“Explore the intricacies of Job Work under GST – from definitions to seamless processes. Learn about supply of services, sending goods to job workers, deemed supplies, and more. Get insights from expert CMA Utpal Kumar Saha for a smooth GST regime transition.”

The process of Job Work is very common in manufacturing, processing industries. The procedure of Job Work under erstwhile Central Excise regime was well defined and settled by the various judgements of Hon’ble Courts. In this given article we would like to explore the various issues of the Job work and smooth functioning thereof under the GST regime.

A. Definition of Job work: Section 2(68) of the CGST Act – ‘job work’ means any treatment or process undertaken by a person on goods belonging to another registered person (referred to as principal) and the expression ‘job worker’ shall be construed accordingly.

Here the expression used is “any treatment or process” and the scope of job work is not limited to a particular job. The limbs of the definition of job work are as follows:

1.There is a process or treatment on the goods;

2. Goods belongings to a registered person;

3. The ownership of goods does not belong to job worker.

B. Job Work is a supply of service: As per schedule II of the CGST Act, 2017 “Any treatment or process which is applied to another person’s goods is a supply of services”. So the job work is a process or treatment undertaken on goods belongings to principle and such treatment or process is considered to be as a supply of service. Thus, the charges for the job work done is basically labour and service charges which is treated as supply of service as per section 7(1)(d) read with serial no 3 of the schedule II of CGST Act, 2017.

C. Sending of goods to Job worker under intimation:

The principal may under intimation sends any input or capital goods without payment of duty to a job worker and subsequently send to another job worker from there. Goods can be dispatched directly to job worker from the vendor’s place of business without bringing them at the place of business of principal. In both of the cases principal can avail input tax credit on procurement of such goods.

As per the provision of section 16(2)(b), no registered person shall be entitled to avail input tax credit on inputs or capital goods or input services unless he has received the goods or services. But such actual receipts of goods in the hands of the principal are not applicable for materials directly send to job worker from vendor’s place of business. It shall be deemed as receipts of goods.

The goods are to be delivered to the place of job worker under intimation to the concerned Jurisdictional Officer of CGST/ SGST, as the case may be. A question may be arisen that how to make an intimation before the department for sending the materials to the Job Worker. Whether a letter of intimation is to be submitted on every delivery of goods to the Job worker or a consolidated intimation is required for sending of goods for a tax period. It has been clarified vide Circular No 38/12/2018 Dated 26th March 2018 that the FORM ITC 04 will serve as the intimation as envisaged under section 143 of the CGST Act, 2017.

D. Documents required for sending the goods to job worker:

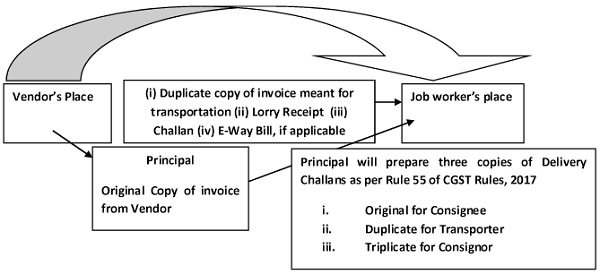

Case No (i): Delivery of goods directly from Vendor’s place of business to job worker–

Vendor will prepare a tax invoice mentioning the principal as buyer and job worker as consignee. In lorry receipts, vendor will be as the consigner and job worker will be the consignee.

However, principal shall prepare a delivery challan containing the details as per rules and forward this challan to the job worker. Principal shall intimate the details input or capital goods, nature of process undertaken at the job worker premises, job worker details and details of subsequent job workers, if any, through filing of return in ITC 04.

Case No (ii): From his own place of business (from the factory)-

Principal will prepare a delivery challan, LR, E-Way Bill and packing list for sending materials to the job worker. Here, consigner will be the principal and consignee will be the job worker. Rest of the procedure like intimation to jurisdictional officer is same as above.

E. Deemed supply of input and capital goods to job worker when the goods are not returned back with specified period of time:

As per section 19(3) of CGST Act, 2017 read with sub-rule (4) of Rule 45 of CGST Rules, 2017 where inputs send for job work are not received back after completion of job work or are not supplied from the place of business of job worker within a period of 1 year of their being send out, it shall be deemed that such inputs were supplied by the principal to the job worker on the day when the said input were send out. Therefore, principal has to pay tax along with the applicable interest as the date of supply was the date of delivery of goods to job worker.

