Preferential Issue of Equity Shares And Convertible Securities Under Companies Act 2013 And SEBI (Issue of Capital Disclosure Requirements), Regulations 2018 {SEBI(ICDR)}

Preferential issue means an issue of specified securities by a listed issuer to any select person or group of persons on a private placement basis and does not include an offer of specified securities made through a public issue, rights issue, bonus issue, employee stock option scheme, employee stock purchase scheme or qualified institutions placement or an issue of sweat equity shares or depository receipts issued in a country outside India or foreign securities

Before knowing Compliance of preferential issue we need to understand the non-applicability of some provisions of Preferential issue and some important terms which are mentioned below:

Non Applicability as per SEBI (ICDR)

1. The provisions shall not apply where the preferential issue of equity shares is made pursuant to:

> conversion of a loan or an option attached to convertible debt instruments in term of section 62(3) and 62(4) of Companies Act, 2013;

> Merger or Amalgamation under Companies Act, 2013 except pricing provision in case of allotment of shares only to a select group of shareholders or shareholders of unlisted companies pursuant to such schemes ;

> a qualified institutions placement;

2. where the preferential issue of specified securities is made in terms the resolution plan approved under IBC except the lock-in provisions

3. The provisions of this Chapter relating to pricing and lock-in shall not apply to equity shares allotted to any financial institution within the meaning of sub-clauses (i) and (ii) of clause (h) of section 2 of the Recovery of Debts due to Banks and Financial Institutions Act, 1993 (51 of 1993)

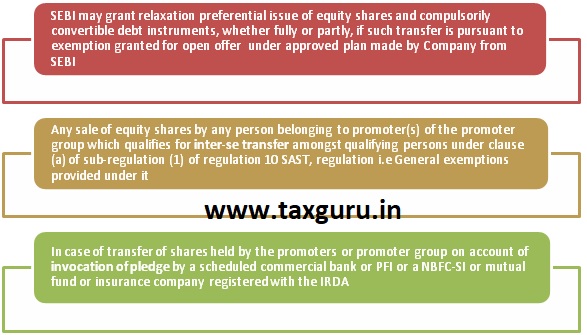

4. If the exemption is given by SEBI Under SAST to make an open offer and if adequate disclosures about the plan are given in the explanatory statement to notice for the general meeting of the shareholders The provisions of regulation 163[Disclosure to shareholders} and sub-regulations (1), (2), (3) and (4) of regulation 164(Pricing) shall not apply to a preferential issue of equity shares and compulsorily convertible debt instruments, whether fully or partly

5. The provisions of issuing securities under preferential issue even if the person who has sold or transferred any equity shares of the issuer during the six months preceding the relevant date { and lock in period shall not apply to a preferential issue of specified securities where the If the proposed allottee is a mutual fund registered with the Board or insurance company registered with Insurance Regulatory and Development Authority of India or a scheduled commercial bank or a public financial institution.

6. Where the preferential issue of equity shares and convertible securities is made to the lenders pursuant to conversion of their debt, as part of a debt restructuring implemented in accordance with the guidelines specified by the Reserve Bank of India, subject to the following conditions mentioned under regulation 159(6) of SEBI (ICDR ) 2018

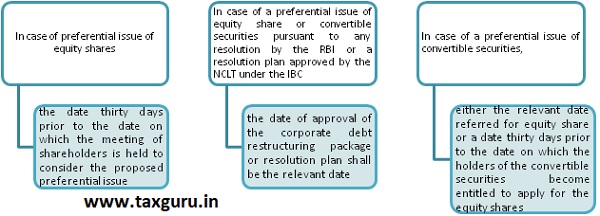

Relevant date

Explanation: Where the relevant date falls on a weekend or a holiday, the day preceding the weekend or the holiday will be reckoned to be the relevant date.

