Notification No. 10/2005, Dated 24-1-2005

It is notified for general information that the enterprises/undertakings, listed at para (3) below have been approved by the Central Government for the purpose of section 10(23G) of the Income-tax Act, 1961, read with rule 2E of the Income-tax Rules, 1962 with effect from the Assessment Year 2002-03 to Assessment Years indicated in para 3 below i.e. upto the end of the periods specified in the agreements dt.29.11.2001 between the Govt. of Maharashtra, Ashoka Buildcon Pvt. Ltd and M/s Ashoka Highway Ad or earlier in the event of violation of the agreements aforesaid.

2. The approval is subject to the conditions that —

(i) the enterprise/undertaking will conform to and comply with the provisions of section 10(23G) of the Income-tax Act, 1961, read with rule 2E of the Income-tax Rules, 1962;

(ii) the Central Government shall withdraw this approval if the enterprise/undertaking:-

(a) ceases to carry on the eligible business as defined in Explanation (b) to Rule 2E of I.T. Rules, 1962; or

(b) fails to maintain books of account and get such accounts audited by an accountant as required by sub-rule (6) of rule 2E of the Income-tax Rules, 1962; or

(c) fails to furnish the audit report as required by sub-rule (6) of rule 2E of the Income-tax Rules, 1962.

3. The enterprises/undertakings approved are—

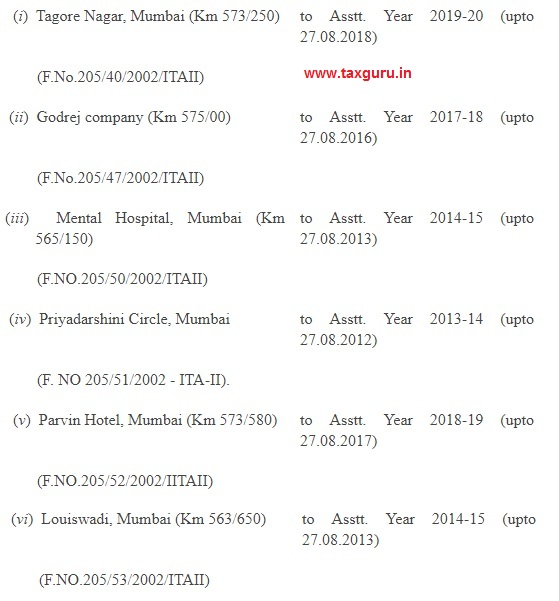

M/s Ashoka Highway Ad, 1/ 2, River View, Gharpure Ghat, Ashok Stambha, Nashik-422002 (Maharashtra) for their projects of construction of foot over-bridges across Eastern Express Highway in Mumbai on Build Operate Transfer (BOT) basis (with advertisement rights) at:

All the agreements dt.29th November, 2001 for the projects as above are on Build, operate and Transfer (BOT) basis between the Government of Maharashtra, M/s Ashoka Buildcon Pvt Ltd and M/s Ashoka Highway Ad.(F.No.205/40/2002-ITAII)

[F.No205/40/2002-ITAII]