Monthly, Quarterly and Annual Returns is compulsory even though no transactions is to be reported. Nil Return has to be submitted.

GST Returns.

Sec 2(97) ―return means any return prescribed or otherwise required to be furnished by or under this Act or the rules made thereunder;

Sec 37. Furnishing details of outward supplies.— (1) Every registered person, other than an Input Service Distributor, a non-resident taxable person and a person paying tax under the provisions of section 10 or section 51 or section 52, shall furnish, electronically, subject to such conditions and restrictions and in such form and manner as may be prescribed, the details of outward supplies of goods or services or both effected during a tax period on or before the tenth day of the month succeeding the said tax period and such details shall, subject to such conditions and restrictions ,within such time and in such manner as may be prescribed, be communicated to the recipient of the said supplies:

Sec 39. Furnishing of returns.— [(1) Every registered person, other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the provisions of section 10 or section 51 or section 52 shall, for every calendar month or part thereof, furnish, a return, electronically, of inward and outward supplies of goods or services or both, input tax credit availed, tax payable, tax paid and such other particulars, in such form and manner, and within such time, as may be prescribed:

Other Sections which requires GST Returns

a. Sec 39(2)

b. Sec 39(3)

c. Sec 39(4)

d. Sec 39(5)

e. Sec 39(6)

f. Sec 39(7)

g. Sec 39(8)

h .Sec 39(9)

i. Sec 39(10)

Returns which are to be submitted under GST Act and Circulars

Following Table shows the GST Return name, description of returns, persons to be filed ,last date of filing and active status respectively.

Table No :1

GSTR-1 |

Details of Outward Supplies of Goods or Services by Normal Taxpayer under QRMP Scheme |

by Normal Taxpayer under QRMP Scheme IFF is to be filed in first two months IFF – Invoice Furnishing Facility. IFF is an optional facility provided to quarterly taxpayers only. | 13 of the month succeeding quarter | Active |

GSTR-3B – |

Monthly/ Quarterly Return by Normal Taxpayer under QRMP Scheme |

Monthly/ Quarterly Return by Normal Taxpayer under QRMP Scheme |

22 or 24 of the month succeeding quarter | Active |

GSTR-1 – |

Details of Outward Supplies of Goods or Services |

Normal Taxpayer |

11 of the next month | Active |

GSTR-3B – Monthly and Quarterly Return by Normal Taxpayer |

Monthly and Quarterly Return by Normal Taxpayer | Monthly and Quarterly Return by Normal Taxpayer | 20 of the next month

22 or 24 of the month succeeding quarter in the case of QRMP Scheme |

Active |

Form GST CMP-08 – Quarterly Statement for Payment of Self-assessed Tax by Composition Taxpayer (FY 2019-20 onwards) |

Quarterly Statement for Payment of Self-assessed Tax |

Composition Taxpayer (FY 2019-20 onwards) |

18 of the month succeeding quarter | Active |

GSTR-4 – |

Return for Financial Year |

Composition Taxpayer (FY 2019-20 Onwards)

|

30 of the month succeeding the financial year | Active |

GSTR-5 |

Return for Non-resident Taxable Person | Return for Non-resident Taxable Person | 20 of the next month | Active |

GSTR-5A |

Details of supplies of online information and database access or retrieval services (OIDAR) |

Person located outside India made to non-taxable persons in India |

20 of the next month | Active |

GSTR-6 – Return for Input Service Distributor (ISD) |

Return for Input Service Distributor (ISD) |

Return for Input Service Distributor (ISD) |

13of the next month | Active |

GSTR-7 – Return for Tax Deducted at Source |

Return for Tax Deducted at Source | Persons responsible for deducting tax | 10 of the next month | Active |

GSTR-8 – Statement for Tax Collection at Source |

GSTR-8 – Statement for Tax Collection at Source |

E-Commerce operators | 10 of the next month | Active |

GSTR-9 – Annual Return for Normal Taxpayer |

Annual Return for Normal Taxpayer |

Normal Taxpayer |

31 st Dec of the next financial year | Active |

GSTR-10 – Final Return

|

Final Return | Normal Taxpayer after Cancellation of Registration | Within three months of the Cancellation of Registration | Active |

GSTR-11 – Statement of Inward Supplies |

Statement of Inward Supplies |

Persons having Unique Identification Number (UIN) |

Quarterly basis. | Active |

Others

Form GSTR-9A

It is an annual return to be filed once, for each financial year, by taxpayers who have opted for composition scheme, for any period during the said financial year. The taxpayers are required to furnish details regarding outward supplies, inward supplies, taxes paid, any refund claimed or demand created or input tax credit availed or reversed due to opting out or opting in to composition scheme.

Form GST CMP-08

It is used to declare the details or summary of self-assessed tax which is payable for a given quarter by taxpayers who are registered as composition taxable person or taxpayer who have opted for composition levy.

