Introduction: –

In the Indian business landscape, meticulous record-keeping under the Goods and Services Tax (GST) system is not merely a legal mandate, but a cornerstone of operational efficiency and compliance. Accurate and detailed accounts facilitate seamless return filing, transparent audit trails, and optimal utilization of Input Tax Credit (ITC), thereby minimizing tax liabilities. This transparency fosters trust with stakeholders and empowers informed business decisions, guiding strategic planning and contributing to long-term sustainability. Investing in diligent record-keeping, potentially supplemented by GST-compliant software, is not just about adhering to regulations, but about building a firm foundation for sustainable business success in the era of GST.

Now we move to learn about maintenance of records and accounts under GST Act 2017

Section 35 of CGST Act 2017 Accounts and other Records

(1) Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of—

(a) production or manufacture of goods;

(b) inward and outward supply of goods or services or both;

(c) stock of goods;

(d) input tax credit availed;

(e) output tax payable and paid; and

(f) such other particulars as may be prescribed

PROVIDED that where more than one place of business is specified in the certificate of registration, the accounts relating to each place of business shall be kept at such places of business:

PROVIDED FURTHER that the registered person may keep and maintain such accounts and other particulars in electronic form in such manner as may be prescribed.

Break down of the section 35(1) of the CGST Act 2017

Definition of Registered Person

As per section 2(94) of the CGST Act 2017, a person who is registered under section 25, but does not include a person having a Unique Identity Number.

Section 25 (1) of the CGST Act 2017, Every person who is liable to be registered under section 22 or section 24 shall apply for registration in every such State or Union territory in which he is so liable within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed: Provided that a casual taxable person or a non-resident taxable person shall apply for registration at least five days prior to the commencement of business. 11[Provided further that a person having a unit, as defined in the Special Economic Zones Act, 2005, in a Special Economic Zone or being a Special Economic Zone developer shall have to apply for a separate registration, as distinct from his place of business located outside the Special Economic Zone in the same State or Union territory].

Section 22(1) of the CGST Act 2017, Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds the threshold limits:

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds threshold limit.

Section 24(1) of the CGST Act 2017,

(1) Notwithstanding anything contained in sub-section (1) of section 22, the following categories of persons shall be required to be registered under this Act, ––

(i) persons making any inter-State taxable supply;

(ii) casual taxable persons making taxable supply;

(iii) persons who are required to pay tax under reverse charge;

(iv) person who are required to pay tax under sub-section (5) of section 9;

(v) non-resident taxable persons making taxable supply;

(vi) persons who are required to deduct tax under section 51, whether or not separately registered under this Act;

(vii) persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

(viii) Input Service Distributor, whether or not separately registered under this Act;

(ix) persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52;

(x) every electronic commerce operator10[who is required to collect tax at source under section 52];

(xi) every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person; and

(xii) such other person or class of persons as may be notified by the Government on the recommendations of the Council.

In simple terms, according to the CGST Act of 2017, a person who needs to register under the Goods and Services Tax (GST) is defined in Section 2(94). However, this definition excludes individuals with a Unique Identity Number.

Now, Section 25(1) specifies that anyone who is required to register under Section 22 or Section 24 must apply for registration within 30 days of becoming liable to register. This applies to each state or union territory where they are liable. There’s an exception for casual or non-resident taxable persons who need to apply at least five days before starting business activities. Additionally, if a person has a unit in a Special Economic Zone, they must apply for a separate registration for that unit.

Furthermore, Section 22(1) states that every supplier is required to register under GST if their aggregate turnover in a financial year exceeds certain threshold limits. The registration is necessary in the state or union territory from where they make taxable supplies of goods or services. Special rules apply if the person makes taxable supplies from special category states. And section 24 of the CGST Act 2017 refers the person who is mandatorily required to get registered under CGST Act 2017.

Definition of Principal place of business: – As per section 2(89) of the CGST Act 2017, means the place of business specified as the principal place of business in the certificate of registration.

The law requires that the books of account shall be maintained at the principal place of business, or may be maintained electronically, on fulfilling the conditions prescribed by the rules.

Section 35(2) of the CGST Act 2017: – Every owner or operator of warehouse or godown or any other place used for storage of goods and every transporter, irrespective of whether he is a registered person or not, shall maintain records of the consigner, consignee and other relevant details of the goods in such manner as may be prescribed.

Example: – Imagine you operate a storage facility for a furniture manufacturer. You would record details about the furniture pieces received from the manufacturer (consigner) and note the details of the businesses or individuals who will receive the furniture (consignee).

