1. The Income Tax Department has launched its new e-filing portal https://www.incometax.gov.in On 7th June 2021.

2. The new e-filing portal has a simplified feature to download Form 26 AS.

3. FORM 26AS: Form 26 AS is the most important document required before filing Income Tax Return (ITR). This Form is also known as the annual consolidated statement, which contains all tax-related information of the taxpayer i.e., details of tax deducted at source, advance tax, etc.

4. Here is a Step-by-Step Guide to download or view Form 26 AS from Income Tax new portal:

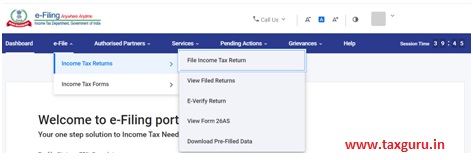

(a) Log in to ‘new income tax Portal https://www.incometax.gov.in by clicking on login button at Top Right Corner of website

(b) Go to the ‘e-File’ / Income Tax Returns / menu, click ‘View Form 26 AS (Tax Credit)’ link.

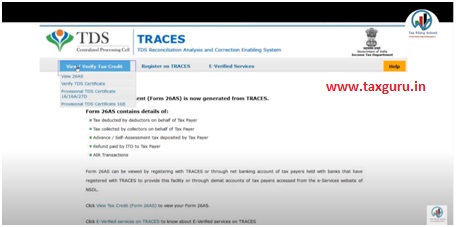

(c) Read the disclaimer, click ‘Confirm’ and you will be redirected to TDS-CPC Portal.

(d) In the TDS-CPC Portal, Agree to the acceptance of usage. Click ‘Proceed’.

(e) Click ‘View Tax Credit (Form 26AS)’

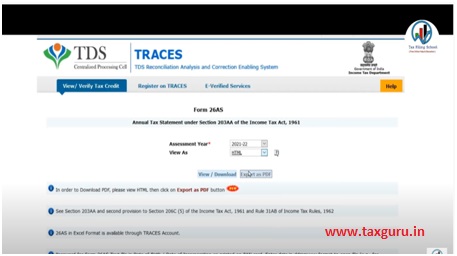

(f) The author can be approached at caanitabhadra@gmail.comSelect the ‘Assessment Year’ and ‘View type’ (HTML, Text, or PDF). Click “View/Download”

(g) To export the Tax Credit Statement as PDF, view it as HTML> click on Export as PDF and you will be able to download your form 26AS in PDF Format.

The author can be approached at caanitabhadra@gmail.com

1) takes many days for 26AS deails translated into tax deposit in new portal

2) in my case one bank details is duplicated. not clear how to remove duplicate

3) The grievance accepted is not resolved even after 20 daysl.

What was the shortcomings in the old sites ? I think it was quite user friendly . Moreover the general public which is busy in different day to day activities , somehow manages to file the IT return after having the understanding of the site . By the time people have some proper understanding of IT site the authorities amends the same , may be to show their intelligence .In new software where is offline option and from where we can download the ITR form 1,2,3,4 etc.This is very confusing one, let be active older one is more friendly.

Filed returns Acknowledgment downloads are not available.

Message reads:

“Down load forms will available enabled Shortly!

Bank needs this for Loan release……

Not able to down load 12 AB or 10 A form and no way I am able to fill in the new 7June launched incometax web site

It was announced that the statement 26AS would capture all data such as salary income, interest earned from bank deposits etc, TDS info, ST/LT gains/losses etc. However I find that ST/LT gains/losses are not shown.

It will capture. It seems the concerned Agencies have not yet submitted the details to the Authorities.

New income tax site is not user friendly. It confuses the user.

The present website is cumbersome compared to earlier e filing website. Surprisingly it says there’s mismatch between PAN and Aadhar details but doesn’t specify the defects and how to rectify. God knows what’s in store when we go for filing e return !!

The old income taxes filing site was very much user friendly than the latest one which is just waste of time to operate and too much s clamsy.

I could complete my e-filing today. Regret to say that I am unable to proceed for e-verification through my Aadhar OTP. After inputting OTP number, system shows some errors. What to do?

What was the need for a new I T site when the old one was perfectly serving the purpose and the general public has been able to understand it to some extent .

New portal is bogus,most clamsy and non performing one.Users are disgusted and frustrated.Job was given a company which knows nothing about income.There must something underground.Users have to suffer.

What was the shortcomings in the old sites ? I think it was quite user friendly . Moreover the general public which is busy in different day to day activities , somehow manages to file the IT return after having the understanding of the site . By the time people have some proper understanding of IT site the authorities amends the same , may be to show their intelligence . They should realize that the assesses are not left with this job only .

Sir

The old it web site was for better than this new one.Infosys is not easy nd user friendly as usual.

Ask vendor to make it simple,smooth nd user friendly

Thanks

Site is childish worthless old was far better fast and responsive. New one is headache says data does not march on login whereas as per PAN and Aadhar both shows same. Wastage of time. 0 value site

The IT Deptt as usual has not applied their mind. Every new application has teething troubles should have been anticipated. This confusion perhaps is created at the time of tax filing delebrately to help CAs &Tax Consultants to loot the honest tax payers who were filing the returns w/o any such help earlier. GREAT ITD of Govt of India. Someone need to think does it simplify the filing or complicate it.

New portal is horrible, profile is corrupted.AS 26 is not updated.Best way is to postpone it till it stabilises and then announce commencement.Any way one can file return in September.

The government had promised an easy taxation system to increase compliance and tax base. However they have created more confusion than ease.

Firstly 2 taxation slabs called as NEW and OLD were introduced creating confusion amongst tax payers.

Then came the JSON in place of XML to enhance the pain.

Now to top it up this non functional upgraded version.

The new website doen not load properly and is extremely slow. The data captured of previous ITRs is also not viewed adequately.

The profile update is not 100% due to mismatch of profile and PAN addresses. Though the addresses are same, there is a variation as the Aadhaar, PAN and ITR Profile address performa sequencing are not identical. It would be ideal if both PAN and Profile address update is done through Aadhaar Offline E-KYC XML file, so that they are identical.

It would have been more prudent to do this upgrade in-between the 2 ITR seasons i.e. from Nov to Mar, to avoid any disturbance and confusion. Doing this upgrade just at the commencement of ITR filing is bound to creat problems, delays and extension of timeline subsequently.

The launch too has not been smooth inspite of spending about 4500 crores on this project.

Site not opened, please update every transaction, if it’s auto populated burden of assessee will be reduced.

Loading of any page takes atleast 10 minutes. In profiles, address doesn’t show correctly. Lot of people have trouble till it establishes and complaints are attended seriously.

This new system should have been started from AY2022 23.

Not sure whether 26 AS covers the portion of payments where no TDS is deducted by the payer e g. LIC Pension for old policies to ensure we don’t leave any thing.

Thank you Madam for this information.

The new portal developed by income tax department is not user friendly. It was very slow. I found the one is better.

Thanks

Do not File ITR now as TDS returns have not yet filed by the deductors and your 26AS will not reflect the tax deducted

Thank you

THANK YOU FOR THE INFORMATION. NEW PORTAL NOT WORKING PROPERLY. THE OLD ONE IS MORE CONVENIENT AND USER FRIENDLY. IT HAS GLITCHES LIKE THE GSTN PORTAL INITIALLY HAD. UNABLE TO FILE RETURN ITR-4.