How to Verify your PAN on New Income Tax Portal – FAQs

Q.1 Why do I need to verify my PAN?

Ans. You can verify your PAN to:

-Check if the details of your PAN, such as name on the PAN card, date of birth are same as the details available in the PAN database.

-Validate if your PAN is active or not.

Q.2 Do I need my mobile number registered on the e-Filing portal for PAN verification?

Ans. You can use any valid mobile number accessible to you during the verification on which you will receive an OTP (valid for 15 minutes with a maximum of three attempts).

Q.3 Is there a limit to the number of PANs which can be verified with a single mobile number for an individual taxpayer?

Ans. Yes. You can verify a maximum of 5 different PANs using one mobile number in a day.

Q.4 As an external agency, can I validate PAN of a user?

Ans. Yes, Verify PAN service is available for all registered users including external agencies. Bulk PAN / TAN verification is a separate service for external agencies that requires the approval of the department.

Q.5 How can I see my PAN details online?

Ans. You can visit the Know your PAN service available in the e-Filing portal. You can also use this service to check if your PAN is valid or not.

How to Verify your PAN on New Income Tax Portal – Manual

1. Overview

Verify Your PAN is a pre-login (login to the portal is not required) service on the e-Filing portal for all users other than External Agencies. External Agencies can access this service after log in. With this service, you can:

- Check if the details of PAN, such as Name on the PAN card, Date of Birth etc. are correct or not

- Verify if PAN is active

2. Prerequisites for availing this service

- Valid PAN

- Valid mobile number (accessible to you)

- For External Agencies: Registered user on the e-Filing portal with valid user ID and password

3. Step-by-Step Guide

3.1 Verify Your PAN

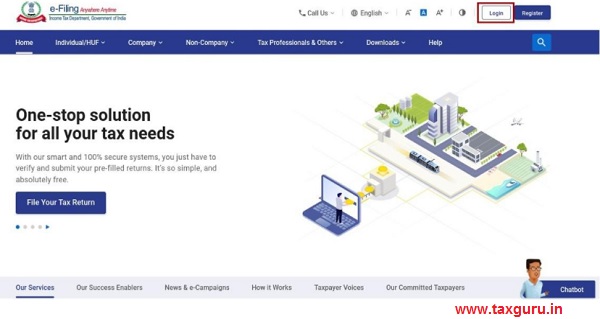

Step 1: Go to e-Filing portal homepage.

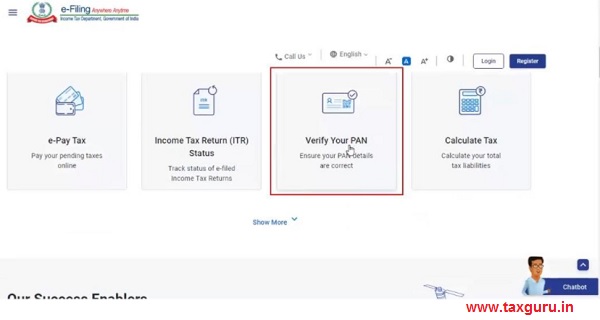

Step 2: Click Verify Your PAN on the e-Filing homepage.

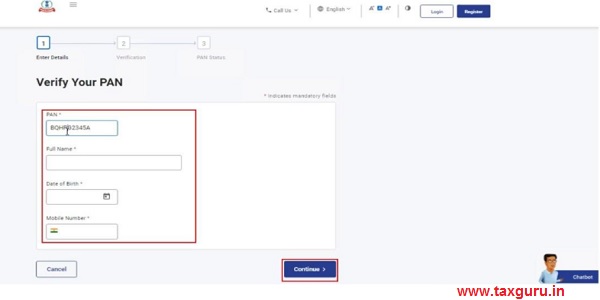

Step 3: On the Verify Your PAN page, enter your PAN, Full Name, Date of Birth and Mobile Number (accessible to you) and click Continue.