ISSUER

Issuer” means a company or a body corporate authorized to issue equity share and convertible securities under the relevant laws and whose equity share and convertible securities are being issued and/or offered for sale in accordance with SEBI (ICDR) regulation

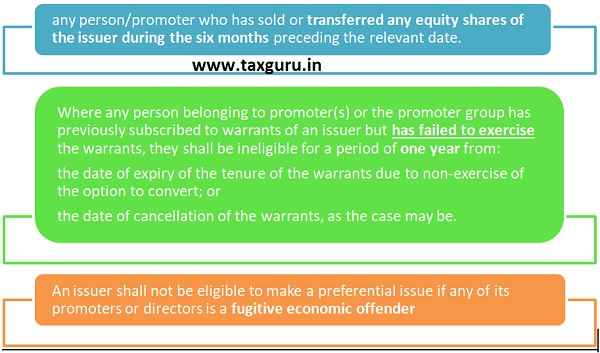

PERSONS NOT ELIGIBLE FOR PREFERENTIAL ISSUE AS PER SEBI (ICDR)

PERSONS ELIGIBLE FOR PREFERENTIAL ISSUE EVEN IF TRANSFERRED ANY EQUITY SHARES OF THE ISSUER DURING THE SIX MONTHS PRECEDING THE RELEVANT DATE AS PER SEBI(ICDR)

VALUATION REQUIRED FOR PREFERENTIAL ISSUE

LISTED SECURITIES AS PER SEBI (ICDR)

1. The price of shares to be issued on a preferential basis by a listed company shall not be required to be determined by the valuation report of a registered valuer

2. Where the equity share or convertible securities are issued on a preferential basis by a listed entity for consideration other than cash, the valuation of the assets in consideration for which the equity shares are issued shall be done by an independent valuer, which shall be submitted to the stock exchanges where the equity shares of the issuer are listed:

3. If the stock exchange(s) is not satisfied with the appropriateness of the valuation, it may get the valuation done by any other valuer and for this purpose it may seek any information, as deemed necessary, from the issuer

4. Where the shares of an issuer are not frequently traded, the price determined by the issuer shall take into account the valuation parameters and the issuer shall submit a certificate stating that the issuer is in compliance of SEBI(ICDR)Regulations, obtained from an independent valuer to the stock exchange where the equity shares of the issuer are listed.

UNLISTED SECURITIES AS PER COMPANIES ACT 2013

1. The price of the shares or other securities to be issued on a preferential basis, either for cash or for consideration other than cash, shall be determined on the basis of valuation report of a registered valuer;

2. Where convertible securities are offered on a preferential basis with an option to apply for and get equity shares allotted, the price of the resultant shares pursuant to conversion shall be determined-

> either upfront at the time when the offer of convertible securities is made, on the basis of valuation report of the registered valuer given at the stage of such offer, or

> at the time, which shall not be earlier than thirty days to the date when the holder of convertible security becomes entitled to apply for shares, on the basis of valuation report of the registered valuer given not earlier than sixty days of the date when the holder of convertible security becomes entitled to apply for shares:

> Company shall take a decision for above valuation at the time of offer of convertible security itself and make such disclosure in the explanatory statement at time of mentioning the relevant date.

PRICING OF LISTED EQUITY SHARES AS PER SEBI (ICDR)

Before we move to the pricing, let’s understand meaning of frequently traded shares:

Frequently traded shares means the shares of the issuer, in which the traded turnover on any recognised stock exchange during the twelve calendar months preceding the relevant date, is at least ten per cent of the total number of shares of such class of shares of the issuer:

In case where the share capital of a particular class of shares of the issuer is not identical throughout such period, the weighted average number of total shares of such class of the issuer shall represent the total number of shares.

