The concept of Job Work is very much integral to most of industrial activities that constitute outsourcing of some or all the activities to a third party. Thus job work means any person who undertakes any activity or carried on any process on goods belonging to another person (principal). The person undertaking such assignment is called job worker who always works under the instructions of the principal. The job worker undertakes the assignment over the inputs or material belonging to his principal by using his resources, machines, processes and may also use his own materials in the process.

♣ Job Work – Business Model :

Job-work has various synonyms in different industries – for example: Job-work” or “sub-contracting” in manufacturing / engineering industry; “Processing” in chemical or textile industry; “A loan licensing” in pharmaceutical industry; “Contract manufacturing” in FMGC industry; and “Bottling” in IMFL industry and so on. However the essence is outsourcing of certain activities.

Let us understand the process of job work through an example which is commonly practiced in textile industry. In the Ready Made Garment industry, the principal wishing to get the garments made in his brand name, may engage a series of job workers as illustrated below. The Principal may instruct the yarn supplier to deliver yarn directly to the job worker say grey fabric manufacturer. After the fabric is made he may instruct the fabric manufacturer to send the same to another job worker for Dyeing. The dyeing materials used for dyeing may be ordered to some other supplier to deliver directly to the dyeing job worker. After dyeing is completed the same may go to the garment manufacturer on instructions from the principal for stitching garments on job work. Some of the accessories may be supplied to this job worker from other source. The garments so made may be sent back to the principal or to any other customer – domestic customer or overseas customer as per the instructions of the principal. See the sample Job Work Model below.

♣ Job Work – Present Taxation System:

Where job work process results in to manufacture of goods, excise duty becomes applicable and in other cases, service tax comes into play. However, if the principal undertakes the liability to pay Duty (Not. No. 214/86), excise duty is exempted. In the course of execution of the work, in some cases the work involve use of materials also by the job worker. In such cases, it involves transfer of material along with job-work services to principal. Therefore it falls under the definition of works contract and attracts service tax and VAT/CST. In some cases, a job worker provides pure labour and entire inputs/raw materials are provided by the principal in such cases service tax is applicable.

♣ Job Work under GST – Definitions :

As per Sec 2 (68) of CGST Act, 2017, “job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly. The above definition has been enhanced (compared to present which confines to manufacturing in Excise) which includes any treatment or process which will also cover repairs, calibration, testing, such services etc. etc.

Schedule I [Section 7] includes activities to be treated as supply even if made without consideration. As per Clause 3 of the schedule, Supply of goods by a principal to his agent or by an agent to his principal shall also be treated as supply. Principal and agent are defined in the act as follows :

Sec 2 (88) “principal” means a person on whose behalf an agent carries on the business of supply or receipt of goods or services or both;

Sec 2 (5) “agent” means a person, including a factor, broker, commission agent, arhatia, del credere agent, an auctioneer or any other mercantile agent, by whatever name called, who carries on the business of supply or receipt of goods or services or both on behalf of another;

Strictly as per these provisions (Clause 3 of Schedule -1), Supply of goods by a principal to his agent or by an agent to his principal shall also be treated as supply, and accordingly GST is leviable. However superseding above clause through the scheme specially provided in Sec 143 of CGST Act, allows supply of goods by a registered person (principal) to Job Worker without payment of GST. He can further send the goods from one job-worker to another job-worker and so on subject to certain condition.

♣ Understanding Job Work Under GST

Job work provisions can be understood easily through the schematic diagram shown below.

♣ Job Work Under GST – Some of Salient Features:

- Only the Registered Persons can avail the provisions of the scheme – Sec 143 (1) of CGST Act

- The provisions require that goods (Inputs or Capital Goods) can only be removed to job worker’s place under intimation to the concerned authorities – Sec 143 (1) of CGST Act

- Any inputs or capital goods can be sent without payment of tax, to a job worker for job-work – Sec 143 (1) of CGST Act

- The term inputs, for the purposes of job work, input includes intermediate goods arising from any treatment or process carried out on the inputs by the principal or the job worker – Sec 143 (1) of CGST Act – Explanation

- Goods from the job worker subsequently can be send to another job worker and likewise – Sec 143 (1) of CGST Act

- Such job work provisions subject to condition that Inputs be brought back within one year – Sec 143 (1) (a) of CGST Act