Example: – If you are a trucking company transporting electronics from a manufacturing unit (consigner) to a retail store (consignee), you would keep records of the sender’s and receiver’s details, along with specifics about the transported goods.

The records to be maintained by the owner or operator of warehouse or godown or transporter irrespective of whether that person is registered or not under GST Act.

Section 35(3) of the CGST Act 2017: – The Commissioner may notify a class of taxable persons to maintain additional accounts or documents for such purpose as may be specified therein.

Section 35(4) of the CGST Act 2017: – Where the Commissioner considers that any class of taxable persons is not in a position to keep and maintain accounts in accordance with the provisions of this section, he may, for reasons to be recorded in writing, permit such class of taxable persons to maintain accounts in such manner as may be prescribed.

Section 35(6) of the CGST Act 2017: – Subject to the provisions of clause (h) of sub-section (5) of section 17, where the registered person fails to account for the goods or services or both in accordance with the provisions of sub-section (1), the proper officer shall determine the amount of tax payable on the goods or services or both that are not accounted for, as if such goods or services or both had been supplied by such person and the provisions of section 73 or section 74, as the case may be, shall, mutatis mutandis, apply for determination of such tax.

In simpler terms, if a registered person under the Goods and Services Tax (GST) fails to account for goods or services in the prescribed manner, the tax authorities (referred to as the “proper officer”) have the authority to determine the amount of tax payable on those unaccounted goods or services. The process for determining this tax liability is similar to the procedures outlined in sections 73 or 74 of the GST Act.

Example : –

Suppose a registered business, XYZ Electronics, fails to properly account for a shipment of electronic devices in its records, and the tax authorities become aware of this discrepancy during an audit. According to the mentioned provision, the proper officer can take the following steps:

The tax authorities will assess the unaccounted goods as if they had been supplied by XYZ Electronics. The officer will calculate the amount of tax payable on these goods, considering the applicable GST rates.

Application of Section 73 or Section 74:

The provisions of section 73 or section 74 of the GST Act will be applied to determine the tax liability. Section 73 deals with cases where there is a discrepancy due to fraud, willful misstatement, or suppression of facts. Section 74 deals with situations where tax evasion is detected during scrutiny, search, or seizure. XYZ Electronics will be issued a notice by the tax authorities, explaining the determined tax liability. XYZ Electronics will be given an opportunity to present their case and provide any necessary clarification or evidence. After considering XYZ Electronics’ response, the proper officer will make a final determination of the tax payable. XYZ Electronics will be required to pay the determined tax amount along with any applicable interest or penalties.

Section 36: Period of retention of account

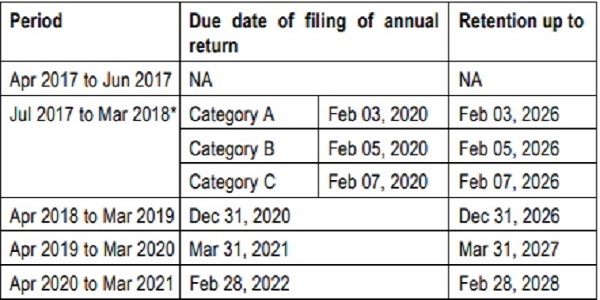

Every registered person required to keep and maintain books of account or other records in accordance with the provisions of sub-section (1) of section 35 shall retain them until the expiry of seventy -two months from the due date of furnishing of annual return for the year pertaining to such accounts and records:

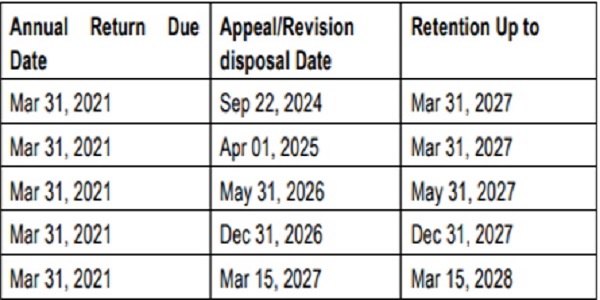

PROVIDED that a registered person, who is a party to an appeal or revision or any other proceedings before any Appellate Authority or Revisional Authority or Appellate Tribunal or court, whether filed by him or by the Commissioner, or is under investigation for an offence under Chapter XIX, shall retain the books of account and other records pertaining to the subject matter of such appeal or revision or proceedings or investigation for a period of one year after final disposal of such appeal or revision or proceedings or investigation, or for the period specified above, whichever is later.