Explanation: For the purpose of this regulation, ‘stock exchange’ means any of the recognised stock exchange(s) in which the equity shares of the issuer are listed and in which the highest trading volume in respect of the equity shares of the issuer has been recorded during the preceding twenty six weeks prior to the relevant date

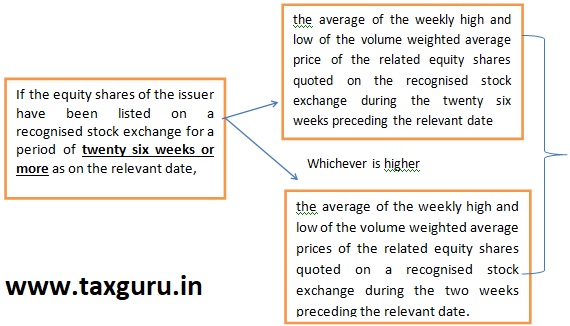

PRICING OF FREQUENTLY TRADED SHARES AND INFREQUENTLY TRADED SHARES

Pricing of infrequently traded shares

It is mentioned under the heading of valuation of listed securities

Pricing of frequently traded shares

–

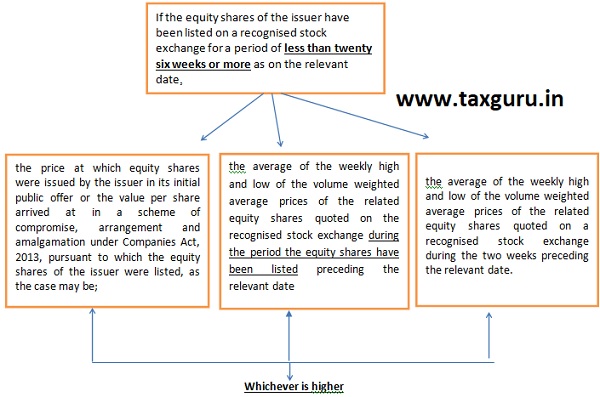

WHERE THE ABOVE SHARE COMPLETES PERIOD OF 26 WEEKS FROM DATE OF LISTING TO STOCK EXCHANGES PRICING SHALL BE:

Average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on the recognised stock exchange during these twenty six weeks and if such recomputed price is higher than the price paid on allotment, the difference shall be paid by the allottees to the issuer.

Equity shares shall remain in lock in until the balance amount is paid by allotee.

PRICING WHEN EQUITY SHARES OR CONVERTIBLE SECURITIES ISSUED TO QIBS

A preferential issue of specified securities to qualified institutional buyers, not exceeding five in number, shall be made at a price not less than the average of the weekly high and low of the volume weighted average prices of the related equity shares quoted on a recognised stock exchange during the two weeks preceding the relevant date.

CONDITIONS FOR PREFERENTIAL ISSUE OF EQUITY SHARE AND CONVERTIBLE SECURITIES

| S No. | Conditions for Listed Companies |

| 1. | All equity shares allotted by way of preferential issue shall be made fully paid up at the time of the allotment |

| 2. | A special resolution has been passed by its shareholders |

| 3. | All equity shares held by the proposed allottees in the issuer are in dematerialised form;

Allotment of the specified securities shall be made only in dematerialised form. |

| 4. | Issuer is in compliance with the stock exchange where the equity shares of the issuer are listed and the SEBI (LODR), 2015, as amended, and any circular or notification issued. |

| 5. | Issuer has obtained the Permanent Account Numbers of the proposed allottees, except those allottees which may be exempt from specifying their Permanent Account Number for transacting in the securities market by the Board. |

| 6. | The tenure of the convertible securities of the issuer shall not exceed eighteen months from the date of their allotment. |

| 7. | The issuer shall place a copy of the certificate of its statutory auditors before the general meeting of the shareholders considering the proposed preferential issue, certifying that the issue is being made in accordance with the requirements of SEBI(ICDR),2018 |

| 8. | The special resolution shall specify the relevant date on the basis of which price of the equity shares to be allotted on conversion or exchange of convertible securities shall be calculated |

| 9. | For Listed Company:

