Transfer pricing study- A Simplified Overview

Since 1991, with the liberalization of trade and foreign exchange policy India has started integrating its economy with global economy. With the growing MNEs interested in India, it has become imperative for tax authorities in India to take cognizance of transfer pricing issues. The Transfer pricing Regulations (TPR) were introduced in India vide introduction of new sections 92A to 92F in the Income Tax Act (‘Act’) and relevant rules 10A to 10E in the Income Tax Rules, 1962.

All income acquired by the company by means of any international transaction shall be calculated at arm’s length price. There are various methods like resale price method, cost plus method, comparable uncontrolled price method, and transactional net margin method to calculate the arm’s length price depending on the nature and type of the transaction, the nature of the group or the association involved, or any other features of the transactions involved.

Transfer Pricing Study

A transfer pricing study examines the pricing of transactions between related two or more associates. By applying and documenting various test methods, it is determined whether the transactions are conducted under market conditions and survive the scrutiny of tax authorities. A study of transfer pricing shall justify how a particular method is selected for enterprises and transactions being reviewed. We can understand the concept of Transfer pricing Study with following Example:

Suppose Mr X who’s son just have qualified CA ,looking for Brides for his son came to you and ask to search daughter in law for his son, Before you search for bride ,Very Firstly you will know about Family of Mr X or Say Grooms family, what Grooms father and mother do ,in which part of country do they live ,what is their income, what is their profession from where actually they belong, how many relatives are there in their family etc , once you know about Grooms family , you will try to know about groom like what is his profession of Groom , how much he earn, what is his expectation about Bride etc

Once you aware about Groom and Groom Family, you will check with internal relatives or nearby areas first to find any Girl ( Bride ) comparable for Boy and if internal comparable is not there than you will go to matrimonial site and other external sources to find match for groom.

There are very few chances to find exact comparable as some features of Bride will not be liked by Boy itself, some factors will not be liked by Boy’s parents or boy’s Grand parents so if you go for exact match there are very little chances to find exact match , so one has to compromise on some features, and in this way you will be able to find most Appropriate match.

Same fundamentals are there in case of transfer pricing study. In case of Transfer pricing, MNE client come to you and ask you to find the most appropriate comparable for its product and make Transfer Pricing Study. In Transfer pricing, term “Match making exercise” is called “FAR Analysis” and term “Bride family” you searched for is called “Tested Party”.

FAR Analysis

In FAR Analysis we try to understand FUNCTION, ASSETS AND RISK borne by our customer first, once we understand FAR of our customer, we find out the tested party and method of arms Length Price. There are three part of FAR Analysis :

1. Functional Analysis

2. Asset Analysis

3. Risk Analysis

FUNCTIONAL ANALYSIS

In functional Analysis we make categorization and sub categorization of entity function it do, once we understand the business/ function we can know lot about the value chain of organization. Whether entity is Manufacturer, Distributor or Service Provider , If it is a manufacturer – whether it is full fledge manufacturer, contract manufacturer, and licensed manufacture…….etc. If it is a distributor – whether it is a dealer, sub dealer, Retailer, limited risk distributor, local /state/ National level / International level Distributor…. etc

Once you complete such type of categorization / sub categorization, one can understand the value chain / supply chain of functions performed

ASSET ANALYSIS

In Asset Analysis it is evaluated about Assets Deployed by MNE for international Transaction or Specified domestic Transaction , If Entity has small set-up or large set-up, Once you aware about assets deployed and size of setup of Entity , one can search comparable or say tested party easily , one can’t compare small set-up entity with large set-up entity . Typically Business Assets (List is illustrative not exhaustive) an entity employ are

| Tangible | Intangible |

| Building | Goodwill |

| Plant/ Machinery | Patents / Trademark |

| Office Equipment | Customer List |

| Vehicles | License/ Copyright |

| Receivable | |

| Inventory | |

| Working Capital |

RISK ANALYSIS / RISK ASSESSMENT

“Higher the risk – Higher the profit”, no one understand this quote better than study of transfer pricing. Risk analysis is the integral part of Transfer pricing, An enterprise accept and manage risk with a view to generate economic benefits/ profits thus assuring its continuity , The assumption of higher risk would arguably be compensated by a greater return expectations, actual return depend on the actual realization of risk. While a company (MNE Group) is compared to other independent entity , it is important that both companies are at the same level of risk or such risks are adjusted to eliminate any material differences else the return on both the transactions would be incomparable.

