Every company export of their goods & services under bond/LUT without payment of IGST and GST Credit for the purchase of Inputs, Capital goods & Input Services are remains unutilised due to the majority of goods are Exported. Credit available at the time of procuring of goods and services are unutilized and remains idle in their Electronic Credit Ledger account.

In Such a case, we are going for filing of Refund claim of Goods and services are exported under LUT without payment of IGST. Unutilised GST credit how to take back as refund by way of filing of the manual Refund claim are discussed below:

Before filing of the manual refund claim of unutilised GST credit let’s understand some of the important terms:

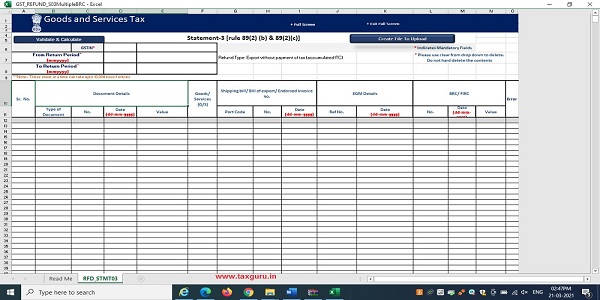

(1) What is the form of Statement 3 under rule 89(2) (b) and 89(2)(c)

Statement 3 are preparing as per rule 89(2)(b) and 89(2)(c) of CGST Rules, 2017.

Following are the important details it has to be mentioned compulsory in the statement 3 at the time of creation of Json filed of statement 3.

(1) GSTIN Number

(2) Return Period: From Return period ——-à To Return period (Mentioned here period for which are going to be apply refund claim). I.e. If we are going for filing of Refund claim for the period of August 2020 to November 2020 than mentioned details about the relevant period only)

(3) Type of Document/ Invoice No/Date of Invoice and Total Value of Invoices mentioned in the statement 3 form at the time of filing application.

It has to verify that the figure which you are mentioned in the Statement 3 it should be matched with your filed GSTR 1 for that period.

(4) Refund application file for Export of Goods or Services are select as per the application

(5) Shipping Bill/Bill of Export/Endorsement invoices–àPort Code, Shipping Bill No, Shipping bill date is compulsory mentioned if you are file refund application for export of goods.

(6) EGM details: EGM Number and EGM date are mandatory to mentioned at the time of filing of Refund application.

It has to be verified with the company ICEGATE IGST Validation details regarding every shipping bills issued by the custom portal against which EGM is filed by the CHA Agent or not. If EGM has not been filed against the invoices than that invoice shall not be consider for calculation of refund claim.

(7) BRC/FIRC is require at the time of filing of Refund application of Export of Services.

Once all data is filed up in statement 3 after that click on Validate & calculate button and creation of Json file. File of Json uploaded on the online portal and validate.

After uploading JSON file on online GST portal, portal has verified all the data with the filed GSTR 1 for that relevant period. All data available in creation of json file should be matched with the filed GSTR 1. If any mismatch of data between creation of Json file and filed GSTR 1 in such a case portal has showing the Download Invalid Invoices which are not matched as per the filed GSTR 1 vs JSON File.

If all the data mentioned in the filed GSTR 1 vs JSON file are matched in a case portal showing Download all valid Invoices. All data are matched with the relevant period than portal is allowed us to fill up the data of Taxable Turnover of Zero rate supply of goods and services. Taxable Turnover of zero rated supply of goods and services should be matched with the total of turnover mentioned in JSON file.

Path: Click on Services menu ——> Refunds ——> Application for Refund —–> Fill Up Refund of ITC on Export of Goods & Services without Payment of Integrated Tax——àDownload excel form of Statement 3

(2) How to calculate Refund amount (Unutilized credit of IGST, CGST, SGST)?

– Meaning of Taxable Turnover of Zero-rated supply of goods or services.

– Meaning of Net Input Tax credit & Adjusted Total Turnover

Meaning of Taxable Turnover of Zero-rated supply of goods or services.