Allotment pursuant to the special resolution shall be completed within a period of fifteen days from the date of passing of such resolution If the allotment of the specified securities is not completed within fifteen days from the date of special resolution, a fresh special resolution shall be passed and the relevant date for determining the price of specified securities under this Chapter shall be taken with reference to the date of the latter special resolution For Unlisted Company the allotment of securities on a preferential basis made pursuant to the special resolution passed shall be completed within a period of twelve months from the date of passing of the special resolution. if the allotment of securities is not completed within twelve months from the date of passing of the special resolution, another special resolution shall be passed for the company to complete such allotment thereafter |

| Common Conditions for Listed and Unlisted Companies | |

| 10. | The issue is authorized by its articles of association |

| 11. | Where shares or other securities are to be allotted for consideration other than cash, the valuation of such consideration shall be done by a registered valuer who shall submit a valuation report to the company giving justification for the valuation |

| 12. | The price of shares or other securities to be issued on preferential basis shall not be less than the price determined on the basis of valuation report of a registered valuer. |

| 13. | A registered valuer is appointed in accordance with the provisions of the Companies Act,2013 the valuation report shall be made by an independent merchant banker who is registered with the SEBI or an independent Chartered Accountant in practice having a minimum experience of ten years |

| Keeping the view of Preferential Allotment under Companies Act 2013 as per Rule 13 of Companies (Share Capital and Debentures ) Rules, 2014 we also need to comply with Section 42 of Companies Act 2013 Some of the conditions pursuant to that are as follows | |

| 14. | Every identified person shall apply for issue along with Private Placement application and subscription money paid either by cheque or demand draft or other banking channel and not by cash |

| 15. | A company shall not utilise monies raised through private placement unless allotment is made and the return of allotment is filed with the Registrar (PAS-3) |

| 16. | No fresh offer or invitation under this section shall be made unless the allotments with respect to any offer or invitation made earlier have been completed or that offer or invitation has been withdrawn or abandoned by the company |

| 17. | A company making an offer or invitation under this section shall allot its securities within sixty days from the date of receipt of the application money for such securities and if the company is not able to allot the securities within that period, it shall repay the application money to the subscribers within fifteen days from the expiry of sixty days and if the company fails to repay the application money within the aforesaid period, it shall be liable to repay that money with interest at the rate of twelve per cent. per annum from the expiry of the sixtieth day: |

| 18. | Monies received on application under this section shall be kept in a separate bank account in a scheduled bank and shall not be utilised for any purpose other than—

(a) for adjustment against allotment of securities; or (b) for the repayment of monies where the company is unable to allot securities. |

| 19. | No company issuing securities under this section shall release any public advertisements or utilise any media, marketing or distribution channels or agents to inform the public at large about such an issue. |

| 20. | An offer or invitation to subscribe securities under private placement shall not be made to persons more than two hundred in the aggregate in a financial year: |

| 21. | A private placement offer cum application letter shall be in the form of an application in Form PAS-4 serially numbered and addressed specifically to the person to whom {no person other than the person so addressed shall be allowed} the offer is made and shall be sent to him, either in writing or in electronic mode, within thirty days of recording the name of such person.

Imp Note: A company shall issue private placement offer cum application letter only after the relevant special resolution or Board resolution has been filed in the Registry i.e only after filing MGT-14 with ROC. |

| 22. | The company shall maintain a complete record of private placement offers in Form PAS-5. |

EXPLANATORY STATEMENT OF SPECIAL RESOLUTION SHALL CONTAIN THE FOLLOWING DISCLOSURES:

| S No. | For Listed and Unlisted Companies |

| 1. | the objects of the issue and amount which the company intends to raise by way of such securities; |

| 2. | the total number of shares or other securities to be issued along with date of passing Board resolution; |

| 3. | the price or price band at/within which the allotment is proposed and kind of securities ; |

| 4. | basis on which the price has been arrived at along with report of the registered valuer; |

| 5. | relevant date with reference to which the price has been arrived at; |

| 6. | the class or classes of persons to whom the allotment is proposed to be made; |

| 7. | intention of promoters, directors or key managerial personnel to subscribe to the offer; |

| 8. | the proposed time within which the allotment shall be completed; |

| 9. | the names of the proposed allottees and the percentage of post preferential offer capital that may be held by them; |

