As you know, our profession is growing exponentially and the main reason is change. Today we are seeing amendments and modifications in almost all laws and are at a stage where we have to transform our thought process and discover new ways of performance. It is time for us to see that clients see value addition in whatever services we provide and for that we need to be geared up at all times.

In view of above I am attaching herewith the link on “Compliance book 2019″ which I have authored in 2018 and will help you in addressing Compliance & Audit related issues. Book Contains the following-

Page Contents

1. Income Tax Act, 1961

1.1 Tax Rates:

1.1.1 For Individuals and HUF:

(Rs. In Lacs)

| A.Y. | Rate* | Income Slab | ||

| General/NRI | Senior citizen** | Super senior citizen*** | ||

| 2019-20 | Nil | Up to 2.5 | Up to 3 | Up to 5 |

| 5% | 2.5 to 5 # | 3 to 5 # | – | |

| 20% | 5 to 10 | 5 to 10 | 5 to 10 | |

| 30% | Above 10 | Above 10 | Above 10 | |

*Exclusive of Health and Education Cess @ 4%

*Exclusive of Surcharge for A.Y. 2019-20 as mentioned below

| Income Slab | Rate |

| From 50 Lacs to 1 Crore | 10% |

| Above 1 Crore | 15% |

In addition to the above tax, if Dividend income received exceeds Rs 10 lacs per annum, additional tax at the rate of 10% of gross amount received shall be paid by all residents assesses except domestic company & certain funds, trust, institutions, etc. From AY 2019-20 Dividend distributed by Equity Oriented mutual funds are taxable at the rate of 10%.

** Resident Individual of 60 Years till 80 Years.

*** Resident Individual 80 Years and above at time during the previous year.

# Rebate as per Sec. 87A will be provided to a resident individual who’s Net Income is < Rs. 3,50,000. Rebate will be Equal to the Actual Tax Payable or Rs. 2500 whichever less for A.Y. 2019-20.

1.1.2. For Co-Operative Societies:

| A.Y. | Amount | Rate of Tax* |

| 2019-20 | Up to Rs.10,000 | 10% |

| From Rs. 10,001 to Rs. 20,000 | 20% | |

| More than Rs. 20,000 | 30% |

*Exclusive of Health and Education Cess @ 4%

*Exclusive of surcharge @ 12% whose total income exceeds Rs. 1 crore

1.1.3 For AOP & BOI :

| Shares of Members are Determinate | Shares of Members are Indeterminate | |||

| Member is an Individual / HUF | Member is a Company | Member is an Individual/HUF | Member is a Company | |

| When None of the member has income in excess Basic exemption limit. | When any of the member have income in Excess of Basic Exemption Limit. | When total income of member company is taxable at rate higher than the Maximum Marginal Rates (i.e. in case of Foreign Companies) | Tax will be charged on the Total income of AOP/BOI at MMR of 35.88%* | Where income of AOP/BOI is taxable at rate higher than the MMR then, the Total Income of AOP/BOI will be taxed at such higher rate. (i.e. in case of Foreign Companies) |

| AOP/BOI will be taxed at the slab rates specified in 1.1.1 | AOP/BOI will be taxed at the Maximum Marginal Rate of 35.88%* | Tax will be charged on that portion of AOP / BOI at such higher rate. | ||

*Maximum Marginal Rate is 35.88% for A.Y. 2019-20

1.1.4 For Other Assesses

| Other Assesses | Income Tax Rate | MAT Rate | Dividend Distribution Tax Rate* |

| Domestic Companies | 30% # | 18.5% | 20.55872%* |

| Foreign Companies | 40% | 18.5% | — |

| Firms/ LLP/ Local Autho. | 30% | Note-1 | — |

*Inclusive Health and Education Cess @ 4%& Surcharge of 12% of Income tax.

# Tax Rate is 25% if turnover or gross receipts of the company doesn’t exceed Rs. 250 Crore in P.Y. 2016-17 (relevant for A.Y. 2019-20.)

Notes:

1. Alternate Minimum Tax (AMT) is applicable to all persons (other than companies) claiming profit linked deductions under chapter VI-A (80-H to 80RRB excluding 80P) and Section 10AA, provided the adjusted income exceeds Rs. 20

2. Marginal Relief is available in case income exceeds Rs. 1 Crore or Rs. 10 Crore, as the case may be, to the extent marginal tax exceeds marginal income.

Applicability of Surcharge & Education Cess:

| Particulars | Applicable to Companies | A.Y. 2019-20 | ||

| Surcharge | Total Income | < Rs. 1 cr | All | NIL |

| Rs. 1 cr to Rs. 10 cr | Domestic | 7% | ||

| Foreign | 2% | |||

| > Rs. 10 cr | Domestic | 12% | ||

| Foreign | 5% | |||

| Education Cess (A.Y. 2018-19) @ 3%, Health & Education Cess (A.Y. 2019-20) @ 4% | ||||

1.2 Advance Tax:

| Due Date | Company / Other than Company |

| 15th June | Up to 15% |

| 15th Sep. | Up to 45% |

| 15th Dec. | Up to 75% |

| 15th Mar. | 100% |

Notes:

1. Advance Tax is not Applicable if Liability to pay Advance Tax is less than Rs. 10,000.

2. An assesse who gets his books audited u/s 44 AD / ADA is required to pay advance tax of the whole amount in one installment on or before 15th March of the financial year.(Applicable w.e.f. 06.2016)

3. Citizen who does not have Income from Business and Profession is not required to pay Advance Tax.

1.3 ITR Forms

| Individual and HUF | ||||

| Nature of income | ITR 1* (Sahaj) | ITR 2 | ITR 3 | ITR 4 |

| Income from salary/pension (for ordinarily resident person) | ✓ | ✓ | ✓ | ✓ |

| Income from salary/pension (for not ordinarily resident and non-resident person) | ✓ | ✓ | ✓ | |

| Income or loss from one house property (excluding brought forward and carried forward losses) | ✓ | ✓ | ✓ | ✓ |

| Income or loss from more than one house property | ✓ | ✓ | ||

| Agricultural income exceeding Rs. 5,000 | ✓ | ✓ | ||

| Total income exceeding Rs. 50 lakhs | ✓ | ✓ | ✓ | |

| Dividend income exceeding Rs. 10 lakhs taxable under Section 115BBDA | ✓ | ✓ | ||

| Unexplained credit or unexplained investment taxable at 60% under Sections 68, 69, 69A, etc. | ✓ | ✓ | ||

| Income from other sources (other than winnings from lottery and race horses or losses under this head) | ✓ | ✓ | ✓ | ✓ |

| Income from other sources (including winnings from lottery and race horses or losses under this head) | ✓ | ✓ | ✓ | |

| Capital gains/loss on sale of investments/property | ✓ | ✓ | ||

| Interest, salary, bonus, commission or share of profit received by a partner from a partnership firm. | ✓ | |||

| Income from business or profession | ✓ | |||

| Income from presumptive business | ✓ | |||

| Income from foreign sources or Foreign assets or having Signing authority in any account outside India | ✓ | ✓ | ||

| Income to be apportioned in accordance with Section 5A | ✓ | ✓ | ✓ | |

| Claiming relief of tax under sections 90, 90A or 91 | ✓ | ✓ | ||

| * Only an Individual, who is an ordinarily resident in India, can file income-tax return in Form ITR-1. | ||||

–

| Other Assessees | ||||

| Status of Assessee | ITR 4 | ITR 5 | ITR 6 | ITR 7 |

| Firm (excluding LLPs) opting for presumptive taxation scheme | ✓ | |||

| Firm (including LLPs) | ✓ | |||

| Association of Persons (AOP) | ✓ | |||

| Body of Individuals (BOI) | ✓ | |||

| Local Authority | ✓ | |||

| Artificial Juridical Person | ✓ | |||

| Companies other than companies claiming exemption under Sec. 11 | ✓ | |||

| Persons including companies required to furnish return under:

A. Section 139(4A); B. Section 139(4B); C. Section 139(4C); D. Section 139(4D); E. Section 139(4E); and F. Section 139(4F) |

✓ | |||

1.4 TDS Rate Chart:

TDS is applicable to any person, other than an individual or a HUF not subject to audit under section 44AB in the immediately preceding year.

