Case Law Details

Pentafour Solec Technologies Ltd. Vs Commissioner of Customs (CESTAT Chennai)

CESTAT Chennai held that duty demand due to non-fulfilment of export obligation justified as department empower to recover escaped duty when post importation conditions are not fulfilled. Accordingly, appeal dismissed.

Facts- Directorate General of Central Excise Initelligence (DGCEI) conducted an investigation into imports of capital goods valued at Rs.20,01,60,280/- made by the Appellant during March 1997 under zero duty EPCG Scheme but could not export the resultant products resulting in issuance of a Show Cause notice dated 02.12.05 alleging contravention of EPCG scheme and seeking to deny the benefit of Customs-Notification No. 111/95-Cus dated 05.06.1995 and consequently proposed to demand Customs duty of Rs.7,89,45,622/- along with applicable interest and to impose penalty u/s. 112(a) of the ACT on the Appellant company and its officials besides, proposing to confiscate the goods imported duty free in terms of Section 111(o) of the ACT and appropriate the duty amount already paid by enforcing the bank guarantee. The adjudicating authority vide Order-in-Original No. 7406/2008 dated 14.03.2008 confirmed the proposals.

Conclusion- Tribunal in the case of Bombay Hospital Trust Vs. Commissioner of Customs, Mumbai has held that when post importation conditions in an exemption notification are not fulfilled, the Department has the power to recover the escaped duty in terms of Section 12 of the Customs Act, 1962. Hence, in view of the above decisions, we are of the considered opinion that the duty demand in the present case is in order and does not call for any interference. Also held that we uphold the confiscation of the imported goods for non-fulfilment of the export obligation under the provisions of Section 111(o) and imposition of fine under Section 125 of the Customs Act, 1962.

FULL TEXT OF THE CESTAT CHENNAI ORDER

The Appellant company-A1 has filed the Customs appeal No. C/42170/2014, being aggrieved by the Order-in-Original No. 27243/2014 dated 30.06.2014 (De-novo) passed by the Commissioner of Customs (Seaport-Export) confirming demand of Customs duty of Rs.7,89,45,622/-with applicable interest, confiscating the imported machinery valued at Rs.20,01,60,280/- with an option to pay redemption fine of Rs.10,00,000/-in leu of confiscation in terms of Section 125 of the Customs Act, 1962 (ACT) and appropriating the duty confirmed by enforcement of bank guarantee, besides imposing penalties of Rs.5,00,000/- on the Appellant A1 and Rs.2,00,000/- each on Chairman(A2) and Managing Director(A3) of the Appellant company under Section 112(a) of the ACT ibid. Customs Appeals No. 42171/2014 and 42172/2014 were filed by the Appellants A2 and A3, and as all the above three appeals are connected matters involving the same impugned order, the appeals are being taken up together for decision by this common order.

2. Briefly stated the facts are that Directorate General of Central Excise Initelligence (DGCEI) conducted an investigation into imports of capital goods valued at Rs.20,01,60,280/- made by the Appellant during March 1997 under zero duty EPCG Scheme but could not export the resultant products resulting in issuance of a Show Cause notice dated 02.12.05 alleging contravention of EPCG scheme and seeking to deny the benefit of Customs-Notification No. 111/95-Cus dated 05.06.1995 and consequently proposed to demand Customs duty of Rs.7,89,45,622/- along with applicable interest and to impose penalty under Section 112(a) of the ACT on the Appellant company and its officials besides, proposing to confiscate the goods imported duty free in terms of Section 111(o) of the ACT and appropriate the duty amount already paid by enforcing the bank guarantee. The adjudicating authority vide Order-in-Original No. 7406/2008 dated 14.03.2008 confirmed the proposals put forth in the above Show Cause Notice and imposed penalties of Rs.10,00,000/- on A1 and Rs.5,00,000/- each on A2 and A3 under Section 112(a) of the ACT. Being aggrieved, the Appellant filed an appeal before the Tribunal, Chennai which vide Final Order No. 454-456/2012 dated 03.05.2012 remanded the matter to the Original Authority for fresh consideration. Accordingly, the Adjudicating Authority had vide the de-novo proceedings confirmed the demand of duty, appropriated the amount payable by enforcing the bank guarantee, confiscated the machinery allowing its redemption on payment of fine of Rs.10,00,000/- and also reduced the penalties imposed under Section 112(a) of ACT ibid as mentioned above.

