The world of GST law is marked by dynamism and complexity. It not only promotes seamless input tax credit (ITC) but also places specific conditions on availing ITC under Section 16(2) of the CGST Act, 2017. Among these conditions, Section 16(2)(c) has garnered particular attention from taxpayers. This article delves into the significance of this section, the impact of non-filing of GSTR-3B by suppliers on ITC, and the crucial role played by Rule 37A.

- Section 16(2)(c) :

Out of 6 conditions laid down in section 16(2), condition of clause (c) of said sub-section attracts special attention of taxpayers which is reproduced as below :

“subject to the provisions of section 41, the tax charged in respect of such supply has been actually paid to the Government, either in cash or through utilization of input tax credit admissible in respect of the said supply; “

Therefore, Section 16(2)(c) restricts the registered person from availing input tax credit on supplies in respect of which tax has not been paid by supplier in his return GSTR-3B even though such supplies have been reported in GSTR-1 by supplier and thus are getting auto-populated in GSTR-2B of the registered person (recipient).

- Circular 170/02/2022 :

CBIC introduced Circular 170/02/2022 dated 06th July, 2022 to ensure furnishing of correct information of ITC availed, reversal thereof and ineligible ITC in Table 4 of GSTR-3B by the registered person. As per para 4.3 of the said circular, registered person is required to report temporary reversal of ITC in Table 4(B)(2) of GSTR-3B on inward supplies in respect of which condition of section 16(2)(c) has not been complied with. Therefore, the registered person is required to temporarily reverse ITC on inward supplies in respect of which tax has not been paid by the supplier. It can be better understood with the help of following example.

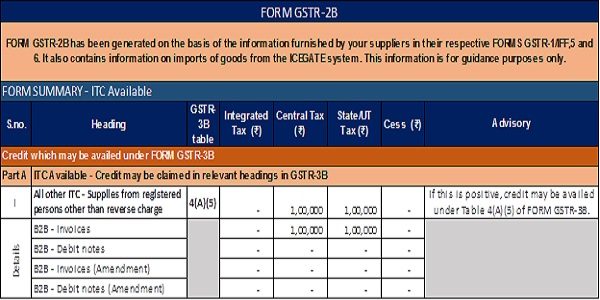

E.g., At the time of filing monthly GSTR-3B for the month of April, 2023 , Mr. X found following information regarding its inward supplies in auto-populated GSTR-2B :

Out of ITC of Rs. 1,00,000 auto-populated in GSTR-2B, ITC of Rs. 80,000 is relating to supplies in respect of which all the conditions of section 16 have been complied with. However, ITC of Rs. 20,000 is relating to such supplies in respect of which all the conditions of section 16 have been complied with except section 16(2)(c) (i.e., tax has not been paid by supplier or can be said that GSTR-3B has not been filed by supplier)

On a strict reading of Circular 170/02/2022, reporting of such auto-populated ITC in GSTR-3B turns out to be as follows :

Such reversed ITC of Rs. 20,000 can be re-availed when GSTR-3B has been filled by the supplier and accordingly reported in table 4(A)(5) and table 4(D)(1) of GSTR-3B for the month of such re-availment.

- Section 41 and Rule 37A :

Section 41 of CGST Act, 2017 has been substituted vide NN 18/2022 – Central Tax dated 28th September, 2022 which is reproduced as under :

“41. Availment of input tax credit-

(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed, be entitled to avail the credit of eligible input tax, as self-assessed, in his return and such amount shall be credited to his electronic credit ledger.