| Sec. | Nature of Payment Description | Threshold Amount Rs. | Rate % | ||

| 192B** | Salary (Other than Government Employee) | As per Normal Slab Rates after providing Deductions of Chapter VI A | |||

| 194A | Interest by bank/co-op society/post office (Refer Note 2) | Rs. 10,000 | 10% | ||

| Interest by others | Rs. 5,000 | 10% | |||

|

194C |

Payment to contractor / sub-contractor/ Advertisement / Transporter | Single Transaction | Rs. 30,000 | 2%* | |

| Aggregate During FY | Rs. 1,00,000 ## | 2%* | |||

| Transporter owning ten or less than ten goods carriage with PAN | TDS not applicable | ||||

| 194D | Insurance commission | Rs. 15,000 | 5% | ||

| 194H | Commission/ brokerage | Rs. 15,000 | 5% | ||

| 194IB | Rent paid by an Individual/HUF Per Month

(if not subject to tax audit u/s. 44AB immediately preceding financial year) (applicable from June 01,2017) |

Rs. 50,000 |

5% |

||

| 194I | RENT | Plant & Machinery, Equipment | Rs. 1,80,000 ^ | 2% | |

| Land & Build., Furniture & Fixture | 10% | ||||

|

194J |

Professional fees | Rs. 30,000 | 10%^^ | ||

| Royalties | Rs. 30,000 | 10%^^ | |||

| Technical Fees | Rs. 30,000 | 10%^^ | |||

| Directors Remuneration. | Nil | 10%^^ | |||

| 194LA | Compensation on acquisition of immovable property (other than agricultural land) | Rs. 2,00,000 | 10% | ||

| 194IA | Purchase of Immovable Properties # (other than agriculture land) | Rs. 50,00,000 | 1% | ||

*Rate 1% in case of Deductee Individual / HUF.

** Person responsible for making payment for calculation of TDS is required to obtain the evidence or proof or particulars of prescribed claims (including claims of set-off of loss) from deductee.

# TAN is not compulsory for deductions u/s 194IA

^No TDS even if payment exceeds Rs. 1,80,000 provided landlord furnishes a self- declaration in prescribed Form. No. 15G/15H to the payer (effective from 1st June, 2016)

^^ If the payee is engaged only in the business of operation of call center, then TDS is to be made @ 2% (applicable from 1st June, 2017.)

Note:

1. If No PAN or invalid PAN, TDS rate is 20%. Declaration of Non Filing of TDS statement is mandatory in case of NILTDS Returns.

2. TDS required to be deducted if Interest received by senior citizen from bank/ co op society/ postoffice exceed Rs. 50,000.

1.5 TCS Rate Chart:

| No. | Nature of Goods | Rate (%) |

| 1. | Scrap, Alcoholic liquor for human Consumption | 1% |

| 2. | Tendu leaves | 5% |

| 3. | Forest Products incl. Timber but excl. Tendu leaves | 2.5% |

| 4. | Parking lot, Toll Plaza, Mining | 2% |

| 5. | Purchase of Motor Vehicle (If value > Rs. 10 Lacs) | 1% |

1.6 Deductions:

| Section | Particulars | Amount | Persons Covered |

|

80C |

LIC*/NSC/PPF/ULIP/ ELSS MF/ Bank FDR

(5 yrs)/ Home Loan Repayment/EPF/ School Fees/Sukanya Samriddhi Scheme |

Rs. 1,50,000 | Individual*/ HUF* |

| 80CCC | Pension Fund | Individual | |

| 80CCD(1) | Contribution to Pension Scheme*** | Employed / Self employed | |

| 80CCD(1B) | Contribution to Notified National Pension Scheme | Rs. 50,000 | Employed / Self employed |

|

80D# |

Mediclaim (payment mode other than cash) | Rs. 25,000**(Gen) &

Rs. 50,000@(Sr.Citizen) |

Individual^/ HUF^ |

| Preventive Health Check-up | Rs. 5,000 | Individual / HUF | |

| 80E | Interest on Loan for Higher Education | Interest paid every year for 8 years | Individual |

| 80EE | Deduction of Interest on Housing Loan | Rs. 50,000

(Note 1) |

Individual |

| 80G | Donation | 100%/50% of donation or 10% of adjusted GTI w.e. is less

(Note 2) |

All |

| 80GGB/

80GGC |

Contribution given to political parties | Any sum contributed (Other than Cash) | Indian Companies/ Any Person other than Local Authority &Artificial Judicial firm |

| 80TTA | Interest on Deposits in Savings Account | Rs. 10,000 | Individual/ HUF

(Other than Senior Citizen) |

| 80TTB | Interest from banks/post office (including FD Interest) | Rs. 50,000 | Senior Citizen Individual |

| 80U | person who has at least 40 % disability | Rs. 75,000 | All |

| disability is 80 percent or more | Rs. 1,25,000 | All |

# Very Senior citizens above the age of 80 years, who are not covered by health insurance, to be allowed deduction of Rs. 30,000 towards medical expenditures.

*Deduction of LIC Premium paid is available to Individual only if it is paid for Individual himself, spouse, or any child of such individual and in case of HUF, any member thereof.

^ Deduction of Mediclaim paid is available to individual only if it is paid for Individual himself, spouse, dependent children of such individual or parents of such individual and in case of HUF, any member thereof.

** Additional deduction for any payment of Mediclaim for parents Rs. 25,000 (Rs. 30,000 if parents are senior citizen).

*** Subject to maximum 10% of Salary of Employee.

For persons having income under the Salaries, standard deduction of Rs. 40,000 will be allowed.

However, the exemption of Transport allowance amounting to Rs. 1600 p.m. and medical reimbursement of Rs. 15000 is not allowed from A.Y. 2019-20 onwards.

Deductions (Cont.)

Note 1:

| Sr. No. | Conditions to be satisfied by the Assessee for Sec 80EE | |

| 1 | Year of Loan Sanctioned | FY 2016-17 only |

| 2 | Amount of Loan Sanctioned | Not more than Rs. 35 Lacs |

| 3 | Value of Residential Flat | Not more than Rs. 50 Lacs |

| 4 | Should not own any Residential House Property | |

Note 2:

Donation made in cash amounting to Rs. 2000 or more will not be allowed as a deduction.

1.7 Carry forward and set off of losses:

| No. | Type of Loss | Set off Under/Against* | Carried Forward for |

| 1 | House Property | All heads ** | 8 Years |

| 2 | Speculation | Speculation | 4 Years |

| 3 | Unabsorbed Depreciation / Cap Exp on Scientific Research / Family Plan | Any Income (Other Than Salary) | No Limit |

| 4 | Other Business Losses | All heads except “Salaries” | 8 Years |

| 5 | Short Term Capital Loss | Short Term and Long Term Capital Gains | 8 Years |

| 6 | Long Term Capital Loss | Long Term Capital Gain | 8 Years |

| 7 | Owning / Maintaining Horse races | Owning / Maintaining Horse races | 4 Years |

| 8 | Specified Business u/s. 35AD | Specified Business u/s. 35AD | No Limit |

* No loss can be set off against winning from lotteries, crossword puzzles, races including horse race, card games and any sort of receipt from gambling or betting of any form or nature.

* For Loss to be carried forward for future periods, Return of loss must be filed in time.

** The maximum amount available for set off of loss from house property in the year will restricted to ₹ 2,00,000 against the income of other head and the unabsorbed loss can be carry forward for set off in subsequent years.

2. Goods & Service Act, 2017

2.1 GST Returns and due dates

| RETURN FORMS | PARTICULARS | FREQUENCY | DUE DATES

|

| GSTR-1 | Details of outward supplies of taxable goods and/or services effected |

|

|

| Turnover upto Rs.1.5 crore | Quarterly | 30th / 31st of the succeeding quarter | |

| Turnover above Rs.1.5 crore | Monthly | 10th of the next month | |

| (Even if no supplies have been effected during a month, a nil return is to be filled mandatorily) | |||

| GSTR-3B | Simple Summary Return for the month | Monthly | 20th of the next month |

| GSTR-4 | Return for taxpayer opting Composite Scheme | Quarterly | 18th of the month succeeding quarter |

| (Even if no supplies have been effected during a month, a nil return is to be filled mandatorily) | |||

| GSTR-5 | Return for Non-Resident taxable person | Monthly | 20th of the next month |

| Or within 7 days after the last day of validity period of registration. | |||

| Whichever is earlier | |||

| GSTR-5A | Online Information and Database Access or Retrieval (OIDAR) | Monthly | 20th of the next month |

| GSTR-6 | Return for Input Service Distributor | Monthly | 13th of the next month |

| GSTR-7 | Return for authorities deducting tax at source. | Monthly | 10th of the next month |

| GSTR-8 | Return for e-commerce operator for the tax collected at source. | Monthly | 10th of the next month |

| GSTR-9 | Annual Return | Annually | 31st December of next financial year* |

| GSTR-9A | Annual Return | Annually | 31st December of next financial year* |

| GSTR-10 | Final (Last)Return | When registration is cancelled or surrendered | Within three months of the date of cancellation or date of cancellation order#, whichever is later. |

# As per Section 29(2), a proper officer is empowered to cancel registration of Taxable person if:

a. A person paying tax under composition scheme has not furnished his GSTR-4 for 3 consecutive tax periods (i.e., 3 consecutive quarters).

b. Any other taxable person has not furnished returns for consecutive period of 6 months.