Turnover of zero-rated supply of goods means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or Letter of Undertaking.

At the time of calculating Taxable Turnover of zero-rated supply of goods – goods which were sold under rebate claim (Goods sold under payment of IGST) are to be excluded from the total turnover of goods.

Goods are sold with payment of IGST in such a case not needed of filing of Refund application separately.

Turnover of zero-rated supply of services means a value of zero-rated supply of services made without payment of tax under bond or Letter of an undertaking.

Meaning of Net Input Tax credit & Adjusted Total Turnover.

Net Input Tax Credit: Input tax credit available during the month. (credit which were availed during the relevant period are to be considered). Input Tax credit of IGST, CGST, SGST are availed during the relevant period are separately disclosed.

Adjusted total Turnover: Adjusted total turnover inclusive of Domestic Turnover + Zero rated supply (Export Turnover) – exempt supplies. It means the sum total of the value of (a) the turnover in a State or a Union territory, as defined Section 2(112) excludes the turnover of Services and (b) the turnover of a zero rated supply of services as per rule 89(4)(d) of CGST Rules, 2017 and non zero rated supply of services.

Excluding: (i) the value of exempt supplies other than zero rated supplies and

(ii) the turnover of supplies in respect of which refund is claimed under rule 4A and 4B.

Turnover means the aggregate value of all taxable supplies (exclude inward supplies on which tax is payable by a person on reverse charge

Domestic Turnover: Turnover of all goods are sold in interstate and intrastate transaction.

Zero rate supply: Turnover of export goods under bond as well as a rebate

Steps to be followed while calculating Refund Amount:

(1) Computation of Refund claimed as per statement 3 on which mention Turnover of zero-rated supply of goods and services

(2) Net Input Tax credit

(3) Adjusted Total Turnover

Computation of Refund claimed (Statement 3A)

AMOUNT ELIGIBLE FOR REFUND CLAIM:

The Lower amount of comparison of all 3 should be eligible for taking Refund Amount.

The Value which was derived as per statement of 3 are compared with Balance available in Electronic Credit Ledger and Tax credit availed during the period. Once comparison was complete than lowest refund amount would be eligible for Refund.

Value as per Statement 3: calculation already made in above

Balance in Electronic Credit ledger: Balance which is available in electronic ledger credit account at the time of submission of Refund Application form.

Tax Credit availed during the period: If we apply for refund claim file for the month of Sept 2017 than total credit availed during that month should be taken.

(3) Documents are submitted at the time of online filing of manual refund claim?

Ans: Following Documents are required to be attached at the time of filing of Online Manual Refund Claim of Export of Goods without payment of IGST

a. Declaration under the 2ndproviso to section 54(3) export of goods is not subject to export duty.

b. Declaration under the 3rdproviso to section 54(3) no drawback in respect of central tax has been claimed/shall be claimed or no refund of IGST paid on supplies has been claimed.

c. Declaration under section 54(3) declares ITC availed on the goods or services used for making “Nil” rated/ exempted supplies has not been included in the refund of ITC claim.

d. Declaration related to claimants have not contravened to Rule 91(1) and incidence of tax has not passed to any other person as per rule 89(2)(1).

e. Annexures B

f. Copy of GSTR 2A for the relevant period.

All documents submitted as per Circular No

Circular No; 125/44/2019 – GST dated 18th November 2019

Circular No: 135/05/2020 – GST dated 31st March 2020

Circular No: 139/09/2020 – GST dated 19th June 2020

After Online filing of Refund Application, it is reach to the respective jurisdictional officer. A Jurisdictional Officer took 15 days for verifying the genuiness about the transactions and documents submitted online are correct as per law or not. Once it’s verify and correct as per the law than he issue provisional order of Refund claim as per Form RFD 04 and Payment Advice as per Form RFD 05.

