‘Tour Operator’ shall mean any person engaged in the business of planning, scheduling, organizing, arranging tours (which may include arrangements for accommodation, sightseeing or other similar services) by any mode of transport, and includes any person engaged in the business of operating tours. The definition is provided by the Explanation in Heading 9985 of GST Tariff Act, 2017.

For example, Make my Trip, Expedia etc. These companies provide a complete package of tour which includes Boarding & Lodging, Transportation, Local Sightseeing, Guides etc. Now a days, this business has become purely an E-commerce business and all the big companies have their own web portal and mobile app.

Come the new idea of businesses, come more challenges with more complexity and opportunity. With this article an effort is made to descript the Services of Tour Operator under the aegis of Indian GST Laws.

As per Heading 9985 of GST Tariff Act, 2017, The rate of GST would be 5% (2.5% CGST+2.5% SGST) provided following conditions are met,

1. Input tax credit on services availed by the entity will not be available. However, Input Tax Credit on the services taken from other Tour Operator are allowed.

2. The entity shall indicate in its invoice that the amount charged is gross amount and inclusive of charges of accommodation and transportation

Therefore, if an entity offers a package to a customer for let’s say Rs. 1,05,000/- inclusive of everything, then the invoice shall be generated for Rs. 1,05,000/- (Rs. 5,000/- being CGST & SGST) and entity has to specifically mention in invoice that amount includes accommodation and transportation etc. No input tax credit on services like hotels, air tickets etc. will be available to the entity. However, Input Tax Credit may be taken on the tour operator services procured from another tour operator.

On the other hand, the entity may charge GST at the rate of 18% (9% CGST+9% SGST) on the total amount. In that case, the entity will be eligible to take all input tax credit like rent, professional fee, lease line, telephone etc. on the services that the entity acquired for providing the underlined services i.e. Tour Operating.

However, most of the input tax credit will not be available to the entity due to the nature and place of supply of those services which are taken by the entity. The main expenditure that entity will occur would be of Boarding & Lodging and Hotel booking. In case of Hotel booking, the place of supply would be the location where the hotel is situated and thus the hotel will charge CGST & SGST on the invoice. If the entity is not registered under GST in the state where the hotel is situated, the entity cannot take the input tax credit on that particular invoice. Same goes with flight tickets. The place of supply in case of air fare, would be the place from where the flight embarks and in case the entity does not have registration under GST in the state from where such flight take-off, the entity cannot take input tax credit of that invoice too.

Let’s understand the situation with an example. Suppose, a customer from Delhi approaches Tour Operator which is situated and registered in Bangalore, Karnataka for a complete package of 5D/6N tour to Kerala. The entity quotes Rs. 1,00,000 (Excluding GST) for the tour. The breakup of the charges is as follows,

|

Air fare (Economy class) from Delhi to Kochi and return 47620 GST charged by the Airlines@ 5% 2380 |

50,000 |

| Hotel Charges 26785

GST charged by Hotel@ 12% 3215 |

30,000 |

| Other Charges 8475

GST Charged @ 18% 1525 |

10,000 |

| Entity’s Fees | 10,000 |

| Total | 1,00,000 |

In this case, entity can opt either to pay 5% GST (IGST) on Rs. 1,00,000/- i.e. Rs. 5,000/- and avail no input tax credit or to pay 18% GST (IGST) and may avail input tax credit. But the entity is not eligible to take input tax credit on Air fare and Hotel charges as the place of supply, in case of Hotel, would be Kerala and in case of Air fare, it would be in Delhi. However, if the entity get itself registered in Kerala and Delhi, then it is possible for the entity to take input tax credit for these services also but that seems quite unfeasible considering the compliance burden which will be increased for the entity.

Further, in this case the entity must raise an invoice indicating specifically that the amount charged is gross amount and inclusive of charges of accommodation and transportation.

Though, most of the companies do operate as Tour Operator services, the entity may either provide services as an agent and charge commission on its service and take reimbursement in actual for the expenses that entity incurred for providing such services. Generally, small business entity opts for this model as in this model, the entity must pay tax only on the commission that it charges and not whole amount which is not even its revenue.

The entity may also opt to provide the underlined services on commission basis. In that case, the service will be categorized as ‘Intermediary’ and services like Boarding & Lodging etc. will be taken by the entity on behalf of customer. The entity will act as ‘Pure Agent’ and take reimbursement on actual basis from the customer.