- In case of capital goods, other than moulds and dies, jigs and fixtures, or tools be brought back within Three Years – Sec 143 (1) (a) of CGST Act

- After completion of job work, such goods may be sent out from the place of business of a job worker on payment of tax within India, or with or without payment of tax for export, as the case may be. – Sec 143 (1) (b) of CGST Act

- For sending the goods after job work from the place of business of the job-worker, either the Job Worker be Registered or the Principal should declare the job workers place as his additional place of business – Sec 143 (1) (b) of CGST Act

- Responsibility for accountability lies with the Principal – Sec 143(2) of CGST Act

- Inputs sent to Job Worker not received back within one year – Considered as Deemed Supply on the day when the said inputs were sent out – Sec 143(3) , Sec 19(3) of CGST Act

- Capital Goods sent to Job Worker not received back within three years – Considered as Deemed Supply on the day when the said CGs were sent out – Sec 143(4) , Sec 19(6) of CGST Act

- Inputs & Capital Goods can be sent directly from other supplier to the Job worker without being first brought to his place of business – inferred from – Sec 19(2) & Sec 19(5) of CGST Act

- ITC allowed on inputs sent to Job worker by principal – Sec 19(1) of CGST Act

- ITC allowed even if inputs directly sent to the Job worker – Sec 19(2) of CGST Act

- ITC allowed on Capital goods sent to Job worker by principal – Sec 19(4) of CGST Act

- ITC allowed even if capital goods directly sent to the Job worker -Sec 19(5) of CGST Act

- Moulds and dies, jigs and fixtures, or tools sent out to a job-worker are not required to be received back by the Principal – Excluded from the Job Work Provisions – Sec 19(7) of CGST Act,

- Waste and Scrap generated at Job worker – may be supplied by the job worker directly from his place of business on payment of tax by Job Worker if such job worker is registered, or by the principal, if the job worker is not registered – Section 143(5) of CGST Act

- Credit on inputs which got consumed during job work – not separately identifiable – consumables cannot be received back by the principal – condition of receiving back the goods after job work cannot be satisfied.

- Provisions relating to Job Work are not applicable to exempted or non-taxable goods

- Job work Charges by job worker shall be treated as supply of service and accordingly GST is applicable in case the threshold limit is crossed – Schedule – II (3) – Treatment or process: Any treatment or process which is applied to another person’s goods is a supply of services.

- The Job worker need to register in case he crosses the threshold limit or his supplies are across the states (inter state) – Sec 22(1) & Sec 24 of CGST Act

- The goods of principal directly supplied from the job worker’s premises will not be included in the aggregate turnover of the job worker. It will be included in the aggregate turnover of the principal. However, the value of goods or services used by the job worker for carrying out the job work will be included in the value of services supplied by the job worker. Sec 22(4) – Explanation – ii of CGST Act

♣ Job Work : Supply the Goods from the Place of Business of a Job Worker

In general business practice, the goods after job work instead of bringing back to the place of principal, may be required to send to other job worker, or any customer. To provide this flexibility, GST law allowed following three options:

- Send goods from the job worker’s premises, subsequently to another Job Worker Without Payment of GST – Sec 143(1)

- Send goods from the job worker’s premises, to any Domestic Customer – On Payment of GST – Sec 143(1) (b)

- Send goods from the job worker’s premises, for Export – With / Without Payment of GST – Sec 143(1) (b)

Diagram below depicts the three cases :

♣ GST Rules – Job Work

- Input Tax Credit Rules :

- Rule 10: Conditions and restriction in respect of inputs and capital goods sent to the job worker

- Rule 10(1): The inputs or capital goods shall be sent to the job worker under the cover of a challan issued by the principal, including where the inputs or capital goods are sent directly to job-worker.

- Rule 10(2): The challan issued by the principal to the job worker shall contain the details specified in rule Invoice.8:

- Rule 10(3): The details of challans in respect of goods dispatched to a job worker or received from a job worker during a tax period shall be included in FORM GSTR-1 furnished for that period.

- Rule 10(4): If the inputs or capital goods are not returned to the principal within the time stipulated in section 143, the challan issued under sub-rule (1) shall be deemed to be an invoice for the purposes of this Act.

- Invoice Rules :

- Rule 8 (1)(b) : Transportation of goods without issue of invoice – transportation of goods for job work – the consigner may issue a delivery challan, serially numbered, in lieu of invoice at the time of removal of goods for transportation, containing details as specified.