(2) The credit of input tax availed by a registered person under sub-section (1) in respect of such supplies of goods or services or both, the tax payable whereon has not been paid by the supplier, shall be reversed along with applicable interest, by the said person in such manner as may be prescribed:

Provided that where the said supplier makes payment of the tax payable in respect of the aforesaid supplies, the said registered person may re-avail the amount of credit reversed by him in such manner as may be prescribed. ”

Also, CBIC introduced Rule 37A of CGST Rules, 2017 vide NN 26/2022 –Central Tax dated 26th December, 2022 which is reproduced as under :

“ 37A. Reversal of input tax credit in the case of non-payment of tax by the supplier and re-availment thereof.-

Where input tax credit has been availed by a registered person in the return in FORM GSTR-3B for a tax period in respect of such invoice or debit note, the details of which have been furnished by the supplier in the statement of outward supplies in FORM GSTR-1 or using the invoice furnishing facility, but the return in FORM GSTR-3B for the tax period corresponding to the said statement of outward supplies has not been furnished by such supplier till the 30th day of September following the end of financial year in which the input tax credit in respect of such invoice or debit note has been availed, the said amount of input tax credit shall be reversed by the said registered person, while furnishing a return in FORM GSTR-3B on or before the 30th day of November following the end of such financial year:

Provided that where the said amount of input tax credit is not reversed by the registered person in a return in FORM GSTR-3B on or before the 30th day of November following the end of such financial year during which such input tax credit has been availed, such amount shall be payable by the said person along with interest thereon under section 50.

Provided further that where the said supplier subsequently furnishes the return in FORM GSTR-3B for the said tax period, the said registered person may re-avail the amount of such credit in the return in FORM GSTR-3B for a tax period thereafter. ”

We can derive following interpretations on a joint reading of section 41 of CGST Act, 2017 and Rule 37A of CGST Rules, 2017 :

– The registered person can avail ITC in respect of supplies in respect of which supplier has not paid tax / not filed GSTR -3B.

– However, the registered person will be required to reverse such ITC if supplier has not filed GSTR – 3B till 30th September of FY following the FY in which such ITC has been availed.

– The registered person will be required to reverse such ITC on or before 30th November of FY following the FY in which such ITC has been availed otherwise interest u/s 50 will get attracted.

– The registered person will be entitle to re-avail ITC on such supplies once supplier has filed GSTR-3B discharging tax liability on such supplies.

- Decoding Rule 37A :

1. FY of ITC availed to be Considered :

Rule 37A specifies to reverse the ITC on supplies in respect of GSTR – 3B has not been filed by supplier till 30th September of FY following the FY in which such ITC has been availed by recipient.

E.g.,

Mr A received supply of goods and corresponding invoice on dt. 01-01-2023 (Invoice FY : 2022-23). ITC in respect of such invoice has been availed by Mr. A in GSTR – 3B of May, 2023 (Availment FY : 2023-24).

Since ITC has been availed by Mr. A in FY 2023-24, he will be required to reverse ITC on such supply if supplier of such goods has not filed GSTR – 3B discharging liability of tax on such supply till 30th September, 2024. Mr. A will be required to reverse such ITC till 30th November, 2024 failing which interest liability u/s 50 will be invoked.

Had ITC on such invoice been availed in FY 2022-23 itself, Mr. A would had been required to reverse such ITC if supplier had not filed GSTR – 3B discharging liability of tax on such supply till 30th September, 2023. Mr. A would had been required to reverse the ITC till 30th November, 2023 failing which Interest Liability u/s 50 would had been invoked.

2. Treatment of Filing of GSTR-3B by Supplier during Intervening period :

Reversal of ITC under Rule 37A is invoked once supplier has not filed GSTR – 3B till 30th September of FY following the FY in which ITC has been availed. However, the recipient gets time till 30th November of such following FY to reverse such ITC. What if supplier has filed GSTR-3B between 01st October to 30th November ?