As per section 2(13) of IGST Act, 2017,

“Intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account”

And as per the Explanation to Rule 33 of CGST Rules, 2017,

“Pure agent” means a person who—

- enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both;

- neither intends to hold nor holds any title to the goods or services or both so procured or supplied as pure agent of the recipient of supply;

- does not use for his own interest such goods or services so procured; and

- receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.”

In this case, the entity has to enter into an agreement with the customer to act as his pure agent and authorize itself to incur the expenses for services like Hotel, Taxi etc. on behalf of customer. The entity, in this case, will charge its commission (whatever agreed) from the customer and will take reimbursement of the expenses on actual basis which it incurred on behalf of customer.

Let’s understand this with our previous example. In that case, if the entity enters into an agreement with the customer to act as pure agent, then the entity will charge GST at the rate of 18% on Rs. 10,000/- only i.e. Rs. 1,800/- and will take reimbursement of Rs. 90,000/- as actual expense incurred on behalf of the customer.

However, in this model, there are certain conditions which needs to be complied with. As per Rule 33 of CGST Rules, 2017,

“Notwithstanding anything contained in the provisions of this Chapter, the expenditure or costs incurred by a supplier as a pure agent of the recipient of supply shall be excluded from the value of supply, if all the following conditions are satisfied, namely, —

- the supplier acts as a pure agent of the recipient of the supply, when he makes the payment to the third party on authorization by such recipient;

- the payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service; and

- the supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account”

Taking the previous example further, the entity has to raise an invoice for Rs. 10,000/- and add 18% GST thereupon and will indicate separately in the invoice for the payment made by the entity as pure agent on behalf of the customer.

A graphical flow chart will explain both the options in much better way,

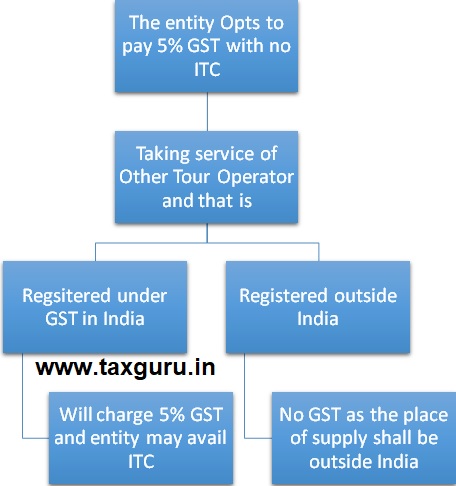

In case the entity takes services of any other Tour Operator, let’s say for planning the itinerary for the customers for particular packages, the entity can take input tax credit regardless of his choice to act as Tour operator or Agent.

For better understanding, let’s continue with the example cited above. In that case, let’s say 25% is the fixed charges for the other Tour Operator which will come out to be Rs. 2,500/- (on Rs. 10,000/-). Now, the other Tour Operator shall charge GST at the rate of 5% (i.e. Rs. 125/-). In this case, the entity can take input tax credit of Rs. 125/- even if the entity has opted to pay tax at the rate of 5% on the total amount.

Let’s understand this with graphical depiction,

The GST shall be charged and paid at the time of payment or invoice whichever is earlier. Therefore, for the purpose of GST, the entity shall recognize its revenue on the payment basis.

However, if the entity opts to act as ‘Pure Agent’ the GST shall be charged when the final invoice is raised or the receipts of the commission whichever is earlier.

About the Author

Author is Amit Jindal, ACA working as Manager Taxation in Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India.

Sir,

I am working as an inbound tour operator. I wish to opt 5% of total amount without claiming ITC. But in my ledger ITC always crediting in and the tax amount is adjusting from this ITC credited and no option for challan creation for payment of tax @5%. Is there any method not to credit ITC in my ledgers?

As per article ,Tour operator (T1) can avail ITC on another tour operator T2.mean if tour operator T1 outsource the tour package to another tour operator,T2 then as per the article T1 can take ITC pass on by T2 if billed @5%. Can you please suggest me the notification/section reference as we have same matter in appeal and GST department disallowing the ITC taken on service of tour operator T2

Can a proprietorship Firm (Tour and Travels) charge gst under RCM to a LLP firm and other Proprietor.

Please Reply…

GST is getting complicated to understand,

This might be answered earlier however, let us take an example

We are purchasing a consolidated package from a B2B tour provider let say Rs. 10,500 which reflects as all taxes included.