3. The Ld. Counsel for the Appellant Shri N. Viswanathan has submitted: –

i. That the duty on the import of the subject goods assessed by the proper officer of customs in terms of Sec. 17 of the Customs Act was only Rs.7,57,80,682/- which was treated as the duty foregone and hence it was impermissible for the authorities to carry out any reassessment of the duty at a distant date without review of the original assessment whereas the lower authority went on to confirm the higher duty assuming that the appellants did not dispute the computation of the said revision of duty which was highly improper and totally impermissible in law.

ii. That the respondent ought to have followed the decision of the Bengaluru Bench of the Tribunal in the case of Rajalakshmi Labs Ltd., which held that the goods in question being not seized and not available for confiscation, the proposal to confiscate the goods cannot be sustained and consequently ought not to have imposed penalties on either of the appellants. It was pointed that the impugned order had placed an incorrect reliance on the judgment of the Supreme Court in the Western Components Ltd., without being conscious of the fact that the said judgment only vindicated the stand of the appellants except for saying that if the goods in question were released already against the execution of a bond then there is no bar in confiscating such goods.

iii. It was submitted that the reliance placed in the impugned order on the decision of the Bombay Hospital Trust was misplaced as the goods imported by Bombay Hospital Trust were seized by the Customs Authorities and were available for confiscation whereas in the case of the appellants admittedly the goods in question were not even available for seizure more particularly when the duty assessed in respect of the goods was available with the customs in the form of BG which was encashed by the Department leaving no scope for any action under Sec. 111 [o] of the Customs Act to warrant invocation of Sec. 125 [2] of the Customs Act and rightly so the notice only invoked Sec. 12 and not Sec. 28 or 125 of the Act.

iv. It was submitted that non-fulfilment of the Export Obligation was due to South Asian Crisis and Global recession in the infrastructure industry but the penalty imposed by the respondent on the appellants even after realising the duty on the imported goods and when Sec. 111 [o] of the Act was not invokable for the reason recorded to the contrary that they violated the notification and that they did not account for the discharge of the EO nor informed the authorities, which are contrary to the express mandate contained in Sec. 112 of the Act especially when this Tribunal in its order had directed in the remand order to show leniency accepting that the failure to perform was beyond their control.

v. It was averred that the demand for interest should be backed by a statutory provision in the Customs Act and if it were to be a demand based on the bond executed viz-à-vis contractual obligation then the department is only expected to move a civil court and not by way of passing an order of adjudication under the Act.

vi. It was submitted that the imposition of personal penalties on the officials of the Appellant company based on the finding recorded in para 22 of the impugned order blaming them for the non-fulfilment of the export obligation even when Sec. 112 [a] mandates the penalty only for improper import or abetting of such import and not in relation to any non-fulfilment of export obligation more particularly when the 1st Appellant was only the importer and there was no scope for alleging them to have abetted any of the acts of commission or omission of the 1st Appellant and which in any case was not alleged and therefore the penalty imposed on them was unsustainable.

4.1 The Ld. Authorised Representative Shri P. Narasimha Rao, Commissioner has reiterated the findings in the impugned order and submitted that the bank guarantee / bond executed by the Appellant were as per the conditions of Notification No. 111/95-Cus. dated 05.06.1995 and hence, any mistake as to quantification pointed out by the Appellant being in the nature of arithmetical error could be corrected at any time in terms of Section 154 of Customs Act, 1962 relying on the decisions in the cases of Commissioner of Customs, Guntur Vs. Sameera Trading Company [2011 (264) ELT 578 (Tri.-Bang.)] and M/s. Boroplast Ltd. Vs Commissioner of Customs, Mumbai [2016 (9) TMI-CESTAT], Mumbai], as the error in quantification of duty liability in bond/ BG could only be subservient to the conditions of the Notifications ibid.