Note: – In general, the due date for filing of annual return falls within 9 months of the end of the financial year, and therefore, the period of retention shall be 81 months from the end of the financial year.

Example 1: –

Example 2:

Rule 56: Maintenance of accounts by registered persons

(1) Every registered person shall keep and maintain, in addition to the particulars mentioned in sub-section (1) of section 35, a true and correct account of the goods or services imported or exported or of supplies attracting payment of tax on reverse charge along with the relevant documents, including invoices, bills of supply, delivery challans, credit notes, debit notes, receipt vouchers, payment vouchers and refund vouchers.

(2) Every registered person, other than a person paying tax under section 10, shall maintain the accounts of stock in respect of goods received and supplied by him, and such accounts shall contain particulars of the opening balance, receipt, supply, goods lost, stolen, destroyed, written off or disposed of by way of gift or free sample and the balance of stock including raw materials, finished goods, scrap and wastage thereof.

(3) Every registered person shall keep and maintain a separate account of advances received, paid and adjustments made thereto

(4) Every registered person, other than a person paying tax under section 10, shall keep and maintain an account, containing the details of tax payable (including tax payable in accordance with the provisions of sub-section (3) and sub-section (4) of section 9), tax collected and paid, input tax, input tax credit claimed, together with a register of tax invoice, credit notes, debit notes, delivery challan issued or received during any tax period.

(5) Every registered person shall keep the particulars of—

(a) names and complete addresses of suppliers from whom he has received the goods or services chargeable to tax under the Act;

(b) names and complete addresses of the persons to whom he has supplied goods or services, where required under the provisions of this Chapter;

(c) the complete address of the premises where goods are stored by him, including goods stored during transit along with the particulars of the stock stored therein.

(6) If any taxable goods are found to be stored at any place(s) other than those declared under sub-rule (5) without the cover of any valid documents, the Proper Officer shall determine the amount of tax payable on such goods as if such goods have been supplied by the registered person.

(7) Every registered person shall keep the books of account at the principal place of business and books of account relating to additional place of business mentioned in his certificate of registration and such books of account shall include any electronic form of data stored on any electronic device

(8) Any entry in registers, accounts and documents shall not be erased, effaced or overwritten, and all incorrect entries, otherwise than those of clerical nature, shall be scored out under attestation and thereafter, the correct entry shall be recorded and where the registers and other documents are maintained electronically, a log of every entry edited or deleted shall be maintained.

(9) Each volume of books of account maintained manually by the registered person shall be serially numbered.

(10) Unless proved otherwise, if any documents, registers, or any books of account belonging to a registered person are found at any premises other than those mentioned in the certificate of registration, they shall be presumed to be maintained by the said registered person.

(11) Every agent referred to in clause (5) of section 2 shall maintain accounts depicting the—

(a) particulars of authorization received by him from each principal to receive or supply goods or services on behalf of such principal separately;

(b) particulars including description, value and quantity (wherever applicable) of goods or services received on behalf of every principal;

(c) particulars including description, value and quantity (wherever applicable) of goods or services supplied on behalf of every principal;

(d) details of accounts furnished to every principal; and

(e) tax paid on receipts or on supply of goods or services effected on behalf of every principal.

(12) Every registered person manufacturing goods shall maintain monthly production accounts showing quantitative details of raw materials or services used in the manufacture and quantitative details of the goods so manufactured including the waste and by products thereof.

(13) Every registered person supplying services shall maintain the accounts showing quantitative details of goods used in the provision of services, details of input services utilised and the services supplied.

(14) Every registered person executing works contract shall keep separate accounts for works contract showing—

(a) the names and addresses of the persons on whose behalf the works contract is executed;

(b) description, value and quantity (wherever applicable) of goods or services received for the execution of works contract;

(c) description, value and quantity (wherever applicable) of goods or services utilized in the execution of works contract;

(d) the details of payment received in respect of each works contract; and

(e) the names and addresses of suppliers from whom he received goods or services.

(15) The records under the provisions of this Chapter may be maintained in electronic form and the record so maintained shall be authenticated by means of a digital signature.

(16) Accounts maintained by the registered person together with all the invoices, bills of supply, credit and debit notes, and delivery challans relating to stocks, deliveries, inward supply and outward supply shall be preserved for the period as provided in section 36 and shall, where such accounts and documents are maintained manually, be kept at every related place of business mentioned in the certificate of registration and shall be accessible at every related place of business where such accounts and documents are maintained digitally.

