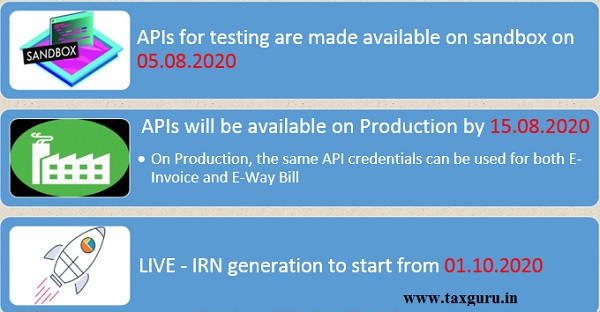

Taxpayers whose aggregate turnover during the financial year 2019-20 exceeds Rupees five hundred crore (Rs. 500 crore) are required to upload the Invoice details on the Government Invoice Registration Portal (IRP) w.e.f. 01st October 2020

Join us to know how to

+ Register the Invoice

+ Generate IRN for the supplies

+ Upload in e-Invoice Portal:

( https://einvoice1.gst.gov.in/)

National Informatics Centre

About National Informatics Centre

- National Informatics Centre (NIC) is government organisation under Ministry of Electronics and IT, GoI

- NIC’s focus is on Citizen Centric Services

- NIC is providing the state-of-art technology solution to the e-governance projects of state and centre governments

- NIC is has NICNET, Wide Area Network covering the PAN India

- NIC projects for tax departments

- Customs

- VAT, PT, Sales Tax, etc.

- E-way Bill Project under GST

- Now, E-Invoicing System

E-Way Bill Project

- E-Way Bill is for movement of goods, having value more than Rs. 50,000, from one place to another

- E-way Bill Project under GST started for PAN India from April 2018

- Daily, on Average 22 Lakh E-Way Bills are generated on the portal

- More than 12 lakh tax payers are using every month on this portal to generate e-Way Bill

- As of now, more than 130 Crores E-Way Bills are generated in last 28 months

- E-Way Bill is linked with E-Invoicing System

What & Why of E Invoice

- It is the process of registration of generated invoice on a Government notified portal

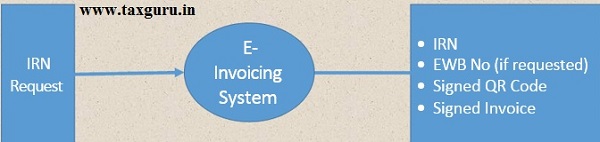

- Unique Invoice Reference Number (IRN) obtained as a result of registration

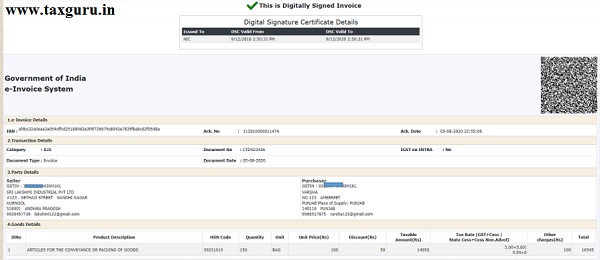

- Signed Invoice, signed by the Invoice Registration (IRP) Portal

- Verifiable Authencity and Integrity of content

- Standardized, Interoperable and Digitized Invoices

- Integrated E Invoice and E Way Bill operations

- Incremental filing of GSTR1

- Part of existing business processes

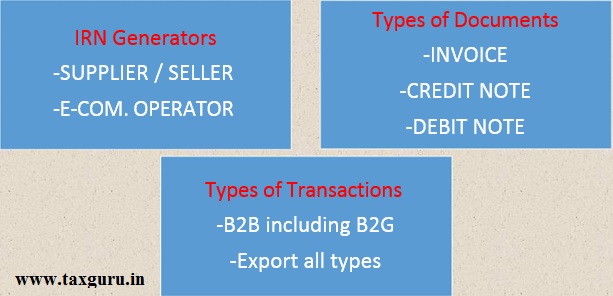

Eligibility

- The business entities having > 500 Cr. turn over in a financial year have to register the Invoices from 1st October 2020

- Turnover considered for the PAN – Aggregate of all GSTINs based on same PAN

- Exemptions

- SEZ Units, and others as per notifications

- Invoices of all B2B and Exports transactions to be registered

E-Invoice Related Points

IRN Request and Response

QR Code

- GSTIN of supplier

- GSTIN of Recipient

- Invoice number as given by Supplier

- Date of generation of invoice

- Invoice value (taxable value and gross tax)

- Number of line items.