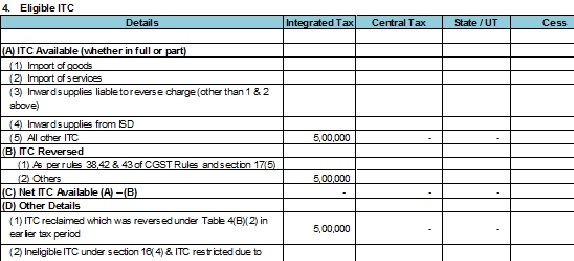

E.g., Mr A received supply of goods and corresponding invoice involving IGST ITC of Rs. 5,00,000 on dt. 01-01-2023 (Invoice FY : 2022-23). ITC in respect of such Invoice has been availed by Mr. A in GSTR – 3B of May, 2023 (Availment FY : 2023-24). Supplier of such goods has filed GSTR – 3B and discharged tax liability on such supply on 05-10-2024.

Since ITC has been availed in FY 2023-24 and supplier has not filed GSTR-3B till 30-09-2024 , Reversal of such ITC has been invoked as on that date. However, Mr. A has time to reverse such ITC without interest liability till 30-11-2024. At the same time since supplier has filed GSTR-3B as on 05-10-2024, Mr A is entitled to reclaim such ITC. Mr. A can give following illustrative treatment of such supply in his monthly GSTR-3B for the month of September, 2024 :

3. Tax Period for GSTR – 3B under consideration :

As per the provisions of Rule 37A of CGST Rules, 2017, the registered person (recipient) is required to ensure filing of GSTR – 3B by supplier for such tax period as it corresponds to tax period of GSTR – 1 or IFF in which Invoice / Debit note has been reported.

In other words, it can be said that registered person is required to ensure that GSTR – 3B has been filed by the supplier for the tax period in which Invoice is auto-populated in GSTR – 2A of recipient. This can be better understood with the below example.

E.g., Mr A received supply of goods and corresponding invoice involving IGST ITC of Rs. 5,00,000 on dt. 01-01-2023 (Invoice FY : 2022-23). ITC in respect of such Invoice has been availed by Mr. A in GSTR – 3B of May, 2023 (Availment FY : 2023-24). Supplier of such goods has filed GSTR – 3B and discharged tax liability on such supply on 05-10-2024.

Since ITC has been availed in FY 2023-24 and supplier has not filed GSTR-3B till 30-09-2024 , Reversal of such ITC has been invoked as on that date. However, Mr. A has time to reverse such ITC without interest liability till 30-11-2024. At the same time since supplier has filed GSTR-3B as on 05-10-2024, Mr A is entitled to reclaim such ITC. Mr. A can give following illustrative treatment of such supply in his monthly GSTR-3B for the month of September, 2024 :

- ITC on supply in respect of which the supplier has not paid the tax :

Concluding entire write-up, it may be relevant to pose a question that for supply in respect of which tax has not been paid by supplier, whether

– ITC should not be availed till supplier files GSTR – 3B as it is restricted u/s 16(2)(c) OR

– ITC should be availed and reversed in monthly return as per Circular 170/02/2022 and re-availed when supplier files GSTR – 3B OR

– ITC should be availed in monthly return and reversed only if vendor has not filed GSTR – 3B till 30th September of the FY following the FY of ITC availment and re-availed when supplier files GSTR – 3B.

From an angle of Working Capital Management and Ease of Compliance, 3rd Option as listed above (Complying with provisions of Rule 37A for such ITC) would be a preferable solution.

Conclusion: Navigating the complexities of Input Tax Credit and supplier non-filing requires a keen understanding of Section 16(2)(c), Circular 170/02/2022, Section 41, and Rule 37A. Ensuring compliance with these provisions is crucial to effectively managing ITC and avoiding unnecessary interest liabilities. The choice between delaying ITC availment until the supplier files GSTR-3B or following the procedures outlined in Rule 37A should be made while considering working capital management and compliance ease.

*****

Disclaimer : The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available in this article are for general informational purposes only. All liability with respect to actions taken or not taken based on the contents of this article are hereby expressly disclaimed.

is it possible to create a system to ensure that payment of GST be paid to government on transaction wise immediately once buyer pays to seller rather than waiting to see whether seller complies with GSTR-3B filing.

How buyer will know about all the conditions are fulfilled or not?