So we can find the tested party who assume the same level of risk, if risk assumed does not match or we don’t find entity assuming same level of risk we have to make adjustments because Profit of higher risk entity can’t be compared with profit of lower risk entity . Following are some typical risk assumed by an entity:

I. Market Risk

II. Environment Risk/ Business Risk

III. Technology risk

IV. Credit Risk

V. Foreign Exchange Ri0sk

VI. Warranty/ performance risk

VII. Manpower risk

VIII. Capacity utilization risk

During Risk Analysis one also check if Entity itself is capable of taking such risk or anybody else is taking risk on its behalf, whether Entity is the self authority for own decision making or anybody else is taking its decision .

Documentation of FAR Analysis

Whatever documents, financials, information you have reviewed to do FAR Analysis, whatever analysis or Working you did to reach conclusion during FAR Analysis , all working you have done to arrive at ALP which will be the most important part of Transfer Pricing study, all such documentation and information should be kept properly and will be important part of Transfer pricing study. All these document and information will be submitted to Transfer Pricing Offer while Income tax assessment,

What is Tested Party

A Participants in an international transaction with whose reference the international transaction is tested , Selection of tested party influences the most appropriate method to be selected .Entity performing the least complex function and not owning any valuable intangible is normally selected as the tested party. Normally least complex entity selected as the tested party as testing of margin of such entity would require least adjustment. Selection of comparable is based on economic characterization of the tested party

In case of Resale Price and Cost Price Method we compare Gross Margin with third Party and in Profit Spilt Method and Transaction Net Margin Method we compare net Margin to reach Arms length Price. For Comparing profit, it is very necessary that party with which we are comparing must be of similar Nature. If It is not of similar nature, comparison of Profit is not feasible. For Example if your Multinational Entity Client has turnover of INR 100 cr and you are comparing its Profit with Entity having turnover of INR 1000 Cr , It is not feasible , if you will compare it you have to make so many assumptions /Adjustments to reach on conclusion , Similarly if your MNE Client is full fledge Manufacturer and seller and you are comparing with Entity who is a Distributer , it will not be feasible as Functional Analysis is not possible with Tested party at all and in such case Profit comparison will become so complex , it will become too difficult to justify your assumptions at time of Assessment in front of Transfer Pricing officer and you will not be able to justify your arms length price. Hence we should select Tested party in such way that

- It should be least complex

- It is possible to have reliable comparable

- It can justify Profit in front of Transfer Pricing officer

- Function ,Assets and Risk should be of similar Nature and have least complex FAR analysis

You can avoid litigations if you make simplified comparable. The more complex comparable, the more chances are there to go in to litigation.

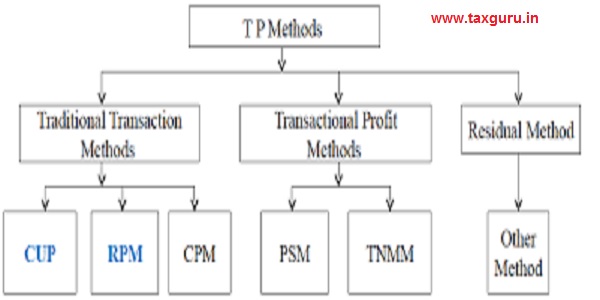

Method of Transfer Pricing u/s Section 92C/10B/AB

The Organization for Economic Co-operation and Development (OECD) outlines five main transfer pricing methods that MNEs and tax administrations can use. The Indian TP Regulations require computation of ALP based on the prescribed TP methods.

OECD said there are case where earlier five methods are not suitable to justify the transaction, in that case assesses should be allowed to use other method through which it can justify its arm’s length price suppose any new brand of USA come to India for which no comparable is there, in such case Entity can use any other method to justify its arms length price. In TP Study it is compulsory to mention the justification / reason of acceptance or rejection of method.