We are using ZOHO accounting to start with.

Under Purchase -> Vendor – Bill is rasied for Rs.10,000 with 5% GST as Inclusive Tax (10,000 + 5 % GST (Rs.500))

Under Sales -> Customer – Invoice , we have raised for Rs.10,500 +1000 = 11,500 with 5 % GST for Rs.10,500 (Inclusive) and 18% on Rs.1000 (Mark up Commission)

Here 5 % GST is applied both on Vendor and Customer as Inclusive Tax.

But when we look at GSTR it reflects as Total Payable of Rs.575 (5%) +180 (18 % )

How is the contra entry for this applied, as if we pay 5 % on total it will be a double GST which is 10 % .

What is the method to be followed.

Dear Sir

Namaskar, this is Satish here from Rana Holidays, Kolhapur.

I need your kind suggestion regarding GST Calculations in below FIT – done by us…

Tour Sector – Mauritius

Taken from B2B Supplier in India – 2HUB – Pls find below Transactions

So what will be the GST in this???

MAURITIUS PACKAGE

Total Invoice from 2HUB Company in India

533957 + 13581 + 2444 = 549982 /- Rs + we have given TCS 30989/- Rs to them

We charged Client as per below

619776 + 30989 (5% GST) + 30989 ( 5 % TCS ) = 681753 /- Rs

So pls suggest how much GST i need to pay….

We are overseas tour operators. Can we pay 18% GST on gross receipt minus air ticket, foreign currency exp, visa exp etc or 5% on Gross receipt only ??

Dear Sir

Please suggest,

Please do not ignore my question

1.how to show reimbursement value in gst portal.

2.This is to be mandatory to show or not.

3.Can show this in exempt sale.

hi, i am working as commission agent for tour operator based out of India, we collect payment in INR in our Indian registered company account on the behalf of the company based outside country and we make remittance overseas as bulk for all the bookings payment come to us , will the gst 18% applicable on the service charge part only , please guide ?

We are agents for cruise operators who are based outside India. The cruises start and end outside India. We are paid commission for booking Indian passengers on the cruise.

Should we invoice the cruise only part and charge 18% GST on our commission. Or charge 5% GST on the gross.

How is TCS added to this Invoice? Is TCS 5% of the total of (Cruise only + commission + 18% GST on commission. )

I m tour planner and serve whole tpur package service for the tourists.

Can I apply 5% on some bills with No ITC claim and 18% on some bills with ITC claim on same month/returns.

Suppose I served 6 tours in a month then

Can I generate 4 bills on 5 % and 2 bills on 18% slab?

We are franchise of a reputed online travel agency dealing in online and offline tour operator…we earn commission for every sale from the agency and 5 %GST of the entire sale value is collected by the agency on customers behalf…customer is billed directly by the agency….please guide our GST output as we do not have any ITC and are paid commission as intermediator. Also what’s the scenario if total commission crosses 20lakhs in one fiscal year

Namaskar,

We are Working as Tour Operator.

We are providing Hotel Booking services to B2C and B2B Client.

On Hotel Booking service: Eg. – We Got Hotel at 2000 and we offered same hotel to our B2B Client at 2500

It that case having following queries:

1. Is SAC code 998555 is correct for it.

2. Is it correct for Invoice ? total Billing Value 2500 and Taxable Value 500 { and 9 % CGST and 9 % SGST on Rs. 500/- }

Request to advice following confusion

I am in Mumbai buying a package tour with all transport hotel from a tour operator in Assam cost Rs 45000 he is charging me + 5% GST on 45000. I am charging client 55000 with Rs 10000 margin + 5% GST so question is already the tour operator is paying 5% on 45000 so i have to pay 5% on 10000 only or total 55000 plus 5% ? Or Pay 18% on 10000 margin only? we are registered with both 18% and 5%.

As for the same client tour operator is paying 5% on 45000 and i am asking cleint 55000 plus 5% so 10 percent on the same client paid at GST ?

confused please help

You can either pay GST @ 18% on Rs. 10,000/- and show Rs. 45,000+5% GST as reimbursement of expenses as actual. In this case, no ITC available

OR

You can pay GST @ 18% and take ITC on GST paid on Rs. 45,000/-

OR

You can pay GST @ 5% on Rs. 55,000/- but ITC will not be available.

You have to explore these three option by analysing which benefits you more.

