduced below for ease of reference:

| 29400000 | SUGARS, CHEMICALLY PURE, OTHER THAN SUCROSE, LACTOSE, MALTOSE, GLUCOSE AND FRUCTOSE; SUGAR ETHERS, SUGAR ACETALS AND SUGAR ESTERS AND THEIR SALTS, OTHER THAN PRODUCTS OF HEADINGS 2937, 2938 OR 2939 |

7.8 Based on the literature provided, I observed that the 5-HMO mix is a mixture consisting of 5 Oligosaccharides i.e. 2′ Fucosyllactose (2′ FL), 3′ Fucosyllactose (3′ FL), Lacto-N-Tetraose (LNT), 3′ Sialyllactose (3′ SL), 6′ Sialyllactose (6′ SL) and leftover unconverted starting materials.

7.9 Before deciding on the classification of `5-HMO Mix’, it would be appropriate to take each and every oligosaccharide present in the mix to determine where these would be classified if imported separately.

7.9.1 2′ Fucosyllactose (2′ FL) have 52% DW of total weight in the 5-HMO Mix. I find that 2′-FL is an oligosaccharide, a disaccharide that consists of lactose (a disaccharide of glucose and galactose) and fucose (a monosaccharide) linked through a glycosidic bond. It is a naturally occurring, non-digestible sugar found in human breast milk and has beneficial prebiotic properties. 2′-Fucosyllactose is chemically pure in its isolated form, meaning it can be precisely synthesized or extracted and purified from biological sources, making it distinct from simple sugars like glucose or lactose. Therefore, 2′-Fucosyllactose satisfies the criterion mentioned in the Heading description ofCTI-12940 as it is a chemically pure sugar other than common sugars like Sucrose, Lactose, Maltose, Glucose and Fructose.

7.9.2 3′ Fucosyllactose (3′ FL) have 13% DW of total weight in the 5-HMO Mix. I find that 3′-FL is a type of fucosylated oligosaccharide composed of lactose (a disaccharide of glucose and galactose) and fucose (a monosaccharide). In 3i-FL, the fucose molecule is linked to the galactose unit of lactose via a glyosidic bond at the 3′ position of the galactose. Like 2′-Fucosyllactose, 3′-FL is a chemically pure oligosaccharide that can be isolated and purified. It is a specific combination of sugars in a defined structure, making it chemically pure. Therefore, 3′-Fucosyllactose satisfies the criterion mentioned in the Heading description of CTH 2940 as it is a chemically pure sugar other than common sugars like Sucrose, Lactose, Maltose, Glucose and Fructose.

7.9.3 Lacto-N-Tetraose (LNT) have 26% DW of total weight in the 5-HMO Mix. I find that LNT is a tetra saccharide, a complex oligosaccharide composed of lactose (a disaccharide of glucose and galactose) and additional monosaccharides, typically glucose and galactose, linked by glyosidic bonds. Specifically, it contains a structure with N-acetylglucosamine (GleNA.c) linked to .the galactose unit ‘of lactose. LNT is a defined oligosaccharide with a specific molecular structure and can be isolated in pure form. Like other oligosaccharides, it is typically synthesized or extracted and purified to achieve a chemically pure product. Therefore, Lacio-N-Tetraose satisfies the criterion mentioned in the Heading description of CTH 2940 as it is a chemically pure sugar other than common sugars like Sucrose, Lactose, Maltose, Glucose and Fructose.

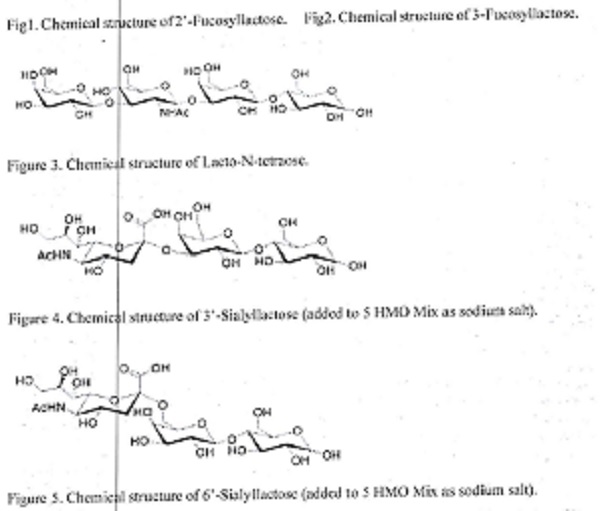

7.9.4 3′ Sialyllactose (3′ SL) have 4% DW of total weight in the 5-HMO Mix. I find that 3′-SL is a sialylated oligosaccharide, meaning it is a modified form of lactose (a disaccharide composed of glucose and galactose) with a sialic acid (a type of sugar molecule) attached to the galactose unit at the 3′ position via a glycosidic bond. The sialic acid is often referred to as N-acetylneuraminate. Like other oligosaccharides, 3′-SL is typically isolated and purified, resulting in a’ chemically pure sugar. It has a defined structure and can be synthesized or extracted with ‘a high degree of purity. Therefore, 3’ Sialyllactose satisfies the criterion mentioned in the Heading description of CTH 2940 as it is a chemically pure sugar other than common sugars like Sucrose, Lactose, Maltose, Glucose and Fructose.