4.2 It was put forth that the impugned order had correctly placed reliance on the Bombay Hospital Trust Vs. Commissioner of Customs, Mumbai [2005 TIOL-996-CESTAT-Mumbai] in confirming the duty demand and appropriating the amount of bank guarantee and hence, the Appellants’ argument that duty difference could only de demanded under Section 28 of the Act was liable to be ignored.

4.3 It was averred that the Appellants’ reliance on the decision in the case of Rajalakshmi Labs was not applicable as in the cited case there was bonafide utilization of goods during the prescribed period whereas, in the present case, there was no intention to fulfil the export obligation. Moreover, the said order was distinguished by Tribunal, Mumbai in the case of Prakash Roadlines Corporation Pvt. Ltd. Vs CC(EP), Mumbai [2019 (369) ELT 663 (Tri.-Mumbai)] and hence, not applicable to facts of this case.

4.4 It was submitted that even after availing huge bank loans from banks and financial institutions, the Appellant had not commenced production of silicon cells over a period of years resulting in non-fulfillment of export obligation even after a period of 8 years under EPCG scheme, thereby violating the conditions of the said Customs Notification which proves their mens rea and hence, the imported goods were liable for confiscation, as held in the decision in the case of Weston Components Limited Vs. Commissioner of Customs, New Delhi [2000 (115) ELT 278 (Tri.-New Delhi)] which ratio was also followed by the CESTAT, Chennai in Farida Prime Tannery Vs. Commissioner of Customs, Chennai [2006 (198) ELT 158 (Tri.-Chennai)] distinguishing the Rajalakshmi Labs Case cited supra. It was submitted that in view of the above decisions and the decision of the Hon’ble High Court of Madras in Visteon Automotive Systems India Ltd. Vs. CESTAT, Chennai [2018 (9) GSTL 142 Madras], goods were rightly confiscated and penalty imposed under Section 112(a). Further, reliance was placed on the decisions in the case of M/s. Sanghi Industries Ltd. & Others Vs. Commissioner of Customs (Export Promotion), Mumbai [2011 (10) TMI 40-CESTAT, Mumbai] and M/s. Shrimandhar Fabrics Pvt. Ltd. Vs. Commissioner of Customs, Ahmedabad [2008 (8) TMI-CESTAT-Ahmedabad].

4.5 It was submitted that in view of the active role played by the Chairman and Managing Director being key managerial persons in charge of the affairs of the Appellant company and allegation of fraudulent activities against them, the objections raised by statutory authorities like financial institutions and banks, imposition of penalty in terms of Section112(a) of ACT was fully justified.

5. Heard both sides and carefully considered the submissions and evidences on record.

6. The main issues that arise for consideration in these appeals are: –

i. Whether the duty quantified and confirmed in the impugned order is correct and sustainable? and,

ii. Whether the redemption fine and penalties imposed on the Appellants are justified in the facts of these appeals?

7. We find that this Tribunal had on the same issues vide [Final Order No. 454-456/2012 dated 03.05.2012] has remanded for decision to the Original Authority which reads as follows: –

“4. After hearing both sides and on perusal of case records including the cited decisions, we find that the appellants are not challenging their liability to pay the duty on the impugned goods. However, they are disputing the quantification of the duty amount. In view of the fact that the appellants did not avail of the opportunity for personal hearing given by the adjudicating Commissioner, they have not been heard on the aspect of quantification of the duty. The duty amount to be paid by the appellants undisputedly has to be the amount leviable on the impugned goods at the time of import but for the exemption availed under Notification No.111/95-Customs dated 5.6.95. Normally, the appellants are required to give Bank Guarantee for the full amount of duty. We find there is a difference between the Bank Guarantee amount and the impugned duty demand quantified and confirmed against the appellants. Had the appellants been present at the time of personal hearing, the computation of the duty amount could have been arrived at with their participation. Since, the appellants have not availed such opportunity, we are of the view that they should be given a second chance to go before the original authority for re-quantification of the correct amount of duty liability. We are also of the view that in a case such as this, where the non-fulfillment of export obligation is not deliberate but on account of the recession in the international market and other economic factors, a lenient view requires to be taken in regard to the amounts of fine and penalty. The ratio of the cited decision in the case of Rajayalakshmi Labs. Ltd (supra) is also required to be taken into account by the adjudicating Commissioner.”

