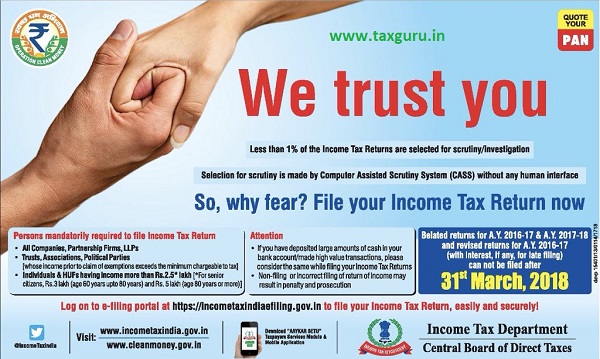

Less than 1% of the Income Tax Returns are selected for scrutiny/investigation

Selection for scrutiny is made by Computer Assisted Scrutiny System (CASS) without any human interface

So, why fear? File your Income Tax Return now

Persons mandatorily required to file Income Tax Return

♦ An Companies, Partnership Firms, LLPs

♦ Trusts, Associations, Political Parties

[whose income prior to claim of exemptions exceeds the minimum chargeable to tax]

♦ Individuals & HUFs having income more than Rs.2.5*lakh [*For senior citizens, Rs. 3 Lakh but (age 60 years upto 80 years) and Rs. 5 lakh (age 80 years or more)]

Attention

- If you have deposited large amounts of cash in your bank account/made high value transactions, please consider the same while filing your Income Tax Returns

- Non-filing or incorrect filing of return of Income may result in penalty and prosecution

Belated returns for A.Y. 2019-20 and revised returns for A.Y. 2019-20 (with Interest, If any, for late filing) can not be filed after 31st March, 2020.

Log on to e-filing portal at https://Incometaxindlaefiling.gov.in to file your Income Tax Returns, easlly and securely!