2.2 Late fees & Interest

Return filing is mandatory under GST. Even if there is no transaction, you must file a Nil return.

- You cannot file a return if you don’t file previous month/quarter’s return.

- Hence, late filing of GST return will have a cascading effect leading to heavy fines and penalty.

LATE FEES AND INTEREST

- Interest is 18% per annum in case of belated payment of tax. It has to be calculated by the tax payer on the amount of outstanding tax to be paid. Time period will be from the next day of filing to the date of payment.

- Interest is 24% per annum in case of undue or excess claim of ITC or on such undue or excess reduction in output tax liability.

- As per GST Act late fee is Rs. 100 per day per Act. So it is 100 under CGST & 100 under SGST. Total will be Rs. 200/day. Maximum is Rs. 5,000. There is no late fee on IGST.

- Late fees for GSTR-3B of July, Aug and Sept waived. Any late fees paid for these months will be credited back to Electronic Cash Ledger under ‘Tax’ and can be utilized to make GST payments.

- As per latest update, late fees for GSTR-5A earlier reduced stands withdrawn. So, the Late fee of Rs 200 per day (or Rs. 100 per day in case of NIL return filing) shall apply with effect from 7th March 2018.

- Late Fee for filing GSTR-1, GSTR-3B, GSTR-4, GSTR-5 & GSTR-6 after the due date has been reduced to 50 per dayof delay.

- Late fee for filing NIL returns have been reduced to 20 per dayof delay for taxpayers (i.e having Nil tax liability for the month) for GSTR-1, GSTR-3B and GSTR-4 & GSTR-5.

2.3 E-Way Bill

E-Way Bill is an Electronic Way bill for movement of goods to be generated on the e-Way Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in Alternatively; E-way bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API. When an e-way bill is generated, a unique E-way Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

E-Way bill will be generated when there is a movement of goods in a vehicle/ conveyance of value more than Rs. 50,000 (either each Invoice or in (aggregate of all Invoices in a vehicle/ Conveyance)# ) –

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person

For this purpose, a supply may be either of the following:

- A supply made for a consideration (payment) in the course of business

- A supply made for a consideration (payment) which may not be in the course of business

- A supply without consideration (without payment)In simpler terms, the term ‘supply’ usually means a:

1. Sale – sale of goods and payment made

2. Transfer – branch transfers for instance

3. Barter/Exchange – where the payment is by goods instead of in money

Therefore, e-Way Bills must be generated on the common portal for all these types of movements. For certain specified Goods, the E-way bill need to be generated mandatorily even if the Value of the consignment of Goods is less than Rs. 50,000:

1. Inter-State movement of Goods by the Principal to the Job-worker by Principal/ registered Job-worker***,

2. Inter-State Transport of Handicraft goods by a dealer exempted from GST registration

3. Registered Person – E-way bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a Registered Person. A Registered person or the transporter may choose to generate and carry E-way bill even if the value of goods is less than Rs 50,000.

4. Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

5. Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

CASES WHEN EWAY BILL IS NOT REQUIRED

In the following cases it is not necessary to generate e-Way Bil:

1. The mode of transport is non-motor vehicle

2. Goods transported from Customs port, airport, air cargo complex or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for clearance by Customs.

3. Goods transported under Customs supervision or under customs seal

4. Goods transported under Customs Bond from ICD to Customs port or from one custom station to another.

5. Transit cargo transported to or from Nepal or Bhutan

6. Movement of goods caused by defence formation under Ministry of defence as a consignor or consignee

7. Empty Cargo containers are being transported

8. Consignor transporting goods to or from between place of business and a weighbridge for weighment at a distance of 20 kms, accompanied by a Delivery challan.

9. Goods being transported by rail where the Consignor of goods is the Central Government, State Governments or a local authority.

10. Goods specifed as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

11. Transport of certain specified goods- Includes the list of exempt supply of goods, Annexure to Rule 138(14), goods treated as no supply as per Schedule III, Certain schedule to Central tax Rate notifications.

Note: Part B of e-Way Bill is not required to be filled where the distance between the consigner or consignee and the transporter is less than 50Kms and transport is within the same state.

12. As per Maharashtra Government notified that no E-Way Bill shall be required to be generated for the intra-State movement in the State of Maharashtra, in respect of the goods valuing below Rs. 1 lakh or for goods transported for Hank, Yarn, Fabric and Garments of any value a distance of upto fifty kilometers within the State of Maharashtra for the purpose of job work as defined in sub-section (68) of section 2 of the Maharashtra Goods and Services Tax Act, 2017.

The revised limit is applicable for goods transported within the State on or before 1st July 2018. Maharashtra implemented the provisions of the E-Way Bill for intra-State movement of goods from 25th May 2018.

VALIDITY OF E-WAY BILL

An e-way bill is valid for periods as listed below, which is based on the distance travelled by the goods. Validity is calculated from the date and time of generation of e-way bill-

| Type of conveyance | Distance | Validity of EWB |

| Other than Over dimensional cargo | Less Than 100 Kms | 1 Day |

| For every additional 100 Kms or part thereof | additional 1 Day | |

| For Over dimensional cargo | Less Than 20 Kms | 1 Day |

| For every additional 20 Kms or part thereof | additional 1 Day |

Validity of Eway bill can be extended also by the generator of such Eway bill, either four hours before expiry or within four hours after its expiry.

DOCUMENTS OR DETAILS REQUIRED TO GENERATE E-WAY BILL

1. Invoice OR

2. Bill of Supply OR

3. Challan related to the consignment of goods

2.4 Reverse Charge Mechanism

Normally, the supplier of goods or services pays the tax on supply. In the case of Reverse Charge, the receiver becomes liable to pay the tax, i.e., the chargeability gets reversed.

2. When is Reverse Charge Applicable?

A. Supply from an Unregistered dealer to a Registered dealer

If a vendor who is not registered under GST, supplies goods to a person who is registered under GST, then Reverse Charge would apply. This means that the GST will have to be paid directly by the receiver of the supplies to the Government instead of the supplier.

The registered dealer who has to pay GST under reverse charge has to do self-invoicing for the purchases made.

For Inter-state purchases the buyer has to pay IGST. For Intra-state purchased CGST and SGST has to be paid under RCM by the purchaser.

Exemption on reverse charge on goods purchased from unregistered dealer is extended up to 30.09.2019.

B. Services through an e-commerce operator

If an e-commerce operator supplies services then reverse charge will be applicable to the e-commerce operator. He will be liable to pay GST.

For example, UrbanClap provides services of plumbers, electricians, teachers, beauticians etc. UrbanClap is liable to pay GST and collect it from the customers instead of the registered service providers.

If the e-commerce operator does not have a physical presence in the taxable territory, then a person representing such electronic commerce operator for any purpose will be liable to pay tax. If there is no representative, the operator will appoint a representative who will be held liable to pay GST.

C. Supply of certain goods and services specified by CBEC

CBEC has issued a list of goods and a list of services on which reverse charge is applicable.