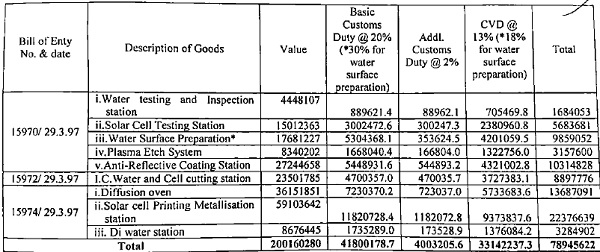

8. The Tribunal Chennai has clearly ordered that the duty amount payable by the Appellant (A1) to be the amount leviable on the imported goods at the time of import but for exemption availed under Notification No. 111/95-Customs dated 05.06.1995. In Paragraph 14 of the impugned order dated 30.06.2014, the duty amount was computed as given below: –

The Importer-Appellant was put on the Notice for demand of duty of Rs.7,89,45,622/-. A perusal of the records indicate that the Ld. Advocate has not disputed the quantification of duty payable on the goods and is only questioning the legality of the demand of duty in excess of the amount mentioned in the Bond executed by the importer at the time of clearance of the goods under EPCG Scheme. Thus, the Appellant has disputed this duty computation on the basis of the Bond executed at the time of import for Rs.7,57,80,682/-. His contention that the demand of duty for non-fulfilment of Export Obligation to be limited to the Bond amount is not agreeable to being premised on erroneous assertion. His assumption that the Bond amount only can be demanded is not even supported by the Tribunal’s Final Order Nos. 454-456 dated 03.05.2012 which has clearly specified that the duty leviable is the duty payable at the time of import, but for the exemption under Notification No. 11/95-Cus dated 05.06.1995. The said Final Order of this Tribunal has attained finality with both the parties accepting the same.

9. We also find that the Adjudicating Authority in the impugned de-novo proceedings has considered the above observations of this Tribunal in Paragraph 7 and reduced the penalties imposed on A1, A2 and A3, considering the recession and prevailing economic conditions at that time. Further, in the present appeal, the Appellant is not only disputing the duty amount but also has contended that the demand of duty and confiscation was not to be confirmed in terms of Section 28/ 125 of the ACT.

10. The Larger Bench of the Tribunal in the case of Bombay Hospital Trust Vs. Commissioner of Customs, Mumbai [2005 (188) ELT 374] has held that when post importation conditions in an exemption notification are not fulfilled, the Department has the power to recover the escaped duty in terms of Section 12 of the Customs Act, 1962. The relevant portion of the said order has been extracted below: –

“10. We have carefully considered all the arguments advanced from both sides as well as the case records, written submissions and the cited case laws. We briefly consider the legal provisions first in relation to the main argument by the appellants that duty cannot be demanded in the present case in the absence of any specific provision of law. We find that in Virgo Steel (supra), a Bench of three Judges of the Apex Court had dealt with this question. We quote from Paragraph 8 thereof :-

“While the absence of notice may invalidate the procedure adopted by the proper officer under the Act, it will not take away the jurisdiction of the Officer to initiate action for the recovery of duty escaped. This is because of the fact that the proper Officer does not derive his power to initiate proceedings for recovery of escaped duty from Section 28 of the Act. Such power is conferred on him by other provisions of the Act which mandate the proper Officer to collect the duty leviable………………………… A cumulative reading of these provisions found in the Act clearly shows that the jurisdiction of a proper Officer to initiate proceedings for recovery of duty which has escaped collection, is not traceable to Section 28. The power to recover duty which has escaped collection is a concomitant power arising out of the levy of customs duty under Section 12 of the Act.”

This decision of the Apex Court clearly traces the power to recover duty which has escaped collection to Section 12 of the Customs Act, 1962.