- HSN Code of main item (the line item having highest taxable value)

- Unique Invoice Reference Number (hash)

Mandatory to print QR code on Invoice

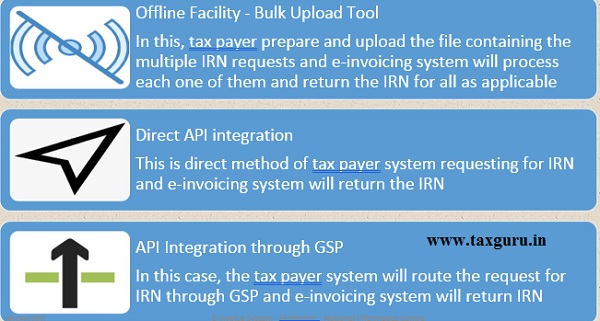

Modes of e-invoice generation

Validations for IRN

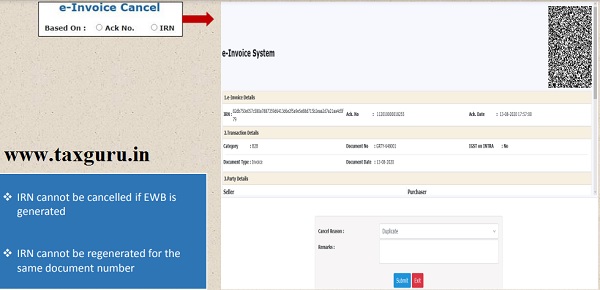

Cancellation of IRN

E Invoice & E Way Bill

- On production environment, E Invoice System and E Way Bill System are seamlessly integrated

- The Credentials of E Way Bill System work on E Invoice System

- E Way Bill can be generated as part of generation of IRN itself or by using the IRN as reference or by calling E Way Bill APIs separately

- Only Part A or the E Way Bill can be generated

- Further operations on E Way Bills can be performed on the E Way Bill System

- On sandbox, both are different systems, however cancellation of EWB is integrated with E Invoice to enable cancellation of E Invoice

General Points

API DEVELOPER PORTAL & ONLINE SANDBOX TEST CLIENT

Introduction to E Invoice Developer Portal

- All information required for ERP and Financial Accounting Software developers to integrate e-Invoicing System through API

- Registration for testing the APIs on Sandbox environment

- General Information like Introduction, Overview, Benefits, Onboarding procedure, best practices, FAQs etc.

- Announcements on latest developments etc.

- API Documentation including specifications, Sample payloads, JSON schemas, Validation details etc.

- Master lists, Sample Codes etc.

- Online API Testing Tool

Who can Register

- Eligible tax payers (> 500Cr TO),

- Same PAN, Same Client Id & Secret, individual user id and password per GSTIN

- GSPs

- Can test with GSTIN like ids

- Can Add eligible tax payers as new accounts and share credentials

- ERPs identified by GSTN

- Facilitate e Invoice operations like GSPs

- E Commerce Operators

- Will register invoices on behalf of eligible tax payers

API Test Tool:

Generate IRN

- Clicking “Sample Json” loads the sample JSON in “Payload – Plain text” text area.

- Required changes in the JSON to satisfy validations to be made.

- Clicking on “Encrypt Payload” will encrypt the payload using available SEK and populate the payload in “Payload –Encrypted” text area.

- Clicking on “Generate IRN” will post the request payload to the respective endpoint, populates the response in “Response – Encrypted” text area, the encrypted response is decrypted using the SEK and populated in “Response – Plain text” text area

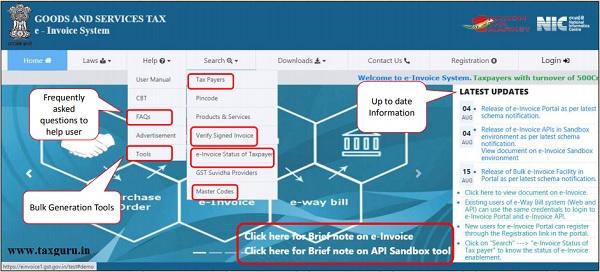

PORTAL DEMO……..