Supplies of services under reverse charge mechanism:

| S/ No. | Description of supply of Service | Supplier of service | Recipient of service |

| 1 | Any service supplied by any person who is located in a non-taxable territory to any person other than nontaxable online recipient | Any person located in a non-taxable territory | Any person located in the taxable territory other than nontaxable online recipient. |

| 2 | GTA Services | Goods Transport Agency (GTA) who has not paid integrated tax at the rate of 12% | Any factory, society, cooperative society, registered person, body corporate, partnership firm, casual taxable person; located in the taxable territory |

| 3 | Legal Services by advocate | An individual advocate including a senior advocate or firm of advocates | Any business entity located in the taxable territory |

| 4 | Services supplied by an arbitral tribunal to a business entity | An arbitral tribunal | Any business entity located in the taxable territory |

| 5 | Services provided by way of sponsorship to any body corporate or partnership firm | Any person | Any body corporate or partnership firm located in the taxable territory |

| 6 | Services supplied by the Central Government, State Government, Union territory or local authority to a business entity excluding, –

(1) renting of immovable property, and (2) services specified below- (i) services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Central Government, State Government or Union territory or local authority; (ii) services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) transport of goods or passengers. |

Central Government, State Government, Union territory or local authority | Any business entity located in the taxable territory |

| 7 | Services supplied by a director of a company or a body corporate to the said company or the body corporate | A director of a company or a body corporate | The company or a body corporate located in the taxable territory |

| 8 | Services supplied by an insurance agent to any person carrying on insurance business | An insurance agent | Any person carrying on insurance business, located in the taxable territory |

| 9 | Services supplied by a recovery agent to a banking company or a financial institution or a non-banking financial company | A recovery agent | A banking company or a financial institution or a non-banking financial company, located in the taxable territory |

| 10 | Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India | A person located in non-taxable territory | Importer, as defined in clause (26) of section 2 of the Customs Act, 1962(52 of 1962), located in the taxable territory |

| 11

|

Supply of services by an author, music composer, photographer, artist or the like by way of transfer or permitting the use or enjoyment of a copyright covered under section 13(1) (a) of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works to a publisher, music company, producer or the like | Author or music composer, photograph her, artist, or the like | Publisher, music company, producer or the like, located in the taxable territory |

| 12 | Supply of services by the members of Overseeing Committee to Reserve Bank of India | Members of Overseeing Committee constituted by the Reserve Bank of India | Reserve Bank of India. |

| 13 | Supply of Security Services | Any person other than body corporate | Registered Person |

3. Time of Supply under Reverse Charge

A. Time of Supply in case of Goods

In case of reverse charge, the time of supply shall be the earliest of the following dates:

- the date of receipt of goods

- the date of recording of payment* in the books of accounts of the recipient of the goods

- the date immediately after 30 days from the date of issue of an invoice by the supplier

If it is not possible to determine the time of supply, the time of supply shall be the date of entry in the books of account of the recipient.

*Note: GST is not applicable to advances under GST. GST in Advance is payable at the time of issue of the invoice. Notification No. 66/2017 – Central Tax issued on 15.11.2017

2.5 Ineligible ITC

Ineligible Input Tax Credit / Blocked Credits

Input Tax credit shall not be available in respect of the following:-

(i) Motor vehicle and other conveyance except when they are used for making the following taxable supplies, namely-

(a) Further supply of such vehicles or conveyances or

(b) Transportation of passenger or

(c) Imparting training on driving, flying, navigating such vehicles or conveyances;

(ii) Motor vehicle and other conveyance except used for transportation of goods

(iii) Supply of goods and/or services such as –

(a) food and beverages, outdoor catering, beauty treatment, health services, cosmetic and plastic surgery except where such supply of goods or services of each category is used for making an outward taxable supply of the particular category of goods or services or both or as an element of a taxable composite or mixed supply.

(b) Membership of a club, health and fitness Centre

(c) Rent-a-cab, life insurance, health insurance except where it is notified by the Government as obligatory for an employer to provide to its employees under any law for the time being in force; or such inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as part of a taxable composite or mixed supply; and

(d) Travel benefits to employees on vacation i.e. leave or home travel concession.

(iv) Works contract services when supplied for construction of immovable property, other than plant and machinery, except where it is for further supply of works contract service; It is important to note that credit of GST paid on works contract services will be allowed only if the output is also works contract services.

(v) Goods or services received by a taxable person for construction of an immovable property on his own account, other than plant and machinery, even though it is used in course or furtherance of business;

“Construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said immovable property. Please note that ‘alterations’ and ‘repairs’ are also included in this definition.

(vi) Goods or services or both on which the tax paid under composition scheme.

(vii) Goods or services or both received by a non-resident taxable person except on goods imported by him.

(viii) Goods or services or both used for personal consumption.

(ix) Goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples.

(x) Any tax paid in accordance with provisions of section 74,129 and 130.

Section 74 provides for the determination of tax paid or short paid or erroneously refunded or input tax credit wrongly availed or utilized by reason of fraud or any willful misstatement or suppression of fact.

Section 129 deals with the detention, seizure and release of goods and conveyances transit and tax paid in the procedure.

Section 130 deals with the confiscation of goods and conveyances and levy of penalty.

3. COMPANIES ACT, 2013

3.1 Company Incorporation Forms

| Form | Purpose |

| RUN | Application for reservation of name (earlier INC-1) |

| INC-2 | One Person Company – Application for Incorporation and Nomination |

| INC-3 | One Person Company- Nominee consent form |

| INC-5 | One Person Company – Intimation of exceeding threshold (Share Capital Rs.50 lakh/Turnover Rs.2 crore) |

| INC-6 | Application for Conversion from Private to OPC |

| INC-7 | Application for Incorporation of Company (Part I Company and Company with more than Seven Subscribers) |

| FC-1 | Information to be filed by foreign company |

| SPICe | New Version Simplified Performa for Incorporating Company Electronically (SPICe) – with mandatory PAN & TAN application included. |

| SPICe AOA | eArticles of Association (SPICe AoA) |

| SPICe MoA | eMemorandum of Association (SPICe MoA) |

| URC-1 | Application by a company for registration under section 366 |

| INC-12 | Application for grant of License under section 8 |

| INC-18 | Application to Regional Director for conversion of section 8 company into company of any other kind |

| INC-20 | Intimation to Registrar of revocation/surrender of license issued under section 8 |

| INC-21 | Declaration prior to the commencement of business or exercising borrowing powers |

| INC-22 | Notice of situation or change of situation of registered office and verification/change of registered office with same locality |

| INC-23 | Application to Regional Director for approval to shift the Registered Office from one state to another state or from jurisdiction of one Registrar to another within the same state |

| INC-27 | Conversion of public company into private company or private company into public company |

| INC-28 | Notice of Order of the Court or any other competent authority |

3.2 Annual filing e Forms

| Form | Purpose | Due Date (Other Companies) | Due Date (OPC) |

| AOC-4 | Filing financial statement & other documents with the ROC | Within 30 days from the date of AGM | 180 days from the closure of Financial year |

| AOC-4 (CFS) | Filing Consolidated Financial Statement & other documents with the ROC | Within 30 days from the date of AGM | 180 days from the closure of Financial year |

| MGT-7 | Annual Return | Within 60 days from the date of AGM | 60 days from the date of AGM |

*Companies which are required to file their Financial Statements in XBRL:

All companies

- listed with any Stock Exchange(s) in India and their Indian subsidiaries; or

- having paid up capital of Rs. 5 crore and above; or,

- having turnover of Rs. 100 crore and above; or

- which were hitherto covered under the Companies (Filing of Documents and Forms in Extensible Business Reporting Language) Rules, 2011

EXCEPTIONS: Banking, Power, NBFC and Insurance Companies are exempted from XBRL filing till further orders.