QRMB Scheme

As a trade facilitation measure and in order to further ease the process of doing business, the GST Council in its 42nd meeting held on 05th October, 2020 had recommended that registered persons having Aggregate Annual Turnover up to ` 5 Cr may be allowed to furnish return on quarterly basis along with monthly payment of tax, with effect from 01.01.2021. This scheme of quarterly return filing along with monthly payment of taxes is referred to as “QRMP Scheme”.

(Source:https://www.cbic.gov.in/resources//htdocs-cbec/gst/12112022/QRMP%20Scheme.pdf)

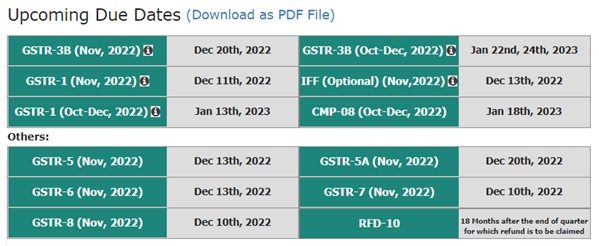

You can see name of the GST Returns and their last dates from the following screen shots of GST websites.

Picture I.

(Source: https://www.gst.gov.in/)

GST Practitioner

GST Practitioner is a tax professional who can prepare returns and perform other activities on the basis of the information furnished to him by a taxable person. (However, the legal responsibility of such filings remains with the Taxpayer.) For this purpose, GST Practitioners (GSTP) are required to be enrolled with Centre or State Authority. CA/ CS/ CMA holding Certificate of Practice (COP), Advocates, Retired Government Officials, and Graduates are eligible to apply for registration. In addition, GSTPs can be appointed Authorized Representatives who can act on the behalf of the taxpayers and represent them before tax authorities.

GST Practitioner must fulfill following conditions he/she can enroll on the GST Portal:

1. Applicant must have a valid PAN Card

2. Applicant must have a valid mobile number

3. Applicant must have a valid e-mail ID

4. Applicant must have a Professional address

5. Applicant must have the prescribed documents and information on all mandatory fields as required for Enrolment

6. Applicant must fulfill the eligibility criteria of GST Practitioner.

Eligibility criteria an applicant must fulfill for becoming a GST Practitioner /enrolling on the GST Portal as a GST Practitioner

- Chartered Accountant holding COP

- Company Secretary holding COP

- Cost and Management Accountant holding COP

- Advocate

- Graduate or Postgraduate degree in Commerce

- Graduate or Postgraduate degree in Banking

- Graduate or Postgraduate degree in Business Administration

- Graduate or Postgraduate degree in Business Management

- Degree examination of any recognized Foreign University

- Retired Government Officials

- Sales Tax Practitioner under existing law

- Tax Return Preparer under existing law

GST Practitioner can perform functions provided below on the GST Portal on behalf of a taxpayer.

Registration:

- Creating and saving the application for amendment of registration

- Creating and saving for filing clarifications (post grant of registration)

- Creating and saving the application to opt for Composition Levy

- Creating and saving the application to withdraw from Composition Levy

- Creating and saving the application for cancellation of Registration

- Creating and saving the application for revocation of cancelled registration for Normal/NRTP/TDS/TCS/OIDAR taxpayers

- Tracking Application Status

- Amendment of Core fields

- Amendment of Non-Core fields

Ledgers:

- Viewing Electronic Cash Ledger

- Viewing Electronic Credit Ledger

- Viewing Electronic Liability Register

Returns:

- Viewing Returns Dashboard

- Creating and preparing different returns (including invoice upload)

- Creating and preparing Annual return

- Tracking Return Status

- Viewing Transition Forms

- Viewing ITC Forms

Payments:

- Creating a Challan and make deposit (utilization can be done by taxpayer only)

- Viewing Saved Challan

- Viewing Challan History

User Services:

- Viewing Saved Application

- Viewing and Creating New Application for:

- Advance Ruling

- Form DRC-03

- Letter of Undertaking

- Appeal

- Rectification of Order

- Restoration of Provisional Attachment

- Deferred Payment/ Payment in Instalments

- Provisional Assessment ASMT-01

- Viewing and Downloading Certificates

- Viewing Notices and Orders

- Viewing Submitted Applications

- Viewing Cause List

- Searching HSN/ Service Classification Code

Refunds:

- Preparing a refund application

- Viewing Saved Refund Application

- Viewing Filed Refund Application

- Track Refund Application status

- View Electronic Liability Register from the link available in the refund application

Letter of Undertaking (LUT):

- Preparing Form GST RFD-11

Qualifying examination for GST Practitioners (Rule 83 A)

To become a GST Practitioner, one has to write an examination.

References:

1. https://www.gst.gov.in/help/helpmodules/