Main Features

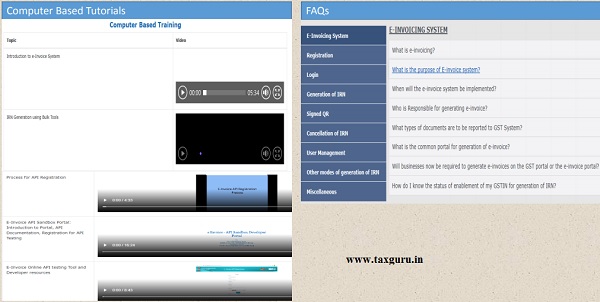

Computer Based Tutorials & FAQs

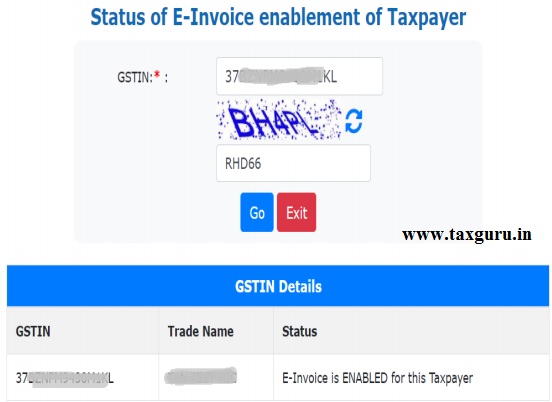

E-Invoice Status

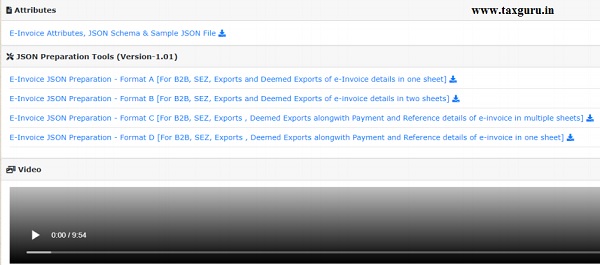

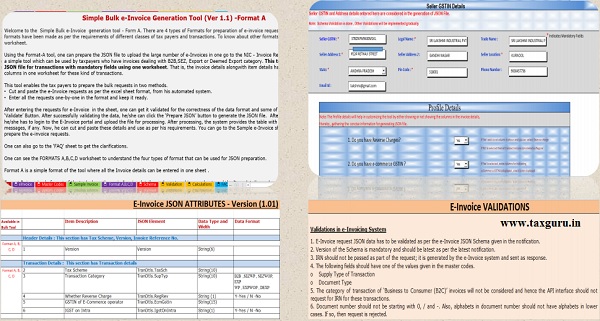

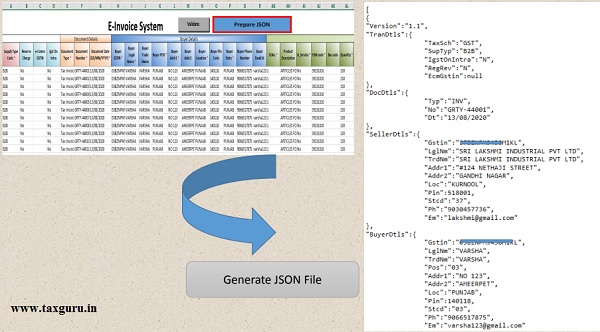

Bulk generation Tools

Bulk Generation Tool

Generate JSON File

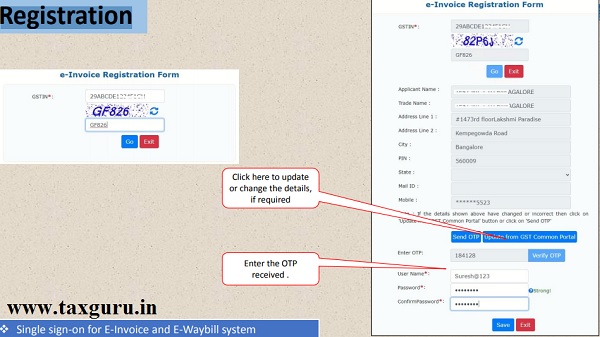

Registration and Login

Registration

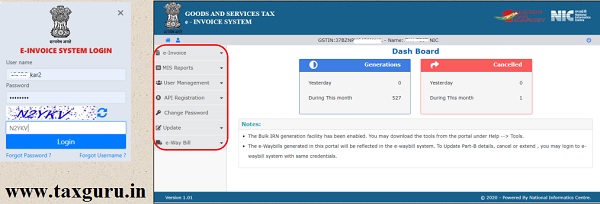

Login

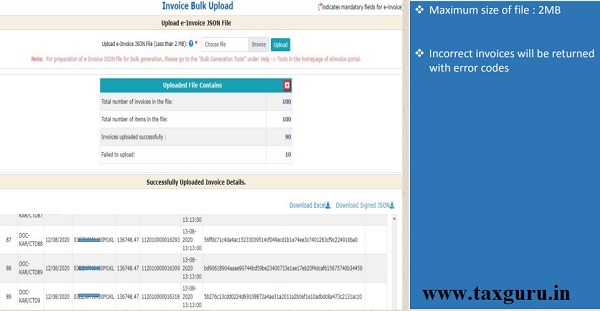

Bulk generation of IRN

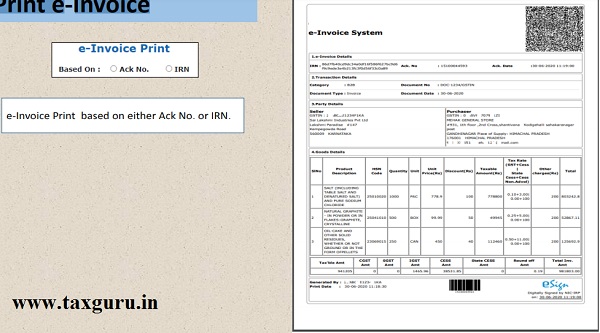

Print e-Invoice

Cancel IRN

Generate E-Way Bill

Print E-Way Bill

MIS Reports

Direct Integration

1. Login to the e-Invoice Portal

2. Submit Application for IP Whitelisting in the Portal

3. Application is scrutinized by the network team and IP is whitelisted

4. Creation of Client-Id and Client-Secret

5. Creation of Username and Password

6. Call the E-invoice APIs

Integration for sister concern GSTIN

1. Take the Client-Id and Client-Secret from your company who has registered for API

2. Login to the e-Invoice Portal

3. Creation of Username and Password for the sister concern GSTIN

4. Call the E-invoice APIs

Integration through GSP

- Login to the e-invoice portal

- Select the GSP

- Creation of username and password

- Call the e-invoice APIs

You may register with more than 1 GSP to call the API

Tools in public domain

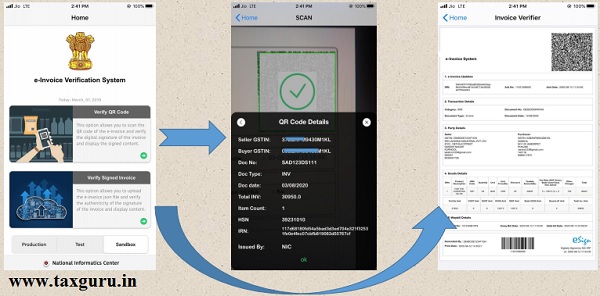

♦ Verify e-Invoice by uploading signed JSON in portal

♦ Verify QR Code using App which can be downloaded from the portal

Verify Signed Invoice

QR Code Verify App

FAQs on e-invoicing

Q : In the e-invoice schema, the amount under ‘other charges (item level)’ is not part of taxable value. However, some charges to be shown in invoice are leviable to GST. How to mention them?