3.3 ALL OTHER FORMS under Companies Act, 2013

1. Informational Services

| AOC-5 | Notice of address at which books of account are maintained – other than RO | |

| MGT-14 | Filing of Resolution and/or agreements with ROC | Within 30 days of passing of resolution or making of agreement. |

| MGT-15 | Filing of Report on Annual General Meeting, with ROC | Within 30 days of the Conclusion of AGM |

| MGT-3 | Notice of situation or change of situation or discontinuation of situation, of place where foreign register shall be kept |

2. Compliance Related Filing

| ADT-1 | Information to the Registrar by Company for appointment of Auditor | 15 days from the conclusion of AGM where the appointment was made |

| ADT-3 | Resignation of an auditor (Intimation to Registrar by the auditor) | |

| FC-4 | Annual Return of a Foreign company | |

| MGT-6 | Declaration of beneficial interest in any shares | Within 30 days of receipt of declaration by the Company |

| MSC-3 | Return of dormant companies | |

| PAS-3 | Filing of Return of Allotment of Securities with ROC | Up to 30th Day of Allotment of Securities. |

| SH-11 | Return of Buy Back of Securities | Within 30 days of Completion of Buy-back of Shares |

| SH-8 | Letter of offer – Buy back | To be filed with ROC before buy- back of securities |

| SH-9 | Declaration of Solvency |

3. Directors – DIN Related

| DIR-3 | Application for allotment of Director Identification Number before appointment in an existing company |

| DIR-3 KYC | KYC of Directors (on or before 30th April of immediate next financial year in which DIN is Allotted) |

| DIR-3C | Intimation of Director Identification Number by the company to the Registrar |

| DIR-5 | Application for surrender of Director Identification Number |

4. Directors – Other Matters

| DIR-9 | A Report by a company to ROC for intimating the disqualification of the director | |

|

DIR-10 |

Form of application for removal of disqualification of directors | |

| DIR-11 | Notice of Resignation of a Director to Registrar | Within 30 days of Resignation |

| DIR-12 | Filing of Return of appointment/cessation or change in designation of Directors or Key Managerial Personnel | Within 30 days of appointment/cessation/change in designation |

| MBP-1 | Notice of Interest by Director | At first Board Meeting participating as Director, or thereafter at First Meeting of Board in every F/Y or whenever there is change in Interest. |

5. Approval Services (Headquarters)

| CG-1 | Form for filing application or documents with Central Government |

| MR-2 | Form of application to the Central Government for approval of appointment or reappointment and remuneration or increase in remuneration or waiver for excess or over payment to managing director or whole time director or manager and commission or remuneration to directors |

6. Approval Services (Regional Director)

| ADJ | Memorandum of Appeal |

| ADT-2 | Application to the CG for removal of auditor before expiry of his term |

| RD-1 | Form for filing application to Regional Director |

7. Approval Services (ROC)

| FTE | Application for striking off the name of company under the Fast Track Exit(FTE) Mode |

| GNL-1 | Form for filing an application with Registrar of Companies (where no e-form is prescribed) |

| GNL-2 | Form for submission of documents with Registrar of Companies (where no e-form is prescribed) |

| MSC-1 | Application to ROC for obtaining the status of dormant company |

| MSC-4 | Application for seeking status of active company |

| STK-2 | Application by company to ROC for removing its name from register of Companies |

8. Change Services

| MGT-10 | Changes in shareholding position of promoters and top ten shareholders | Within 15 days of the Change |

| SH-7 | Filing of Notice of alteration of Share Capital with ROC | Within 30 days of such alteration or increase or such redemption |

| DIR-6 | Intimation of changes in particulars of Director to be given to the Central Government | |

| FC-2 | Return of alteration in the documents filed for registration by foreign company | |

| FC-3 | Annual accounts along with the list of all principal places of business in India established by foreign company | |

| INC-24 | Application for approval of Central Government for change of name | |

| INC-4 | One Person Company- Change in Member/Nominee | |

| MGT 14 | Application for Conversion from Private to OPC |

9. Charges Management

| CHG-1 | Application for registration of creation, modification of charge (other than those related to debentures) including particulars of modification of charge by Asset Reconstruction Company in terms of Securitization and Reconstruction of Financial Assets and Enforcement of Securities Interest Act, 2002 (SARFAESI) | Within 30 days of creation of Charge or Modification of Charge as the case may be. |

| CHG-4 | Notice of Satisfaction of Charge with ROC | Within 30 days from the date of payment or satisfaction of Charge |

| CHG-6 | Notice of appointment or cessation of receiver or manager | |

| CHG-8 | Application for extension of time for filing particulars of registration of creation / modification / satisfaction of charge OR for rectification of omission or misstatement of any particular in respect of creation/ modification/ satisfaction of charge | |

| CHG-9 | Filing of Registration/Modification of charge created on debentures, with the ROC | Within 30 days of Creation/Modification of Charge created on Debentures |

| GNL-3 | Particulars of person(s) or director(s) or charged or specified for the purpose of section 2(60) |

10. Shares and Securities

| SH-1 | Certificate of Securities (in case of subscriber to memorandum) | Within 2 months from the date of incorporation |

| SH-1 | Certificate of Securities (in case of allotment of any of its shares) | Within 2 Months from the date of allotment |

| SH-1 | Certificate of Securities (Other Instruments of Transfer) | Within 1 month from the date of receipt of the intimation of transmission |

| SH-1 | Certificate of Securities (in case of debentures) | Within 6 Months from the date of allotment |

| SH-4 | Securities Transfer Form to be filed with the Company | Within 60 days of execution of instrument of transfer |

| PAS-2 | Information Memorandum | |

| PAS-4 | Private Placement Offer Letter | Within 30 days of Allotment of Securities |

| PAS-5 | Record of Private Placement | Within 30 days of Allotment of Securities |

| RD-2 | Form for filing petitions to Central Government (Regional Director) |

11. Deposits

| DPT-1 | Circular or circular in the form of advertisement inviting deposits | |

| DPT-3 | Return of Deposits | On or before 30th June of every year |

| DPT-4 | Filing of Return a statement of all deposits accepted by the Company and sums remaining unpaid with interest thereon and other prescribed details. | Within 3 Months, from the date of Commencement of the Act OR Within 3 Months from the date on which such payments becomes due. |

12. Investors Services

| ICP | INVESTOR COMPLAINT FORM |

| SCP | SERIOUS COMPLAINT FORM |

13. MANAGERIAL PERSONNEL

| MR-1 | Return of appointment of Return of appointment of key managerial personnel | Within 60 days of appointment |

| MR-2 | Form of Application to the Central Government for approval of appointment or reappointment and remuneration or increase in remuneration or waiver for excess or over payment to managing director or whole time director or manager and commission or remuneration to directors | |

| MR-3 | SECRETARIAL AUDIT REPORT | Every listed company, and Every public company having paid-up share capital of Rs 50 crore or more or turnover of Rs 250 crore or more |

14. Nidhi Companies

| NDH-1 | Return of Statutory Compliances – Nidhi Companies |

| NDH-2 | Application for extension of Time – Nidhi Companies |

| NDH-3 | Half Yearly Return – Nidhi Companies |

15. Other Residual Forms

| MGT-4 | Intimation to Company for not holding Beneficial Interest in shares of Company by Registered Holder | Within 30 days of entry of name in Register of Members |

| MGT-5 | Intimation to Company for holding Beneficial Interest in shares of Company by Beneficial Owner | Within 30 days of acquisition of beneficial interest Or Change in Beneficial Interest |

| CRL-1 | Information to the Registrar by company regarding the number of layers of subsidiaries. | |

| GNL-4 | Addendum for rectification of defects or incompleteness. | |

| BankACC | Application for simplifying bank account opening process as user shall not be required to submit any physical application form. | |

| Refund | Application for requesting refund of fees paid. | |

| CFI(CSR) | Reply To Call for Information on CSR | |

| CRA-2 | Intimation of appointment of cost auditor by the company to Central Government | Only by Companies prescribed as per The Companies (Cost records and Audit Rules), 2014 |

| CRA-4 | Filing of Cost Audit Report | 30 days from the receipt of Cost Audit Report |

4. Limited Liability Partnership Act, 2008

Limited Liability Partnership (LLP) is a type of business entity sharing features of a partnership firm and a company. LLP’s are regulated by the Registrar of Companies, Ministry of Corporate Affairs. LLP is a legal entity, separate from its partners and it has perpetual succession. Some of the major benefits and powers enjoyed by LLPs are the following:

- Separate legal entity.

- Buying, Selling and Holding of movable, immovable, tangible or intangible assets.

- Powers to sue and be sued.

- Powers to open bank account.

- Powers to employ persons.

- Powers to enter into all types of legal contracts.

In line with the powers, all LLPs are required to maintain compliance and file certain statutory filing with the Government each year. In this part, we look at the major compliance requirements for an LLP.

4.1 Important LLP Due Dates:

The following filings are mandatory for all LLPs irrespective of activity. In addition to the below, a LLP having GST registration would have to file GST returns every month.

| Form | Due Date | Authority |

| Form – 11 (Annual Return) | 30th May | Ministry of Corporate Affairs |

| Form – 8 (Statement of Accounts) | 30th October | Ministry of Corporate Affairs |

| Income Tax Return (ITR-5 Form) | 31st July – If tax audit not required.

