Press release on the mandatory use of HSN/SAC on GST invoices w.e.f 1.4.2021

Ministry of Finance

HSN Code/ Service Accounting Code mandatory on invoices as per revised requirement from 1st April 2021 for GST taxpayer with turnover of more than Rs 5 crore

Posted On: 31 MAR 2021

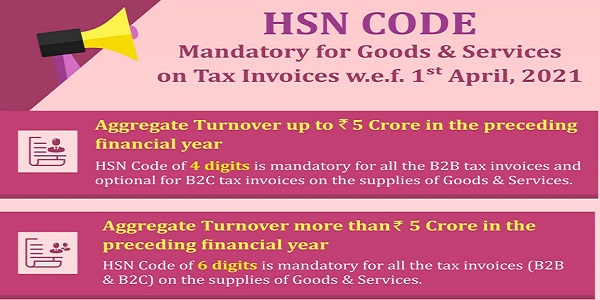

With effect from the 1st April, 2021, it has been made mandatory for a GST taxpayer, having turnover of more than Rs 5 crore in the preceding financial year, to furnish 6 digits HSN Code (Harmonised System of Nomenclature Code), or as the case may be, SAC (Service Accounting Code) on the invoices issued for supplies of taxable goods and services. A taxpayer having turnover of upto Rs 5 crore in the preceding financial year is required to mandatorily furnish 4 digits HSN code on B2B invoices. Earlier, the requirement was 4 digits and 2 digits respectively. For more details, notification No. 78/2020-Central Tax, dated 15.10.2020 may be referred to (accessible at GST Audit relaxation to SMEs to continue in FY 2019-20)

Accordingly, with effect from the 1st April, 2021, GST taxpayers will have to furnish HSN/SAC in their invoices, as per the revised requirement.

Image Source- CBIC Twitter Handle

HSN codes for goods at 6 digits are universally common. Therefore, common HSN codes apply to Customs and GST. Accordingly, codes prescribed in the Customs tariff are used for the GST purposes too (as has been specifically mentioned in the GST rate schedule). In Customs Tariff, HS code is prescribed as heading (4 digits HS), sub-heading (6 digits HS) and tariff items (8 digits). These documents are accessible on the CBIC web-site. The Customs Tariff may be accessed at https://www.cbic.gov.in/htdocs-cbec/customs/cst2021-020221/cst-idx for HSN codes.

GST rate schedule for goods and services may be accessed at https://www.cbic.gov.in/htdocs-cbec/gst/index-english and then follow the path ‘GST Rates/Ready reckoner-Updated Notifications/Finder’ -> GST Rates Ready Reckoner/Updated Notifications .

Further, HSN search facility is also available on the GST portal.

Manufacturers and importers/exporters have been commonly using HSN Codes. Manufacturers were furnishing these codes even in the pre-GST regime. Importers and exporters have been furnishing these codes in import/export documents. Traders would mostly be using HSN codes furnished in the invoices issued to them by the manufacturer or importer suppliers. As such, a large number of GST taxpayers are already furnishing HS codes/SAC at 6/8 digits on voluntary basis on the invoices, e -way bills and GSTR 1 returns.

****

(Release ID: 1708713)

Is HSN Code filed Zero gst return tax payer?

HI SIR UPTO 5 CRORE TURNOVER SAC CODE MANDATORY IN GSTR-1

if turnover in previous year is upto 1.5crores than hsn is it mandatory yo furnish?

If any product whose GST rate is nil and has only 4 digit HSN code then is it mandatory to fill table 12 in GSTR1?

HELLO FRIENDS

I FILED GSTR-1 OF APRIL 2021 WITHOUT DISCLOSING HSN SUMMARY. WILL I BE PENALISED. IF YES, THEN HOW MUCH. OR IS THERE ANY WAY TO RECTIFY THE GSTR-1.

small vender hsn code in mandatory