MCA has clarified two things- 1. No need of Auditor’s certificate in DPT-3 for transactions not considered deposits and Revision of time line for filing particulars of exempted deposit (receipt of money or loan which are not considered as deposit) in form DPT 3 is not justified.

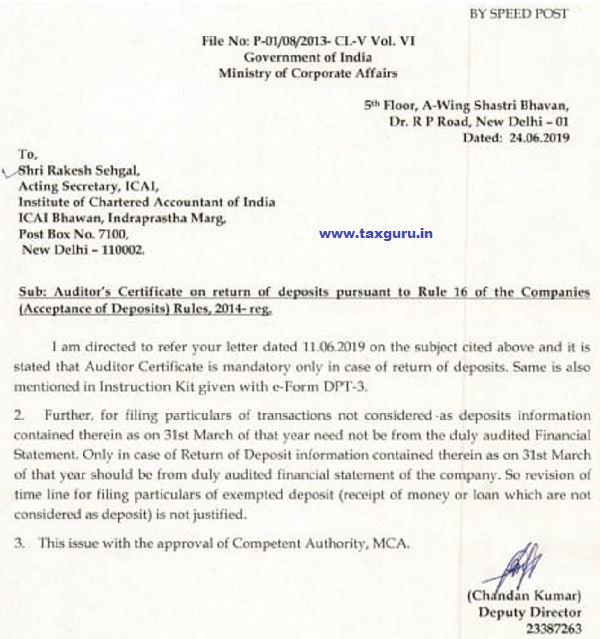

BY SPEED POST

File No: P-01/08/2013-CL-V Vol. VI

Government of India

Ministry of Corporate Affairs

5th Floor, A-Wing Shastri Bhavan,

Dr. R P Road, New Delhi -01

Dated: 24.06.2019

To,

Shri Rakesh Sehgal,

Acting Secretary, ICAI,

Institute of Chartered Accountant of India

ICAI Bhawan, Indraprastha Marg

Post Box No. 7100,

New Delhi -110002.

Sub: Auditor’s Certificate on return of_deposit pursuant to Rule 16 of the Companies (Acceptance of Deposits) Rules, 2014-reg.

I am directed to refer your letter dated 11.06.2019 on the subject cited above and it is stated that Auditor Certificate is mandatory only in case of return of deposits. Same is also mentioned In Instruction Kit given with e-Form DPT-3.

2. Further, for filing particulars of transactions not considered as deposits Information contained therein as on 31st March of that year need not be from the duly audited Financial Statement. Only in case of Return of Deposit information contained therein as on 31st March of that year should be from duly audited financial statement of the company. So revision of time line for filing particulars of exempted deposit (receipt of money or loan which are not considered as deposit) is not justified.

3. This issue with the approval of Competent Authority, MCA.

(Chandan Kumar)

Deputy Director

23387263

DPT-3 Due date extension