30th September – If tax audit required. |

Income Tax Department |

Books of Accounts

All LLPs must maintain proper books of account relating to its affairs each year on cash or accrual basis. The book of accounts must be kept as per double entry system of accounting at the registered office. In case of LLPs with a turnover of more than Rs.40 lakhs or capital of over 25 lakhs, the accounts must be audited by a Chartered Accountant.

Any LLP that does not comply with the provision of the Act can be punishable with a fine of not less than Rs. 25,000 and to a maximum of Rs. 5,00,000. Further, the designated partner could be punished with a penalty of Rs. 10,000 and Rs. 1,00,000 for non-compliance.

4.2 Other Forms for LLP:

> LLP Form 11

Annual return filing under form 11 is a summary of all the designated partners like whether there are any changes in the management of the LLP or not. Every LLP is required to file annual return in Form 11 to the Registrar of companies within 60 days from the closure of financial year i.e. annual return have to be filed on or before 30th May every year. Accordingly for the financial year 2018-2019, 30th May, 2019 is the last date for filing of annual return under form 11.

> LLP Form 8

Every LLP is required to prepare and close its accounts until the 31st March every year. LLP are required to maintain the Books of Accounts in Double Entry System and has to prepare a Statement of Accounts every year ending on 31st March. From 8 is to be filed, by at least two Designated Partners, with the Registrar on or before 30th October every year. Accordingly for the current financial year, 30th October, 2019 is the last date for filing statement of accounts for the financial year 2018-2019.

> Income Tax Return

Every LLP has to file Income Tax Returns every year. LLP being a separate legal entity, apart from the partner’s income tax return, you have to always file the LLP Income tax return. The last date of filing of income tax return for LLP is 31st July or 30th September, as the case may be. If LLP’s books of accounts are not required to be audited, than, due date for filing income tax return would be 31st July and if LLP is covered under tax audit i.e. books of accounts are to be audited, due date for filing Income tax return would be 30th September.

> Tax Audit

Every LLP whose turnover exceeds INR 1 Cr. in case of a business or INR 50 Lakh in case of a profession, is required to get its books of accounts tax audited under section 44AB of the Income-tax Act. Such audit will have to be completed and filed by 30th September.

> LLP Act

It may be noted that only those LLP whose annual turnover exceeds Rs. 40 lakhs or whose contribution exceeds Rs. 25 lakhs are required to get their accounts audited.

> Certificate from Company Secretary

In case of LLPs with turnover more than five crores rupees in a financial year or contribution more than fifty lakh rupees, the annual return filed under form 11 needs to be certified by a Company Secretary in Practice.

> Penalty for Late Filing

If there is a delay in filing Form 8 and 11 of LLP, penalty of Rs. 100 per day per form is payable from the due date of filing return till the date actual return is filed.

In case of late filing income tax return, a penalty of Rs. 5000 would be applicable for returns late filed between 1st August and 31st December of the assessment year. A penalty of Rs. 10,000 will be applicable on return filed after 31st December of the same assessment year.

5. Compliance Calendar

| Month | Payment of | TDS Return (Quraterly) | Payment of ESIC | Filling of Income Tax Return | ||

| TDS | PF | Advance Payment of Income Tax | ||||

| April | 30 | 15 | 15 | |||

| May | 7 | 15 | 31 | 15 | ||

| June | 7 | 15 | 15 | 15 | ||

| July | 7 | 15 | 31 | 15 | 31 | |

| August | 7 | 15 | 15 | |||

| September | 7 | 15 | 15 | 15 | 30 | |

| October | 7 | 15 | 31 | 15 | ||

| November | 7 | 15 | 15 | 30* | ||

| December | 7 | 15 | 15 | 15 | ||

| January | 7 | 15 | 31 | 15 | ||

| February | 7 | 15 | 15 | |||

| March | 7 | 15 | 15/31 | 15 | ||

*Submission of transfer pricing Report

6. Compliances under SEBI Listing Regulations 2015 (LODR)

| Sr. no. | Quarterly / Half Yearly / Annual Compliances under SEBI Listing Regulations 2015 (LODR) | Time Limit/Deadline |

| 1 | Compliance Certificate certifying maintaining physical & electronic transfer facility

– The listed entity shall submit a compliance certificate to the exchange, duly signed by both that is by the compliance officer of the listed entity and the authorized representative of the share transfer agent |

Within one month of end of each half of the financial year. |

| 2 | Statement of Investor complaints

– The listed entity shall file with the recognised stock exchange(s) a statement giving the number of investor complaints pending at the beginning of the quarter, those received during the quarter, disposed of during the quarter and those remaining unresolved at the end of the quarter. |

Within Twenty one days from the end of each quarter. |

| 3 | Corporate Governance

– The listed entity shall submit a quarterly compliance report on corporate governance |

Within 15 days from quarter end. |

| 4 | Shareholding Pattern

– Provided that in case of listed entities which have listed their specified securities on SME Exchange, the above statements shall be submitted on a half yearly basis within twenty one days from the end of each half year. |

Within 21 days from quarter end. |

| 5 | Financial Results

– The listed entity shall submit quarterly and year-to-date standalone financial results to the stock exchange along with Limited Review Report or Audit Report as applicable. |

Within 45 days from quarter end . And in case of Annual Financial Result, within 60 days from end of Financial Year. |

| 6 | Annual Report

– The listed entity shall submit the annual report to the stock exchange within twenty one working days of it being approved and adopted in the annual general meeting as per the provisions of the Companies Act, 2013. |

Within twenty one working days of it being approved and adopted in the annual general meeting. |

| 7 | Certificate from Practicing Company Secretary

– The listed entity shall ensure that the share transfer agent and/or the in-house share transfer facility, as the case may be, produces a certificate from a practicing company secretary |

Within one month of the end of each half of the financial year. |

| 8 | Reconciliation of Share Capital Audit (SEBI- DP Reg.55A)

– Listed entities are required to submit Reconciliation of Share Capital Audit Report on a quarterly basis to the stock exchanges audited by a qualified chartered accountant or a practicing company secretary for the purpose of reconciliation of share capital held in depositories and in physical form with the issued / listed capital. |

Within 30 days from quarter end. |

| 9 | Outcome of Board Meeting (Schedule III Part A- (4)

|

The listed entity shall disclose the information to the Exchange(s), within 30 minutes of the closure of the meeting. |

| 10 | Voting Result | The listed entity shall submit to the stock exchange, within forty eight hours of conclusion of its General Meeting |

7. RBI Compliances Calendar

| Sr. no. | Particlars | Time Limit/Deadline |

| 1 | Annual Return on Foreign liabilities & Assets

– Companies having foreign Investment |

15th July |

| 2 | Quarterly Returns By NBFCs

– NBFCs accepting public deposits |

Within 15 days from the close of the quarter |

| 3 | Quarterly Return to be submitted by NBFCs having overseas investment. | Within a period of one month from the close of the quarter |

| 4 | Annual Returns by RNBCs (Residuary Non-Banking Companies) | 30th September |

| 5 | Quarterly Return of NBFC having asset size of Rs. 50-100 crores

– Non-deposit taking NBFCs having asset size Rs. 50-100 crores and above |

Within 15 days from the close of the quarter |

| 6 | Monthly Return on Capital Market Exposures

– Deposit taking NBFCs and RNBCs having asset size of Rs. 100 crores and above; holding public deposits of Rs. 20 crore and above. |

7th day of next month |

| 7 | Asset-Liability Management (ALM) Return | Within one month of the end of each half of the financial year, i.e., 30th April & 30th October |

| 8 | Quarterly Return on Assets acquired, securitized and Reconstructed

– Securitisation Companies & Reconstruction Companies |

Within 15 days from the close of the quarter |

8. Accounting Ratio Analysis

1. Balance Sheet Model of a Company

Business companies require money to run their operations. This money, or capital, is provided by the investors. This is mutually beneficial to the companies and to the investors. The investors get a reasonable return on their investment, and the companies get the badly needed capital.

Generally speaking, the companies employ two forms of capital: the debt capital and the equity capital. The companies acquire the capital from two types of investors, the bondholders provide the debt capital and the stockholders the equity capital. From the perspective of the investors, the risk of these investments is different, the bonds being the safer investment relative to the stocks. Similarly, the companies bear more risk when they issue bonds, because the companies must pay interest on the bonds.

