Introduction: –

Introduction: –

Greetings to everyone on occasion of completing one-year of GST on 1st July. With the advent of GST regime, we have seen lots of Ups and Downs on paradigm shift of the economy by abolishing around 17 indirect taxes and 23 cesses to achieve One Nation One Tax.

Lots of issues pertaining to GST are resolving day by day, but still some grey areas exist, one of which is “How to find out taxable Jurisdiction of the assessee”.

Based on the Decision of 21st GST Council meeting held at Hyderabad, a detailed guideline has been provided vide Circular No. 01/2017 dated 20th September, 2017 for division of Taxpayer base between the Centre and the States to ensure single interface under the GST.

The followings are the gist of guidelines-

i) Of the total number of taxpayers below Rs. 1.5 crore turnover, all administrative control over 90% of the taxpayers shall vest with the State tax administration and 10% with the Central tax administration;

ii) In respect of the total number of taxpayers above Rs. 1.5 crore turnover, all administrative control shall be divided equally in the ratio of 50% each for the Central and the State tax administration;

iii) The division of taxpayers in each State shall be done by computer at the State level based on stratified random sampling and could also take into account the geographical location and type of the taxpayers, as may be mutually agreed.

For the purpose of computation of turnover, procedure has been clarified in para 2 of the circular with respect to the taxpayers registered either under standalone erstwhile laws such as VAT, Central Excise, Service tax or under two or more laws together.

Now, let’s discuss the issue – “How to find out Taxable Jurisdiction of assessee”.

Steps to be followed:

GST Portal:

Open the link of GST i.e. https://gst.gov.in , and then go to Search Taxpayer option; fill your GSTIN/UIN no. from where you will get all the details of the Taxpayer including Central jurisdiction and State jurisdiction.

The Jurisdiction which is shown in RED Colour is the actual taxable jurisdiction of the Taxpayer. Example shown below: Centre is the taxable authority.

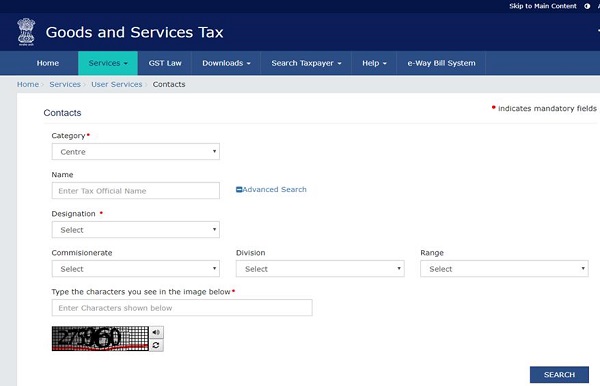

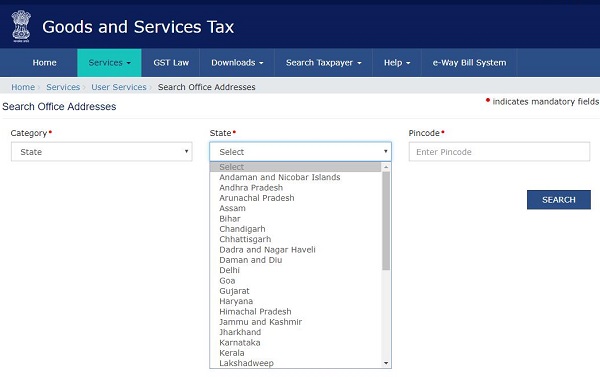

Further, you may also check user Services under Services icon of this portal to find out address of the concerned Tax Officer. These two options under Search icon i.e. Contacts, and Search office addresses provides you the details of Officer in relation to desired jurisdiction.

CBEC Sites:

Further, the Government has launched a GST portal i.e. https://cbec-gst.gov.in/know-your-jurisdiction.html, which also helps to determine the Range under which the Taxpayer jurisdiction falls.

Taxpayer while going through the GST Registration process is required to provide the Jurisdiction details of the place of business. So, this portal aids in determining the exact Jurisdiction of the taxpayer through searching their locality.

