Sponsored

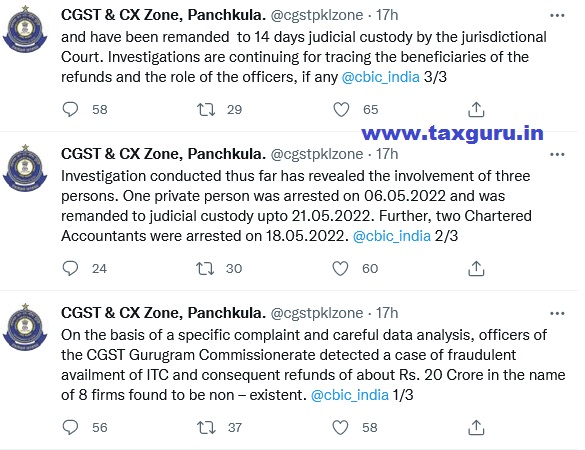

On the basis of a specific complaint and careful data analysis, officers of the CGST Gurugram Commissionerate detected a case of fraudulent availment of ITC and consequent refunds of about Rs. 20 Crore in the name of 8 firms found to be non – existent Investigation conducted thus far has revealed the involvement of three persons.

One private person was arrested on 06.05.2022 and was remanded to judicial custody upto 21.05.2022. Further, two Chartered Accountants were arrested on 18.05.2022 and have been remanded to 14 days judicial custody by the jurisdictional Court. Investigations are continuing for tracing the beneficiaries of the refunds and the role of the officers, if any.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Gurugram officer has been transferred to Panchkula after protests.

This is wrong statement. GST Officers issued refunds and later on, after enquiries were made as to how refund of 15 crore was issued with in 102 minutes and that too after office hours, they made CAs scapegoat.