(17) Any person having custody over the goods in the capacity of a carrier or a clearing and forwarding agent for delivery or dispatch thereof to a recipient on behalf of any registered person shall maintain true and correct records in respect of such goods handled by him on behalf of such registered person and shall produce the details thereof as and when required by the proper officer.

(18) Every registered person shall, on demand, produce the books of account which he is required to maintain under any law for the time being in force.

Summary of Rule 56 of CGST Rules 2017

Registered persons must maintain accurate and detailed accounts of all goods and services, including imports, exports, supplies, advances, taxes, and stocks. This includes keeping records of suppliers, customers, and storage locations. Records can be physical or electronic, but must be kept at the principal place of business and any additional places of business. Any errors must be corrected with attestation, and electronic records must have a log of all edits and deletions. Agents, manufacturers, service providers, and those executing works contracts have additional specific record-keeping requirements. Records must be preserved for a specified period and produced on demand to the proper officer.

Rule 57: Generation and maintenance of electronic records

(1) Proper electronic back-up of records shall be maintained and preserved in such manner that, in the event of destruction of such records due to accidents or natural causes, the information can be restored within a reasonable period of time.

(2) The registered person maintaining electronic records shall produce, on demand, the relevant records or documents, duly authenticated by him, in hard copy or in any electronically readable format.

(3) Where the accounts and records are stored electronically by any registered person, he shall, on demand, provide the details of such files, passwords of such files and explanation for codes used, where necessary, for access and any other information which is required for such access along with a sample copy in print form of the information stored in such files.

Rule 58: Records to be maintained by owner or operator of godown or warehouse and transporters

(1) Every person required to maintain records and accounts in accordance with the provisions of sub-section (2) of section 35, if not already registered under the Act, shall submit the details regarding his business electronically on the common portal in FORM GST ENR-01, either directly or through a Facilitation Centre notified by the Commissioner and, upon validation of the details furnished, a unique enrolment number shall be generated and communicated to the said person.

(1A) For the purposes of Chapter XVI of these rules, a transporter who is registered in more than one State or Union Territory having the same Permanent Account Number, he may apply for a unique common enrolment number by submitting the details in FORM GST ENR-02 using any one of his Goods and Services Tax Identification Numbers, and upon validation of the details furnished, a unique common enrolment number shall be generated and communicated to the said transporter: PROVIDED that where the said transporter has obtained a unique common enrolment number, he shall not be eligible to use any of the Goods and Services Tax Identification Numbers for the purposes of the said Chapter XVI.

(2) The person enrolled under sub-rule (1) as aforesaid in any other State or Union territory shall be deemed to be enrolled in the State or Union territory.

(3) Every person who is enrolled under sub-rule (1) shall, where required, amend the details furnished in FORM GST ENR-01 electronically on the common portal either directly or through a Facilitation Centre notified by the Commissioner.

(4) Subject to the provisions of rule 56,—

(a) any person engaged in the business of transporting goods shall maintain records of goods transported, delivered and goods stored in transit by him along with the Goods and Services Tax Identification Number of the registered consigner and consignee for each of his branches.

(b) every owner or operator of a warehouse or godown shall maintain books of account with respect to the period for which particular goods remain in the warehouse, including the particulars relating to dispatch, movement, receipt and disposal of such goods.

(5) The owner or the operator of the godown shall store the goods in such manner that they can be identified item-wise and owner-wise and shall facilitate any physical verification or inspection by the proper officer on demand.

Summary of Rule 58 of CGST Rules 2017

Owners or operators of godowns and warehouses, as well as transporters, must enroll electronically and maintain records of goods transported, delivered, and stored, including GSTIN numbers of consignors and consignees. Transporters registered in multiple states with the same PAN can apply for a unique common enrolment number. Warehouse operators must keep records of goods movement and storage, and store goods in a way that allows for item-wise and owner-wise identification and inspection.

Conclusion:

Efficient record-keeping under the GST Act of 2017 is not merely a regulatory obligation; it is a strategic imperative for businesses. By understanding and adhering to the stipulations outlined in the legislation, businesses can ensure compliance, minimize tax liabilities, and foster transparency. Investing in robust record-keeping practices is an investment in long-term sustainability and success in the GST era.

sir,

A business person new registered recently composite scheme under gst act .

question:

1.dealer which type of account records maintained in manually system

2.dealer which type of account records maintained in computer system

3.dealer account records how many years holding.

Documents mentioned in section 35(1), kindly refer that section. i have mentioned all the documents required to be maintained by the registered person whether he opted or not for composition scheme. As per section 35(2), every registered person needs to retain the documents and records for 72 months from due date of annual return of that particular year.