For more details, you can reach out to us on our website

Dear Mr. Joseph, the basic condition being a tour operator is that you provide the services all inclusive, that is to say you don’t give the bifurcation of the amounts charged, say commission etc.

You are just invoicing your customer for the package as a whole. So in your case, you will be invoicing your customer, in your example, for 11,500 (exclusive of GST) without showing the markup amount. Now, on such bill, you will be charging GST @5% which comes out to be 575.

Since, you have also taken the input tour operator services, and ITC of 500 is available, your net cash payable will be 75 only.

Hope this makes sense.

Dear sir

Please reply of my question

My question is

For example:- sale

Total invoice value. 111800

Reimburseable. 100000

Margin /taxable 10000

GST@18%. 1800

Now here my question is

1 What should be value of total invoice,

As above mentioned sale example we have to show total invoice value -111800 Or 11800 in GST R 1 or GST R3B in B2B transaction case.

1 What should be value of total invoice, As above mentioned sale example we have to show total invoice value -111800 Or 11800 in GST R 1 or GST R3B in B2C transaction case.

3.how to show reimburse amount in GST R3B or GST R1

4 .what we have to show reimburse amount in exempt supply or not.

The invoice value will remain 1,11,800.- but the actual ale will be considered as 11,800/- (Rs. 10,000/- your commission/margin and Rs. 1,800 as GST). When you raise the invoice, you will indicate Rs. 1 lakh separately for reimbursement of actual expenses which were incurred on behalf of client. In returns also, the sale value will be 11,800.

Please reply

what will be invoice value in gst return.

Dear Sir

Can we show exempt sale of reimbursement value.

Please reply

What is the HSN code or SAC when we are charging 18% on the commission earned

i charge bookings on per head basis including food.

what GST should i charge and what code should i use?

can i take ITC?

You can charge 5% GST where ITC will not be available else charge 18% and avail ITC

Booked 2 hotels in HP for client based Mumbai. One hotel is giving gross invoice for which we will raise a commission invoice and other hotel is giving net invoice both billed to us. Can we show Hotel cost + commission charged to client + 18% on commission? If so, do we show gross amount of hotel 1 & net amount of hotel 2?

Please elaborate your query a little more. Whether you will charge commission to hotel in case where hotel is giving gross invoice or to customer and whether both hotel booked for same customer.

Dear Sir,

We will charge a commission to the client. Both hotel bookings are for the same client. We will also raise a commission invoice on one hotel that gave us a gross rate; this will be our additional income.

We will invoice the client for reimbursement of hotel room bookings total of gross & net hotel invoices and add our commission.

The client and tour operator are based in Maharashtra while the hotels are in Chandigarh & HP.

On the commission invoice to hotel, you have to charge IGST at 18% and on invoice to customer you will charge 18% CGST/SGST on the commission only and rest will be shown as reimbursement. Else you can charge 5% on the total invoice to customer but in that case input won’t be allowed. You can contact us through our website for detailed legal opinion.

Thank you Neeraj ji.

We received advance from the customer for tour packages and we give cancelation option also to customers, Kindly let us know we need to book the GST liability at the time advance received or at the time of travel date?. as many tours get canceled before travel date, it is difficult to manage to reversal of GST liabilities.

As per GST Laws, you have to book GST at the time of receiving advance and also have to reverse the same when the customer cancel the booking. You can follow the other practice which almost every tour operator do. When the booking is canceled, don’t pay back the GST amount and correspondingly, don’t reverse the GST. You can tell the customer that this much amount is cancelation charges.

Can we make interstate supply while we are paying 5% gst under this scheme

Yes you can.

Hi,

When we raise invoice in tours and travels supplier point of view, please answer whether GST is applicable for TOLL and BATA

In case of hotel booking through online platform like Make My Trip, whether the hotel should issue invoice to the guest (B2C) or to the online service provider (B2B)? Here consideration received by the hotel from the online service provider

Yes, the invoice should be to the customer. Online service provider works as a pure agent.

How to file GSTR 1 and GSTR 3B for Travel Agents.

Only for railways and flights.

I have a tour oprater service and as itc process if i make 5% gst bill then i am not eligble for itc..I know than but my main quation will get the ITC for other like . i am spening the mony on facebook ads and they are charging me 18% GST will i get the GST itc for this .. if i purhessed any laptop for office purpers and i take the GST bill form Shop then i ma eligible to claim the GST for laptop

In case you are making 5% GST bill you cannot take ITC of Facebook bill and also not of Laptop bill

Its Possible if i make 18% gst or 5 % GST bill.

example : I have 6 sales invoice and I make 3 sales Invoice in 18% GSt & rest 3 for 5% GST for any month not every month will i eligble for ITC for all like. facebook, laptop or other purches etc.

