File No.CT/10077/2019-GSTINFO1

User Manual for Kerala Flood Cess (KFC) Annual Return

1. Menu

Click the ‘Annual Return’

2. List of pending annual return

List of pending annual returns will be available and one can proceed by clicking the button ‘Prepare online’

3. Annual Return Filing Page

On clicking the ‘prepare online‘ button the following page will be displayed

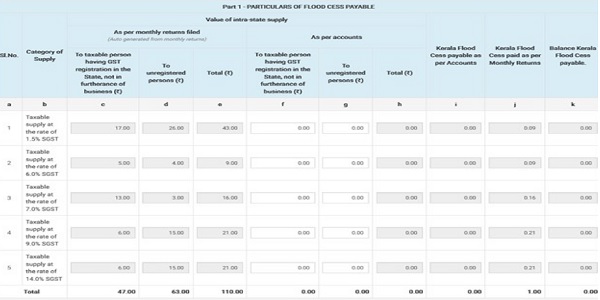

Return filing page is divided into 4 sections /parts

Part 1

Data as per monthly returns filed will get populated in part 1 of annual return. Values as per the books of accounts have to be filled up and balance Cess payable will be shown in the ‘ Balance Kerala Flood Cess Payable’ column ‘K’

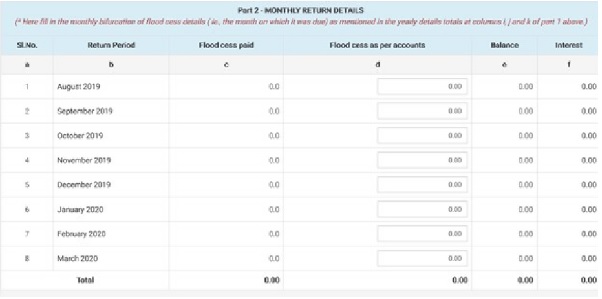

Part 2

In this section monthly bifurcations of flood cess have to be filled up, ie the month on which the KFC was due. The total figures in Part 2 have to be same as the figure in column K of part 1

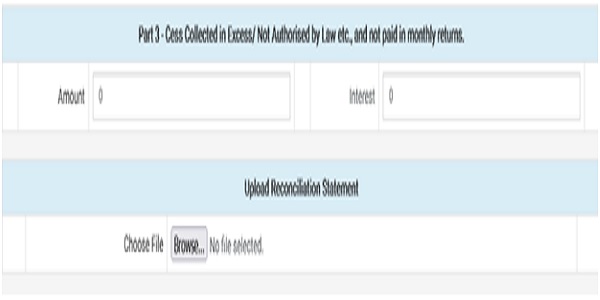

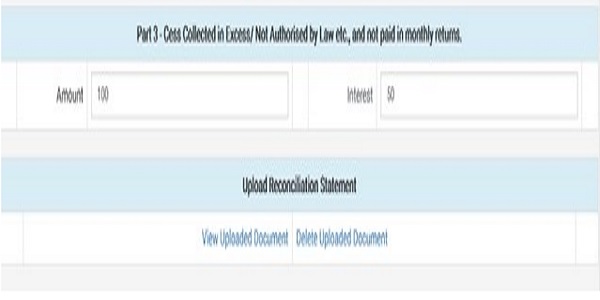

Part 3

In this section, cess collected in excess/not permitted by law etc, not paid in monthly returns can be remitted by filling up the cess amount and interest accrued. Reconciliation statement can also be uploaded here.

Reconciliation Statement is limited to maximum of 3 MB in PDF format is allowable.

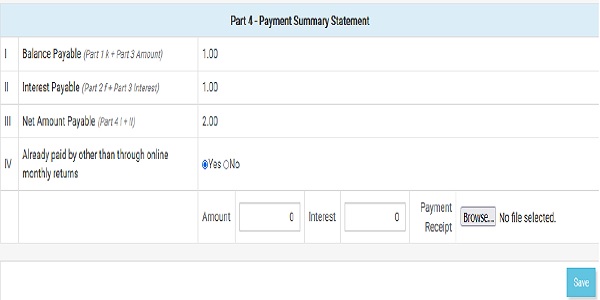

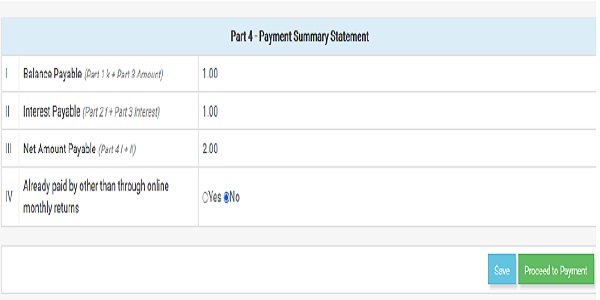

Part 4

In this part, the Balance cess ,Interest payable as on date and Net Amount will be shown . The interest field is made editable to do corrections if it is already paid through white chalan/payment through online treasury portal. Details of cess and interest paid other than online monthly returns can be entered in the ‘Amount’ and ‘Interest’ column and upload the proof of payment and then click ‘save’ button and then click ‘proceed to payment’.

If there is no tax paid other than online monthly returns, then click ‘save’ button.

