Dear Readers, after the implementation of GST Law in July, 2017, now GST Department has started taking action against GST Defaulter. Due to a decrease in revenue collection of GST from its targeted budget, now GST Department is taking all steps to curb GST malpractices and to catch GST Defaulters. In the recent steps, GST Department is canceling GST Registration of GST Return Defaulters Suo- Motto and Starts blocking E-Way bill generation, if the dealer is a defaulter in GST return Filing for more than 2 months.

Section 29 (2) of CGST Act, 2017 empowers, GST officer to cancel the registration of a person from such date, including any retrospective date, as he may deem fit, where-

(a) a registered person has contravened such provisions of the Act or the rules made thereunder as may be prescribed; or

(b) a person paying tax under section 10 (i.e Composition levy) has not furnished returns for 3 consecutive tax periods; or

(c) any registered person, other than composition registered dealer who has not furnished returns for a continuous period of 6 months; or

(d) any person who has taken voluntary registration under sub-section (3) of section 25 has not commenced business within 6 months from the date of registration (i.e filing Nil GST Returns); or

(e) registration has been obtained by means of fraud, willful misstatement or suppression of facts:

Provided that the proper officer shall not cancel the registration without giving the person an opportunity of being heard

In today’s scenario, reasons for cancellation of GST Registration of maximum dealers are due to conditions specified in clause (c), (d) and (e) above.

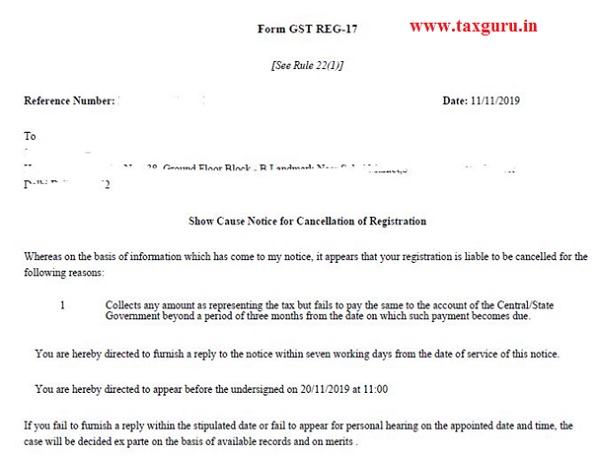

Before cancellation of GST Registration, GST Officer is under obligation to issue a show-cause notice in Form GST REG-17, specifying the reason why, GST registration should not be canceled and registered dealer has to reply for the same within the specified time period.

Precaution: Here the mostly dealers faces the heat of GST Department, they do not reply to this show cause notice within prescribed time period. Please note that this time department is very active related to these notices. In some cases, it is observed that the GST Department cancels the GST Registration on the next day of reply submission due date, if you do not reply within the specified time period.

If registered dealer do not reply to this show cause notice or fails to correct the identified error as mentioned in Show cause notice, GST officer cancels the GST Registration and issue GST Cancellation Order in FORM GST REG-19

Q-1 What to do, if GST Registration is canceled Suo- Motto by GST Officer?

If due to some reason, you are not able to reply with Suo- Motto cancellation order and your GST Registration is canceled by GST Officer then GST Department is giving another opportunity to you to re-activate you canceled GST Registration.

For Re-activation of Cancelled GST, firstly you have to correct the error/reason due to which your GST is canceled and after which you have to file GST Cancellation Revocation Request. Please note that, as per law, you have only 30 days time period to file Revocation request.

Q-2 I filed my GST Revocation Request but the same is rejected by Proper Officer. Where there is any other opportunity available with the registered dealers to re-active Cancelled GST Registration?

If your revocation request is rejected by GST Officer and you are not satisfied with this order, then you have another chance to approach the department again for GST Re-activation but the process is very lengthy, time-consuming and to be taken within 3 months of this rejection.

It is suggested that kindly comply with the law and if you receive any show-cause notice from the department then reply to that notice as soon as possible to avoid any troubling situation in the future.

This article is for the purpose of information and shall not be treated as a solicitation in any manner and for any other purpose whatsoever. It shall not be used as a legal opinion and not be used for rendering any professional advice. This article is written on the basis of the author’s personal experience and provision applicable as on the date of writing of this article. Adequate attention has been given to avoid any clerical/arithmetical error, however; if it still persists kindly intimate us to avoid such error for the benefits of other readers.

The Author “CA. Shiv Kumar Sharma” can be reached at mail –shivsharma786@gmail.com and Mobile/Whatsapp – 9911303737/ 9716118384