In that situation the job worker will be the recipient of goods and a tax invoice shall be raised to the job worker and the same will be incorporated in GSTR 1 and GSTR 3B and principal shall pay the tax along with interest at the time of filing of GSTR 3B.

Same principle is applicable to capital goods also but the time limit of 3 years will be applicable instead of 1 year. In case of moulds, dies, jigs, fixture and tools, the time period of 1 year or 3 years is not applicable. Where goods are directly send from vendor’s place of business, then 1 year or 3 years shall be counted from the date of receipt of such goods by the job worker.

F. Delivery of goods directly to customer from job worker place of business:

Principal can directly deliver the goods from the job worker’s place of business to minimize the transportation cost and time also, provided such job worker is registered under GST or the principal has declared the premises of job worker as an additional place of business in his registration certificate.

Principal will pay the appropriate tax on goods supply to the ultimate customer as per the HSN code of the materials and rates thereon. Principal will also prepare tax invoice for sending materials to the customer directly from job worker premises. The following documents are required for delivery of goods to the customer from job worker place of business:

(i) Tax Invoice of the Principal;

(ii) E-Way Bill where dispatch from address will be the job worker premises address and dispatch to address will be the customer address;

(iii) Lorry Receipt where consignor will be the Principal a/c Job Worker and consignee will be the Customer;

(iv) Packing List;

(v) Challan, if required.

G. Bring back of goods send for job work to another place of business of the principal in different states or in same state under different GSTN:

It is not necessary that the principal shall first bring back the input or capital goods to his place of business from where such goods were send for job work. Principal can bring back such goods to his any place of business located in another State under different GSTN. In that situation it will be treated as transaction between distinct persons and the procedure as state above shall be applied. Principal shall raise a tax invoice charging IGST on goods supplied to its premises located in different State under different GSTN. It is worthwhile to mention that the provision of job work shall, mutatis mutandis, apply to IGST Act also as per the provision of section 20(xxii) of IGST Act, 2017.

H. Record keeping liability:

The responsibility of keeping the records for the inputs and capital goods is of the principal. However, it is advisable for the job worker to maintain proper quantitative records of input or capital goods received from principal vide delivery challan and also quantitative details of processed goods return to principal or deliver to another job worker. A monthly reconciliation of input and output of materials is required to be done from both the end for maintaining a hygienic relation with the job worker and the said records shall be signed jointly by principal and job worker.

I. Return back of inputs after processing from the place of job worker:

After completion of job work the goods may be returned back to the principal or may directly delivered to ultimate customer against supply order. Job worker may send back the materials to the principal under a delivery challan or may endorse the original challan for sending back the materials to principal.

The endorsement of the original challan is possible in case when the full quantity of materials is sending back to the principal after necessary treatment and process undertaken on the materials otherwise job worker will send materials under his own challan.

Further to mention that a new challan is required to be issued by the job worker when part of the goods are returned back to the principal.

J. Sending of Inputs or capital goods for job work to a related person:

As per section 7(1)(c) read with serial no 2 of schedule I, “supply of goods or services or both between related persons or between distinct persons as specified in section 25, when made in the course or furtherance of business” is deemed to be a supply. Now, a query may be raised that sending of input or capital goods to a related party without consideration is a supply and tax will be charged accordingly based on value as prescribed in valuation rules. We may analyze that job work is a process or treatment undertaken on goods belonging to another registered person. There is a specific provision in section 19 (3) for input and section 19(6) for capital goods that if such input or capital goods are not returned back within a period of 1 year or 3 year of their being send out or are not supplied from the place of the job worker with payment of tax, it shall be deemed that such input or capital goods were supplied by the principal on that day when said goods were send out to job worker. So in view of the above provision, sending of goods for job work to a related person is not a supply as per schedule I provided the other conditions of job work procedures are satisfied.

K. Clearing of Waste and Scrap:

Waste or scrap generated during the process of job work may be supplied directly by the job worker on payment of duty if he is registered. These may be supplied by the principal on payment of duty if the job worker is not registered. [Relevant section 143(5)].