11. Section 28 has two main ingredients : (i) issue of show cause notice, (ii) within the stipulated time period for recovery of duty, short levied, not levied and erroneously refunded. The first ingredient is merely a restatement of one of the Principles of natural justice. Even in the absence of such an explicit provision, a duty demand has to be proceeded by a notice. In the present case, such notices have been issued prior to issue of the impugned order.

12. As regards the time limits under Section 28, both sides have agreed that since the duty demand does not relate to short levy or non levy at the time of initial assessment on importation, but has arisen subsequently on account of failure to fulfil the post-importation conditions under the Notification No. 64/88, the said Section 28 has no application to a duty demand of this kind. We do not, therefore, wish to dwell further on the inapplicability of Section 28 to such demands. However, we note that since no specific time limit is prescribed under any other provision of the statute, the notice of demand in such cases cannot be subjected to any limitation of time. This view is supported by the ratio of the following two decisions of the Honourable Bombay High Court and the Apex Court :-

(i) Prakash Cotton Mills Pvt. Ltd. v. S.K. Bhardwaj, A.C.C.E. – 1987 (32) E.LT. 534 (Bombay)

(ii) Commissioner v. Raghuvar (India) Ltd. – 2000 (118) E.L.T. 311 (S.C.)

13. We find that while Section 12 gives the power to levy customs duty, Section 25 gives the power to grant exemption of duty in the public interest either absolutely or subject to conditions. In the case of Notification No. 64/88, the exemption granted is conditional. The conditions relating to (i) free treatment of 40% outdoor patients and (ii) reservation of 10% of beds for free treatment of patients with family income less than Rs. 500 p.m. make it manifestly clear what the public interest behind the said exemption is. If these conditions are not fulfilled after importation and the public interest is not served, the exemption becomes unavailable and full duty as leviable under Section 12 becomes payable.

14. We note that the impugned notification has not provided for obtaining any bond or bank guarantee for recovery of duty in the event of failure to fulfil the conditions of free treatment. However, it is the prerogative of the Government to grant exemption, as has been held in Sri Sathya Sai Inst. (supra), and it is for the Government to incorporate appropriate provisions. Merely because some other exemption notifications incorporate provisions regarding bond etc. by way of extra precaution and this one does not (as the Government may have valid reasons not to burden hospitals doing genuine charitable work with bonds and bank guarantees), this cannot be a valid plea by the appellants not to pay the demanded duty when the conditions of free treatment are violated. We also do not think that it is necessary for an exemption notification issued under Section 25 to contain a recovery provision when the power to recover duty can be traced to Section 12, nor any mandate to provide such a recovery provision in an exemption notification is contained in the said Section 25.

15. We find that in Mediwell (supra), the Apex Court has interpreted the said Notification No. 64/88 in the context of allowing import of medical equipment without payment of duty and has observed in Paragraph 12 thereof as follows :-

“While, therefore, we accept the contentions of Mr. Jaitley, learned senior Counsel appearing for the appellant that the appellant was entitled to get the certificate from Respondent No. 2 which would enable the appellant to import the equipment without payment of customs duty but at the same time we would like to observe that the very notification granting exemption must be construed to cast continuing obligation on the part of all those who have obtained the certificate from the appropriate authority and on the basis of that to have imported equipments without payment of customs duty to give free treatment at least to 40% of the outdoor patients as well as would give free treatment to all the indoor patients belonging to the families with an income of less than Rs. 500/- p.m. The competent authority, therefore, should continue to be vigilant and check whether the undertakings given by the applicants are being duly compiled with after getting the benefit of the exemption notification and importing the equipment without payment of customs duty and if on such enquiry the authorities are satisfied that the continuing obligation are not being carried out then it would be fully open to the authority to ask the person who have availed of the benefit of exemption to pay the duty payable in respect of the equipments which have been imported without payment of customs duty. Needless to mention the Government has granted exemption from payment of customs duty with the sole object that 40% of all outdoor patients and entire indoor patients of the low income group whose income is less than Rs. 500/- p.m. would be able to receive free treatment in the Institute. That objective must be achieved at any cost, and the very authority who have granted such certificate of exemption would ensure that the obligation imposed on the persons availing of the exemption notification are being duly carried out and on being satisfied that the said obligations have not been discharged they can enforce realization of the customs duty from them.”