Or Its possbile one month i make 18% GST for claim ITC and 1 month 5% GST bill..

You can do that too.

Yes you can take input proportionately. You can take all the input and then reverse proportionately in the proportion of 18% supply and 5% supply. For detailed assistance on this you can connect with us.

Dear Sir

Please advise on following question.

We are tour operator and charge GST@5% from our guests.

Can any of the guest claim this GST credit against this invoice ?

For example, I sold a package tour including hotel and transportation for Rs. 25000+5% GST. We paid 5% GST to govt. We have issued invoice to guest mentioning package cost Rs.25000 + GST. Now can the guest claim credit against this invoice ?

There are different answers received on this platform but not satisfactory.

Kindly advise.

Naresh

Your customer/guest can take input tax credit of this 5%. But you cannot take any ITC for paying out your GST liability except that ITC which is on the services taken by you from other tour operator. You can write to us on our email id detailing your query, and we will reply accordingly.

applying for new GST registration for Tour operator, but stuck in between. as Tour operator is not mentioned specifically under the Business type/category. please advise what category to be selected and what will be HSN number.

If there is no specific category mentioned, you can select Others. The HSN code is 998555.

Hello sir,

I have started a new travel agency, Now As of things will charge 18% on flight bookings and 5% on cabs,hotel,visa. .Now my question is should I charge these GST on my margin (Ie 1000₹+18% was flight ticket and I sold for 1200₹) then my invoice to client should like (1200+18%) or (200+18%) for flights..if it’s (1200+18% then invoice value is 1416₹ which he can claim, oR (200+18% =236₹) which he can claim

Second , I’m getting an invoice from hotel people for 12% but I’m giving to client as 5%.. so it should be on whole amount or only on my margin should give ..

Please advice

Regards,

Sheriff

Please advice…

Mr Sheriff

In the case flight ticket booking, you have to charge GST at the rate of 18% on the commission value i.e. in your case you have to charge GST on INR 200. In case of hotel booking, you can charge GST both ways either on whole value or only on the commission. In case you are working on commission basis then GST rate would be 18%. In case you are charging GST on the whole amount, GST would be charged based on the room tariff as below,

INR 7,500 28%

If room tariff is below Rs.1,000 then there would be no GST. If it is between Rs.1,000 -2,499.99 then the rate would be 12%. If it is between Rs.2,500 -7,499.99 then 18% and if it is INR 7,500 or more the rate would be 28%.

For more detail on this you can reach out to us on our website

Sir my vichele is in tender under govt hospital for staff duty … i will pay 12 percent gst and my annual income is less then 5 lakh what can i do? I should pay or not plsase tell me

If your annual income is less than 5 lakh then you need not to get registered under GST and if you are not registered then there is no liability of GST on you for the services you provide

Dear Sir

can we take input tax credit on Input goods & assets or other support service credit while we obtaining 5 % GST Slab ??

No, you cannot.

Dear Sir

Can a travel company work as both method as a tour operators and pay 5% gst on whole amount ,and take ITC in case purchase package from other tour operator.

As a travel agent and pay gst 18% only on service charge with itc.

Yes, you can work both ways simultaneously. But in that case you have to maintain separate record

I am own a transport which provide staff travelling to company. In this case I have two client 1 client asking for 18% and 1 client asking for 5% while I have one transport can I gave two different types of GST percentages. Can anyone suggest answer for my question

Yes, you can.

What if I am providing Tour service to Government department. is 5% tax applicable to me.

As I am charging 5% tax in B2C and government department is paying RCM and not paying me 5%.

Hi,

Sir I have made partial advance payment of total tour package but now tour is canceled, now I am asking for refund but tour operator says that we have paid 5% GST so this amount will no be paid. Please suggest & confirm.

You are eligible for GST refund also on the proportionate amount of advance that you have paid. You need to talk with the tour agency and ask them to give you a credit note for this.”

Some a portal charged 5% TDS on commission earned (Not 18% GST on commission).