L. Submission of Details in GSTR -1 and GST ITC 04:

Principal shall prepare challan details and submit in FORM GST ITC-04 on or before 25th day after the end of a particular period.

Principal shall file ITC 04 half yearly basis on 25th October and 25th May where the turnover of the principal during the immediately preceding financial year exceeds five crore otherwise ITC 04 will be filed on yearly basis.

Principal shall intimate in GSTR – 1 the number of delivery challan issued and cancelled thereon under the head “Documents issued during the tax period” in part 13 of GSTR-1 return. Where the inputs or capital goods are not returned to the principal within the time stipulated in section 143, it shall be deemed that such inputs or capital goods had been supplied by the principal to the job worker and said supply shall be declared in FORM GSTR-1and the principal shall be liable to pay the tax along with applicable interest.

M. Important issues of ITC 04:

There are four important disclosures the principal shall make at the time of filing of ITC 04 Return. The first part is the details of input or capital goods sent to job worker. Second part is the details of input or capital goods received back from job worker and in this part the principal shall disclose the loss and wastage made during the processing of inputs.

The third part is the details of input or capital goods received back from job worker other than the job worker to whom the original input or capital goods were sent out. The last part is the details of supply made directly from the premises of the job worker.

A proforma of format of records are given herein under for east reference of the tax payer.

1. Details of Goods sent for Job Work during the Financial Year (sending materials)

Sl No |

Name of the Job Worker |

GSTN of the Job Worker |

Challan No against which goods are sent – Challan issed by the Principle |

Challan date |

Lorry No/ Lorry Receipts No |

LR Date |

Transporter Name |

E-Way Bill No(Sending the materials) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

E-Way Bill Date |

Description of Goods |

UOM |

Qty |

Basic Value of goods |

Rate of Tax |

|||

10 |

11 |

12 |

13 |

14 |

15 |

2. Details of Goods return back from the Job Work during the Financial Year ( returning materials)

Sl No |

Name of the Job Worker |

GSTN of the Job Worker |

Challan No issued by Job Worker for returning the materials |

Challan date |

Lorry No/ Lorry Receipts No |

LR Date |

Transporter Name |

E-Way Bill No (Return materials) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

E-Way Bill Date |

Description of Goods |

UoM |

Quantity Return Back |

Original Challan No against which goods are sent |

Original Challan Date |

Return period ( Original challan date less receive date) |

Vale of Goods Return |

Type of work done by Job Worker |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

Losses/ Wastage during the Job Work |

Value of Loss of Materials |

|||||||

19 |

20 |

|||||||

3. Details of Inputs sent to job worker and subsequently supplied from the premises of job worker

Sl No |

Name of the Job Worker |

GSTN of the Job Worker |

Invoice No of the Principle |

Invoice Date |

Lorry No/ Lorry Receipts No |

LR Date |

Transporter Name |

E-Way Bill No (Return materials) |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

E-Way Bill Date |

Description of Goods |

UoM |

Qty |

Original Challan No against which goods are sent |

Original Challan Date |

Type of work done by Job Worker |

Losses/ Wastage during the Job Work |

Value of Loss of Materials |

10 |

11 |

12 |

13 |

14 |

15 |

16 |

17 |

18 |

N. Other Issues:

As per the provision of section 143 read with rule 45 if the goods are not returned back from the place of the Job worker within the period of 1 Year or 3 Years, as the case may be, it shall be deemed that the goods were supplied to the Job-worker on the date of sending out for job work. Often a query has been faced as to the matter when the job worker is returning back the materials to principal after 1 Year or 3 Year of there being sent out. It is to note that said returning back of material by job worker after the specified period shall be deemed to be supply and GST will be levied on such return of materials.

There is no requirement or time bound mechanism regarding the moulds, dies, jigs and fixtures for returning back from job worker premises or direct delivery of goods from job worker premises.

*****

Complied by- CMA Utpal Kumar Saha | ACMA, LLB | E-Mail: [email protected] | Mobile- 9073393531/ 9007087949

Where bullion dealers getting work done through local artisan has to file ITC 04, as well liability of E way bill for gold delivered for job of making ornaments.

An elaborate article on job work under GST explaining all the procedures and intricacies. Well written and very informative.

Thank you Mr. S H KARTHIKEYAN.

Regards

CMA Utpal K Saha