Consider a corporation that has no debt. Stockholders provide the entire financing of the company. We call it an all-equity company. Figure 1.1 shows this as Company A. This company can borrow some money, by selling long-term bonds. From the proceeds of the sale of the bonds, it buys back some of its outstanding stock. Thus it can replace some equity with debt. Suppose it is able to do so in a judicious way so that its debt ratio, or debt-to-assets ratio, becomes 25%. Now it looks like Company B in the diagram

Occasionally, corporations get too far in debt. For example, Company C in the diagram has 80% debt, which is too much. Such a company is always worried about its ability to pay interest to the bondholders. If it is unable to pay interest on time, the bondholders can force it into bankruptcy. It is the possibility of bankruptcy that makes it a risky company.

Figure 1.1 shows the relative amounts of money invested by the two types of investors, the stockholders, and the bondholders. Their stakes in the company are represented by the two areas, white and gray. We know that the company should employ the debt and the equity in proper proportions. Too much debt can lead to financial failure of a company.

The capital is invested in the assets of the companies. If the debt capital is B, and the equity capital S, then the total capital of the company is B + S. This must also be equal to the total value of the company, V,

V = B + S

Now we may look at the financial condition of a company from a different angle. This time we look at its balance sheet. The balance sheet of a company lists its assets and liabilities at a particular time. For example, we may be looking at the balance sheet of a company as of December 31,2018 . The stockholders equity, or just equity, by definition, is

Stockholders Equity = Assets − Liabilities

When a corporation is set up, it clearly spells out the rights and expectations of both types of investors. The bondholders are lending their money to the corporation at a certain rate of interest. They expect to receive their interest on time, along with the final payment of the bonds when they mature. The stockholders cannot demand dividends from the company. The stockholders, even though they are owners of the company, have limited liability in case the company gets into serious financial or legal difficulties. They are also the holders of a call option on the assets of the company, with an exercise price equal to the face value of the bonds of a company. In case of liquidation, they receive whatever the company is left with after all other creditors are satisfied. In this sense, they are the last ones in line to receive the benefits from the company. This concept leads us to equation (1.2). We may rewrite this equation as

Assets = Liabilities + Equity

This is exactly the same as (1.1). The above equation may also be represented by a pie chart, with two pieces belonging to the stockholders and bondholders. The total value of the assets of the company is simply the whole pie, the sum of liabilities and equity.

What makes up the assets of a company? First, the obvious physical ones: buildings and lands; factories and warehouses; machinery and equipment; inventories of merchandise and finished goods. Second, we consider the financial assets: money in checking accounts and marketable securities; the money it expects to receive from its customers. The less obvious assets include the expertise of its managers, the quality of its products, and the reputation of its brand name.

The liabilities of a company include the money it has borrowed from bondholders, and other lenders. It also includes the money it owes to its suppliers, or any other unpaid bills. Accountants spend a considerable amount of effort in classifying and measuring the assets and liabilities of a corporation.

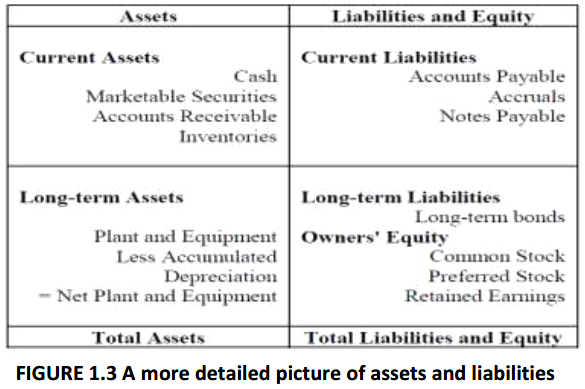

One way to classify the assets and liabilities is whether they are long-term, or short-term. The distinction between long-term and short-term is rather arbitrary. Generally, the assets that are going to last for more than a year are considered to be long-term assets. Similarly, long-term liabilities are due after more than a year. Based on this differentiation, we may slice the balance sheet into four quadrants, as indicated in the following diagram. Again, it is just an aid in visualizing the capital structure of a corporation, with the added dimension of time.

Figure 1.3 shows the financial condition of a company in terms of its assets and liabilities, but classifying them whether they are short-term or long-term.

Next, we try to fill out additional details in the picture. We may do so by looking at the assets and liabilities more closely. In the above table, the assets are listed in order of their accounting liquidity, that is, the ease with which the assets can be converted into cash.

Cash is the lifeblood of a corporation. If a company does not have enough cash on hand to pay its workers on time, or its suppliers, it can run into serious problems. This can lead to a liquidity crisis, otherwise known as a cash crunch. Careful management of the cash position of a company is one of the basic problems in the working capital management.

Let us revisit equation (1.3) to develop another important concept, namely the cash equation. Let us write

Assets = Liabilities + Equity

as follows:

Cash + Current assets (except cash) + Fixed assets = Short-term liabilities + Long-term debt + Equity

Rearranging terms, we find

Cash = Short-term liabilities + Long-term debt + Equity − Fixed assets − Current assets (except cash)

The above equation isolates cash as one factor, and the other financial parameters that cash depends upon. By examining the above equation we notice, for example, increasing long-term debt and equity will increase the cash position of a company. Further, increasing the fixed assets, or the net working capital (except cash) will decrease the cash position of a company.

2. Net Working Capital

By definition, the net working capital of a company is the difference between the current assets and the current liabilities of a company:

Net working capital = Current assets – Current liabilities

The changes in current assets and current liabilities will create a change in the net working capital of a company. We also recall that the four main items in the current assets of a company are: (1) cash, (2) marketable securities, (3) accounts receivable, and (4) inventories. The three principal items in the current liabilities are (1) account payable, (2) accrued wages, taxes, and other accrued expenses, and (3) notes payable. Any change in these seven items will lead to a change in the net working capital of a corporation.

3. Ratio Analysis

It is possible to look at the financial health of a corporation by looking at some of its key financial ratios. Ratio analysis can also be used as a diagnostic tool to find the sources of financial trouble at a company.

The ratios may be divided into these types:

A. Liquidity Ratios:

First we look at the liquidity ratios of a company. These ratios focus on the availability of cash to manage the day to day operations of the company. In particular, we define the current ratio as

Current ratio = Total current assets /Total current liabilities

The current ratio of a company gives us a quick way to look at its current assets and current liabilities. They should be nearly equal to one another. The ideal current ratio is 2: 1. It is a stark indication of the financial soundness of a business concern. When Current assets double the current liabilities, it is considered to be satisfactory. Next, we look at a more stringent ratio that gives us the cash position of the company more accurately by removing the value of the inventories from the current assets. This gives us the quick ratio, or the acid test ratio, as follows:

Quick or Acid Test = (Current assets –inventories) / Current liabilities

The ideal Quick Ratio is 1: 1 and is considered to be appropriate. High Acid Test Ratio is an accurate indication that the firm has relatively better financial position and adequacy to meet its current obligation in time.

B. Asset Management Ratios:

1. The asset management ratios evaluate the efficiency of use of the principal assets of a company, such as its inventory.

Inventory Turnover = Cost of goods sold / Inventories (average)

This ratio measures the efficient use of inventories. A company should have a high turnover ratio, which is managed through a small amount of inventories. This means that a company should have a small inventory and try to sell it as quickly as possible. Unfortunately, a small inventory also means lower sales.

2. Closely related to the inventory management is the management of receivables. A company should have a small amount invested in the receivables. That is, the company should try to sell the goods for cash. To measure the efficiency of this operation, we define the Days Sales Outstanding as

Days sales outstanding = Receivables / Sales per day

3. A broader measure of the efficiency of use of assets is the fixed assets turnover. This ratio is defined as follows.

Fixed assets turnover = Annual sales/Net fixed assets (average)

4. Some corporations have a huge investment in fixed assets, plant and equipment. This is the case of electric utilities or real estate investment trusts, for instance. Other corporations, such as software development companies, may have a rather small investment in equipment. It is proper to compare companies with one another that are in the same line of business.

A broader measure of asset utilization is the following ratio

Total assets turnover = Annual sales / Total assets (average)

This ratio looks at the aggregate assets of a company and measures the way the company utilizes them.