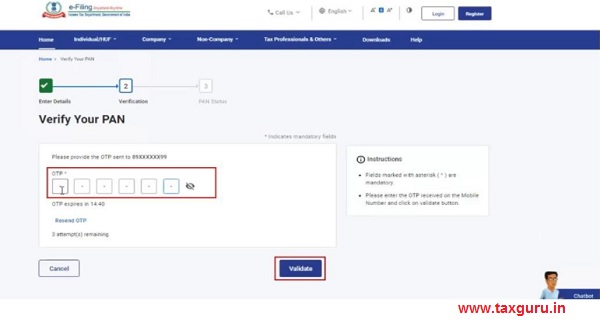

Step 4: On the Verification page, enter the 6-digit OTP received on the mobile number entered in Step 3 and click Validate.

Note:

• OTP will be valid for 15 minutes only.

• You have 3 attempts to enter the correct OTP.

• The OTP expiry countdown timer on screen tells you when the OTP will expire.

• The OTP timer displays the time remaining to regenerate an OTP. On clicking Resend OTP, a new OTP will be generated and sent.

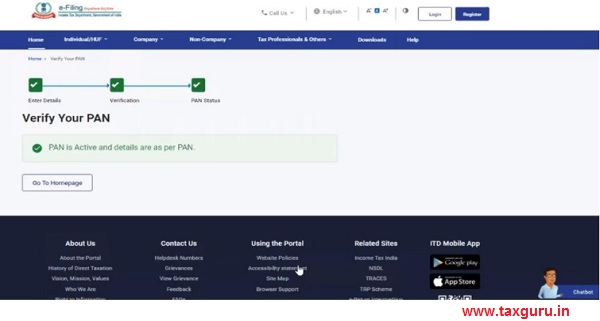

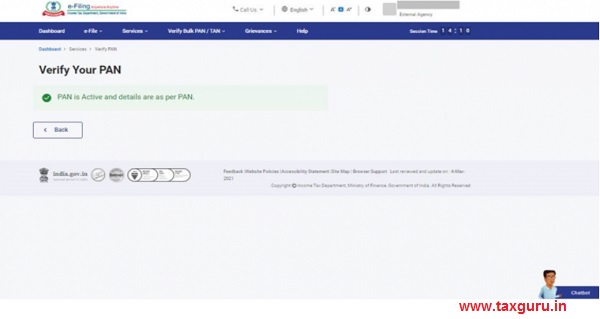

On successful verification, your PAN status will be displayed.

3.2 Verify PAN for External Agency

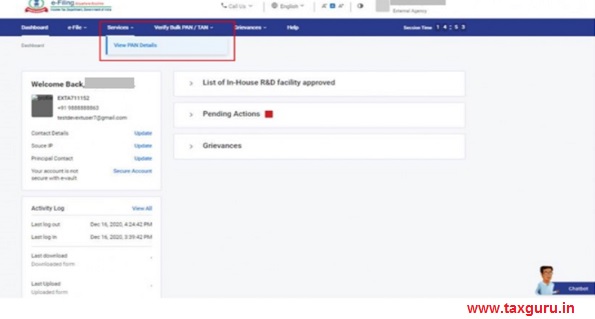

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: Click Services > View PAN details.

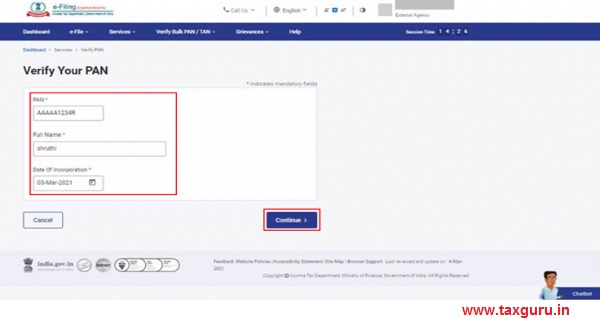

Step 3: On the Verify Your PAN page, enter the PAN (which you want to verify), Full Name and Date of incorporation (DOI) / Date of Birth (DOB) and click Continue.

On successful validation, PAN status will be displayed.

. Correct date of birth as per PAN Card not shown. How to rectify or edit?