BSE SME Platform achieves milestone of 400 Listed Companies

SMEs are an integral part of the India growth story, need to sensitize international investors about BSE SME: Union Commerce and Industry Minister

“BSE SME could also become a springboard for companies to get into the main exchange”

“BSE SME platform can look at setting up a platform at GIFT City”

“BSE could also offer technology services to the companies which could add lustre to the SME exchange”

Mumbai, 10 October 2022

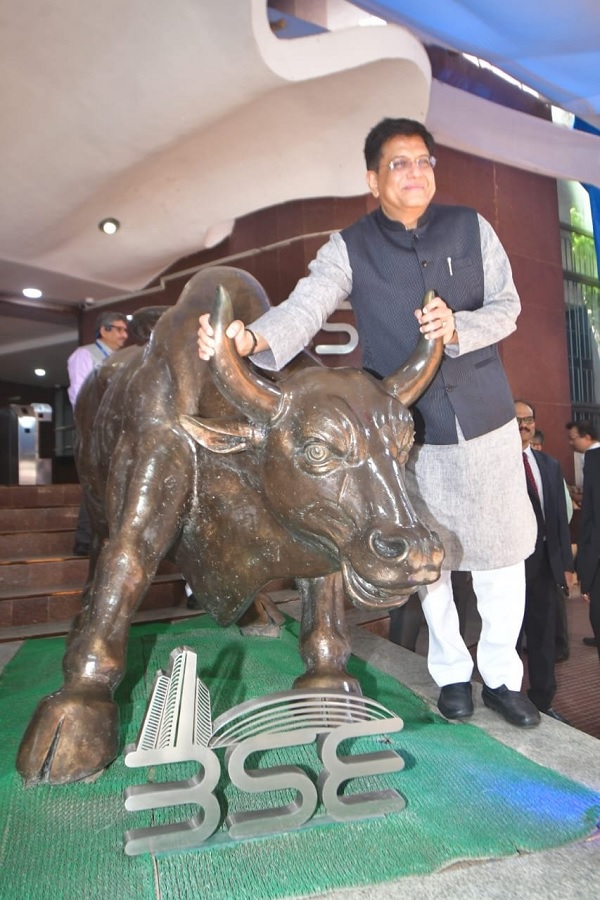

Union Commerce and Industry Minister Shri Piyush Goyal attended the Listing Celebration of the 400th company in BSE SME Platform in Mumbai today. With the listing of eight new companies in the exchange’s SME platform today, the BSE SME platform has achieved the milestone of 400 listed companies. Union Minister Piyush Goyal rang the ceremonious bell today to mark the special occasion.

BSE Ltd has set up the BSE SME Platform in March 2012 as per the rules and regulations laid down by SEBI. BSE SME Platform offers an entrepreneur and investor friendly environment, which enables the listing of SMEs from the unorganized sector scattered throughout India, into a regulated and organized sector. The listed SMEs step into the threshold of BSE SME Platform and foray in to the world of finance for further growth and development. BSE SME assists these SMEs to raise equity capital for their growth and expansion and thus help them blossom into full-fledged companies and in due time, enable them to migrate into the Main Board of BSE as per the existing rules and regulations.

Union Commerce & Industry Minister said, “400 companies is an important milestone for BSE SME platform”. “BSE SME could also become a springboard for companies to get into the main exchange”, he further added. Stating that the BSE SME platform has huge potential, he urged the exchange to get this ecosystem known across the world. “We need to market it better, also need to sensitize international investors; the international funds too need to get to know about this exchange”. He suggested that the Bombay Stock Exchange could send either some representative from the exchange or some companies listed on the exchange to be a part of industry delegations to foreign countries, so that more international investors partake in the activities of the exchange.

He said that SMEs are an integral part of the India growth story and that more collaboration and participation will add speed to the growth of this BSE SME exchange. In this context, the Minister also said, “We have more than 100 unicorns, many soonicorns are on the way to becoming unicorns, Commerce and Industry Ministry could help forge partnership between BSE and startup ecosystem. This will be good for both, help startups grow faster and help BSE enlarge platform”.

Speaking about the huge potential of this exchange, the Commerce and Industry Minister also said, “Mumbai is the place from where we hope the SME sector will get new wings, raise more capital and truly become an international centre enabling more SMEs to ramp up their growth faster”. He also suggested, “BSE SME platform can look at setting up a platform at GIFT City”.

Union Minister also urged BSE at creating an interface with the startup ecosystem. This will help them grow faster and encourage domestic capital into the startups. “Indian investors are able to hold the Indian market strong. This has demonstrated the equity culture and that capacity of Indian investors to take risks has increased”. BSE could also offer technology services to the companies which could add lustre to the SME exchange, he added.

Speaking about India’s growth story, he said, nowhere in the world do we have the opportunity of the size and scale that India offers today. “Going forward, India will lead global growth. The world is excited and bullish about the India growth story. They are looking at us with confidence, hope and commitment. Even on a business-as-usual pace, India will be a $30-$32 trillion dollar economy when we mark 100 years of Independence”. Markets have shown tremendous confidence in the India growth story, he added.