- Rule 8 (2) : The delivery challan shall be prepared in triplicate, in case of supply of goods, in the following manner:–

- (a) the original copy being marked as ORIGINAL FOR CONSIGNEE;

- (b) the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- (c) the triplicate copy being marked as TRIPLICATE FOR CONSIGNER.

- Rule 8 (3) : Where goods are being transported on a delivery challan in lieu of invoice, the same shall be declared in FORM [WAYBILL].

- E-way Bill Rules :

- Rule 2 : Documents and devices to be carried by a person-in-charge of a conveyance

- Rule 2(1): The person in charge of a conveyance shall carry —

- (a) ……… delivery challan, and

- (b) a copy of the e-way bill or the e-way bill number

- Rule 2(1): The person in charge of a conveyance shall carry —

- Rule 2 : Documents and devices to be carried by a person-in-charge of a conveyance

♣ Transitional Provisions Relating to Job Work :

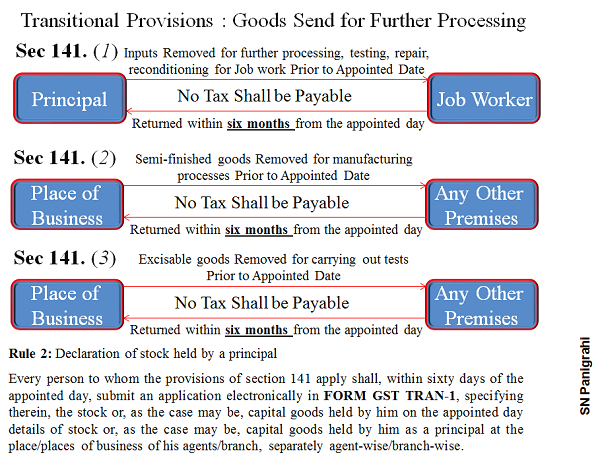

Sec 141 of CGST Act, provides Transitional provisions relating to job work. As per the provisions, any inputs, semi-finished goods, any excisable goods had been removed for further processing, testing, repair, reconditioning or any other purpose, for carrying out certain manufacturing processes, for carrying out tests or any other process in accordance with the provisions of existing law prior to the appointed day and such goods, are returned to the said place on or after the appointed day, no tax shall be payable if the said goods, after undergoing tests or any other process, are returned to the said place within six months from the appointed day

The period of six months may, on sufficient cause being shown, be extended by the Commissioner for a further period not exceeding two months

If the said goods are not returned within the period specified in this sub-section, the input tax credit shall be liable to be recovered in accordance with the provisions of clause (a) of sub-section (8) of section 142

- Draft Transitional Provisions Rules

- Rule : 2. Declaration of stock held by a principal

Every person to whom the provisions of section 141 apply shall, within sixty days of the appointed day, submit an application electronically in FORM GST TRAN-1, specifying therein, the stock or, as the case may be, capital goods held by him on the appointed day details of stock or, as the case may be, capital goods held by him as a principal at the place/places of business of his agents/branch, separately agent-wise/branch-wise.

♣ Application of Provisions of CGST Act to other GST Laws

CGST Act is like a mother of all GST Laws providing elaborate provisions on almost all aspects. Provisions which are not specifically available in other related laws like IGST Act and SGST / UT GST Act are adopted from CGST Act. Sec 20 of IGST Act and Sec 21 of UT GST Act / SGST Act provides provision for such adoption. Accordingly the provisions of the Central Goods and Services Tax Act, relating to Job Work shall, mutatis mutandis, apply to IGST and SGST / UT GST Act.

Therefore, all the Job work provisions discussed so far are applicable to all intra-state and inter-state transactions as well applicable to union territories also.

♣ Conclusions :

GST law allows any registered person (principal) to send taxable goods – both inputs and capital goods, without payment of tax, to a job worker. The goods also allowed to send directly from any other source to job worker. Input Tax Credit is allowed on such goods sent for job work. There can be further movement of such goods from one job worker to another or to the domestic or overseas customer. However such goods must be brought back to principal’s place of business or must be removed after payment of tax thereon for domestic customer or export with or without payment of tax.