A : Such other charges (taxable) may be added as one more line item. For example, freight charges, insurance charges will have separate line entries.

Q : In the current schema, there is no provision to report details of supplies not covered under GST, e.g. a hotel wants to give single invoice for a B2B supply where the supply includes food and beverages (leviable to GST) and Alcoholic beverages (outside GST).

A : Ideally, for items outside GST levy, separate invoice may be given. Some businesses are following this.

Q : What is the maximum number of line items which can be reported in an invoice?

A : The limit is kept at 1000 presently. It will be enhanced based on requirement in future. Taxpayers who are required to report more than 1000 line items may contact NIC (support.einv.api@gov.in) so that necessary enablement can be made. If it is increased beyond 1000 items, then response will be delayed because of processing time taken for that.

Q : In case of Credit Note and Debit Note, is there any validation with respect to referred invoice number?

A : Presently, No linkage or validation is built with original invoice values for the credit note and debit note.

Q : Do I need to print QR Code on the invoice? If so, what shall be its size and location on the invoice copy?

While returning IRN, the IRP is also giving an IRN No, Acknowledgement No. and Date. Whether this also need to be printed while issuing invoice?

A : The QR code which comes as part of signed JSON from IRP, shall be extracted and placed on the invoice. Printing of QR code can be dene on any place on the invoice with any size, but it should be readable by standard mobile devices. QR code can not be printed on separate paper Printing of IRN No, Acknowledgement No and Date, given by IRP, are optional and can be recorded in the ERP system for reference purpose.

Q : Do I need to print e-invoice as provided in the portal or can I have mine one.

