MSME in the country will now be known as ‘UDYAM’

The Union Ministry of Micro, Small and Medium Enterprises (MSME), vide the notification dated 26th June, 20201, declare new process of classification and registration of enterprises as MSME.

Highlights of this Notification are:

An enterprise for this purpose will be known as ‘UDYAM’ and its registration process will be known as ‘UDYAM REGISTRATION’.

The process of registration is starting from 1st July, 2020.

Existing Udyog Aadhar Memorandum (UAM) enterprises: The existing Udyog Aadhar holder shall be register again till 31st march, 2021.

Udyog Aadhaar Number: need Udyog Aadhaar Number of the enterprises verified through OTP

New Registration:

MSME registration process is fully online, paperless and based on self-declaration.

The registration may be obtained based on a self-declaration by the applicant, without submitting any other documents, certificates proofs of investment in plant and machinery or equipment or turnover.

Process for new registration as under:

Requirement of Adhaar:

| Type of Entity | Aadhaar of |

| Proprietorship Firm | Proprietor |

| Partnership Firm | Managing Partner |

| HUF | Karta |

| Company / LLP / Cooperatives / Trust / Organizations | Authorised Signatory |

Requirement of PAN & GST:

PAN & GST is mandatory requirement.

If no PAN & GST:

The MSME registration is online and self-declaration basis which continue till 31st March, 2021. In other words, if the enterprises have no PAN or GST, self-declaration will suffice till 31st March 2021. However, this facility available only for the proprietary concern for new registration only.

Why GSTN Mandatory:

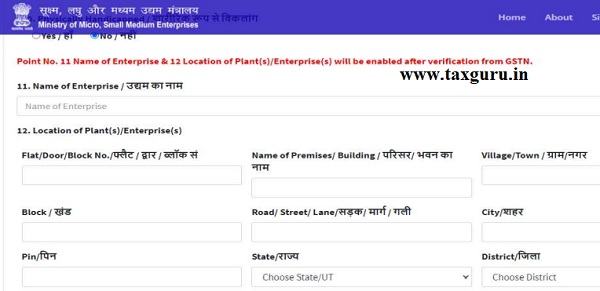

For new registration the GSTN is mandatory requirement to verify name or location of the enterprises as one can see the screen shot of the registration form:

Why PAN mandatory:

For new registration PAN is mandatory to fetch the details of investment and turnover figures of enterprises as one can see the screen shot of the registration form:

In simple words the government shall verify the self-declared information of the enterprises through its different wings at the same time update or downgrade the status (whether micro, small or medium) on real time basis.

An enterprises have to file income tax return and file GST return to maintain the status under MSME. Means a proprietary concern having income within exemption limit shall have to file ITR, if not wish to suspense MSME status.

Check your category of business under MSME:

in order to increase the scope and bringing larger number of firms within the ambit of MSME. revised classification based on composite criteria of investment and turnover of enterprises2.

| Classification | Micro | Small | Medium |

| Manufacturing Enterprises and Enterprises rendering Services | Investment in Plant and Machinery or Equipment not more than Rs.1 crore and Annual Turnover not more than Rs. 5 crores. | Investment in Plant and Machinery or Equipment not more than Rs.10 crore and Annual Turnover not more than Rs. 50 crores | Investment in Plant and Machinery or Equipment not more than Rs. 50 crore and Annual Turnover not more than Rs. 250 crores. |

Checklist for New Udyam Registration

| Sl. No. | Information Required | Rxemarks |

| 1. | Aadhaar No. | |

| If Mobile No. not Registered with Aadhaar than provide any other photo ID Proof | Bank photo passbook; or voter ID Card; or passport; or driving license; or PAN card; or employee photo identity. | |

| 2 | Phone No & Email ID of Applicant Linked with Aadhaar | |

| 3 | Investment in Plant and Machinery | |

| 4 | Main Business Activity of Enterprise | Manufacturer or Service Provider |

| 5. | Name & Type of the Firm | Proprietorship/Partnership Firm/ Private Company |

| 6 | Address of the Office | |

| 7 | Location of the Plant | |

| 8 | Date of start of the Business/Operation | first sales Bill |

| 9 | The total number of person employed | |

| 10 | Bank Details Bank Account No. and IFSC |

Disclaimer:

The entire content of this write up have been prepared on the basis of relevant provisions and as per the information available at the time of preparation. It is not intended to be a professional advice at all. It is suggested that before making any decision do consult any professional/advisor.

Whether the above classification is also applicable to “Traders”