1. Comparable Uncontrolled Price Method ( CUP Method)

2. Resale Price Method

3. Cost Plus Method

4. Profit Split Method

5. Transaction Net Margin Method

CUP Method 10B (1) (A) / OECT TP Guideline para 2.14.

CUP Method compare the two to reach on Arms Length Prices :

- The price charged for property or services Transferred into a controlled Transaction

To

- The prices charged for property or services transferred in a comparable uncontrolled transaction in comparable circumstances

Types of CUP

CUP can be either ‘Internal’ or ‘External’

Internal CUP: – Internal CUP is available when the tax payer enters into a similar transaction with unrelated parties, as is done with related party.

External CUP: – External CUP is available if a transaction between two independent enterprises takes place under comparable conditions involving comparable goods or services. As per OECD TP guidelines, Internal comparable is preferred over External comparable

CUP Method is most reliable method

In other method we start to drive price but in CUP Method, price is already thee we just have to compare it . In case where CUP Method can be applied with other transfer pricing methods, CUP Method is preferable , but while using CUP Method , first condition which should be fulfilled is “Product and market conditions should be of similar nature, if product and market condition are not similar than it will impact price of product and price will not be comparable. Example of some attributes are :

I. Branded Vs Generic Product

II. Geographical difference ( Price in Delhi may differ than price in Mumbai)

III. Warranty product vs. non Warranty product

IV. After sales support and duration of after sales support

V. Quantity ( Buying one laptop Vs buying 100 laptops)

VI. FOB Value Vs CIF Value

VII. Credit Terms ( One month Credit Vs 3 months Credit)

If there are differences in similarities , Market condition or any other terms and conditions than one should check whether reasonable adjustment can be done to uncontrolled prices , if yes than use CUP method if attributes are not similar and reasonable adjustment can’t be done that one should use any other method. Practical examples where CUP Method can be used are

- Interest rate charged on group loan

- Royalties

- Sale of listed securities,

- Back office services where hourly rate could be compared

Resale Price Method

As it appears from name, in this method one compare its prices with price at which Associated Enterprise resale the product to third party and find out the margin getting from this sale to third party and that margin is reduced from resale price between two or more associated enterprise to reach on Arms length prices

In Resale price method, one compare gross profit margin, For comparing gross profit margin it is necessary to have same function and same scale , similar assets and Risk of Tested party. Here it is the point to note that functional comparability is more important than product comparability in this method. If you compare the GP Margin of Distributor with Manufacturer than it is not comparable at all. Material differences which will/can affect GP Margin are:

a. Sales volume

b. Lever of Risk undertaken

c. Contractual Terms

d. Marketing / Advertising Services

e. Accounting Practices

f. Inventory level

We can understand it with following Example ;

| Sale Price to NON AE | 100 | Sale Price to NON AE | 120 |

| Purchase from AE | 80 | Purchase from NON AE | 85 |

| GP in controlled Transaction | 20 | GP in controlled Transaction | 35 |

| Percentage | 20% | Percentage | 29.16% |

COMPUTATION OF ARMS LEGNTH PRICE

| Sale Price to NON AE | 100 |

| Arms length GP Margian | 29.16 |

| Arms length Purchase Price | 70.84 |

Note : The amount that remains after the margin has been subtracted and fair adjustments have been made (e.g. expenses like customs duty have been taken into account) is the arm’s length price for the original transaction between related entities. If a distributor offers a warranty and sells the product at a higher price to account for that warranty, then they will make a higher gross profit margin than a distributor that does not offer a warranty and sells the product at a lower price. For the two transactions to be comparable, the taxpayer must make accurate adjustments to the transaction cost to account for the margin discrepancy

APPLICABILITY : Resale price method is the Most Appropriate Method for distributor to benchmark international transaction under trading activity involving purchase of goods and reselling the same without adding value to such goods. The tribunal also held that comparable set should be to such comparable companies for which GP Margin can be computed without allocation / truncations

COST PLUS METHOD :

As it appears from name, In this method organization margin charges by third party and add that margin to cost charges to Associated Enterprises to reach Arm’s length prices

In this case Arms Length Price will be 100+15 i.e. 115

CP Method often used where semi finished goods are transacted between AEs or when related entities have long term arrangement for buy and supply. The supplier’s costs are added to a markup for the product or service so that the supplier makes an appropriate profit that takes into account the functions they performed and the current conditions of the market. The combined price is the arm’s length price for the transaction.

