Facts of the case

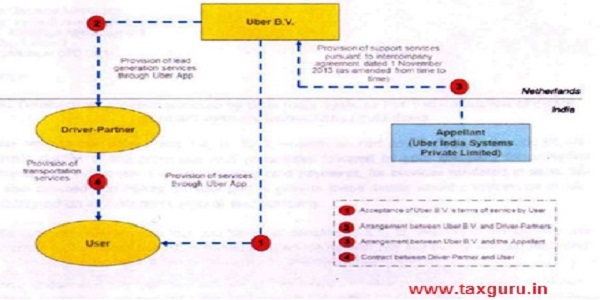

– Uber Technologies Inc. is a company incorporated in USA and owner of Uber Application (“Uber App”) and has granted license of the Uber App to a company incorporated in the Netherlands namely, Uber B.V. to soperate the Uber App worldwide in India (Excluding USA).

– Uber group had set up a subsidiary namely, Uber India Systems Private Limited (UISPL) in India (i.e. the -assessee company) to market and promote the use of the Uber App in India and provide support services in connection with the same.

– Uber B.V. engaged UISPL to provide support services under an Intercompany Service Agreement for an arms length consideration i.e. cost plus 8.5%.

– The support services provided by UISPL includes inter alia promotion of the Uber app amongst potential customers and performing certain business support services such as Driver verification, documentation relating to registration of Driver partners, and other incidental support service-

– Diagrammatic representation of their business model is as under-

– RBI issued a circular dated 22nd August 2014, which provides that if Driver Partner and User are in India, then payment cannot be collected by UBER B.V. in a bank account outside India and thereafter, UBER B.V. permitted UISPL to open a bank account in India to undertake collection and disbursement function on behalf of UBER B.V. for a fixed monthly consideration of Rs. 5 lakhs.

Contentions of the CIT(A)

– UISPL (i.e. the assessee company) is the face of Uber B.V. in India as everything outside the app is done by UISPL and collection and disbursement function is being done by UISPL.

– UISPL is the person responsible for making payment to Driver- Partners as the bank account from which the payment is made is in the name of UISPL.

– The transaction between the Uber B.V. and the Driver-Partners is specifically covered by Circular No. 558 which provides for deduction of tax at source under section 194C of the Act.

Observation by ITAT

– Following three conditions are required to be fulfilled to conclude that UISPL is required to withhold tax u/s 194C-

| Conditions of Section 194C | Finding by Tribunal |

| 1. UISPL should be the ‘person responsible for paying’ as per provisions of Section 204 of the Act | UISPL is not “the person responsible for paying” for the transactions that are facilitated between a User and a Driver-Partner through the Uber App since the amount paid in cash is directly paid by user to driver partner and UISPL is not involved in transaction, then how the very same UISPL could be treated when the person responsible for payment when the user decides to make payment through digital means. |

| 2. The disbursement made should be in pursuance for carrying out any work by the Driver-partners for USIPL | Role of UISPL is limited to act as a payment and collection service provider of Uber B.V. whereby the ride fare is collected by UISPL in its bank account on behalf of Uber B.V. and thereafter payments are made, on the instruction of Uber B.V., to Driver-Partners. |

| 3. There is a contract between Driver-Partners and USIPL for the said work | It is User who enters into a contract with the Driver-Partner pursuant to which the transportation service is rendered by the Driver-partner to the User. |

Further, the amendment made by Finance Act 2020 in section 204 of the act by way of insertion of clause (v) thereon is as under-

Section 204 – For the purposes of the foregoing provisions of this Chapter

and section 285, the expression “person responsible for paying” means-

(i) …………….

(ii) …………….

(iii) …………….

(iv) …………….

(v) in the case of a person not resident in India, the person himself or any person authorized by such person or the agent of such person in India including any person treated as an agent under section 163.

– If the version of the revenue is to be accepted by holding that UISPL would be person responsible for paying‟ as it was making payment to Driver-Partners on behalf of Uber B.V. (Non-resident) and that the said provision was always there in the statute, then there would be absolutely no necessity for the parliament to even introduce this amendment by way of insertion of clause (v) in section 204 of the Act in the Finance Act 2020 with effect from 1.4.2020.

– If the contention of the revenue is to be accepted then the entire amendment inserted by finance act 2020 in section 204 would be

Conclusion

– It could be safely concluded that UISPL cannot be treated as a “person responsible for paying‟ for the purpose of section 194C read with section 204 of the Act, for more than one reason and also the provisions of section 194C of the Act cannot be made applicable thereon.

– Hence the assessee company i.e. UISPL cannot be treated as an “assessee in default‟ and no order could be passed u/s 201/201(1A) of the Act in its hands for the years under consideration.

Hi, drivers are loosing interest driving ola & uber due to low payment so they are interested in local fare, at present what they are receiving can’t manage their livelihood & car 🚗.

Your good office should think about it 😓