| 10. | the change in control, if any, in the company that would occur consequent to the preferential offer |

| 11. | the number of persons to whom allotment on preferential basis have already been made during the year, in terms of number of securities as well as price; |

| 12. | the justification for the allotment proposed to be made for consideration other than cash together with valuation report of the registered valuer and name address of the valuer who performed the valuation |

| 13. | The pre issue and post issue shareholding pattern of the company in the format mentioned in annexure A |

| For Listed Companies | |

| 14. | Undertaking that the issuer shall re-compute the price of the specified securities in terms of the provision of these regulations where it is required to do so; undertaking that if the amount payable on account of the re-computation of price is not paid within the time stipulated in these regulations, the specified securities shall continue to be locked- in till the time such amount is paid by the allottees. |

| 15. | Disclosures specified in Schedule VI of SEBI (ICDR), 2018, if the issuer or any of its promoters or directors is a wilful defaulter. |

COMPANIES ACT COMPLIANCES- ROC FILING

1. MGT- 14 within 30 days of passing Board resolution in which Preferential allotment is approved

2. MGT-14 within 30 days of passing Special Resolution

3. PAS -3 within fifteen days of allotment along with a complete list of all the allottees containing-

> the full name, address, permanent Account Number and E-mail ID of such security holder;

> the class of security held;

> the date of allotment of security ;

> the number of securities herd, nominal value and amount paid on such securities; and particulars of consideration received if tire securities were issued for consideration other than cash.

SEBI (LODR) COMPLIANCES

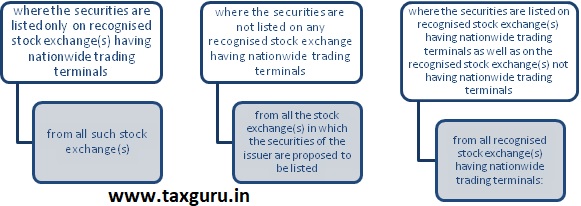

In-principle approval of recognized stock exchange(s).

The listed entity, before issuing securities, shall obtain an ‘in-principle’ approval from recognised stock exchange(s) in the following manner:

LISTING APPLICATION

Issuer shall make an application to the exchange/s for listing in case of further issue of equity shares from the date of allotment within 20 days

TRADING APPROVAL

Listed entities shall make an application for trading approval to the stock exchange/s within 7 working days from the date of grant of listing approval by the stock exchange/s.

POST ALLOTMENT COMPLIANCES

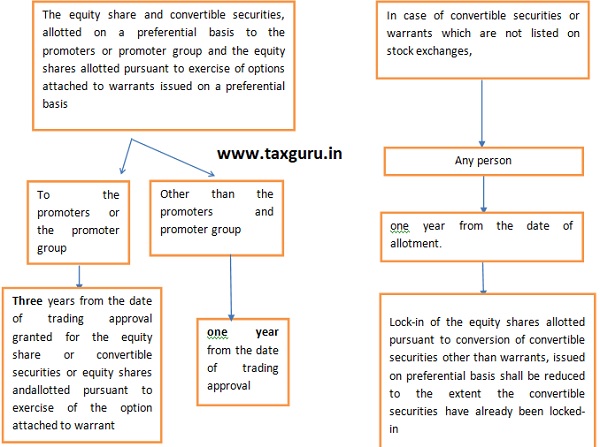

Lock in period as SEBI (ICDR)

Trading approval shall mean the latest date when trading approval has been granted by all the stock exchanges where the equity shares of the issuer are listed, for specified securities allotted as per the provisions of this Chapter.

1. The equity shares issued on a preferential basis pursuant to any resolution of stressed assets under a framework specified by the RBI or a resolution plan approved by the NCLT under the IBC, shall be locked-in for a period of one year from the trading approval:

2. Not more than twenty per cent. of the total capital of the issuer shall be locked-in for three years from the date of trading approval

3. Equity shares allotted in excess of the twenty per cent. shall be locked-in for one year from the date of trading approval pursuant to exercise of options or otherwise, as the case may be.