A : Ideal, you need to have your invoice as you are preparing. This will have your logo and terms and conditions, etc. Only you need to print the QR code on it.

Q : Can I amend the details of a reported invoice for which IRN has already been generated?

A : Amendments are not possible, once IRN is generated on IRP. Any changes in the invoice details reported to IRP can be carried out on GST portal (while filing GSTR-1). However, these changes will be flagged to proper officer for information

Q : Is e-invoicing applicable for supplies by notified persons to Government Departments / PSUs? Or e-invoice is applicable for B2G transactions?

A : Government Departments / PSUs might have registered as regular GSTIN or TDS GSTIN. If the transaction is with TDS authority/ registration, then e-invoicing is necessary.

Q : Can e-commerce entities generate e-invoices on behalf of the sellers on their platforms?

A : Yes. E-Commerce Operators are allowed to generate the e-invoices on behalf of the suppliers.

Q : Is e-invoicing voluntary, that is, can entities with aggregate turnover les than Rs. 500 Cr. Allowed to generate e-invoices from IRP, if they wish to do so?

A : No, presently, only the notified class of persons will be allowed/enabled to generate e-invoices to IRP. In phased manner, other entities will be enabled for IRN generation

Q : In case of breakdown of internet connectivity in certain areas, will there be any relaxation for the requirement to obtain IRN?

A : The mechanism to provide relaxation in such contingent situations will be notified by government soon.

Q : TCS of Income Tax is not part of E invoice schema. Is it not required to be displayed in e-invoice? if so, how to pass these details.?

A : Clarification on this will be provided by Government soon.

Q : Who has to generate Reverse Charge Mechanism (RCM) invoices ?

A : RCM related invoices have to be generated by the supplier, not by recipient

- In case of B2B RCM invoices, the if the supplier is notified to generate the IRN, he will do so with RC flag in it, otherwise not required.

- In case of B2C RCM invoices or self invoices, then IRN need not have to be generated

Q : Whether B2C invoices can be reported to IRP for generation of IRN?

A : Reporting B2C invoices by notified persons is not allowed currently. Printing of dynamic code on B2C invoices is not be confused with B2B reporting.

Q : How to generate the QR code of B2C invoices as per the notification?

A : There is a separate notification issued by government for QR code generation for B2C invoices. Purpose of this is for enable digital payment by consumer. That’s is separate process, not rated to e-invoicing.

Q : Can we use the same credentials to access e-Invoice and e-Way bill production?

A : Yes, Same credentials can be used in production. If you have credential for e-way bill, then that will also work for e-invoice. Otherwise, you can register freshly and create your user credentials.

Q : On e-invoice portal, IRN generation are failing because of minor variations in calculation. What should be done?

A : Calculation validations have been improved recently with tolerance limit for each one. Now, all types of transactions will be passed through.

Q : What is the time limit for generation of IRN

A : Previously, 24 hours time limit had been provided for generation of IRN after preparation of invoice by the tax payers.

Now, that validation has been removed based on demand of tax payers. IRN should be generated before issuing the invoice to the other party or movement of goods.

Q : The tax payers, who have crossed with aggregate Turnover of Rs 500 Crores, have not been enabled. What should they do?

A : The list of tax payers, who have been crossed with aggregate turnover of Rs. 500 Crores, have been identified by based on the turnover declared in GSTR3B for previous years.

The separate option is being provided on the portal for self-declaration by the tax payers, who have crossed with aggregate turnover of Rs. 500 Crores, to register and get enabled for e-invoicing system. It will be enabled in couple days.

Q : The tax payers, who have crossed with aggregate Turnover of Rs 500 Crores, have not been enabled. What should they do?

A : The list of tax payers, who have been crossed with aggregate turnover of Rs 500 Crores, have been identified by based on the turnover declared in GSTR3B for previous year.

The separate option is being provided on the portal for self-declaration by the tax payers, who have crossed with aggregate turnover of Rs 500 Crores, to register and get enabled for e-invoicing system. It will be enabled in couple days.

Q : Can the taxpayer is allowed to generate IRN after EWB generation.

A : Ideally, First E-invoice/IRN has to be generated and then e-way bill.

On the same line if IRN has to be cancelled, first e-way bill has to cancelled and then IRN

Q : How to generate the e-way bill through API, when I don’t have the distance between source and destination PINs?

A : E-Way Bill system has distance between all the postal PINs of India. If you send the distance as ZERO, then system considers it has request for auto calculated PIN-PIN distance and uses that generates the e-way bill.