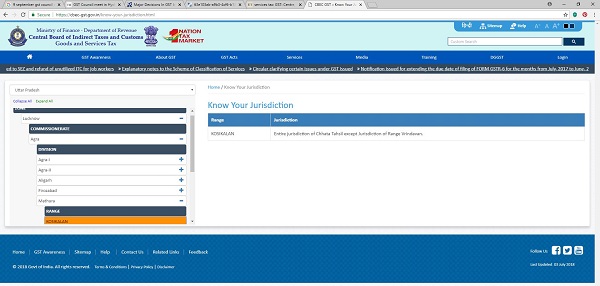

E.g. ABC is a company wants to search his Commissionerate for the place of business situated in “Kosikalan”. For this purpose, company has to follow the following steps:-

i. First go to site of CBEC, having following link https://cbec-gst.gov.in/know-your-jurisdiction.html.

ii. Then, select the states under which it covers. For this example, “Kosikalan” is situated under “Uttar Pradesh”.

iii. Now select the zone, here two Zones i.e. Lucknow and Meerut are displayed.

iv. Now for sack of simplicity, just click on Expand All icon.

v. All the Commissionerate expands into Division and Range.

vi. Here, we analyse that “Kosikalan” Range is situated in “Mathura” Division under Commissionerate “Agra”.

CBIC MITRA Help desk:

Furthermore, Taxpayer may also dial on Tollfree helpline no. 1800-1200-232 along with E-mail cbecmitra.helpdesk@icegate.gov.in for resolving their queries.

GSTN Help desk:

For resolving any grievances of a Tax payer, Department has also provided helpline no. 0124-4688999 along with E-mail helpdesk@gst.gov.in .

Self Help Portal:

Tax payer may also try to lodge complaints to find their jurisdiction of respective business. But this portal i.e. https://selfservice.gstsystem.in/ has been designed for lodging complaints by taxpayers and other stakeholders on some selected issues. They can lodge Complaint here indicating issues or problems faced by them while working on GSTN portal instead of sending emails to the Helpdesk. It has been designed in a manner that the user can explain issues faced and upload screenshots of pages where they faced the problem, for quick redressal of grievances. This Self-help portal determine issue of jurisdiction in relation to New registration when correct jurisdiction is not available.

GST Seva kendra:

Contact Details of GST Seva Kendra .

The following link of CBIC provides a list of contact details of various Seva kendra located various parts of India. This facility provides to locate the jurisdiction of department as per area wise. The zonal wise postal address containing phone no. as well as E-mail id in a tabular form.

State Jurisdiction:

For determining the State jurisdiction of the department, the Taxpayers have to refer their respective State Vat/Sales tax website for searching ward and circle.

Central Jurisdiction:

Central jurisdiction itself covered under CBIC Portal of GST. So, above process may also be followed to determine the applicability of central jurisdiction.

Now what happen if still Taxpayer not able to find his Jurisdictional officer?

The problem may occur if you have selected the wrong jurisdiction at the time of registration since ward and circle are based on the Pin-code and locality of the Taxpayer. Taxpayer may submit an application to Administrative/IT cell of respective state for correction in this regard.

Don’t forget to check to know your jurisdiction.

Conclusion:

For redressing any grievances of the Taxpayer, very active process is initiated by the Department. Effective measures are taken to overcome any cumbersome issue pertaining to Taxpayer. That’s why 24*7 Toll free customer support service, Customer help portal, Self-help portal and other media are canalized to reduce the burden of pressure from the Taxpayer.

DISCLAIMER: The views expressed are strictly of the author and A2Z Taxcorp LLP. The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation of firm. Neither the author nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon.

(Author can be reached at Email: bimaljain@hotmail.com)

unable to search the range , jurisdiction, of Addess Greewood plaza, netaji subhash marg, sector-45, gurugram, haryana-122001 for GST address amendment , please suggest

Village_gobindgar Jugaina Ludhiana Kon se area code me apply hoga

Sir, i want to know my want or circle no for gst apply

i am living in sewak park, uttam nagar, ND 110059

What is difference between Malvani-Malad_701 and Malvani-Malad_702 while updating Sector / Circle / Ward /Charge / Unit.

I am not sure what to select. I am from Mumbai suburban area Malad and reside at gate no 8 Malwani

Cancellation of Registration

ARN – AA08111802068A

PEDIG BATRA HE PZL HELP

GOvt is doing lot of to simplify GSt it means Govt is learning from expirence then why for small defaults which are mostly technical without intent to evasions of Tax heavy penalties are imposed Liberal attitude should be adopted ate least for three years