The Minister also charted out the requirements for an enabling environment for growth. It includes:

- Greater engagement with technology

- Reducing compliance burden

- Decriminalization of laws

- Promoting innovation

- Improving logistics infrastructure

- Free Trade Agreements

The Minister also mentioned that Government aimed for an orderly revival from the pandemic and industry has shown tremendous resilience. “We have reasonably handled the current geopolitical situation in light of the Russia-Ukraine conflict”.

The representatives of the eight companies which were listed today, traders, investors and industry representatives were present on the occasion. Jaipur City MP Ramcharan Bohra, BSE Chairman SS Mundra and Head of BSE SME and Start-up Platform Ajay Thakur were also present.

So far, 152 companies have migrated to the main board. The 394 companies listed on BSE SME Platform have raised Rs.4,263.00 crore from the market and total market capitalization of 394 companies as on October 07, 2022 is Rs. 60,000 Crore. BSE is the market leader in this segment with a market share of 60 percent.

Click here for details of the eight companies which were listed today.

***

SEBI came out with detailed guidelines on 18th May 2010 for launching of SME Exchange/Platform. BSE became the first stock exchange to get the approval from SEBI and launch its SME platform on 13th March 2012.

Silicon Rental Solutions Limited and Trident Lifeline Limited became the 395th company to get listed on the BSE SME Platform on October 10, 2022. Silicon Rental Solutions Limited came out with an initial public offering of 27,12,000 Equity Shares of Rs.10 Each (“Equity Shares”) For Cash at a Price of Rs. 78 Per Equity Share (The “Offer Price”), Aggregating to Rs. 21.15 Crore. The company has successfully completed its public issue on September 30, 2022.

Trident Lifeline Limited became the 396th company to get listed on the BSE SME Platform on October 10, 2022. Trident Lifeline Limited came out with an initial public offering of 34,99,200 Equity Shares of Rs.10 Each (“Equity Shares”) For Cash at a Price of Rs. 101 Per Equity Share (The “Offer Price”), Aggregating to Rs. 35.34 Crore. The company has successfully completed its public issue on September 29, 2022.

Silicon Rental Solutions Limited is Maharashtra based company whose registered office is at Mumbai. The company engaged in IT equipment outsourcing company, engaged in providing end-to-end IT equipment on a rental and returnable basis in India. The company provides laptops, desktops, printers, servers and other peripherals like CCTV cameras, projectors, storage devices, etc., mainly to small, medium and large corporate. The company provides IT renting services to the client base present in almost 16 states and 3 Union Territories across India. Silicon Rentals Solutions also has a trained and dedicated team of engineers who are capable of providing the support and maintenance of the hired equipment. Mumbai based Hem Securities Limited, was the lead manager to Silicon Rental Solutions Limited.

Trident Lifeline Limited is Gujarat based company whose registered office is at Surat. The company engaged in marketing of pharmaceutical products in domestic as well as international market. The company is also engaged in distribution of pharmaceutical products through third-party distribution network. Trident Lifeline product portfolio consists of 832 products, including Anti-Bacterial, Anti Diarrheal, Anti-Fungal, Anti Malerial, Anti Diabetic, Dental Cure, Proton Pump Inhibitor, Anti Protozoal, Anti Histamine, Anti-Hypertensive drugs, Anti Lipidemic Drug, Anti Parasitic, Multivitamin, Multimineral Nyteraceutical and Non-steroidal anti-inflammatory drug (NSAIDs). Ahmedabad based Beeline Capital Advisors Private Limited, was the lead manager to Trident Lifeline Limited.

Reetech International Cargo and Courier Limited and Cargotrans Maritime Limited became the 397th and 398th company to get listed on the BSE SME Platform on October 10, 2022. Reetech International Cargo and Courier Limited came out with an initial public offering of 11,14,800 Equity Shares of Rs.10 Each (“Equity Shares”) For Cash at a Price of Rs. 105 Per Equity Share (The “Offer Price”), Aggregating to Rs. 11.71 Crore. The company has successfully completed its public issue on September 29, 2022.

Cargotrans Maritime Limited came out with an initial public offering of 10,80,000 Equity Shares of Rs.10 Each (“Equity Shares”) For Cash at a Price of Rs. 45 Per Equity Share

(The “Offer Price”), Aggregating to Rs. 4.86 Crore. The company has successfully completed its public issue on September 29, 2022.

Reetech International Cargo and Courier Limited is Chhattisgarh based company whose registered office is at Raipur. The company engaged in Coal Supplier in India. The company’s diversified product portfolio comprises coal from Indonesia, South Africa, Australia and India, among other origins. The company supply the products to customers in various sectors i.e., Power, Steel, Rolling and other industries. An effective handling and transportation of the orders is facilitated through Road transportation and Railway. Mumbai based Gretex Corporate Services Limited, was the lead manager to Reetech International Cargo and Courier Limited.