Very liberal provisions are made to receive back the goods sent for job work. For inputs one year period is provided (as against present 180 days) and for capital goods three year period is provided (as against two years at present). In case the goods are not received back within specified period such goods shall be treated as deemed supply on the day when the said goods were sent out and tax is applicable with interest theron. Job work Charges by job worker shall be treated as supply of service and accordingly GST is applicable in case the threshold limit is crossed or his supplies are across the states (inter-state). In such case the job worker need to register and discharge the tax liability.

Transitional provisions are also provided. Accordingly any inputs, semi-finished goods, any excisable goods had been removed for further processing, testing, repair, reconditioning or any other purposes prior to the appointed day and such goods, are returned to the said place on or after the appointed day, no tax shall be payable if the said goods, after undergoing tests or any other process, are returned to the said place within six months from the appointed day subject to declaration of stocks held at other places.

If the said goods are not returned within the period specified in this sub-section, the input tax credit shall be liable to be recovered.

The provisions relating to job work have been adopted in the IGST Act as well as in SGST / UTGST Act from CGST Act and therefore job-worker and principal can be located either in same State or in same Union Territory or in different States or Union Territories and applicable in the similar fashion.

Dear Sir,

If job worker uses his own material and sends the same after processing to the principal, and principal in turn reimburses the material used to the job worker.

What documents shall be prepared and is it still a job work or supplly?

Sir, I am Principal and send the material for job work to unregistered job worker june,2017 after completing the work, job worker send back the shirt in July, 2017 is the rcm is applicable on me and how i will treat in job work return

Good day Sir,

I am a CUSTOMS BROKER and handling quite a few SEZ shipments, in this connection I have some query which I would like your kind-self to address please.

A SEZ unit has given works contract for constructing a building for which the Unit will monitor the rate of Steel being purchased by the Contractor for supply into SEZ premises to be utilsedin constructing the Building . The Unit will be paying the contractor on CFT/CBM basis of the structure accounting for the steel utilised. As the Principal here is the Unit but the purchaser of steel is the contractor we would like to know who has to dispose the steel scrap now under GST regime as the NSDL portal is only picking up the GSTN No of the Unit as consignor.

Can you plz give your valuable input.

There is facility to input the scrap buyers GSTN NO.,

Dear Sir

as a job worker we registered under GST we are clearing goods to domestic customer while paying gst on behalf of our principle.

whether we are eligible to avail input GST on behalf of our principle because our principle is not taking credit.

any body please clarify.

if goods sent directly to job worker from supplier on behalf of principle and input credit (GST) can avail by job worker and can clear goods directly from job worker place and while paying GST.

please let us know job work process from starting to end. we have atleast 250 items to send for job work in a month. Earlier we use 57F3 challan now what ?

me mumbai me job work shirt or pent ka kar ta hu.muje gst kitna charge karna he.

In case of job work, where job worker will add some input material during the process, value of which cannot be easily determined and Principal agrees job work charges. Whether it will be treated as composite service and accordingly GST to be charged ? Will there be any problem on a later date with respect to valuation of material & service ?

Let me clarify when the goods presently don’t lies under gst if such goods go for job work for up gradation /processing etc and after that the processed material is being used for final touch at this point whether principal is listed coming under gst for processing material?

one more i want information regarding formate of challan & register to be maintain by job worker &

principal.

above all information given by author is very useful and lot of clarity come out.

Thanks sir,

So useful constrictive atricle . Thanks from bottom of hearts for sharing with a lot of efforts n endeavours.

Helpful information with good graphical presentation which makes it more understandable.

Nicely written

I want to know, if the tax charged by the Job worker in his Invoice for the job work he has done to principal (without adding his material) whether the principal can avail the tax as Input services? At present there is no tax for job work and what will be the scenario in GST?

Thanks, very useful article

Job work Charges by job worker shall be treated as supply of service

If job worker not registered (unregistered) due to below threshold limit then service receiver (principal) liable for service tax under reverse charge?

Very well explained the whole process of Job Work under GST

Very many thanks to the author. Were looking forward to the provisions with respect to JOB WORK concepts in the CGST Act. This article has given lot of clarity. Thanks once again – See more at: https://taxguru.in/goods-and-service-tax/job-work-provisions-gst.html#comment-1958892

Very many thanks to the author. Were looking forward to the provisions with respect to JOB WORK concepts in the CGST Act. This article has given lot of clarity. Thanks once again.