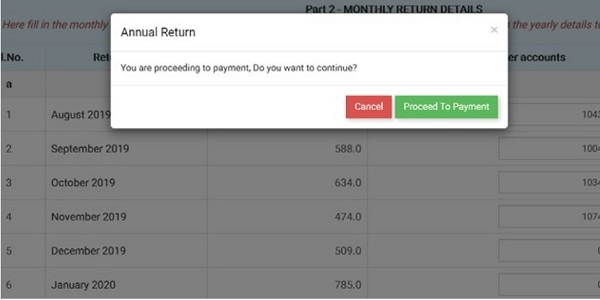

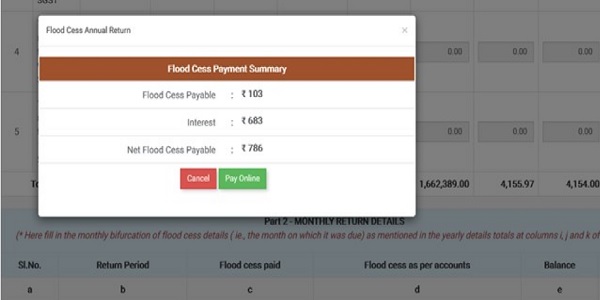

4. Payment section

On clicking the ‘proceed to payment’ button afer saviing the return the followiing pop up be displayed . Here also click ‘proceed to payment’

Verify the amount and click “Pay Online “for effecting payment.

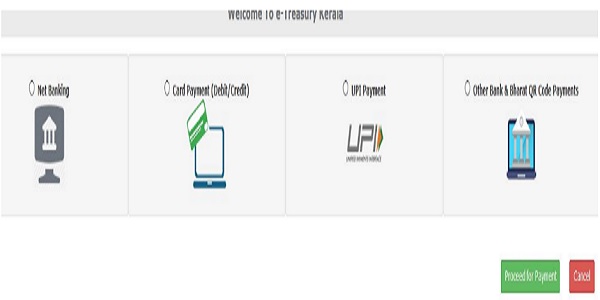

The following payment window will be displayed

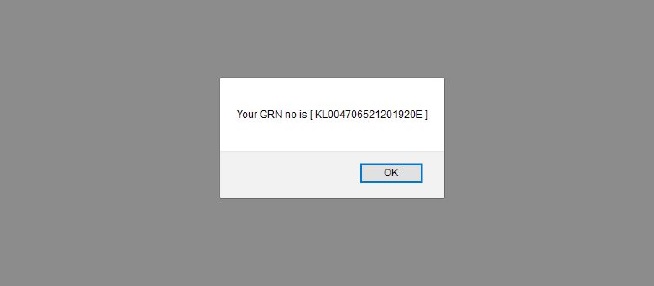

- Select mode of payment and give required details for each payment mode. Then proceed for payment. A GRN will be generated as below;

- Click “OK”

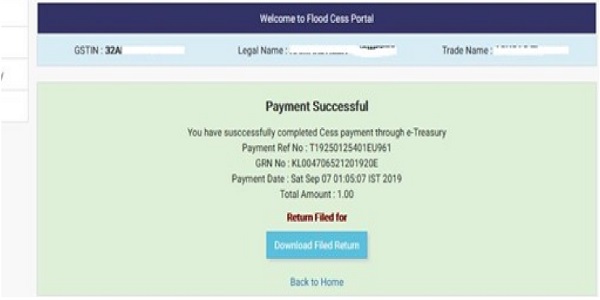

- After the completion of payment , the following window will be displayed

- The tax payer can download the Filed Return by clicking the “Download Filed Return” link.

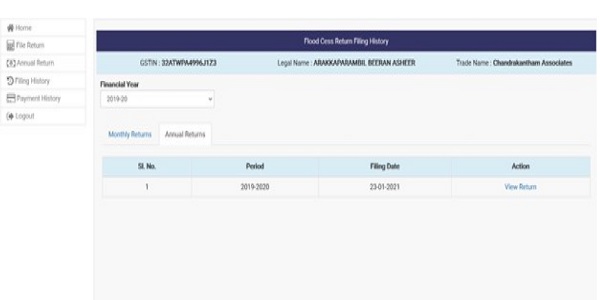

5. Filing History

To view the annual returns filed, go to ’filing history’ menu and select annual return tab.

On clicking the view button annual return can be viewed .

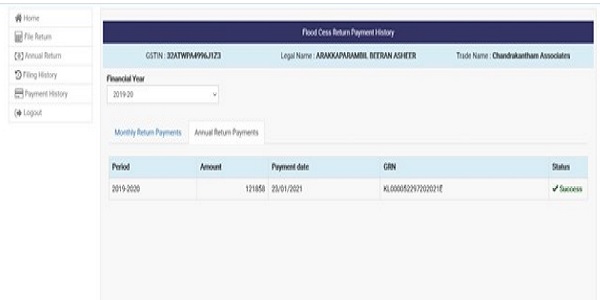

6. Payment History

It shows the status of payment made like ‘success’/‘failed’/’pending’

Very very useful and informative

we wrongly entered amount 18% instead of 28%, but taxable and tax are same. while rectify the same in annual return , their showing to pay additional amount pay in 28% column