Applicabilty of disallowance u/s 40A of the Act in case assessee opts for presumptive taxation u/s 44AD.

Sec 40A relates to disallowance related to excess payment of related party, cash payment to a person in excess of Rs. 10,000 in a day, payment to unapproved fund, mark to market losses etc. The comparison of sec 44AD and 40A is very interesting and different from sec 43B and sec 40. Sec 40A overrides all the other provisions of PGBP.

Also Read: Analysis of Section 40A(3) & Section 40A(3A) of Income Tax Act, 1961

The section begins with ―The provisions of this section shall have effect notwithstanding anything to the contrary contained in any other provisions of this Act relating to the computation of income under the head ―Profits and gains of business or profession‖. The non-obstante clause of this section seems to override provisions of sec 44AD. However, the Panaji Tribunal in case of Good Luck Kinetic v. ITO (2015) 58 relating to disallowance u/s 43B have considered two points:

i. Amplitude of non-obstante clause

ii. Payment to crown i.e statutory dues

The provisions of sec 40A are not related to statutory dues and such other dues. It just imposes restrictions on payments and disallows amount which is not paid as per the provisions of the Act. It is also to be noted that provisions of sec 40A of the Act are with regard to allowability of expenditure which has been actually incurred and claimed by the assessee from sec 30 to 38 of the Act. Therefore, if the assessee declares income as per the provisions of sec 44AD of the Act, no disallowance shall be made u/s 40A of the Act.

Example : If any person opting for sec 44AD has made cash purchases worth Rs. 15,000 no disallowance can be made u/s 40A(3), even if the cash payment to a person exceeds Rs. 10,000 in a day. Cash payment to transporter in excess of Rs. 35,000 in a day shall not be disallowed.

Similarly, disallowance u/s 40A for excess payment to relatives cannot be made. No addition u/s 41 can be made.

Incentives to encourage cashless business transactions

A. Presumptive Rate of Income:

The presumptive rate of income would be 8% of total turnover or gross receipts.

However, Proviso to sub-section (1) provides that the presumptive rate of 6% of total turnover or gross receipts will be applicable in respect of amount which is received

By and account payee cheque or

By an account payee bank draft

By use of electronic clearing system through a bank account OR through such other electronic mode as may be prescribed.

During the previous year or before the due date of filing of return under section 139(1) in respect of the previous year.

However the assessee can declare in his return an amount higher than presumptive income so calculated, claimed to have been actually earned by him.

√ Other Electronic Prescribed by CBDT: The Central Board of Direct Taxes has prescribed other electronic modes to provide for the followings as an acceptable electronic mode of payments-

(a) Credit Card;

(b) Debit Card;

(c) Net Banking;

(d) IMPS (Immediate Payment Service);

(e) UPI (Unified Payment Interface);

(f) RTGS (Real Time Gross Settlement);

(g) NEFT (National Electronic Funds Transfer), and

(h) BHIM (Bharat Interface for Money) Aadhaar Pay‖

Example: Mr. Arshdeep Singh, an individual carrying business of laptops has a Turnover of Rs. 80 Lakhs during the F.Y. 19-20. He has received the payments as

Rs.60 Lakh in cash

Rs.10 Lakh by account payee cheque during the previous year Rs. 4 Lakh by ECS through bank account upto 31st July 2019 Rs. 6 Lakh has not been received yet.

Now, since the TO is below Rs.2 Cr, he has the option of availing benefits of section 44AD. Mr. Arshdeep Singh can exercise this option and declare income as

8% of Rs.66,00,000 (60 Lakh + 6 Lakh) – 5,28,000

6% of Rs. 14 Lakh (10 Lakh + 4 Lakh) – 84,000

Total income from PGBP = 6,12,000

B. Combined Study of Section 44AB with Section 44AD’

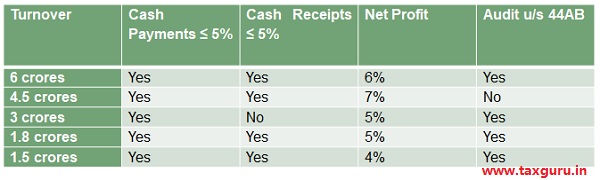

Currently, businesses having turnover of more than one crore rupees are required to get their books of accounts audited by an accountant. In order to reduce the compliance burden on small retailers, traders, shopkeepers who comprise the MSME sector, the Finance Act 2020 has raised the limit of audit by five times the turnover threshold for audit from the existing Rs. 1 crore to Rs. 5 crores. It is also to be noted that this amendment is applicable for F.Y. 2019-20 i.e for the A.Y. 2020-21

Further, in order to boost less cash economy, it has been provided that the increased limit for mandatory tax audit shall apply only to those businesses which carry out less than 5% of their business transactions in cash. But in this connection, following points are to be noted

1. This threshold limit for the applicability of mandatory tax audits is applicable to business entity only and limit for a professional assessee shall continue to be at Rs. 50 lacs even if he receives entire consideration in non-cash mode.

2. It is not provided that who will certify the margin of transactions in cash mode of 5 It appears that the assessee is himself requiring declaring the percentage of receipt in cash mode and non-cash mode.

3. The provision to increase the turnover limit for a mandatory tax audit is amended to benefit the MSME sector.

4. The amendment is carried out only in section 44AB. No amendment is made in section 44AD and thus the turnover limit of Rs. 2 crores shall continue. Suppose an assessee is having a turnover of 180 lacs for the financial year 2020-21 and all the transactions of business are by non-cash modes. The net profit of the assessee is Rs.7 lacs which is less than 6% of turnover of the assessee. Now as per the provisions of sec 44AD, the assessee is required to maintain books of account and get them audited u/s 44AB of the Act.

5. The term ‘aggregate of all receipts and aggregate of all payments‘ is very wide and covers not only the receipts and payments on account of turnover or sales but all other business transactions. Capital introduction, receipt and repayment of a loan, etc., partners‘ drawings, payment of freights, etc. Even payment of taxes made in cash will come within the purview of cash transactions. It can be better understood with the help of following table.

In case of any doubt or query, readers are requested to approach the author at ca.rskalra@yahoo.com.

In case of any doubt or query, readers are requested to approach the author at ca.rskalra@yahoo.com.