RFD 04 provisional refund order issued by officer of central jurisdiction along with the signature, date & place. RFD 04 form details mention as under:

| Sr No | Description | Central Tax | State/UT Tax | Integrated Tax | Cess |

| i | Amount of Refund Claimed | ***** | ***** | ***** | ***** |

| I (a) | Corrected Amount of refund claimed | ***** | ***** | ***** | ***** |

| ii | 10% of the amount at i(a) claimed as refund (to be sanctioned later) | ***** | ***** | ***** | ***** |

| iii | Balance Amount (i(a)-ii) | ***** | ***** | ***** | ***** |

| iv | Amount of Refund sanctioned | ***** | ***** | ***** | ***** |

Total Amount of Refund claimed to disclose amount which was already mentioned in Acknowledgement copy of RFD 01.

90% of the Total Amount of Refund Claimed approved by the department and mention in a corrected amount of refund claimed.

10% of Total Amount of Refund claim release after completion of final sanction of refund order.

Bank Details also mention in Provisional Refund Order as per below format:

| v | Bank Account No. as per application | ********** |

| vi. | Name of the Bank | ********** |

| vii. | Address of the Bank/Branch | ********** |

| viii. | IFSC code no of Bank | ********** |

| ix. | MICR code | ********** |

RFD 05 Payment Advice issued by the department in that separately disclosed all details of (IGST/CGST/SGST) amount related to Refund (as per sanction order).

Provisional Refund Order (RFD 04) and Payment Advice (RFD 05) both are issued at the same time by the Officer of Jurisdiction.

*****

Disclaimer: The contents of this document are solely for informational purpose. It does not constitute professional advice. Neither the authors accept any liabilities for any loss or damage of any kind arising out of any information in this document nor for any actions taken in reliance thereon. If have any questions than you can reach on me : dharmesh@equalsphereindia.com

Sir,1.Export turnover should be calculated as per FOB value as shown in shipping bill or bank rate of currency as on date of export.

2.EGM number is not visible on ICEgate site but available at custom portal.GST officer asking why EGM is not visible. Therefore he want to reject application.What to do in that case.

You can ask your CHA Agents why EGM no is not showing on ICEGATE portal.

dear sir if my major purchase is at 0.1% against LUT

& And my misc purchase is at normal rate of gst and i am making export at zero % than can i take refund of itc on my total purchase???

Sir, we are making exports (trading of goods outside India) without payment of IGST. The ITC accumulated on account of purchases made from 2019 up to date has to be claimed as refund. But, GSTR1 is not filed from the commencement of business. Kindly suggest some alternate method for claiming Refund of such ITC.

You have to file GSTR1 and GST3B before filing of Refund Claim.

I have filed within the relevant period but claimed unutilzed ITC for earlier period. Is it eligible? For example Jan’20 FIRC and have filed RFD-01 on Jan’22 but claimed Unutilzed ITC of Nov’19, Dec’19 & Jan’20.. Is it claimable?

No because as per the GST Refund formula “Net ITC” is calculated for the relevant period at the time of applying GST Refund Claim.

i.e. if you file GST Refund claim for the period of 01-04-2020 to 31-03-2021 then System wlll show to you Net ITC for the said year.

In your case, It was not possible for the file claim of ITC earlier period.

In refund without payment of Tax In IFRC copy we have two date one is date of issue of IFRC COPY and other is date when payment received in bank

which date we should take

Sir, Can we Procure Goods or Services with out payment of Input GST for Export purpose. Since Refund process is cumbersome.

For filing manual refund claim of un utilized GST credit,you have mentioned that for exporters of services(Point 7, filing of statement 3) shall furnish FIRC.You may be aware that as per the directive of RBI,banks have stopped the issuance of FIRC except for FII/FDI.The state GST authorities are insisting for FIRC as per the GST circulars for processing refunds.Small service exporters are not able get their refund ever since the GST started,caught between RBI and GST circulars.Can you suggest any remedy.

Sir, I understand the bank has stopped for an issue of FIRC but you can ask the bank for an issue of Inward Remittance Certificate and most of the banks issued.

Declaration we have to seperatley attach in pdf file or just tick mark on bottom?

Declaration attached in PDF format as per circular no. 135