7.9.5 .6′ Sialyllactose (6′ SL) have 5% DW of total weight in the 5-HMO Mix. I find that 6′-SI is a sialylated oligosaccharide consisting of lactose (a disaccharide composed of glucose and galactose) with a sialic acid (N-acetylneuraminate) attached to the galactose unit at the 6′ position via a glycosidic bond. The sialic acid modification is important for various biological functions, including modulation of immune responses and gut health. Like other oligosaccharides 6.-SL is typically synthesized or extracted and can be purified to achieve a orm. It has a specific molecular structure and can be produced in isolated or ruse in nutrition and research. Therefore, 6′ Sialyllactose satisfies the d in the Heading description of CTH 2940 as it is a chemically pure sugar sugars like Sucrose, Lactose, ‘Maltose, Glucose and Fructose.

7.10 – Further, n the Exhibit B submitted with the application, it is mentioned that the individual HMO powders i.e. 2′ FL, 3′ FL, LNT, 3′ SL and 6′ SL are used in a wet-blending process to generate to the product `5-HMO Mix’. I further find that The wet blending process is a manufacturing technique commonly used to create a homogeneous mixture of ingredients, including oligosaccharides like 2′-Fucosyllactose, 3′-Fucosyllactose, Lacto-N-Tetraose, 6′-Sialyllactose, ‘a d 3′-Sialyllactose and it does not chemically alter the oligosaccharides. It ensures a uniform mixture suitable for further processing, such as spray drying or incorporation into products e infant formula.

7.11 From the above, I find that the constituent oligosaccharides of 5-HMO mix individually can be classifie under CTH 2940 and the wet-blending process used to mix these 5 constituent Oligosaccharid s does not chemically alter them. Now the question before me is whether the mixture of thes oligosaccharides containing some miniscule amount of impurity can also be classified unde heading 2940 or not.

7.12 I find the t the Heading 2940 under the Harmonized System (HSN) refers to “chemically pure sugars,” a d the term “chemically pure” generally means that the substance should have a high level of purity, typically without significant impurities. I further find that Chapter note 1(a) of Chapte 29 allows for the presence of a small amount of impurities (such as residual solvents, starting materials, or by-products) and therefore, although the heading mentions Chemically P e sugars, the presence of small amount of impurities might not disqualify the product from being considered “chemically pure” as long as the primary substance is clearly identifiable at d predominant and the impurities are not altering the characteristics of the compound.

7.13 I forth r find that the mixture i.e. `5-1-1M0 Mix’ predominantly consists of these 5 oligosaccharides (more than 90%) with only trace amount of impurities. the mixture can be classified and r Heading 2940 as Chemically Pure Sugar.

7.14 The Heading 1702 covers common sugars, such as glucose, lactose, fructose, sucrose, and other sugars in solid form, including refined sugars or crude sugars whereas the constituent oligosaccharide ies present in 5-HMO Mix are synthesized from a carbon source (e.g. Sucrose, Glucose or G product) and Lactose as precursor by production strains. Further, the explanatory notes of He ding 2940 clearly states that the term “Sugars” in the heading 2940 covers Oligosaccharide des. Since, Oligosaccharides are specifically mentioned in heading 2940, they cannot be cl ossified under Heading 1702.

The Hon’ble Supreme Court in a catena of judgment has held that the specific entry should prey lover general entry. Moreover, in case of Commissioner of Central Excise versus Wockhardt I life Sciences Ltd. [2012 (277) E.L.T. 299 (S.c.)], it was held that classification of goods cannot be under residuary entry in presence of specific entry, even if it requires product to be under ood in technical sense. It was further held that the Residuary entry can be taken refuge of o y in absence of specific entry.

Further, in the case of Western India Plywoods Ltd. Versus Collector of Customs, Cochin [20 5 (188) E.L.T. 365 (S.c.)], it was held that application of residuary entry to be made with extreme caution, being attracted only when no other provision expressly or by necessary implication applies to goods in question.

7.15 I find that the product i.e. `5-1-IMO Mix’ cannot be classified under the Heading 2106 which covers “Other food preparations, not elsewhere specified” as it is not a food preparation but an intermediary product which would further used in manufacturing of final product.

7.16 I observe that the Heading 1901 covers “malt extract; food preparations of flour, groats, meal, starch or malt extract, not containing cocoa or containing less than 40% by weight of cocoa calculated on a totally defatted basis, not elsewhere specified or included; food preparations of goods of headings 0401 to 0404, not containing cocoa or containing less than 5% by weight of cocoa calculated on a totally defatted basis, not elsewhere specified or included”. This heading is used for classification of Infant Formulas put up for retails sale, since the subject goods i.e. `5-HMO Mix’ are intermediaries used for manufacturing of’ Infant Formula, hence it cannot be classified under Heading 1901.

7.17 I, further observed that the Heading 3824 covers “prepared binders for foundry moulids or cores; chemical products and preparations of the chemical or allied industries (including those consisting of mixtures of natural products), not elsewhere specified or included”. Since there is a specific heading for oligosaccharides, they cannot be classified as misc. chemical products and preparations of the chemical or allied industries not elsewhere specified or included.

8. In light of the above facts, discussions and observations, my views on the questions raised by the applicant are as under:

a) Whether the product in question i.e., 5-HMO Mix in the present application is classifiable under Tariff Item 2940 0000 of the First Schedule to the Customs Tariff Act, 1975?

Ans.: Yes, 5-HMO Mix in the present application is classifiable under Tariff Item 2940 0000 of the First Schedule to the Customs Tariff Act, 1975.

b) If the answer to the above question is in the negative, then whether the product in question in the present application is classifiable under Tariff Item 1702 9090?

Ans.: Not Applicable

c) If the product mentioned above is not classifiable under the Tariff Item as mentioned above, then what would be the correct classification of the above product under the Tariff?

Ans.: Not Applicable

9. I rule accordingly.