In case airline ticket breakup is

Base fare : 13,319, Other Taxes :578, K3 : 668 = 14,565 (Gross fare)

Less (Commission earned ) = -327.65

Add (TDS deducted 5% of comm) = 16.38

Nett Payable Amount 14254/-

Can you please advice me how to raise tax invoice if I sell it @14,500

How to get ITC ?

Sir How to Generate invoice only in flight tickets booked by clients.

What will be the procedure to claim GST?

In case flight ticket is booked by client himself then you will bill for only your commission as agreed upon and charge GST @ 18% thereupon. You cannot take input on that because the invoice is in the name of the client and not you.”

Sir, we are a travel agency offering bungalows, villas, tours packages and various services. What GST we should charge particularly on bungalows, villas, hotels to our client. Is it on the commission, if yes then customers might clearly know the business inside out and might refrain doing business with us in future. Also on what amount we have to file our ITC to get rebate or input tax credit

Hi

Thanx for such an elaborate GST guidlines for travel agents.

I just have a question:

Many a times guests want a GST credit from their Flight and Hotel Bookings done through us. But these days most of the Travel agents use consolidators inventory for the same and don’t have option to put guests GST in those bookings so that he can get back the GST input.

How to deal with these?

Also, in international bookings, how to deal with such GST issues?

Thanx.

Atin.

Sir, please clarify, if the entity is working as a pure agent and charging 18% GST on the commission amount only. Will ITC be available on that GST amount on commission?

How much percent gst on visa to be charged to customer as a travel agent

Dear Sir

Can a travel company work as both method as a tour operators and pay 5% gst on whole amount ,and take ITC in case purchase package from other tour operator.

As a travel agent and pay gst 18% only on service charge with itc.

Sir i am a travel agent in Port Blair , if my package cost (separate cost)

HOTEL – 22000

CRUISE – 15000

VEHICLE COST = 8000

SERVICE CHARGE = 2000

THEN HOW CAN I GENERATE MY GST BILL ,

PLEASE ADVICE

How to show reimbursement amount in gst return .

If tour and travel agent company paying margin basis gst.

I am working in a tour and travel agent company.

I have a problem or confusion in gst return filling that if we are paying tax on margin basis in gst then I want to ask you how to show in gst return .

What we have to show reimburse value in gst return in 3b or R 1 as a total invoice value .

Please suggest me.

Hello Sir,

Whether it is allowed to opt for both the options in the same financial year ie to pay GST @5%/18% for some clients and also act as a pure agent and charge GST @18% on commission for some other clients

Dear sir

If we are working as a tour and travel agent and paying gst on services charge ,

Then in this case how to show total invoice amount in gst return.

Suppose we give package to client Rs -1,00,000 including services charge.

Our purchase for of client is -85000

Our magin is -15000

Taxable. -12712

Gst,18%. 2288

Total. 15000

Then in gst return what total invoice value We have to show in gst R1

15000 or 100000

And in gstr3B what taxable value we have to show. -12712. Or another value .

Please suggest me .

Where tour operator is preparing invoice on pure agent basis charging gst on only commission amount and taking only reimbursement of hotel booking, whether hotel invoice will be in the name of your operator or the client of tour operator who is service receipent? In case tour operator take hotel invoice in own name, what will be the consequences?

If a company is operating as a pure agent in few places , and as tour operator in few.. Can it bill 18% & 5% respectively and file in GST returns ?

Dear Mr Neeraj,

In the below explanation, Is 18% mentioned assuming that the Tour operator has opted for the 18% GST ? or is it charged at 18% for both cases i.e 5% and 18% ?

“Let’s understand this with our previous example. In that case, if the entity enters into an agreement with the customer to act as pure agent, then the entity will charge GST at the rate of 18% on Rs. 10,000/- only i.e. Rs. 1,800/- and will take reimbursement of Rs. 90,000/- as actual expense incurred on behalf of the customer.”

Hi Sir, you said generally small businesses act as pure agent and charge GST on commission/ Service charges only,

Suppose a tour operator make hotel bookings not as per client requirement i mean fixed number of bookings every month then this tour operator aslo need to charge based on slabs? or how can this is chargable when he sell to their customers

Dear Sir,

thanks for your advice. i just want to know the input tax credit allowed between two operators from same service – there is still doubt in this in many minds. So want to find out which particular section is this allowed under the Act? – input credit is allowed from same serivce in B2B. which particular section?

thansk and regards

Thanks

Dear Sir

please check also my quary

Simple and Lucid Explanation. Very nice and helpful