C. Debt Management Ratios:

1. The corporations borrow money to do their business because debt capital is cheaper than the equity capital. On the other hand, excessive amount of debt can create problems for the company. To see the debt level of a company, we define its debt ratio, or leverage ratio as follows

Debt ratio = Total debt / Total assets

Of course, the companies must maintain their debt at an optimal level. The optimal debt ratio is determined by the same proportion of liabilities and equity as a debt-to-equity ratio. If the ratio is less than 0.5, most of the company’s assets are financed through equity. If the ratio is greater than 0.5, most of the company’s assets are financed through debt.

2. Another ratio that looks at the ability of a company to pay its interest when due is its interest coverage ratio, or times interest earned. This is defined As

Interest coverage = EBIT / Interest charges

If this ratio is 4, then for each dollar of interest due, the company has $4 available. This is a fairly safe ratio, and the probability of default is quite low.

3. Another ratio that signifies the speed and efficiency of collection from receivables of the company is Debtors Turnover Ratio. It is defined as

Debtors Turnover Ratio = Credit Sales/(Avg Debtors + Bills Receivables)

Higher turnover signifies speedy and effective collection. Lower turnover indicates sluggish and inefficient collection leading to the doubts that receivables might contain significant doubtful debts.

D. Profitability Ratios:

1. The next set of ratios measure the ability of a company to generate profits. These ratios are of interest to investors who would like to invest in the most profitable companies around. The first ratio is the net profit margin, defined as

Net profit margin = Net income / Total operating revenue

In this ratio, net income is defined to be the income after taxes, available to the stockholders of the company.

2. The next ratio looks at the profitability from the point of view of the management of a company. In this case the denominator is EBIT, meaning earnings before interest and taxes. If the EBIT is too small, then the financial managers at a corporation will have difficulty in paying the interest on time. We define gross profit margin as follows:

Gross profit margin = EBIT / Total operating revenue

3. Another ratio that the investors like to review is net return on assets. We may define it as

Net return on assets = Net income / Total average assets

4. The similar ratio that the management wants to review is gross return on assets, defined as follows

Gross return on assets = EBIT / Total average assets

5. The stockholders are particularly interested in the following three ratios. First, return on common equity, that measures the return to the stockholders on stockholders’ investment in the company. This is defined as

Return on common equity = Net income to stakeholders / Average common equity

Second, is the dividend payout ratio. This represents the fraction of money paid to the stockholders out of the income after taxed. We may define it as

Dividend payout ratio = Total cash dividends / Net income

The dividend payout ratio is important to the management as well. They cannot afford to pay large dividends when the company needs the money to finance new profitable projects. The growth of a company depends upon the retention rate, that is, the money that is not paid out as dividends. So, we define the third quantity, the sustainable growth rate as

Sustainable growth rate = ROE * Retention ratio

where ROE stands for the return on equity for a company.

E. Market Value:

From an investor’s point of view, it is important to see the difference between the market value of the stock of a company, and its accounting value, or book value. To get a perspective on this difference, we define the Market/Book ratio as

Market/Book ratio = Market price/share Book value/share

The investors hunting for bargains like to see this ratio as small as possible.

P-E ratio = Market price/share Earnings per share

and

Dividend yield = Dividend per share/Market price per share

F. Capitalisation Ratio:

Capitalization ratios are indicators that measure the proportion of debt in a company’s capital structure. These are discussed as below:

1. The relationship between borrowed funds and internal owner’s funds is measured by Debt-Equity ratio. This ratio is also known as debt to net worth ratio. It is defined as

Debt Equity Ratio = Total Long Term Debts/Shareholders Funds

Where total long-term debts excludes current liabilities. Shareholder’s funds include (i) Ordinary share capital, (ii) Credit balance of profit and loss account and free reserves etc., but deduction should be made for fictitious assets if any in the balance sheet. For most companies the maximum acceptable debt-to-equity ratio is 1.5-2 and less. For large public companies the debt-to-equity ratio may be much more than 2, but for most small and medium companies it is not acceptable.

2. Another ratio which measures the extent of capitalization by the funds raised by the issue of fixed cost securities. This is defined as

Capital Gearing Ratio = Equity/Fixed cost bearing Securities

Highly geared mean lower proportion of equity. Low geared means high proportion of equity as compared to fixed cost bearing capital.

Where,

Equity = Equity share capital + Free reserves + Profits and loss account credit balance

Fixed cost bearing securities = Debentures + Long term loans

9. INDIAN ACCOUNTING STANDARD

Standards related to financial reporting and disclosures

First-time adoption of Ind AS: Ind AS 101

An entity moving from Indian GAAP to Ind AS needs to apply the requirements of Ind AS 101. An entity shall apply this Ind AS in: (a) its first Ind AS financial statements; and (b) each interim financial report, if any, that it presents in accordance with Ind AS 34, Interim Financial Reporting, for part of the period covered by its first Ind AS financial statements.

The objective of this Ind AS is to ensure that an entity’s first Ind AS financial statements, and its interim financial reports for part of the period covered by those financial statements, contain high quality information that: (a) is transparent for users and comparable over all periods presented; (b) provides a suitable starting point for accounting in accordance with Indian Accounting Standards (Ind ASs); and (c) can be generated at a cost that does not exceed the benefits.

Presentation of financial statements: Ind AS 1

The objective of financial statements is to provide information that is useful in making economic decisions. This standard prescribes the basis for the presentation of general purpose financial statements in order to ensure comparability both with the entity’s financial statements of previous periods and with those of other entities. It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content.

An entity shall present a single statement of profit and loss, with profit or loss and other comprehensive income presented in two sections within the same statement. The sections shall be presented together with the profit and loss section presented first followed directly by the other comprehensive section.

An entity shall present, with equal prominence, all of the financial statements in a complete set of financial statements. Financial statements disclose corresponding information for the preceding period, unless a standard or interpretation permits or requires otherwise.

> Material items

The nature and amount of items of income and expense are disclosed separately where they are material. Disclosure may be in the statement or in the notes. Such income and expenses might include restructuring costs; write-downs of inventories or property, plant and equipment; litigation settlements; and gains or losses on disposals of property, plant and equipment.

> Presentation of true and fair view

Financial statements shall present a true and fair view of the financial position, financial performance and cash flows of an entity. The application of Ind AS, with additional disclosures when necessary, is presumed to result in financial statements that present a true and fair view.

> Going concern and accrual basis of accounting

An entity shall prepare financial statements on a going concern basis unless management intends to either liquidate the entity or cease trading, or has no realistic alternative but to do so. An entity shall prepare its financial statements, except for cash flow information, using the accrual basis of accounting.

> Offsetting

An entity shall not offset assets and liabilities or income and expenses, unless required or permitted by Ind AS.

> Balance sheet

The balance sheet presents an entity’s financial position at a specific point in time. Subject to meeting certain minimum presentation and disclosure requirements, management may use its judgement regarding the form of presentation, such as which sub-classifications to present and what information to disclose on the face of the statement or in the notes.

Ind AS 1 specifies that the following items, as a minimum, shall be presented on the face of the balance sheet:

- Assets: Property, plant and equipment; investment property; intangible assets; financial assets; investments accounted for using the equity method; biological assets; deferred tax assets; current tax assets; inventories; trade and other receivables; and cash and cash equivalents.

- Equity: Issued capital and reserves attributable to the parent’s owners; and non-controlling interest.

- Liabilities: Deferred tax liabilities; current tax liabilities; financial liabilities; provisions; and trade and other payables.

- Assets and liabilities held for sale: The total of assets classified as held for sale and assets included in disposal groups classified as held for sale; and liabilities included in disposal groups classified as held for sale in accordance with Ind AS 105, ‘non-current assets held for sale and discontinued operations’.

Current and non-current assets and liabilities are presented as separate classifications in the statement, unless the presentation based on liquidity provides reliable and more relevant information.

> Statement of profit and loss

The statement of profit and loss presents an entity’s performance over a specific period. The statement of profit and loss includes all items of income and expense and includes each component of other comprehensive income classified by nature.

> Items to be presented in statement of profit and loss

Ind AS 1 specifies certain items presented in the statement of profit and loss. Additional line items or sub-headings are presented in this statement when relevant to an understanding of the entity’s financial performance. Any item of income or expense is not presented as extraordinary item in the statement of profit and loss or in the notes. The expenses are classified in the statement of profit and loss based on the nature of expense.

> Other comprehensive income

An entity shall present items of other comprehensive income grouped into those that will be reclassified subsequently to profit or loss and those that will not be reclassified. An entity shall disclose reclassification adjustments relating to the components of other comprehensive income.