Sponsored

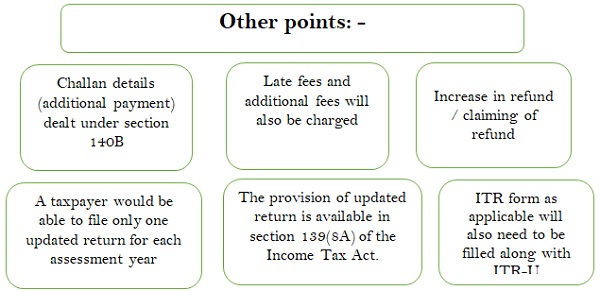

The income tax department has notified Form ITR-U under Section 139(8A) of the Income Tax Act, 1961 for filing the ‘Updated’ income tax return.

The government introduced the concept of updated return in income tax in the Union Budget 2022. The new provision allows the taxpayers to update their ITRs within two years of filing, on payment of additional taxes, in case of errors or omissions.

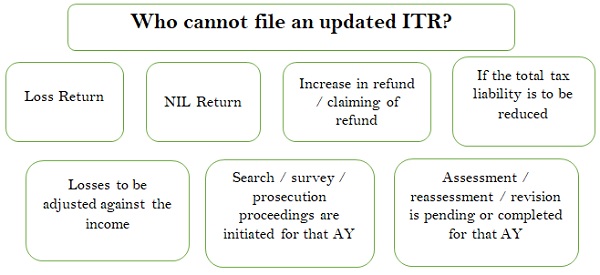

√ It Means act does not allow the taxpayers to file the updated return if there is no additional tax outgo.

√ If a taxpayer files an updated return but does not pay the additional taxes, the return will be considered invalid.

Additional interest payment: –

|

S. no. |

Particulars | Rate of Interest |

| 1. | If updated ITR is filed within 12 months from end of relevant AY (for FY 2020-21) | 25% on tax due amount |

| 2. | If updated ITR is filed After 12 months but before 24 months from end of relevant AY (for FY 2019-20) | 50% on tax due amount |

Compiled by: – CA Ayush Agarwal | CA Piyush Agarwal

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Dear Sir, I did not find anything about not allowing Nil return in 139(8A). Could you please clarify what you mean by that and also eventually where it is mentioned? Thank you.

Can i file ITR For the financial year 2022-23 in ITR-U sir? For original return?

Hi,

For covering a complex issue in your article, I appreciate your efforts and congratulate you.

Can you please help me with following issue ?

I am an NRI and except bank’s saving interest, I don’t have any other income or any financial ownership in any form in India. I have missed filing my ITR2 for AY 2022-23 but have filed returns for all previous and also for AY 2023-24. My total interest income in AY 2022-23 in India is less than Rs 1.5 lakh with refundable TDS of Rs. 190 only. That means I am still supposed to pay Self assessment tax of Rs 810 ( penalty of Rs. 1000 – refundable TDS of Rs. 190).

Can I file ITR2 u/s 139 (8a) after paying self assessment tax as above for AY 2022-23 ?

Your early response will be of great help.

Thanks and regards.

while filing ITR(U)for AY22-23,I filled up all options in basic Excell offline utility ITR-1 ,validate ,calculate tax etc but Json file generation is not responding on 12/06/23 pl help

Hello,

Under which head we have to pay tax during filing of ITR-U SA tax and Additional tax

at the time of return filling for A Y 21-22 Capital Gain profit not accounted. but when i received intimation from I T dept. as per computation after including Capital gain i have Actual Income tax. if i wants to file return u/s 139 (8A) then the S A tax paid after Capital gain can be adjusted or not

Sir i fill my return 20-21 nill return bt now 21-22 not filled..is this possible?

Hello Sir, In PY 2020-21 I received arrear salary of last year (2019-20) .But I forgot to claim relief u/s 89 for it as resulting I had paid excess tax, so Now what can I do for relief u/s 89 in the current year so that I will claim refund against it.

and can I update ITR u/s 139(8A) ?

Can we file this to a company ITR. Please let me know the process of filing.

WHEN CAN WE CAN FILE RETURN UNDER THIS SECTION ON INCOME TAX PORTAL

Hello, Now Portal enabled for filing ITR-U

whether Income tax department has notified ITR U,

If so one can upload Return of Income for the A.Y.2020-2021.I checked by log in to income tax e file website but I could not find ITR U.I may request you to clarify and explain the process to file the same.

Hello, Now Portal enabled for filing ITR-U