Cargotrans Maritime Limited is Gujarat based company whose registered office is at Kachchh. The company engaged in international logistics solutions provider. The company’s core business is providing sea logistics services including ocean freight forwarding (FCL and LCL), transportation, customs clearance, warehousing and other value-added services to clients. The company operates at 4 seaports in Gujarat i.e., Mundra, Hazira, Kandla and Pipavav. Currently, Cargotrans Maritime operates a fleet of 9 owned commercial trailers for moving containers and apart from this company also hires third-party transport operators to meet the shipping demand of the customers. Mumbai based Hem Securities Limited, was the lead manager to Cargotrans Maritime Limited.

Concord Control Systems Limited and Insolation Energy Limited became the 399th and 400th company to get listed on the BSE SME Platform on October 10, 2022. Concord Controls Systems Limited came out with an initial public offering of 15,12,000 Equity Shares of Rs.10 Each (“Equity Shares”) For Cash at a Price of Rs. 55 Per Equity Share (The “Offer Price”), Aggregating to Rs. 8.32 Crore. The company has successfully completed its public issue on September 29, 2022.

Insolation Energy Limited came out with an initial public offering of 58,32,000 Equity Shares of Rs.10 Each (“Equity Shares”) For Cash at a Price of Rs. 38 Per Equity Share (The “Offer Price”), Aggregating to Rs. 22.16 Crore. The company has successfully completed its public issue on September 29, 2022.

Concord Control Systems Limited is Uttar Pradesh based company whose registered office is at Lucknow. The company engaged in manufacturing and supply of coach-related and electrification products for Indian Railways and other Railway Contractors. The company manufactures products required in railway coaches like Inter-Vehicular Coupler, Emergency Lighting System, Brushless DC carriage fan, Exhaust fans, Cable Jackets, Bellows etc. and products required in the electrification of coaches and broad-gauge network of Indian Railways like Battery Charger 200 AH, Battery Charger 40 AH, Tensile Testing Machine. Concord Control Systems Limited is an approved vendor by Research Design and Standards Organisation (“RDSO”) to manufacture and supply these products for the Indian Railways. Mumbai based Hem Securities Limited, was the lead manager to Concord Control Systems Limited.

Insolation Energy Limited is Rajasthan based company whose registered office is at Jaipur. The company engaged in manufacturing solar panels and modules of high efficiency of various sizes. The company’s 200 MW (Rated Installed Capacity) SPV Module manufacturing unit is located at Jaipur, spread over more than 60,000 Sq. ft area with the latest machinery. In addition to the manufacture of solar PV modules, the Company trades in Solar Power Conditioning Unit (PCU) which uses solar energy and power from the grid to charge batteries and tall tabular Lead Acid Batteries are used to store energy generated from the solar panels. The company is also an integrated solar energy solutions provider offering engineering, procurement and construction (“EPC”) services to our customers. Jaipur based Holani Consultants Private Limited, was the lead manager to Insolation Energy Limited.

About BSE

BSE (formerly Bombay Stock Exchange) established in 1875, is Asia’s first & now the world’s fastest Stock Exchange with a speed of 6 microseconds. BSE is India’s leading exchange group and has played a prominent role in developing the Indian capital market. BSE is a corporatized and demutualized entity, with a broad shareholder base that includes the leading global exchange- Deutsche Bourse, as a strategic partner. BSE provides an efficient and transparent market for trading in equity, debt instruments, equity derivatives, currency derivatives, commodity derivatives, interest rate derivatives, mutual funds and stock lending and borrowing.

BSE also has a dedicated platform for trading in equities of small and medium enterprises (SMEs) that has been highly successful. BSE also has a dedicated MF distribution platform BSE STAR MF which is India Largest Mutual Funds Distribution Infrastructure. On October 1, 2018, BSE launched commodity derivatives trading in Gold, Silver, Copper, Oman Crude Oil Guar Gum, Guar Seeds & Turmeric.

BSE provides a host of other services to capital market participants including risk management, clearing, settlement, market data services and education. It has a global reach with customers around the world and a nation-wide presence. BSE’s systems and processes are designed to safeguard market integrity, drive the growth of the Indian capital market and stimulate innovation and competition across all market segments.

Indian Clearing Corporation Limited, a wholly owned subsidiary of BSE, acts as the central counterparty to all trades executed on the BSE trading platform and provides full novation, guaranteeing the settlement of all bonafide trades executed. BSE Institute Ltd, another fully owned subsidiary of BSE runs one of the most respected capital market educational institutes in the country. Central Depository Services Ltd. (CDSL), associate company of BSE, is one of the two Depositories in India.

BSE has set up an Investor Protection Fund (IPF) on July 10, 1986 to meet the claims of investors against defaulter Members, in accordance with the Guidelines issued by the Ministry of Finance, Government of India. BSE Investor Protection Fund is responsible for creating Capital markets related awareness among the investor community in India.

*****