TRANSACTION NET MARGIN METHOD :

TNMM Method assess the Net Profit against an appropriate base such as sale or assets and use the same net profit indicator for comparable transaction for Example – An independent enterprise sale IT Equipment with technical support , Price of technical support is included in price of IT Equipment which can’t be separated , An AE sell the same product but does not offer support so the GP Margin is not comparable . It this case AE will assess net margin to sale of that Independent enterprise and find the transfer price/ Arms length price

This method is often used for low risk routine like services such as manufacturer and provision of Administrative support services, we can understand it with one more example :

Company X provide administrative support service such as invoicing and book keeping , company Y which is AE of company X Ask to provide invoicing services, Company X know its cost of one hour of services Rs 125000 for 1000 Hours, but company X wondered what transfer price is should charge to Company Y . There are many companies who provide such services including company B Who provide exact same services and same business model so company X look at Enterprise B to determine a good arms length price and find the cost plus margin of company B.

Profit & Loss of Enterprises B

| Revenue | 500000 | |

| Labour cost | 225000 | |

| Office Exp | 100000 | |

| Selling & Advt Exp | 75000 | 400000 |

| EBITA ( Net Profit to Sale) | 100000 | |

| Net Profit Percentage | 25% |

Computation of Arms Length Price

| Cost of Company X | 125000 |

| Net Profit Percentage @25% | 31250 |

| Cost | 156250 |

So Arms Length Price will be 156.250 per hour

Comparison of three methods

| Particular | RPM | CPM | TNMM |

| Profit Level | GP/Sale | GP/Cost | Operating Margin/ Sale |

| Tested Party | Purchase from AE , Resale to Non AE without significant value addition | Supply to AE done not carry routine tangible | Least complex |

| Comparison at | Gross level | Gross Level | Net Level |

If Tangible are comparable than you can go for TNMM Method but if comparable is too complex than TNMM is not advisable.

PROFIT SPILT METHOD (PSM)

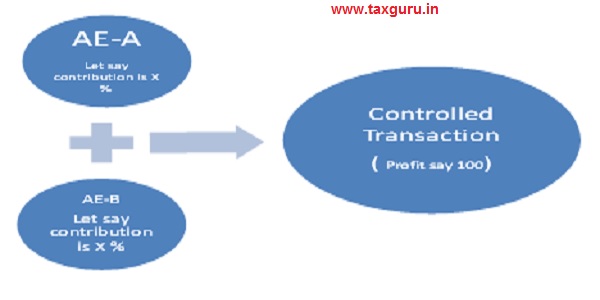

In this method we check how independent enterprise split this profit in uncontrolled transaction and on the basis of that we reach of arms length price. There are two approach that can be taken for splitting profit :

- Contribution Analysis ; Combined profit are divided based on relative value of function performed , asset used or Risk Assumed

- Residual Analysis ; Firstly each entity allocate arms length computation and residual profit divided based on analysis of Facts and circumstances

Profit of AE-B : (100* Y%)

Profit of AE-A : (100* X%)

Use of Multiple Year Data

Originally, the TP Regulations did not provide for using data of years other than the year in which transactions were undertaken (except in certain specific cases). The CBDT has amended the Rules and now permitted use of ‘multiple year data’ while performing a benchmarking analysis. If certain conditions are satisfied, the taxpayer shall be permitted to use comparable data of 2 years preceding the relevant fiscal year along with that of the relevant fiscal “current” year.

These are the five transfer pricing methods, and the one favored by the OECD. The option that an organization chooses to use depends on the particular situation. It should take into account the amount of relevant comparables data that is available, the level of comparability of the uncontrolled and controlled transactions in question, and whether a method is appropriate for the nature of a particular transaction (determined through a functional analysis). The OECD states that it is not necessary to use more than one transfer pricing method when determining the arm’s length price for a particular transaction.

Very interesting and knowledge able article briefing transfer pricing study