4. The entire pre-preferential allotment shareholding of the allottees, if any, shall be locked-in from the relevant date up to a period of six months from the date of trading approval:

5. In case of convertible securities or warrants which are not listed on stock exchanges, the entire pre-preferential allotment shareholding of the allottees, if any, shall be locked-in from the relevant date up to a period of six months from the date of allotment of such securities.

Explanations For the purpose of this regulation:

(I) The expression “total capital of the issuer” means:

(a) equity share capital issued by way of public issue or rights issue including equity shares issued pursuant to conversion of specified securities which are convertible; and

(b) specified securities issued on a preferential basis to the promoters or the promoters group.

(II) For the computation of twenty per cent. of the total capital of the issuer, the amount of minimum promoters’ contribution held and locked-in, in the past in terms of Securities and Exchange Board of India (Disclosure and Investor Protection) Guidelines, 2000 or these regulations shall be taken into account.

(III) The minimum promoters’ contribution shall not be put under fresh lock-in again, even though it is considered for computing the requirement of twenty per cent. of the total capital of the issuer, in case the said minimum promoters’ contribution is free of lock-in at the time of the preferential issue.

TRANSFERABILITY AS SEBI (ICDR)

1. May be transferred among the promoters or the promoter group or to a new promoter or persons in control of the issuer subject to provision of SAST, However that the lock-in on such securities shall continue for the remaining period with the transferee.

2. The equity share or convertible securities allotted on a preferential basis shall not be transferable by the allottees till the trading approval is granted for such securities by all the recognised stock exchanges where the equity shares of the issuer are listed.

PAYMENT OF CONSIDERATION AS SEBI (ICDR)

| Other than cash | Securities allotted pursuant to RBI and NCLT | Warrants If pricing is as per the method frequently traded shares | Warrants if pricing is some other formula |

| Full consideration of specified securities other than warrants, shall be paid by the allottees at the time of allotment of such specified securities | consideration may be in terms of such scheme.

|

Twenty five per cent of the consideration at the time allotment of warrant and balance seventy five per cent the time of allotment of the equity shares pursuant to exercise of options against each such warrant by the warrant holder.

If the consideration shall be paid at determined in terms of pricing on frequently traded shares(mentioned above) |

Twenty-five per cent. of the consideration amount calculated as per the formula with conversion date being the relevant date shall be paid against each warrant on the date of allotment of warrants and the balance consideration shall be paid at the time of allotment of the equity shares pursuant to exercise of options against each such warrant by the warrant holder |

| In case the warrant holder does not exercise the option for equity shares against any of the warrants held by the warrant holder, the consideration paid in respect of such warrant mentioned above shall be forfeited by the issuer | |||

| The issuer shall ensure that the consideration of specified securities, if paid in cash, shall be received from respective allottee’s bank account and in the case of joint holders, shall be received from the bank account of the person whose name appears first in the application | |||

| The issuer shall submit a certificate from the statutory auditors to the stock exchanges where the equity shares of the issuer are listed stating that the issuer is in compliance as mentioned above and the relevant documents thereof are maintained by the issuer as on the date of certification | |||

Annexure-A

| S. No. | Category | Pre-issue | Post-issue | ||

| No of shares held | % of share holding | No of shares held | % of share holding | ||

| A | Promoters’ holding | ||||

| 1 | Indian | ||||

| Individual | |||||

| Bodies corporate | |||||

| Sub-total | |||||

| 2 | Foreign promoters | ||||

| sub-total (A) | |||||

| B | Non-promoters’ holding | ||||

| 1 | Institutional investors | ||||

| 2 | Non-institution | ||||

| Private corporate bodies | |||||

| Directors and relatives | |||||

| Indian public | |||||

| others (including NRIs) | |||||

| Sub-total (B) | |||||

| GRAND TOTAL | |||||