The Apex Court has thus clearly held that the said Notification No. 65/88 casts a continuing obligation and that in the event of failure to discharge that obligation, duty is demandable.

……….

………

22. Accordingly, we answer the reference as follows :-

(i) When a post-importation condition in an exemption notification is not fulfilled, the Department has the power to recover the escaped duty in terms of Section 12 of the Customs Act, 1962. Paragraph 12 of the Apex Court decision in Mediwell (supra) also provides an authority for such recovery.

(ii) Such demand notices will not be subject to any limitation of time”

11. We also observe that the above decision was affirmed by the Hon’ble High Court of Mumbai [2006 (201) ELT 0555 (Bom.)]. Hence, in view of the above decisions, we are of the considered opinion that the duty demand in the present case is in order and does not call for any interference.

12. Regarding Confiscation and imposition of redemption fine under Section 125 of the ACT, we find that the Hon’ble Supreme Court in the case of Weston Components Ltd. Vs CC, New Delhi has held as follows: –

“It is contended by the learned Counsel for the appellant that redemption fine could not be imposed because the goods were no longer in the custody of the respondent-authority. It is an admitted fact that the goods were released to the appellant on an application made by it and on the appellant executing a bond. Under these circumstances if subsequently it is found that the import was not valid or that there was any other irregularity which would entitle the customs authorities to confiscate the said goods, then the mere fact that the goods were released on the bond being executed, would not take away the power of the customs authorities to levy redemption fine.”

As pointed out by Ld. AR, the above case was relied upon by this Tribunal in the case of Farida Prime Tannery Vs. Commissioner of Customs [2006 (198) ELT 158]. Further, we also find that in the case of Visteon Automotive Systems India Ltd. Vs. CESTAT, Chennai [2018 (9) GSTL 142], the Hon’ble High Court of Madras has held as follows: –

“23. The penalty directed against the importer under Section 112 and the fine payable under Section 125 operate in two different fields. The fine under Section 125 is in lieu of confiscation of the goods. The payment of fine followed up by payment of duty and other charges leviable, as per sub-section (2) of Section 125, fetches relief for the goods from getting confiscated. By subjecting the goods to payment of duty and other charges, the improper and irregular importation is sought to be regularised, whereas, by subjecting the goods to payment of fine under sub-section (1) of Section 125, the goods are saved from getting confiscated. Hence, the availability of the goods is not necessary for imposing the redemption fine. The opening words of Section 125, “Whenever confiscation of any goods is authorised by this Act ….”, brings out the point clearly. The power to impose redemption fine springs from the authorisation of confiscation of goods provided for under Section 111 of the Act. When once power of authorisation for confiscation of goods gets traced to the said Section 111 of the Act, we are of the opinion that the physical availability of goods is not so much relevant. The redemption fine is in fact to avoid such consequences flowing from Section 111 only. Hence, the payment of redemption fine saves the goods from getting confiscated. Hence, their physical availability does not have any significance for imposition of redemption fine under Section 125 of the Act. We accordingly answer question No. (iii).”

In view of the above, we uphold the confiscation of the imported goods for non-fulfilment of the export obligation under the provisions of Section 111(o) and imposition of fine under Section 125 of the Customs Act, 1962.

13. On the issue of imposition of penalties, we find the Adjudicating Authority has already complied with the earlier order of this Tribunal to show lenience by reducing the penalties imposed to Rs.5,00,000/- on the Appellant (A1) and Rs.2,00,000/- each on the Appellants (A2 and A3) which cannot be termed to be excessive. As such, the impugned Order-in-Original No. 27243/2014 dated 30.06.2014 of the Commissioner of Customs, Chennai do not call for any interference and so, required to be upheld.

14. Thus, after appreciating the facts and following the above decisions, we are inclined to dismiss the appeals filed by the Appellants.

(Order pronounced in open court on 17.12.2024)